🧵 December Setup: The Perfect Storm for Silver 🥈🔥

1️⃣

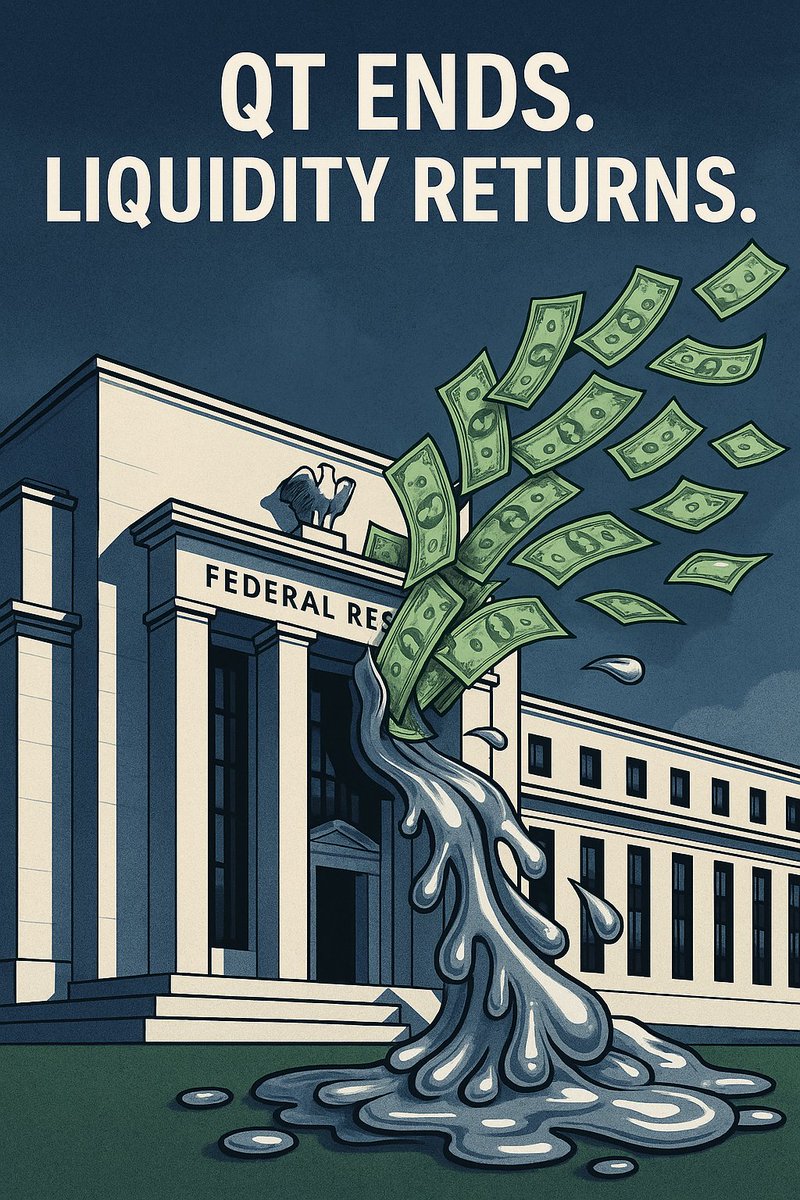

It’s official.

The Fed ends its balance sheet wind-down on December 1.

QT is over.

Translation?

💸 Liquidity is coming back.

The era of “tightening” quietly flips to loosening.

1️⃣

It’s official.

The Fed ends its balance sheet wind-down on December 1.

QT is over.

Translation?

💸 Liquidity is coming back.

The era of “tightening” quietly flips to loosening.

2️⃣

At the same time…

December is the front & delivery month at the COMEX.

That’s when the biggest physical deliveries take place.

And London (LBMA) is already running low. 👇

At the same time…

December is the front & delivery month at the COMEX.

That’s when the biggest physical deliveries take place.

And London (LBMA) is already running low. 👇

3️⃣

📉 TF Metals Report:

London silver stocks drawn down again in October

46 M oz drained from New York

22 M oz drained from Shanghai

Part of that metal was shipped to London just to keep it alive

You can’t print silver.

📉 TF Metals Report:

London silver stocks drawn down again in October

46 M oz drained from New York

22 M oz drained from Shanghai

Part of that metal was shipped to London just to keep it alive

You can’t print silver.

4️⃣

Now connect the dots:

Fed stops tightening → dollar liquidity expands.

LBMA is bleeding physical.

COMEX heads into a major delivery cycle.

Liquidity floods the system.

Metal leaves the vaults.

Now connect the dots:

Fed stops tightening → dollar liquidity expands.

LBMA is bleeding physical.

COMEX heads into a major delivery cycle.

Liquidity floods the system.

Metal leaves the vaults.

5️⃣

Every previous QE cycle sent gold and silver higher.

But this time the physical side is already dry.

No buffer, no stockpiles, no rescue from Shanghai or NY.

This is where paper meets scarcity.

Every previous QE cycle sent gold and silver higher.

But this time the physical side is already dry.

No buffer, no stockpiles, no rescue from Shanghai or NY.

This is where paper meets scarcity.

6️⃣

When fiat expands and metal disappears,

price is the only relief valve.

That’s why December might be remembered as the month the “paper illusion” cracked again.

When fiat expands and metal disappears,

price is the only relief valve.

That’s why December might be remembered as the month the “paper illusion” cracked again.

7️⃣

They’ll call it “liquidity management.”

We’ll call it what it is:

The start of QE 5 — and the beginning of the next silver storm.

🥈 flows where truth returns. ⚡

They’ll call it “liquidity management.”

We’ll call it what it is:

The start of QE 5 — and the beginning of the next silver storm.

🥈 flows where truth returns. ⚡

📣

If you see the setup —

Follow 🦍

Share 🥈

Stay ready.

#Silver #Gold #COMEX #LBMA #Fed #QE #StackerLogic #SilverSqueeze

If you see the setup —

Follow 🦍

Share 🥈

Stay ready.

#Silver #Gold #COMEX #LBMA #Fed #QE #StackerLogic #SilverSqueeze

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh