Thus, inflation and wages are not driven by labor conditions; they respond to the credit cycle and the associated demand and price dynamics. The NK causal chain is reversed.

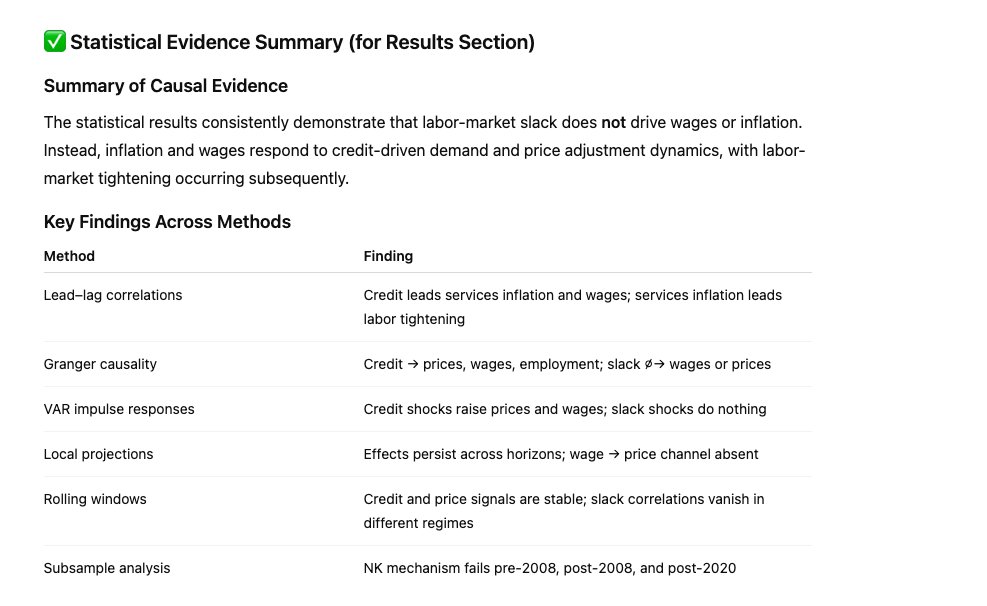

4. Empirical Results

Across all methods, the findings point to a unified conclusion: the labor channel does not causally drive wages or inflation.

Across all methods, the findings point to a unified conclusion: the labor channel does not causally drive wages or inflation.

4.4 VAR Results

The causal chain runs from credit and demand conditions to prices and then to labor, not from labor to prices.

The causal chain runs from credit and demand conditions to prices and then to labor, not from labor to prices.

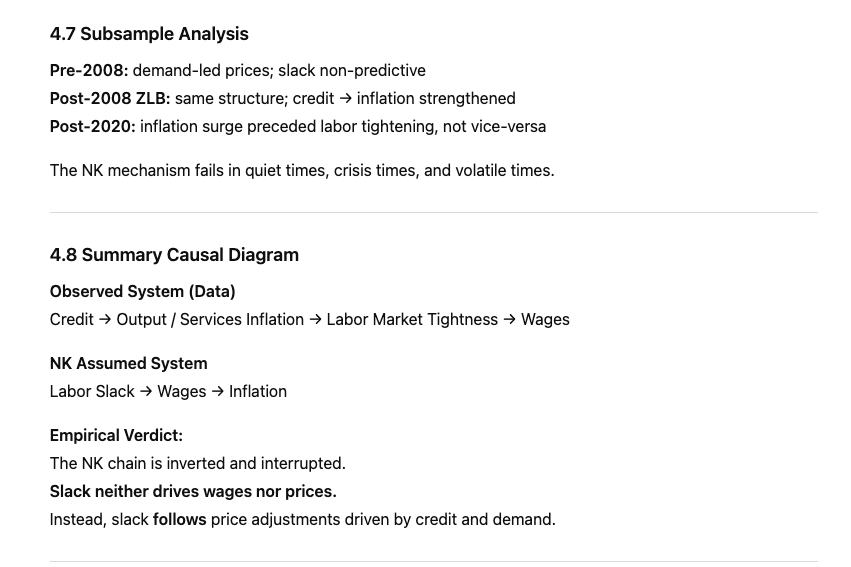

4.8 Summary Causal Diagram

Empirical Verdict:

The NK chain is inverted and interrupted.

Slack neither drives wages nor prices.

Instead, slack follows price adjustments driven by credit and demand.

Empirical Verdict:

The NK chain is inverted and interrupted.

Slack neither drives wages nor prices.

Instead, slack follows price adjustments driven by credit and demand.

Inflation and wages are downstream of credit and demand, not labor-market slack.

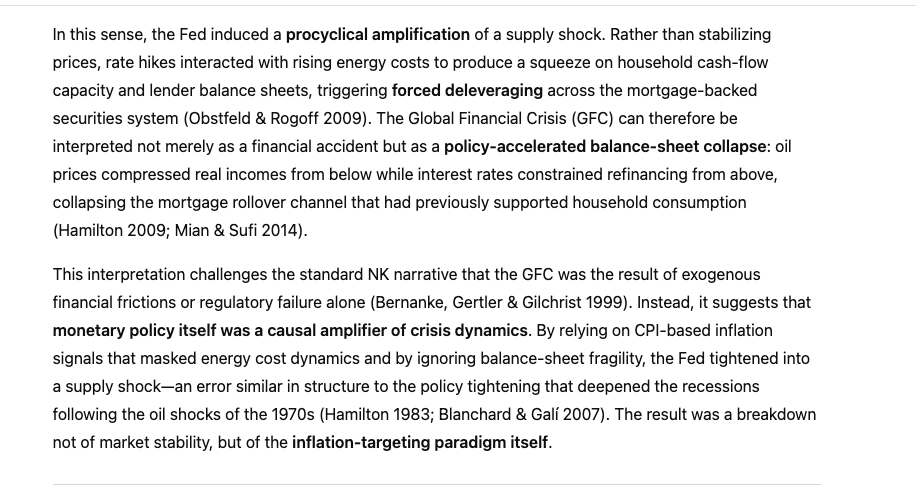

The canonical NK transmission mechanism fails both theoretically and empirically.

The canonical NK transmission mechanism fails both theoretically and empirically.

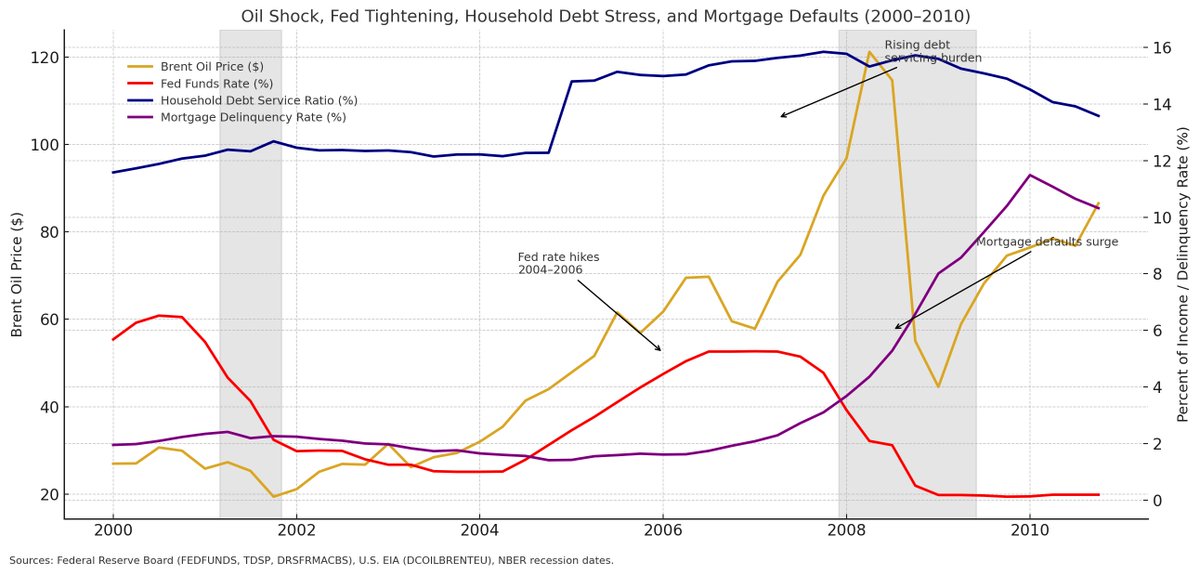

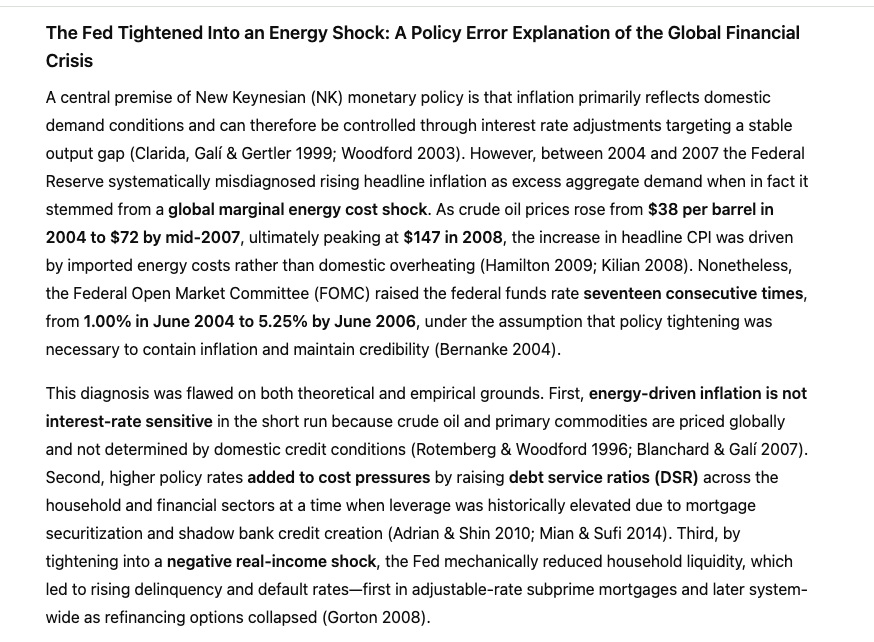

5. Interpretation: Balance-Sheet Transmission and Policy Implications

Labor-market outcomes are responses, not initiators.

Labor-market outcomes are responses, not initiators.

5.8 A Model for the Modern Economy

Place labor market outcomes at the end of the chain, not the beginning

Place labor market outcomes at the end of the chain, not the beginning

6. Conclusion

Using quarterly U.S. data from 1988–2024 and a comprehensive suite of empirical methods, we find no evidence supporting this mechanism. Instead, the data consistently show that credit expansion drives demand, services inflation responds first, and labor-market tightening and wage growth follow with lags.

Using quarterly U.S. data from 1988–2024 and a comprehensive suite of empirical methods, we find no evidence supporting this mechanism. Instead, the data consistently show that credit expansion drives demand, services inflation responds first, and labor-market tightening and wage growth follow with lags.

Conclusion of Defense

Inflation and wages do not originate in labor slack.

They originate in credit-demand dynamics, with labor conditions responding ex-post.

Inflation and wages do not originate in labor slack.

They originate in credit-demand dynamics, with labor conditions responding ex-post.

it is a direction-of-causality result. The NK mechanism does not hold except via incidental co-movement driven by upstream credit cycles.

@threadreaderapp

unroll

unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh