China's currency is objectively very weak, especially in inflation adjusted terms (it is down just under 20% from its 2021 high). And it is very tightly managed against the dollar --

But within that broad regime, there has been a tiny bit of appreciation over the last 6ms

1/ many

But within that broad regime, there has been a tiny bit of appreciation over the last 6ms

1/ many

And to be sure, the movement is primarily against the dollar -- the yuan remains incredibly weak against the euro (contributing to the second China shock, China's rising share of the EU auto market & German automotive angst)

2/

2/

There is something technically very strange about the yuan's appreciation -- it has come even though the onshore spot rate has remained weaker than the daily fix (in theory the mid point of the band). That is strange ...

3/

3/

For all intents and purposes the strong side of the band has been lost -- it just isn't used. The fix acts as the upper limit on how far the yuan can appreciate

4/

4/

What is more is that there has been a spike in fx settlement whenever spot has been close to the band -- indicating that the state banks are buying fx to control the pace of appreciation right at the fix (not at the strong side of the band)

5/

5/

All in all it is a strange picture -- the yuan is more tightly managed v the dollar than in the past, the band has shrunk, and there is now a bit of market pressure for the yuan to appreciate (from its current still very week level)

6/

6/

And a couple of big picture observations --

it has been strange that the Trump Administration (and Secretary Bessent) have shown more interest in supporting the Argentine peso than in pushing the yuan (and Asian currencies) to appreciate from v. low levels

7/

it has been strange that the Trump Administration (and Secretary Bessent) have shown more interest in supporting the Argentine peso than in pushing the yuan (and Asian currencies) to appreciate from v. low levels

7/

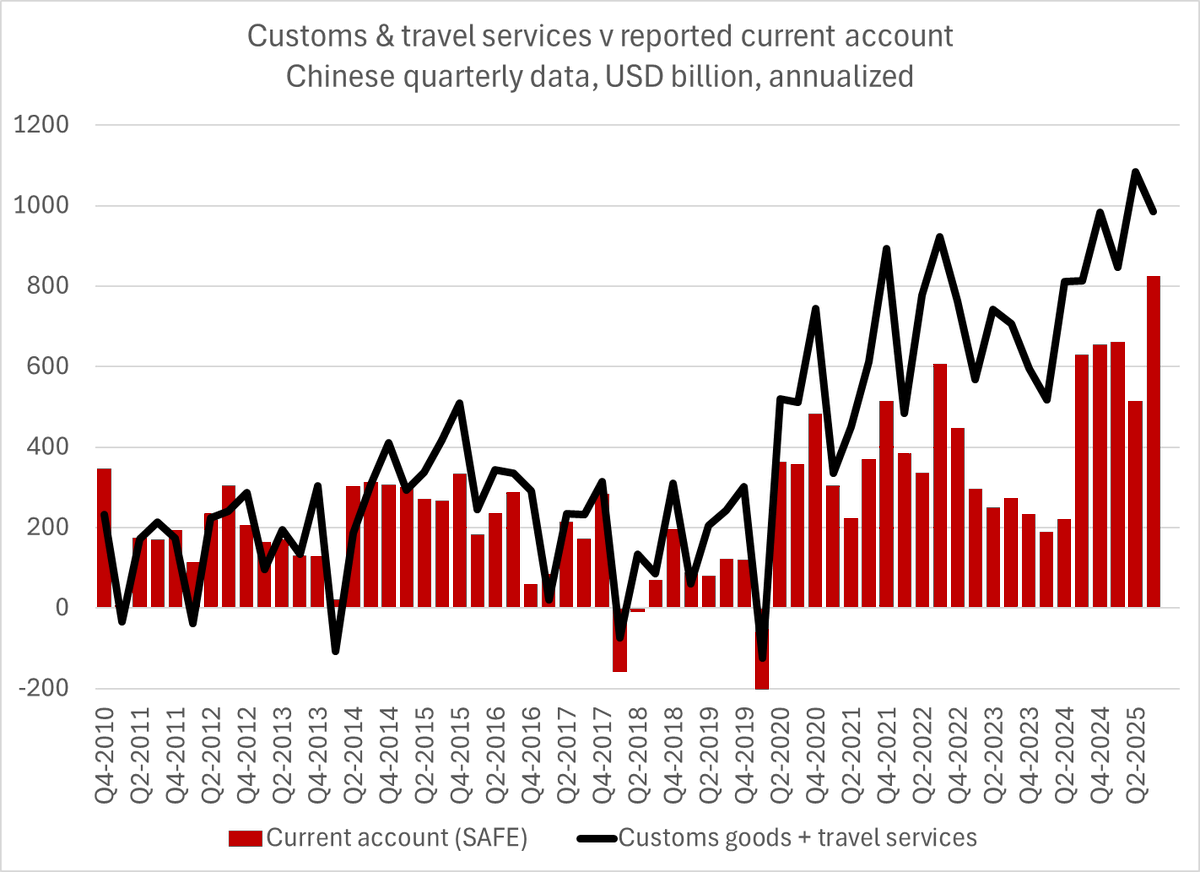

After all the administration (or least the President) ostensibly wants to reduce the US trade deficit/ China's surplus -- and the one thing that is known to slow China's export juggernaut is CNY appreciation (the 05 to 15 move did bring down China's surplus relative to its GDP)

8/

8/

But by all accounts currency (along with other macro and big structural issues) haven't been on the agenda of the recent round of bilateral trade talks

9/

9/

So I increasingly think it will fall to Europe -- which is getting pounded by the second China shock -- to make currency issues a priority ... the second Trump administration is focused on smaller, but more tangible issues (like selling soybeans and maybe Boeings)

10/10

10/10

• • •

Missing some Tweet in this thread? You can try to

force a refresh