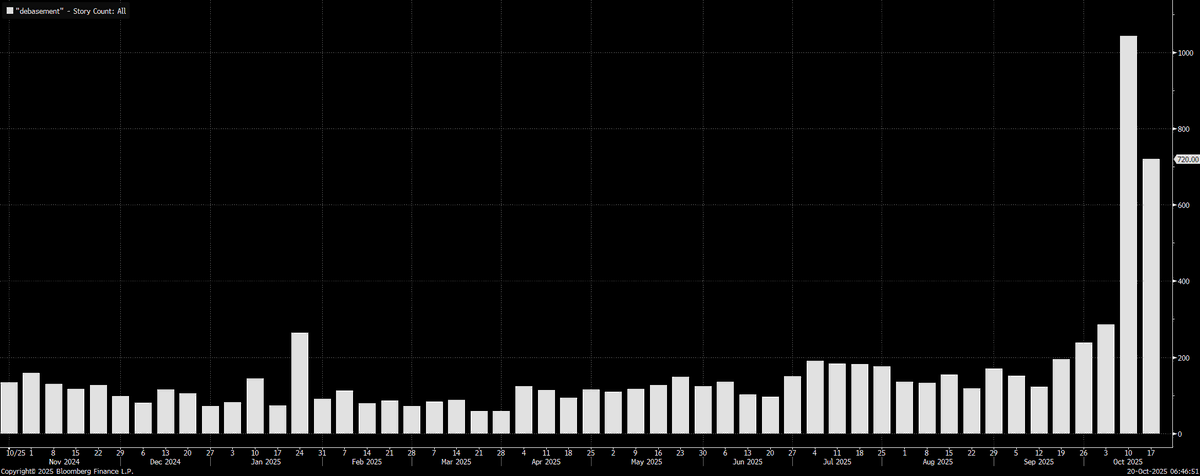

The Fed is going to keep creating inequality in the system until the middle class gets completely cooked

This means that managing macro flows and cycle risk is the only way to maneuver through the next decade 🧵👇

This means that managing macro flows and cycle risk is the only way to maneuver through the next decade 🧵👇

The Fed’s transmission mechanism lifts asset prices faster than wages. QE and low rates raise the price of duration assets first. Households with assets gain. Households living on labor incomes lag.

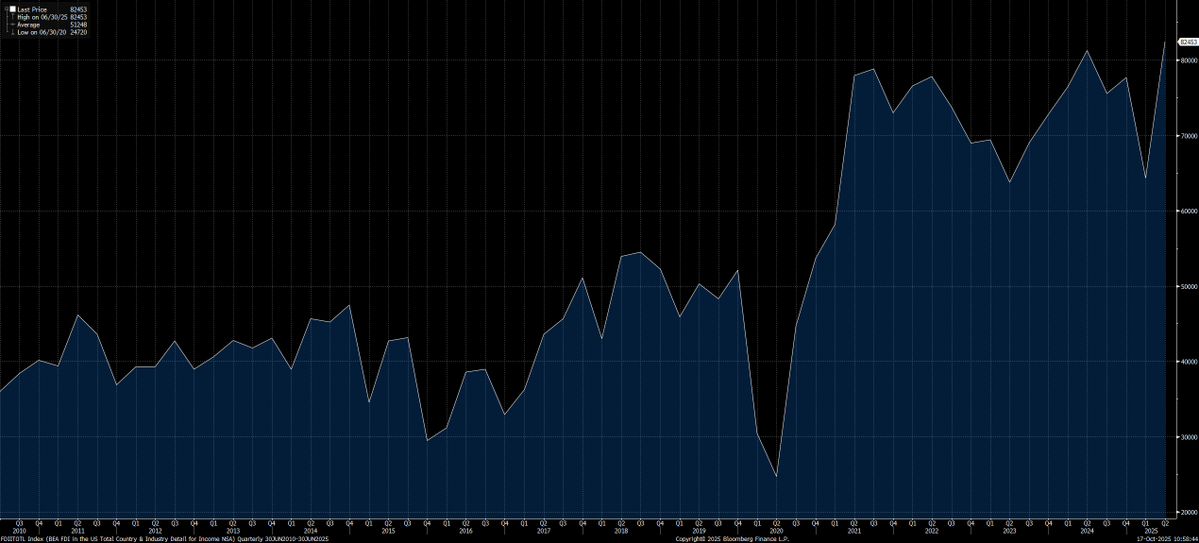

Even though we have come off a little, we have a MASSIVE amount of reserves in the system.

Even though we have come off a little, we have a MASSIVE amount of reserves in the system.

When the policy rate drops, discount rates fall and collateral values jump. Equity, real estate, and private assets reprice. Access to cheap credit is not evenly distributed, so the wealth effect is not either.

As a result, housing affordability is crashing

As a result, housing affordability is crashing

Higher collateral values widen credit access for already-wealthy households. That increases leverage capacity, then future asset buying, then prices again. It is a loop that widens wealth dispersion.

On the liability side, rising assets do not erase fixed costs of living. Rents, tuition, and healthcare climb with asset valuations while median wages lag. The policy put lifts balance sheets more than paychecks.

The result is core CPI is still well above 2%

The result is core CPI is still well above 2%

Now the international layer. A strong global demand for dollar assets requires the United States to supply safe balance sheet. The clean way to supply it is to run external deficits and import foreign savings.

This is why the current account is negative

This is why the current account is negative

Capital inflows keep the dollar firm. A firm dollar cheapens imports and raises the relative price of US tradables. The result is a structural bias toward consumption and finance over tradable production.

China is taking the other side of this global trade and geopolitical risk is fluctuating in the middle

China is taking the other side of this global trade and geopolitical risk is fluctuating in the middle

https://x.com/Brad_Setser/status/1983004153313149102

Because the world wants dollar assets in bad times and in good times, the US absorbs global cycles through the exchange rate and the current account. The distributional effect lands on everyday workers

There is a reason the S&P500 is sitting at all time high valuations

This is a reflection of macro liquidity in the system as trade imbalances and the Fed are BOTH pushing money into the system

This is a reflection of macro liquidity in the system as trade imbalances and the Fed are BOTH pushing money into the system

This is the credit cycle I have been laying out. It will continue until things become unsustainable and then we move into a bear market. For now, we melt up higher

https://x.com/Globalflows/status/1982906573522702480

Everything is moving in lockstep with the thesis I have been laying out:

https://x.com/Globalflows/status/1980367381664072037

When my strategy flips bearish equities, I will immediately publish a report on it here: capitalflowsresearch.com/subscribe

• • •

Missing some Tweet in this thread? You can try to

force a refresh