A few things I can show to those doing @investingidiocy style trading on shitcoins

An easy win is to rebalance not to the center (like Rob does) but back to the edge of the band

This is because tradfi futures are in contracts of 100k-ish and you want to optimize for number of trades

Whereas crypto you can make tiny trades

It’s a small but meaningful improvement

1/

An easy win is to rebalance not to the center (like Rob does) but back to the edge of the band

This is because tradfi futures are in contracts of 100k-ish and you want to optimize for number of trades

Whereas crypto you can make tiny trades

It’s a small but meaningful improvement

1/

The next easy win is to not rebalance at 00:00 GMT like every other cvnt

There are very pronounced and exploitable intraday seasonality effects in crypto

If you can, spread your trading over the full day, but an easy 80/20 hack is to just move it outside of the window 23:00 to 04:00

/2

There are very pronounced and exploitable intraday seasonality effects in crypto

If you can, spread your trading over the full day, but an easy 80/20 hack is to just move it outside of the window 23:00 to 04:00

/2

Another easy win is the easiest of all

Shitcoin trend works better on big coins

You can model those interactions properly if you’re a smartcvnt

But if you’re a dumb cvnt you can just choose a universe of big coins

/3

Shitcoin trend works better on big coins

You can model those interactions properly if you’re a smartcvnt

But if you’re a dumb cvnt you can just choose a universe of big coins

/3

Next easy win

Consider ETH and ETC

ETC is basically a high beta version of ETH, meaning when ETH moves ETC moves more

But on any sort of calculation ETC is gonna look like its trending harder than ETH

When that just ain’t so

/4

Consider ETH and ETC

ETC is basically a high beta version of ETH, meaning when ETH moves ETC moves more

But on any sort of calculation ETC is gonna look like its trending harder than ETH

When that just ain’t so

/4

You can compare apples for apples by vol normalizing the time series FIRST

@investingidiocy does this with his normalized momentum feature

You can extend this concept out to ALL trend following features

/5

@investingidiocy does this with his normalized momentum feature

You can extend this concept out to ALL trend following features

/5

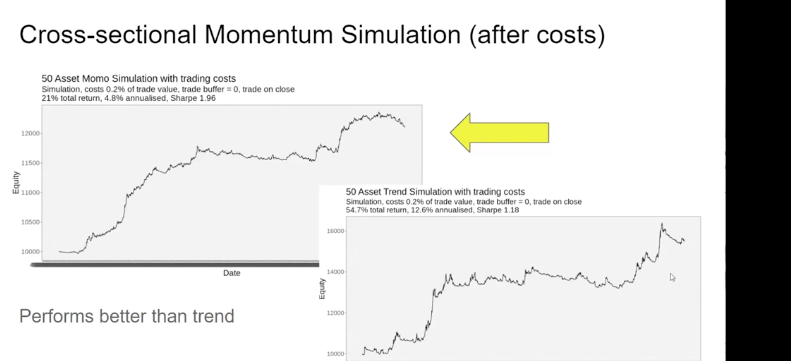

@investingidiocy The next logical step is to cross sectionalize your trend features

This is a fancy way of saying "go long the top half and short the bottom half"

Like this

/6

This is a fancy way of saying "go long the top half and short the bottom half"

Like this

/6

@investingidiocy Cross sectional trend is a better behaved version of trend, without some of the lovely qualities that trend following has (ain't shit for free principle)

You can see its the same basic equity curve but smoother

Which is what "higher Sharpe" means if you aren't a fuckwit

/7

You can see its the same basic equity curve but smoother

Which is what "higher Sharpe" means if you aren't a fuckwit

/7

@investingidiocy So far, we've stacked a bunch of small but meaningful improvements together to improve @investingidiocy's very good tradfi trend system

You might be wanting MORE

Well, its a good news/bad news situation

/8

You might be wanting MORE

Well, its a good news/bad news situation

/8

@investingidiocy The good news is that we aren't into the rarified air of super-secret alpha stat-arb systems

It's all stuff that everyone knows and is happy to talk about

The bad news is that your execution won't be good enough to monetize a lot of stuff from here

/9

It's all stuff that everyone knows and is happy to talk about

The bad news is that your execution won't be good enough to monetize a lot of stuff from here

/9

@investingidiocy For example, a feature with well known predictive qualities, which performs at roughly Sharpe 2 in crypto is aggression

This is an 3 day average of market buys v market sells

Before costs this looks like a dream signal

But prepare for disappointment

/10

This is an 3 day average of market buys v market sells

Before costs this looks like a dream signal

But prepare for disappointment

/10

@investingidiocy See how much this signal wiggles around?

In the real world that means your system is jumping in and out of positions too much to make a profit unless you are really good at execution (ie be a market maker)

/11

In the real world that means your system is jumping in and out of positions too much to make a profit unless you are really good at execution (ie be a market maker)

/11

@investingidiocy Sometimes signals that lose money can be additive to a portfolio due to the magical power of netting (if system a is long and b is short you save costs)

But not here, with naive daily execution

/12

But not here, with naive daily execution

/12

@investingidiocy You can see we are approaching the very limits of what can be done with @investingidiocy's system without getting better at execution

A simulation of 1/4 trend/momo/carry/aggression with conservative cost estimates has a Sharpe which is lower than just 1/3 trend/momo carry

/13

A simulation of 1/4 trend/momo/carry/aggression with conservative cost estimates has a Sharpe which is lower than just 1/3 trend/momo carry

/13

@investingidiocy Compare with trend/momo/carry which is a pretty sensible idea that pretty much every quant firm would agree with done in a simple robust way

Bravo @investingidiocy

It's a fucking good system, I've run it for years

/14

Bravo @investingidiocy

It's a fucking good system, I've run it for years

/14

@investingidiocy But what if you wanted to be a fancy boy and get even more performance?

You *could* implement a proper MVO but that requires you to be much better and more careful, and your system is already pretty complicated

/15

You *could* implement a proper MVO but that requires you to be much better and more careful, and your system is already pretty complicated

/15

@investingidiocy You might want to upweight or downweight your signals based on simple hueristics like Rob calls handcrafting

I'll spare you the math but a rolling window of 6 months is better for crypto

/16

I'll spare you the math but a rolling window of 6 months is better for crypto

/16

@investingidiocy In technical terms, signal performance anywhere from 5-7 months has internal correlation of .13 with the following month performance

Meaning that if eg moving average crossovers "worked" in the last 6 months they will probably continue to outperform and vice versa

/17

Meaning that if eg moving average crossovers "worked" in the last 6 months they will probably continue to outperform and vice versa

/17

@investingidiocy So at this point you have quite a reasonable system

It's probably done alright, but been a bit of a cvnt to trade

It's probably gone sideways for looong and painful periods, despite making really good money (at least double what you'd expect in tradfi)

/18

It's probably done alright, but been a bit of a cvnt to trade

It's probably gone sideways for looong and painful periods, despite making really good money (at least double what you'd expect in tradfi)

/18

@investingidiocy And here I'll mention in passing that you are getting double the returns for a reason

It's hugely risky to have anything to do with crypto, which is why sensible people don't do it

And why you get paid a premium for being covered in shit

Like a plumber, really

/19

It's hugely risky to have anything to do with crypto, which is why sensible people don't do it

And why you get paid a premium for being covered in shit

Like a plumber, really

/19

Its best, in my view, to accept what is shit about a trade in advance and do it with eyes wide open

In crypto you take hacking, regulation, smart contract, quantum encryption, counterparty risk, and all kinds of risks you are taking without even being aware

It's nucking futs

/20

In crypto you take hacking, regulation, smart contract, quantum encryption, counterparty risk, and all kinds of risks you are taking without even being aware

It's nucking futs

/20

@investingidiocy So if you DO want those outside returns and are willing to take more riskage for the biscuit

I reckon it's a good trade, despite all the obvious drawbacks

If those drawbacks didn't exist, people smarter than us would be trading them

/21

I reckon it's a good trade, despite all the obvious drawbacks

If those drawbacks didn't exist, people smarter than us would be trading them

/21

@investingidiocy But let's say you were an absolute animal

You implemented the system from Rob Carver's excellent books

You made all the improvements I've outlined above

You've got yourself a pro level system fr

Better than 90% of tradfi kwants

But...

/22

You implemented the system from Rob Carver's excellent books

You made all the improvements I've outlined above

You've got yourself a pro level system fr

Better than 90% of tradfi kwants

But...

/22

@investingidiocy At this point you are kinda stuck.

There are other edges

And they fall into two categories

Both suck

/23

There are other edges

And they fall into two categories

Both suck

/23

@investingidiocy Firstly, things that you can do that are highly profitable that have very little capacity

Lemme help the STREET KWANTS

Virtually any idea you have about shorting small cap crypto will work

This is because, obviously and trivially, shitcoins are, on average, really shit

/24

Lemme help the STREET KWANTS

Virtually any idea you have about shorting small cap crypto will work

This is because, obviously and trivially, shitcoins are, on average, really shit

/24

@investingidiocy Shorting new lows

Shorting new listings

Shorting things where the funding rate blows out so much it can only be crime by insiders selling

These are SHIT HOT trades. *You* can do them, with a mouse and a spreadsheet

/25

Shorting new listings

Shorting things where the funding rate blows out so much it can only be crime by insiders selling

These are SHIT HOT trades. *You* can do them, with a mouse and a spreadsheet

/25

@investingidiocy The catch is they can hardly hold any money

You won't get more than a few hundred K into stuff like this

But still...

The other category of stuff is more frustrating (and we will get to the solution in a few minutes(

/26

You won't get more than a few hundred K into stuff like this

But still...

The other category of stuff is more frustrating (and we will get to the solution in a few minutes(

/26

@investingidiocy Some signals are great but wiggle around too much for you to be able to monetize them

Obviously you can smooth things with an EWMA or whatever (reach for the simplest tool as a habit)

But there are limits

/27

Obviously you can smooth things with an EWMA or whatever (reach for the simplest tool as a habit)

But there are limits

/27

@investingidiocy What kind of things do I mean?

Well, in TradFi land @investingidiocy has zero idea which instrument is gonna trend next year

He *has* to throw as many things as he can, and his Sharpe will scale with the square root of the indepenent bets

/28

Well, in TradFi land @investingidiocy has zero idea which instrument is gonna trend next year

He *has* to throw as many things as he can, and his Sharpe will scale with the square root of the indepenent bets

/28

@investingidiocy Does that hold for crypto?

Well, NO it doesn't. But (suckily) its too good for you to monetize properly without good execution

Let me make it clearer

/29

Well, NO it doesn't. But (suckily) its too good for you to monetize properly without good execution

Let me make it clearer

/29

@investingidiocy There are things which demonstrably predict how likely something is to trend

This is NOT the case in TradFi

It is true that trend works best on BTC, then ETH, then XRP, SOL... all rolling off in an almost perfectly linear manner until small coins show NEGATIVE trend

/30

This is NOT the case in TradFi

It is true that trend works best on BTC, then ETH, then XRP, SOL... all rolling off in an almost perfectly linear manner until small coins show NEGATIVE trend

/30

@investingidiocy This is a big fucking deal, right?

There is a *number* of things which predict how much something is likely to trend

And you can model that carefully and build radically better trend models

/31

There is a *number* of things which predict how much something is likely to trend

And you can model that carefully and build radically better trend models

/31

@investingidiocy But, and it's a big fucking but

These models will turn over your book every few days

Run the T cost math on turning over book 100+ times per year

You'll lose money

/32

These models will turn over your book every few days

Run the T cost math on turning over book 100+ times per year

You'll lose money

/32

@investingidiocy Would you like to know the solution?

It's pretty obvious, now

If you *could* execute like a market maker, continuously adjusting position sizes up or down as your signal strength went up and down...

Then you could model all these other interactions

And do other shit

/33

It's pretty obvious, now

If you *could* execute like a market maker, continuously adjusting position sizes up or down as your signal strength went up and down...

Then you could model all these other interactions

And do other shit

/33

@investingidiocy You could take advantage of seasonality, and rebalancing flows, and shorting dogshit...

And good execution opens up the door to do mean reversion trading as well

/34

And good execution opens up the door to do mean reversion trading as well

/34

@investingidiocy And mean reversion works when trend doesn't so its an ideal thing to mix into a soup

But you would need to have market maker execution and the system recalculating positions continuously

/35

But you would need to have market maker execution and the system recalculating positions continuously

/35

@investingidiocy But this, with a lot of features, a good stat-arb system and an MVO would be the platonic ideal of a state of the art trading system

As a retail tradoor, I've got an itch I have to scratch to trade a TRULY pro level system just once in my life

So I built it. Kinda

/36

As a retail tradoor, I've got an itch I have to scratch to trade a TRULY pro level system just once in my life

So I built it. Kinda

/36

@investingidiocy I just solved the problem in a different way

I needed world class HFT execution

And now @liquiditygoblin is our business partner and dear friend

That's what HyperTrend is

/37

I needed world class HFT execution

And now @liquiditygoblin is our business partner and dear friend

That's what HyperTrend is

/37

@investingidiocy @liquiditygoblin Without the marketing bullshit

HyperTrend is a USDC denominated DeFi vault running a sophisticated and close to state-of-the-art quant system with HFT execution

It's all the hedge fund backend stuff built into a smart contract

/38

HyperTrend is a USDC denominated DeFi vault running a sophisticated and close to state-of-the-art quant system with HFT execution

It's all the hedge fund backend stuff built into a smart contract

/38

@investingidiocy @liquiditygoblin Its amazing tech, for real. @therobotjames @liquiditygoblin and all our team are so proud of it

If you are a quant shop or prop firm that would like your own vault like this (with our MM execution) just reach out... our business model is rent this infra (50bps AUM)

/39

If you are a quant shop or prop firm that would like your own vault like this (with our MM execution) just reach out... our business model is rent this infra (50bps AUM)

/39

@investingidiocy @liquiditygoblin @therobotjames We are going to open up our vaults for deposits soon

Fees are 2/20

It should be *comfortably* over Sharpe 2.0 at scale (probably more at first)

If you'd like to know more about our trading systems watch this

/40

Fees are 2/20

It should be *comfortably* over Sharpe 2.0 at scale (probably more at first)

If you'd like to know more about our trading systems watch this

/40

• • •

Missing some Tweet in this thread? You can try to

force a refresh