Lost in the timeline? Tap Highlights. That’s where every thread lives—quick summaries, and a clear path to the ideas you came for.

How to get URL link on X (Twitter) App

2/23 The old comfort blanket was simple: if mines hiccup, “secondary supply” appears.

2/23 The old comfort blanket was simple: if mines hiccup, “secondary supply” appears.

2/23 What happened: $CCJ @Cameco + $BN @Brookfield (owners of @WECNuclear) signed a binding term sheet with @CommerceGov to accelerate deployment of Westinghouse units in the U.S.—with help on financing, permitting, and long-lead items. 🔧⏳

2/23 What happened: $CCJ @Cameco + $BN @Brookfield (owners of @WECNuclear) signed a binding term sheet with @CommerceGov to accelerate deployment of Westinghouse units in the U.S.—with help on financing, permitting, and long-lead items. 🔧⏳

2/23 Uranium is heating up 🔥⚛️

2/23 Uranium is heating up 🔥⚛️

2/23

2/23

2/23 📊 Reality check: Etango (Namibia) isn’t at FID yet. Despite that, two Fortune 500 North American utilities signed binding contracts. That’s rare—and revealing. $BMN @BannermanEnergy #uranium #energy

2/23 📊 Reality check: Etango (Namibia) isn’t at FID yet. Despite that, two Fortune 500 North American utilities signed binding contracts. That’s rare—and revealing. $BMN @BannermanEnergy #uranium #energy

1/ ⚙️ Uranium is back in the spotlight. Prices rise, Washington frets over imports, and juniors like $AEC.V suddenly stand center stage. #Uranium #NuclearEnergy #U3O8

1/ ⚙️ Uranium is back in the spotlight. Prices rise, Washington frets over imports, and juniors like $AEC.V suddenly stand center stage. #Uranium #NuclearEnergy #U3O8

2/12 What’s FAST-41 in plain English? A single federal timetable where agencies coordinate and publish dates. Clarity, not shortcuts. ⏳✅ #permitting #policy

2/12 What’s FAST-41 in plain English? A single federal timetable where agencies coordinate and publish dates. Clarity, not shortcuts. ⏳✅ #permitting #policy

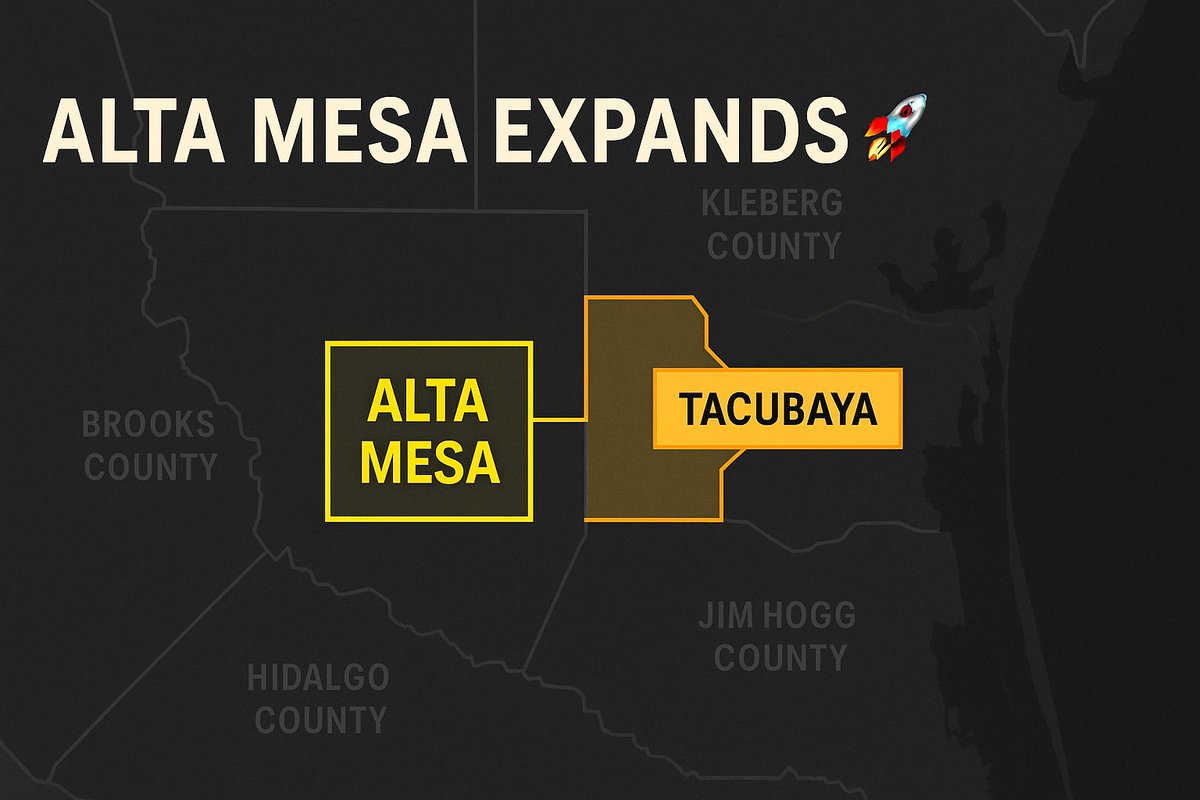

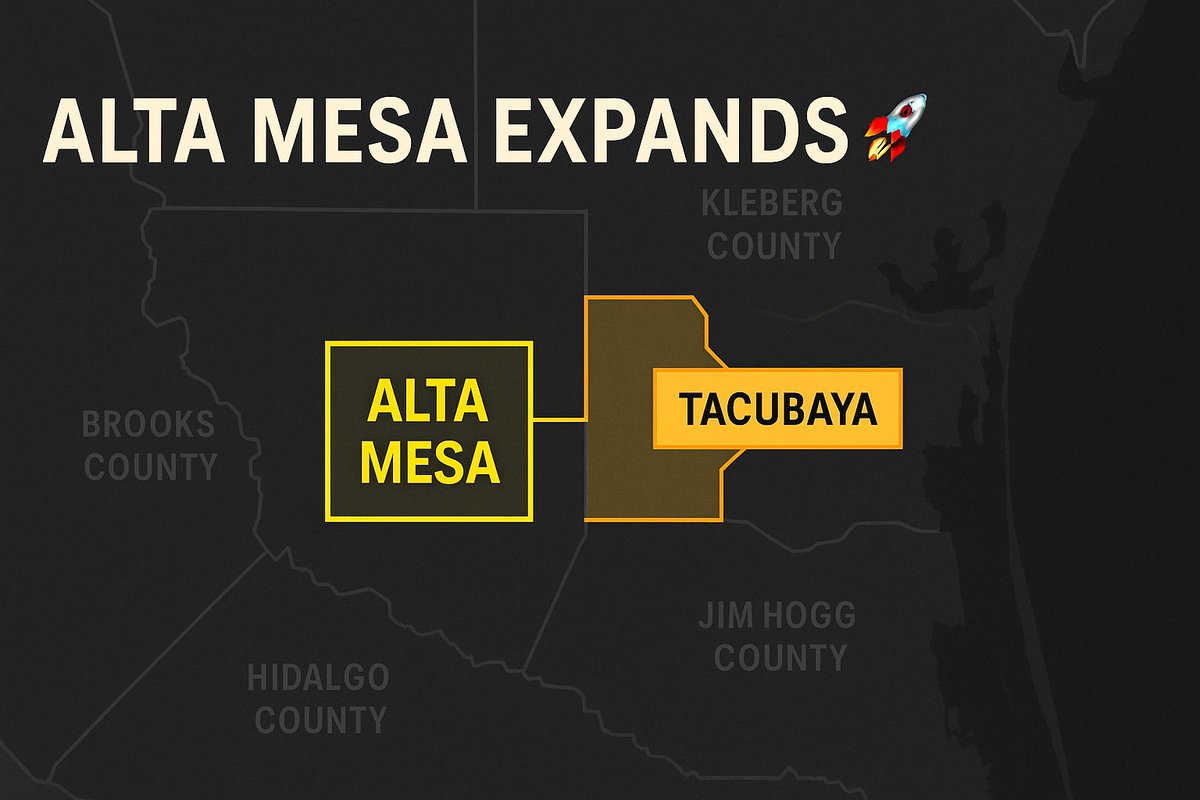

1/ enCore $EU grabs 5,900 acres (Tacubaya) beside Alta Mesa CPP (18.08.25). Immediate adjacency = plug-and-play expansion into existing ISR facility. #Uranium #EnergySecurity #Nuclear

1/ enCore $EU grabs 5,900 acres (Tacubaya) beside Alta Mesa CPP (18.08.25). Immediate adjacency = plug-and-play expansion into existing ISR facility. #Uranium #EnergySecurity #Nuclear

2/ 🏭 The Big Asset:

2/ 🏭 The Big Asset: