Today is a sad day, but the show must go on. Time to think about the poor bankers if Reform or Tories get in and abandon Renewables Obligations and cut carbon taxes (1/n)

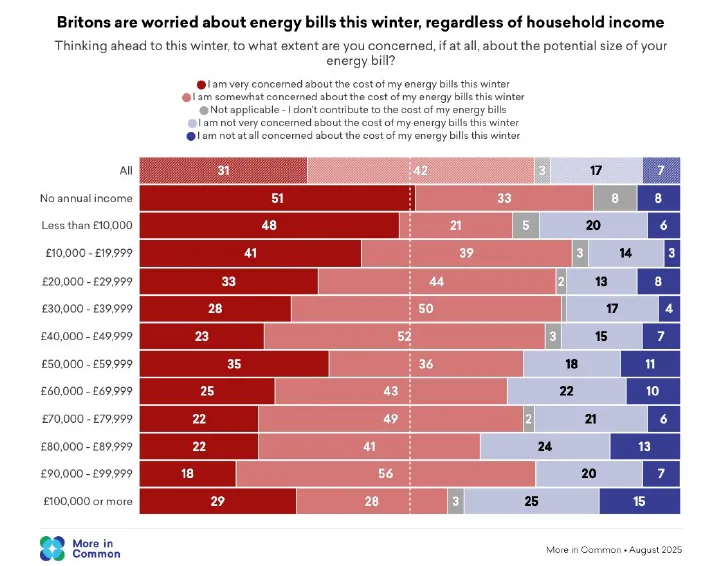

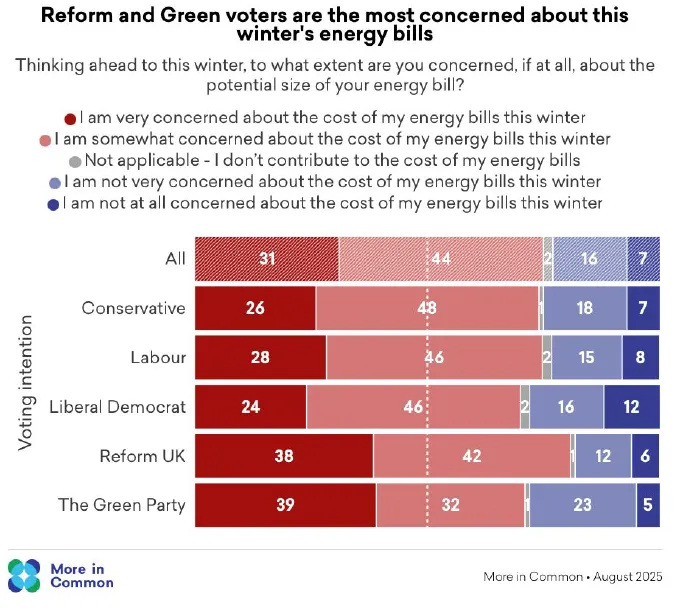

ROCs will cost about £7.8bn this financial year. Onshore and offshore wind are the biggest recipients of ROC subsidies (2/n)

Carbon costs add about £2bn to electricity bills and the cost is rising after Starmer announced we would realign with the EU ETS scheme. Carbon costs make up about a third of wholesale electricity prices (3/n)

Removal of carbon costs and ROCs will be dangerous for operators and investment companies that finance their investments with debt, typically about 40% of gross asset value (4/n)

Large operators like RWE & smaller operators like the generation arm of Ecotricity carry quite a lot of debt on their balance sheets. Losing a third of market-derived revenue will be a big blow to ROC-funded generators. Losing ROC subsidies will have an even bigger impact (5/n)

If we look at a hypothetical ROC-funded offshore windfarm we can calculate the impact on Gross and Net Asset Values (GAV & NAV) assuming 40% gearing. (6/n)

Removing carbon costs cuts GAV by 21% and NAV by 35%. Removing ROCs cuts GAV by over 75% and sends NAV negative. Removing both sends GAV to almost zero (7/n)

At first glance, CfD-funded generators should be unaffected. But there's some windfarms (e.g. Seagreen and Moray West) operating on merchant rates, by not activating their contracts (8/n)

If market rates fall from ~£75/MWh to ~£55/MWh, revenue falls, making it tricky to repay debts. Seagreen has £3.1bn of debt with finance costs of £150m/yr. With revenue at £55/MWh it wouldn't generate enough cash to cover interest & principal payments even before opex (9/n)

Windfarms operating on a pure merchant basis would also see revenue plummet if carbon costs are removed from wholesale prices. Bankers should be getting worried (10/n)

Ending ROCs early and eliminating carbon costs from electricity will benefit consumers. But exposing windfarms to economic reality will be catastrophic for revenue & asset values. Bankers Beware. (11/n)

If you enjoyed this thread, please like and share. You can sign up for free to read the full article on the link below (12/12)

open.substack.com/pub/davidturve…

open.substack.com/pub/davidturve…

Hi @threadreaderapp unroll please.

• • •

Missing some Tweet in this thread? You can try to

force a refresh