🧵 BTC vs Silver: The Real Anti-Inflation Paradox

1️⃣

Everyone says Bitcoin is “anti-inflationary.”

Fixed supply. Predictable issuance. Digital scarcity.

Sounds perfect, right?

Wrong. That’s exactly where the problem begins. 👇

#Silver #Bitcoin #Gold #StackerLogic #SilverStackers #SilverSqueeze #SoundMoney #HardAssets #PreciousMetals

1️⃣

Everyone says Bitcoin is “anti-inflationary.”

Fixed supply. Predictable issuance. Digital scarcity.

Sounds perfect, right?

Wrong. That’s exactly where the problem begins. 👇

#Silver #Bitcoin #Gold #StackerLogic #SilverStackers #SilverSqueeze #SoundMoney #HardAssets #PreciousMetals

2️⃣

Because when a real crisis hits — markets don’t care about perfect equations.

They care about flow, adaptability and survival.

That’s where silver leaves Bitcoin in the dust.

Because when a real crisis hits — markets don’t care about perfect equations.

They care about flow, adaptability and survival.

That’s where silver leaves Bitcoin in the dust.

3️⃣

🥈 When demand spikes, silver moves.

Recycling ramps up. Miners expand output.

Old vaults open.

Metal flows from weak hands to strong hands.

The system breathes. It adapts.

🥈 When demand spikes, silver moves.

Recycling ramps up. Miners expand output.

Old vaults open.

Metal flows from weak hands to strong hands.

The system breathes. It adapts.

4️⃣

₿ Bitcoin can’t do that.

Its emission schedule is locked in code — immune to human need.

No matter how desperate the world gets, blocks tick at the same pace.

That’s not strength.

That’s paralysis.

₿ Bitcoin can’t do that.

Its emission schedule is locked in code — immune to human need.

No matter how desperate the world gets, blocks tick at the same pace.

That’s not strength.

That’s paralysis.

5️⃣

In theory, “fixed supply” sounds like protection.

In practice, it removes feedback — the heartbeat of every living market.

Without feedback, systems don’t evolve. They just wait.

In theory, “fixed supply” sounds like protection.

In practice, it removes feedback — the heartbeat of every living market.

Without feedback, systems don’t evolve. They just wait.

6️⃣

Silver responds to pressure like nature does:

pressure → reaction → balance.

It’s self-correcting, elastic, real.

Bitcoin ignores pressure:

pressure → no change → instability.

Silver responds to pressure like nature does:

pressure → reaction → balance.

It’s self-correcting, elastic, real.

Bitcoin ignores pressure:

pressure → no change → instability.

7️⃣

That’s the paradox:

In calm times, Bitcoin looks perfect.

In chaos, its perfection becomes its cage. 🧊

Silver — real, tangible, alive — survives because it adapts.

Not because it’s frozen in code.

That’s the paradox:

In calm times, Bitcoin looks perfect.

In chaos, its perfection becomes its cage. 🧊

Silver — real, tangible, alive — survives because it adapts.

Not because it’s frozen in code.

8️⃣

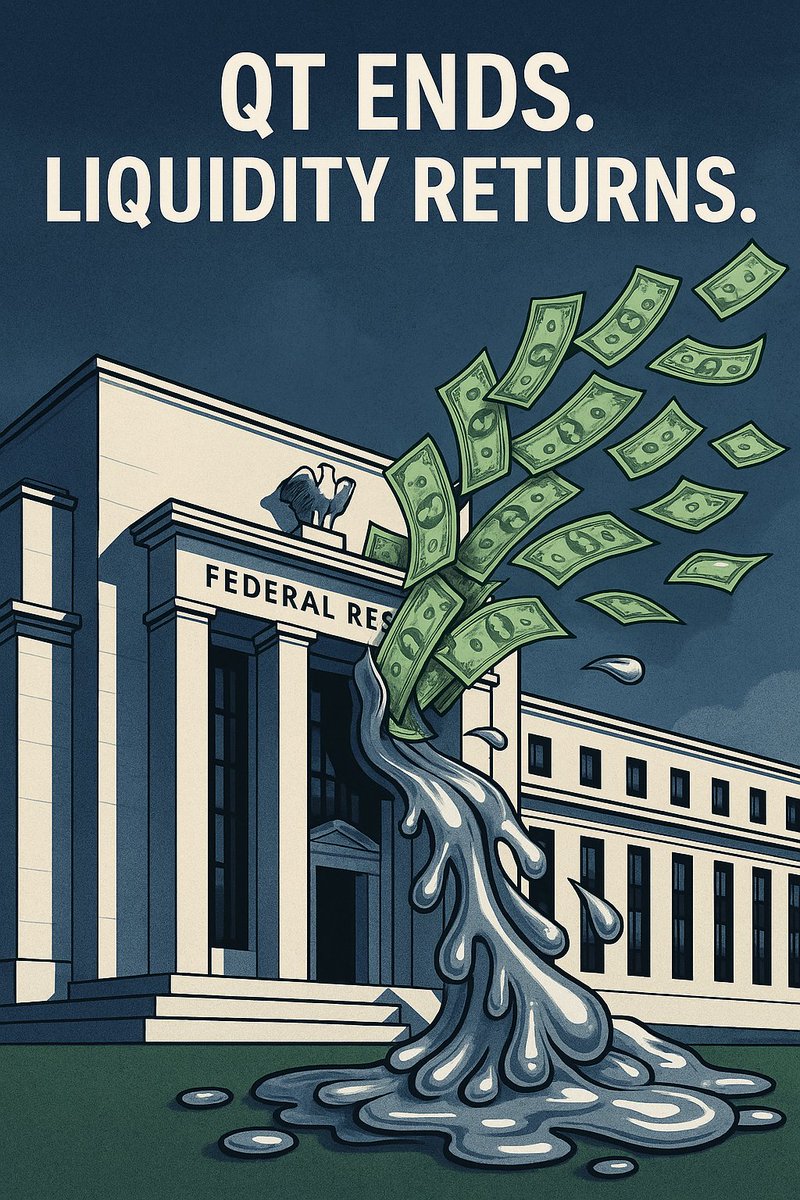

When liquidity freezes, BTC can only go up in price — but not in availability.

It becomes a speculative mirror, not a stabilizing force.

Silver, on the other hand, becomes functional money again — the metal of the people.

When liquidity freezes, BTC can only go up in price — but not in availability.

It becomes a speculative mirror, not a stabilizing force.

Silver, on the other hand, becomes functional money again — the metal of the people.

9️⃣

Nature rewards adaptability, not rigidity.

That’s why the metal born in stars still outlives every digital illusion.

When things collapse, I don’t want perfection.

I want reaction.

🥈 > ₿

Follow for more real metal logic.

Share if you’d rather guard your own ounces. 🥈💪

Nature rewards adaptability, not rigidity.

That’s why the metal born in stars still outlives every digital illusion.

When things collapse, I don’t want perfection.

I want reaction.

🥈 > ₿

Follow for more real metal logic.

Share if you’d rather guard your own ounces. 🥈💪

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh