My top 10 investing lessons I wish I knew 10 years ago:

1. Become a learning machine

The best investors are always learning. Make it a top priority.

1. Become a learning machine

The best investors are always learning. Make it a top priority.

2. Don’t use leverage

Leverage is tempting, but it magnifies risk.

Keep your investments simple and within your means.

Leverage is tempting, but it magnifies risk.

Keep your investments simple and within your means.

3. Keep your costs low

Small fees add up over time.

High fees can eat away at your returns.

Always choose low-cost investments, and make sure the fees are justified by the returns.

Small fees add up over time.

High fees can eat away at your returns.

Always choose low-cost investments, and make sure the fees are justified by the returns.

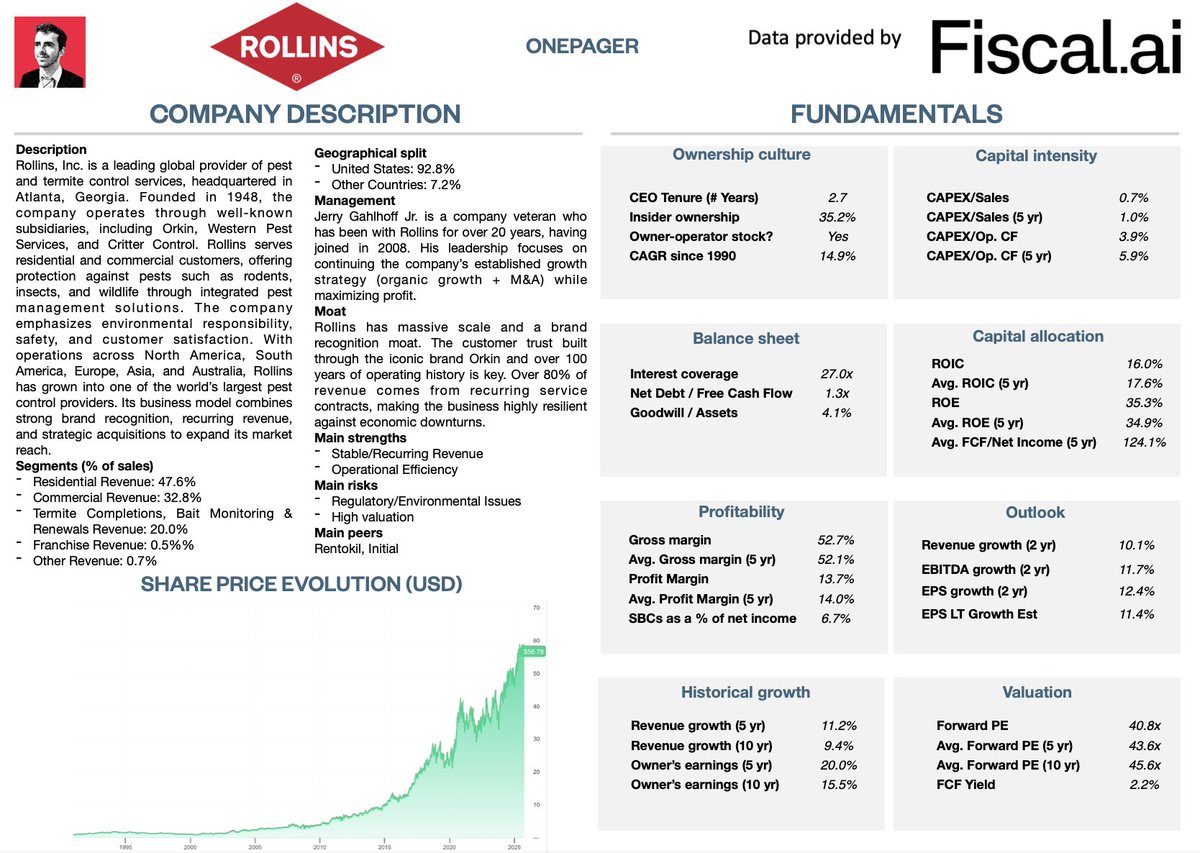

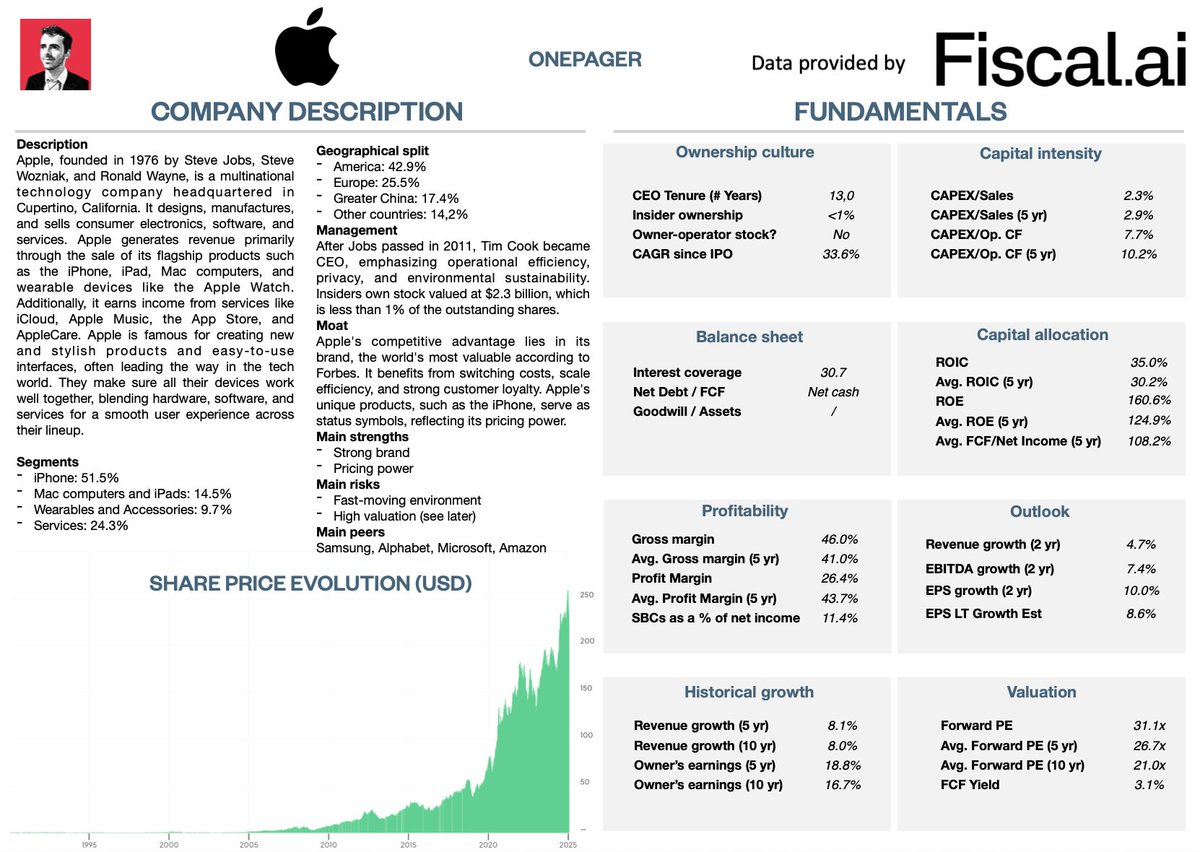

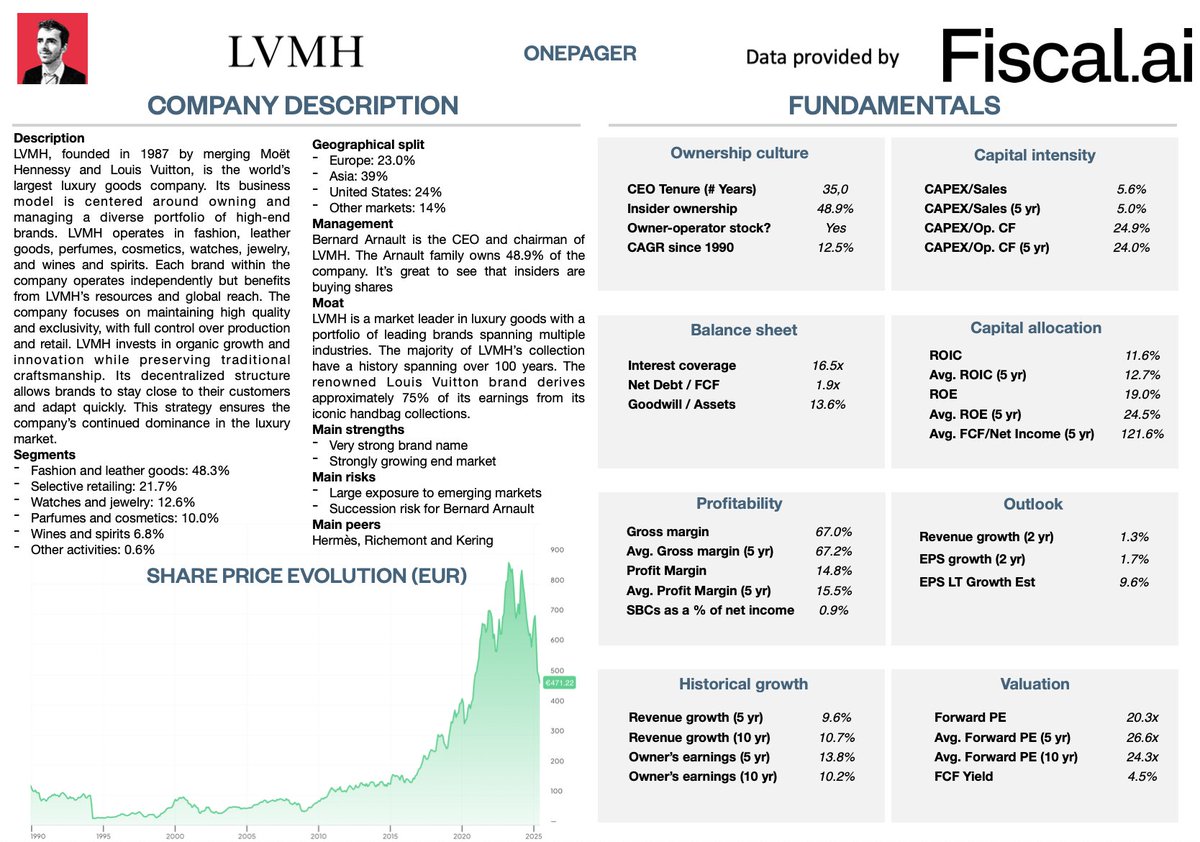

4. Know what you own

Don’t invest in something you don’t understand.

If I could go back, I’d tell myself to only invest in businesses I could explain to others.

Knowledge about what you're investing in is vital.

Don’t invest in something you don’t understand.

If I could go back, I’d tell myself to only invest in businesses I could explain to others.

Knowledge about what you're investing in is vital.

5. Let your winners run

It’s easy to sell a stock when it’s up, but real wealth comes from letting your winners grow.

Patience pays off.

The longer you hold great companies, the greater the returns.

It’s easy to sell a stock when it’s up, but real wealth comes from letting your winners grow.

Patience pays off.

The longer you hold great companies, the greater the returns.

6. Never time the market

Trying to buy at the lowest point and sell at the highest is a fool’s game.

Focus on finding great companies and holding them long-term.

Short-term moves don’t matter much in the grand scheme.

Trying to buy at the lowest point and sell at the highest is a fool’s game.

Focus on finding great companies and holding them long-term.

Short-term moves don’t matter much in the grand scheme.

7. Invest in great companies

It’s not about finding the next big trend; it’s about investing in businesses with a proven track record and long-term potential.

Find companies that will grow, not just for a quarter, but for decades.

It’s not about finding the next big trend; it’s about investing in businesses with a proven track record and long-term potential.

Find companies that will grow, not just for a quarter, but for decades.

8. Do your own homework

Relying on others is dangerous.

I learned that doing my own research, whether it's reading financial reports, understanding the business model, or staying up to date, was the key to making smarter decisions.

Relying on others is dangerous.

I learned that doing my own research, whether it's reading financial reports, understanding the business model, or staying up to date, was the key to making smarter decisions.

9. Always keep things simple

Investing doesn’t need to be complicated.

It’s tempting to follow complex strategies, but simplicity works.

Focus on what you know and understand. Invest in businesses, not trends.

Investing doesn’t need to be complicated.

It’s tempting to follow complex strategies, but simplicity works.

Focus on what you know and understand. Invest in businesses, not trends.

10. Take advantage of Mr. Market

Market volatility can work in your favor.

Mr. Market is irrational. Use that to your advantage.

When others panic, it’s often the best time to buy high-quality companies at a discount.

Market volatility can work in your favor.

Mr. Market is irrational. Use that to your advantage.

When others panic, it’s often the best time to buy high-quality companies at a discount.

That's it for today. Did you like this?

Here are 50 investing visuals with 50 important investing lessons: compounding-quality.kit.com/e1d0d78891

Here are 50 investing visuals with 50 important investing lessons: compounding-quality.kit.com/e1d0d78891

• • •

Missing some Tweet in this thread? You can try to

force a refresh