Free cash flow is a measure after capital expenditures and incorporates fluctuations in working capital.

Since founding, BYD's modus operandi has been to re-allocate every dollar of operating cashflow + as much capital as it can raise — as non-dilutively as possible — to support the needs of a rapidly growing business.

Frankly, it is financially illiterate to describe re-investment back into a growing business as "losses". Negative cashflow is a cashflow item and — especially if related to CapEx and working capital fluctuations (which I will address below) — is conceptually different from "losses" which is an income statement term.

Since founding, BYD's modus operandi has been to re-allocate every dollar of operating cashflow + as much capital as it can raise — as non-dilutively as possible — to support the needs of a rapidly growing business.

Frankly, it is financially illiterate to describe re-investment back into a growing business as "losses". Negative cashflow is a cashflow item and — especially if related to CapEx and working capital fluctuations (which I will address below) — is conceptually different from "losses" which is an income statement term.

https://x.com/GlennLuk/status/1983939382156443991

A better approach is to consider how much long-term capital the company has raised an compare it to the scale of operating capacity that capital has enabled.

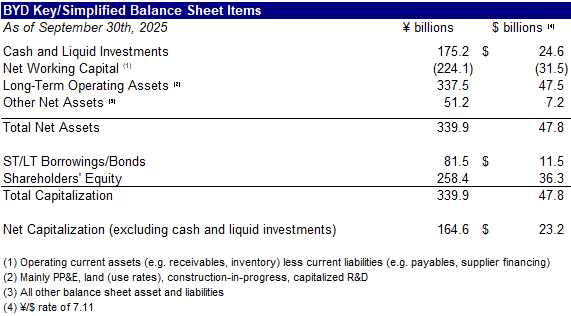

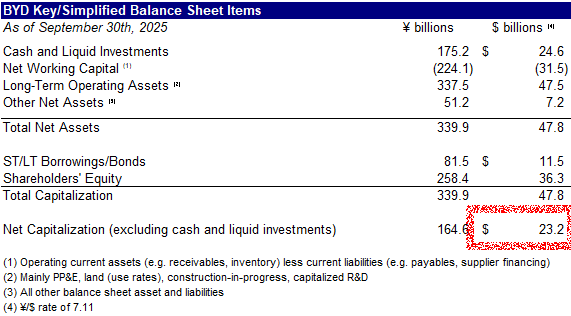

We can look at this from BYD's latest balance sheet, which I have summarized here:

We can look at this from BYD's latest balance sheet, which I have summarized here:

To date, BYD has taken in a total of ¥340B in debt and equity funding.

This number includes ~¥82B of ST/LT borrowings and ¥258B of equity (or equity-like) funding.

The equity funding includes ¥107B of "undistributed profit" which is similar in concept to retained earnings (we'll get back to this point in a bit).

This number includes ~¥82B of ST/LT borrowings and ¥258B of equity (or equity-like) funding.

The equity funding includes ¥107B of "undistributed profit" which is similar in concept to retained earnings (we'll get back to this point in a bit).

This capital (~$23B in USD, net of cash) has funded the buildout of BYD's operation today, which includes:

(i) its contract manufacturing operation (~$27B in revenue, ~1/5th the size of Foxconn)

(ii) the world's second-largest battery business (after CATL), and

(iii) the world's largest (and a highly verticalized) NEV production operation which combined with the battery business generates ~$100B in revenue @ ~22% gross margin and has ~7M in production capacity (incl. construction-in-progress)

(i) its contract manufacturing operation (~$27B in revenue, ~1/5th the size of Foxconn)

(ii) the world's second-largest battery business (after CATL), and

(iii) the world's largest (and a highly verticalized) NEV production operation which combined with the battery business generates ~$100B in revenue @ ~22% gross margin and has ~7M in production capacity (incl. construction-in-progress)

Just to put this in perspective, Tesla's comparable figure is ~$38B (shareholders' equity minus cash and ST investments), >60% higher than BYD (~$23B).

This has funded a business that generates ~$80B in run-rate revenue (~16% gross margin) and vehicle production capacity of ~2.4M p.a.

Note: Tesla is not some inefficiently run company; I'd argue that it is the most capital-efficient and best-run advanced manufacturer outside of China today.

This has funded a business that generates ~$80B in run-rate revenue (~16% gross margin) and vehicle production capacity of ~2.4M p.a.

Note: Tesla is not some inefficiently run company; I'd argue that it is the most capital-efficient and best-run advanced manufacturer outside of China today.

So the better way to look at this is not "accumulated free cash flow" but considering whether the operating business/footprint today justifies that capital that has been invested + whether business can continue compounding at a high rate of return going forward.

This is almost certainly the way Charlie Munger and Warren Buffett looked at the investment over their long ownership period starting in 2008.

This is almost certainly the way Charlie Munger and Warren Buffett looked at the investment over their long ownership period starting in 2008.

OP highlights the supplier financing question. This is something I have analyzed before.

If BYD were to switch a normal payable days cycle, this would result in ¥106B in additional net working capital.

If BYD were to switch a normal payable days cycle, this would result in ¥106B in additional net working capital.

https://x.com/GlennLuk/status/1936791469655732451

This is how that change impacts BYD's balance sheet.

Effectively, what was once funded by negative working capital is now funded by additional borrowings (or a drawdown out of the ¥175B it has in cash and equivalents).

This increases BYD's net capitalization to ~$38B, in line with Tesla's.

Note: BYD is still running a negative net working capital balance after the pro forma reduction in payables. But this new pro forma balance is in line with Tesla, which also runs a substantial net operating** working capital deficit.

** current operating assets (excl cash/equivalents) minus current operating liabilities (excl ST borrowings)

Effectively, what was once funded by negative working capital is now funded by additional borrowings (or a drawdown out of the ¥175B it has in cash and equivalents).

This increases BYD's net capitalization to ~$38B, in line with Tesla's.

Note: BYD is still running a negative net working capital balance after the pro forma reduction in payables. But this new pro forma balance is in line with Tesla, which also runs a substantial net operating** working capital deficit.

** current operating assets (excl cash/equivalents) minus current operating liabilities (excl ST borrowings)

Thus for the same level of nominal $/¥ capitalization, compared to Tesla, BYD produces:

(i) ~3x the car volume

(ii) ~2x the gross profit (far more vertically integrated), and

(iii) has a large CM business to boot.

It is growing faster than Tesla on a YoY business and choosing to re-invest more heavily in the business, as evidenced by its continued rapid expansion in production capacity and R&D workforce, investing ~1.5x as much CapEx and ~2x as much in R&D (~6x the number of engineers).

(i) ~3x the car volume

(ii) ~2x the gross profit (far more vertically integrated), and

(iii) has a large CM business to boot.

It is growing faster than Tesla on a YoY business and choosing to re-invest more heavily in the business, as evidenced by its continued rapid expansion in production capacity and R&D workforce, investing ~1.5x as much CapEx and ~2x as much in R&D (~6x the number of engineers).

This financial illiteracy has extended to comments below like this.

Referencing the aforementioned "undistributed profits" or "retained earnings", we can clearly see that BYD has generated cumulative profits of ¥107B since inception.

Referencing the aforementioned "undistributed profits" or "retained earnings", we can clearly see that BYD has generated cumulative profits of ¥107B since inception.

https://x.com/Noahpinion/status/1984170802334540245

Per above, these profits — and more, via external capital raising at significant premiums to book value — have been reinvested back into the business, at high RoICs, especially if you take into account the long-term, highly efficient operation that has been built.

Now do gross margin. Or expand beyond a single quarter.

And Tesla's FCF is higher because it is investing far less in CapEx and R&D today compared to BYD, as described above.

See, it's very easy to cherrypick stats to show what you want to show.

And Tesla's FCF is higher because it is investing far less in CapEx and R&D today compared to BYD, as described above.

See, it's very easy to cherrypick stats to show what you want to show.

https://x.com/alojoh/status/1983947892164604337

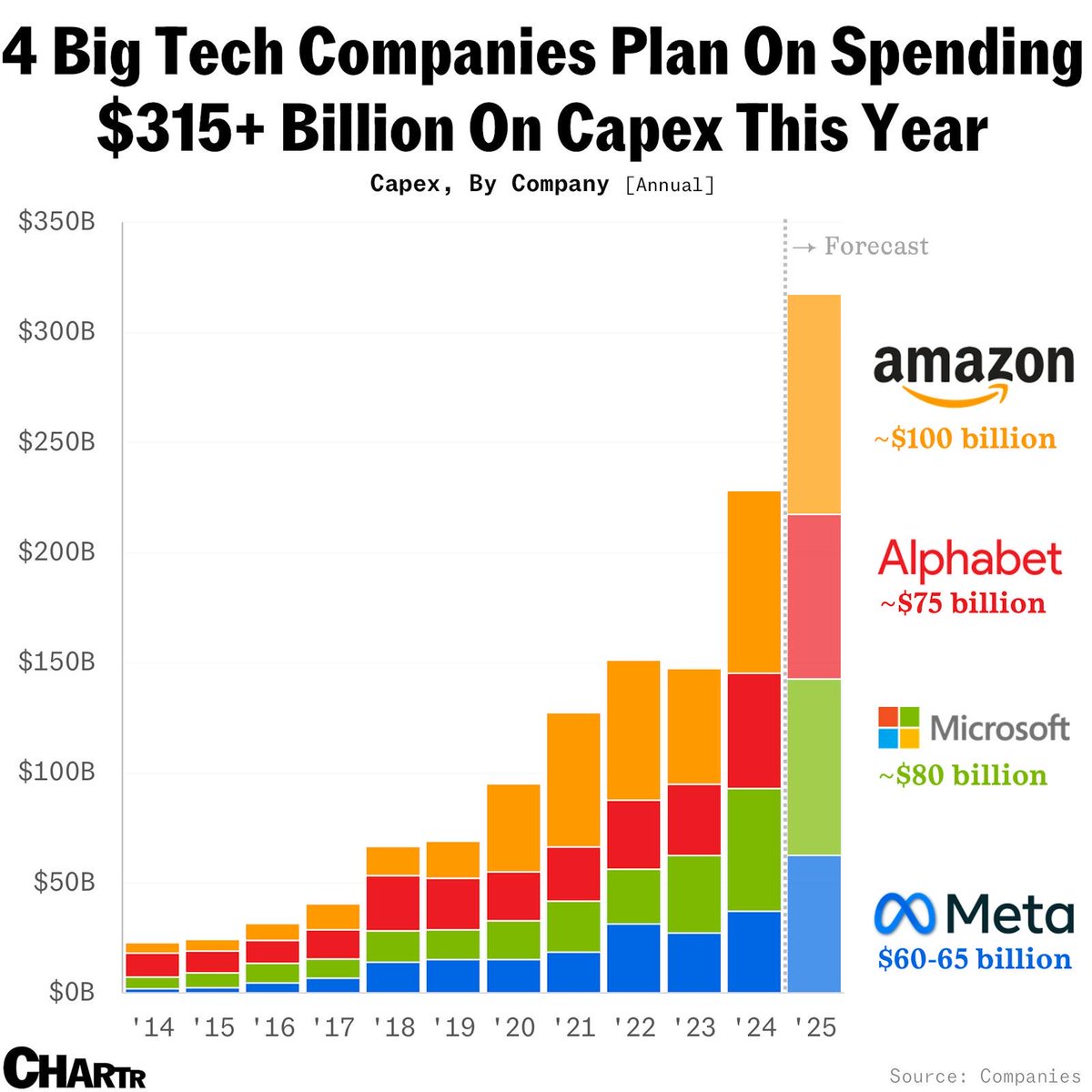

Big Tech companies investing heavily in AI CapEx right now are running free cash flow tens of billions p.a. below operating income, just like BYD.

This is because they — like BYD in EVs — view AI a as a large growth opportunity and it takes significant CapEx to buildout hyperscalers.

This is because they — like BYD in EVs — view AI a as a large growth opportunity and it takes significant CapEx to buildout hyperscalers.

• • •

Missing some Tweet in this thread? You can try to

force a refresh