Excellent piece by @AnaSwanson on the now expected Trump-Xi trade deal/ truce/ US walk back

Agree with Mr. Czin. The most remarkable thing about the current US trade agenda with China is all the things that aren't on it. I would include currency on that list of course

1/

Agree with Mr. Czin. The most remarkable thing about the current US trade agenda with China is all the things that aren't on it. I would include currency on that list of course

1/

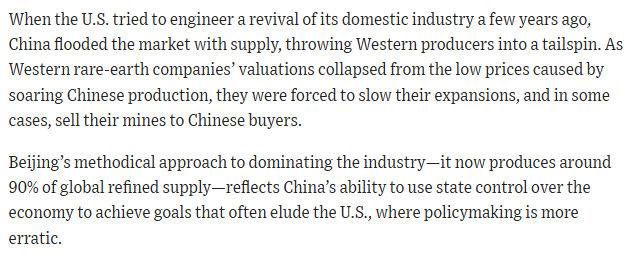

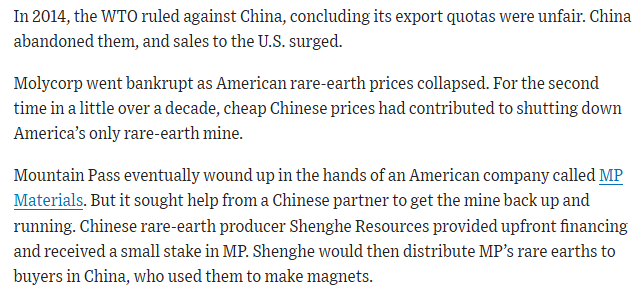

The best argument for the limited US agenda is that the US lacks the leverage to get China to fundamentally change, so the best the US can hope for is selling some beans and getting export licenses for rare earths

2/

nytimes.com/2025/10/27/us/…

2/

nytimes.com/2025/10/27/us/…

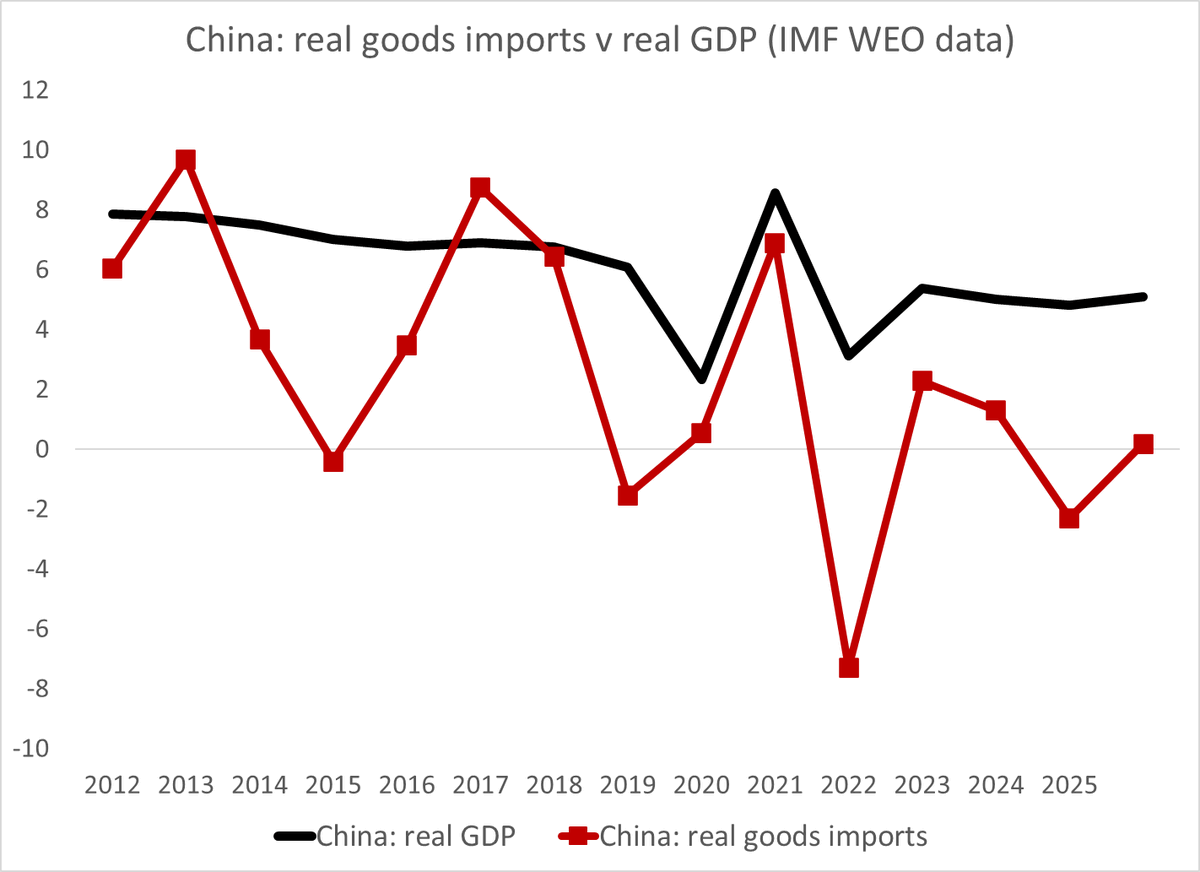

As the FT notes in a very good leader, China's leaders just doubled down on a manufacturing led growth strategy )"there is no retreat from the manufacturing-led development pursued under the current five-year plan")

3/

ft.com/content/e61634…

3/

ft.com/content/e61634…

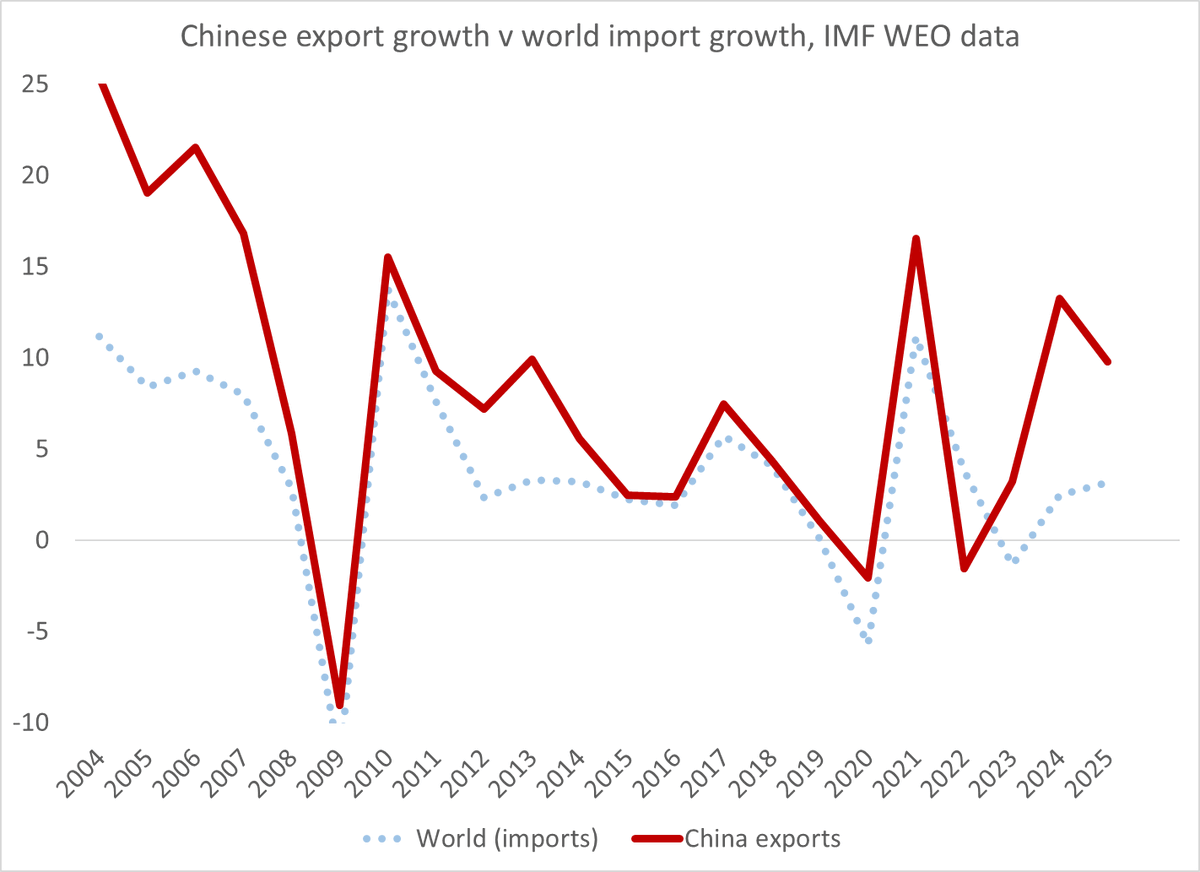

But just as Trump looks to have initially over-estimated his term 2 leverage over China, China risks over-estimating the world's tolerance for ever more unbalanced Chinese trade

4/4

4/4

• • •

Missing some Tweet in this thread? You can try to

force a refresh