1/23 ⚡🚨 Did the U.S. just go “all-in” on nuclear? A binding deal puts Washington side-by-side with $CCJ @Cameco and $BN @Brookfield to fast-track @WECNuclear reactors across America. Grid stress, AI demand, and geopolitics collide. Buckle up. 💥🌍

2/23 What happened: $CCJ @Cameco + $BN @Brookfield (owners of @WECNuclear) signed a binding term sheet with @CommerceGov to accelerate deployment of Westinghouse units in the U.S.—with help on financing, permitting, and long-lead items. 🔧⏳

3/23 Why now? Power demand is surging (AI/data centers), grids are aging, and reliability is king. Nuclear = dense, 24/7, zero-carbon baseload. Think of it as energy “core memory” for the digital economy. 🧠⚡ @IEA @World_Nuclear

4/23 The workhorse: @WECNuclear’s AP1000—passive safety, proven design, global fleet momentum. Standardizing around a platform cuts cost/complexity like using one operating system across many devices. 💡🧩

5/23 Money talk: The U.S. aims to arrange financing and smooth approvals for a program sized at least around tens of billions (headline number: ~$80B) to roll out @WECNuclear units—and move fast on long-lead components. 🏗️💵 @CommerceGov

6/23 Sweetener: Once definitive agreements are signed and the build program reaches scale, the U.S. gets a “Participation Interest” in cash distributions above a threshold—aligning government with @WECNuclear’s success. 🪙📈

7/23 IPO kicker: If milestones are met by a target date and @WECNuclear is IPO-ready at a high valuation, the U.S. can push for an IPO—its participation flipping into a time-limited warrant tied to that equity value. ⏳📊

8/23 Translation: Washington isn’t just writing checks—it’s acting like a co-builder with upside. Think “public-private rocket stage”: government thrust early, private market orbit later. 🚀🤝 @CommerceGov

9/23 Why it matters for $CCJ @Cameco: dual exposure. (1) 49% owner of @WECNuclear = upside from systems & services. (2) Fuel cycle business benefits as more reactors = more lifetime fuel demand. Flywheel effect. 🔄⚛️

10/23 Why it matters for $BN @Brookfield: scaling a flagship energy platform with deep infra/utility DNA. If deployment accelerates, Brookfield’s industrial toolkit meets a massive U.S. build cycle. 🧰🏗️

11/23 What’s likely to get built: @WECNuclear AP1000s first—proven, modular, and primed for U.S. replication. Fewer bespoke designs = fewer surprises. Assembly line > art project. 🛠️📦

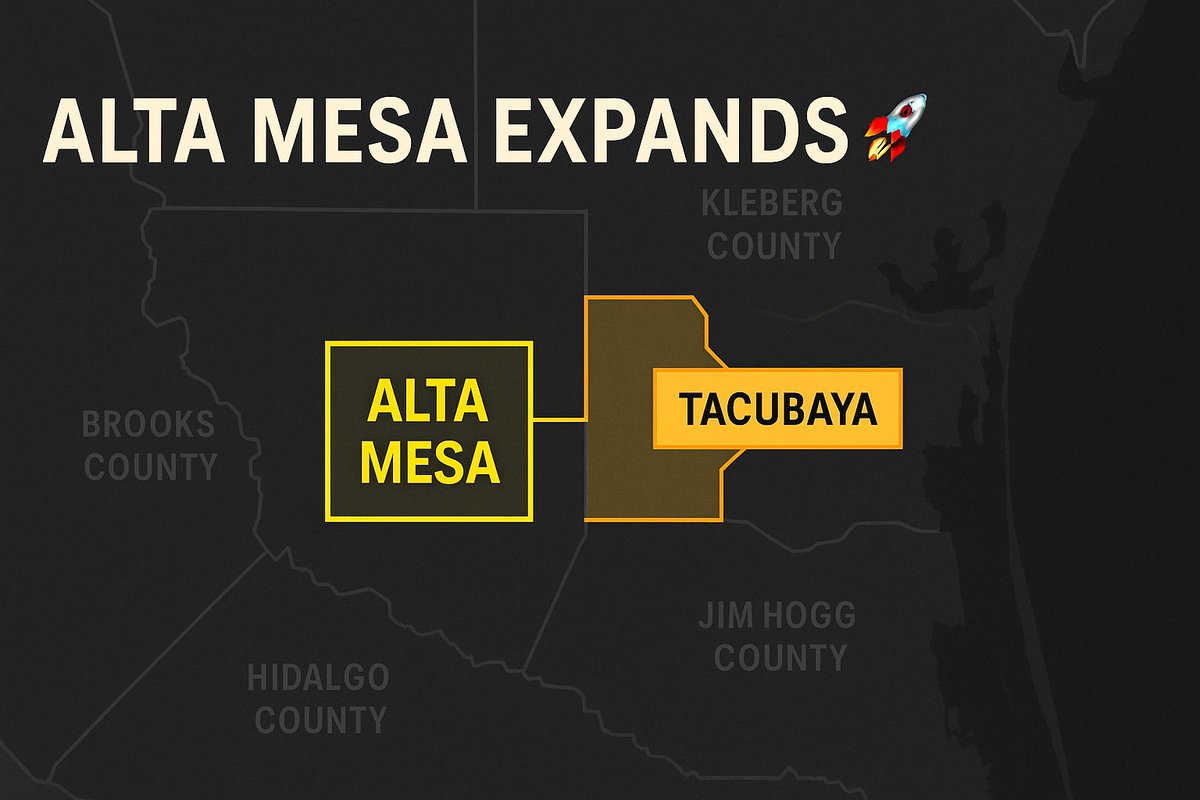

12/23 Where could they go? Expect brownfield sites, coal-to-nuclear swaps, and regulated utility jurisdictions first. Watch the Southeast/Midwest for early movers (P&L and permitting matter). 🗺️⛓️ @World_Nuclear

13/23 Still TBD: Which financing pipes? DOE LPO? Tax credits? Vendor finance? Utility balance sheets? The term sheet sets the stage; definitive agreements will pick the instruments. 🎺📑 @CommerceGov

14/23 Supply chain reality check: heavy forgings, NSSS components, skilled trades. Scaling @WECNuclear requires re-industrializing the backbone—orders must land early to lock capacity. 🏭🔩

15/23 Regulatory path: Standardized designs can compress schedules, but NRC + state approvals still rule. Expect early work on site-specific COL amendments and cost-recovery frameworks. 🗂️⏱️ @NRCgov

16/23 Timelines: Long-lead buys now; FIDs over the next 12–24 months would be the tell. Execution risk rises with election cycles and rate environments—tempo discipline is everything. ⏳📆

17/23 Fuel cycle: More reactors mean more LEU demand, conversion, enrichment. $CCJ @Cameco benefits; HALEU/advanced fuels are a parallel push (watch $LEU @CentrusEnergy for niche angles). ⚛️🔁

18/23 Winners: standardized nuclear vendors (@WECNuclear), component makers, EPCs, utilities securing firm power. Potential losers: spot gas peakers where capacity payments shift to nukes. It’s a portfolio rotation in electrons. 🔄⚡

19/23 AI angle: Data centers need “always-on” gigawatts. Nuclear PPAs could become the new “hyperscaler hedge”—firm, clean, and brand-safe. 🖥️🔌🤝 @OpenAI @Google @Microsoft

20/23 Costs: Oversight + standardization aim to avoid past blowouts. But inflation, supply gaps, and rate volatility remain wildcards. This is industrial policy, not a magic trick. 🎛️🧮

21/23 What to watch: 1) Site list. 2) Turbine/forging orders. 3) State utility filings. 4) EPC partner reveals. 5) Definitive agreements inked. Each is a breadcrumb on the build path. 🍞➡️

22/23 Global knock-on: If the U.S. can crack repeatable delivery with @WECNuclear, allies will copy-paste. Nuclear export playbooks get an upgrade. ✈️📦 @IEA @World_Nuclear

23/23 Bottom line: A moonshot with teeth. If execution lands, America gets firm power at scale—and $CCJ @Cameco, $BN @Brookfield, and @WECNuclear ride the updraft. Clip & save these milestones. 📌📈

If this thread brought you value 💡, take the next step: one insightful article 🔎 could help you spot red flags 🚩 before they cost you money 💸.

For the price of a coffee ☕️, get the complete breakdown 🧾.

Join here 👇🏼

patreon.com/JohnGalt88

substack.com/@johngalt88

For the price of a coffee ☕️, get the complete breakdown 🧾.

Join here 👇🏼

patreon.com/JohnGalt88

substack.com/@johngalt88

• • •

Missing some Tweet in this thread? You can try to

force a refresh