The Ringgit appreciated to RM4.1895 against the US dollar this morning. 📈

Could this be due to the ASEAN Summit and PMX?

Yes, but it’s not the only driving factor.

Allow me to explain. 🧵

Could this be due to the ASEAN Summit and PMX?

Yes, but it’s not the only driving factor.

Allow me to explain. 🧵

1. Currencies fluctuate due to supply and demand.

Many factors influence this balance, such as:

• Interest rates by central banks

• Domestic growth & trade

• Foreign investor confidence and capital flows

• Inflation

Many factors influence this balance, such as:

• Interest rates by central banks

• Domestic growth & trade

• Foreign investor confidence and capital flows

• Inflation

2. During the ASEAN Summit on 26-28 October, the ringgit strengthened noticeably.

And yes, the successful event boosted investor confidence in Malaysia, which in turn, helped to strengthen the local currency.

But only marginally.

And yes, the successful event boosted investor confidence in Malaysia, which in turn, helped to strengthen the local currency.

But only marginally.

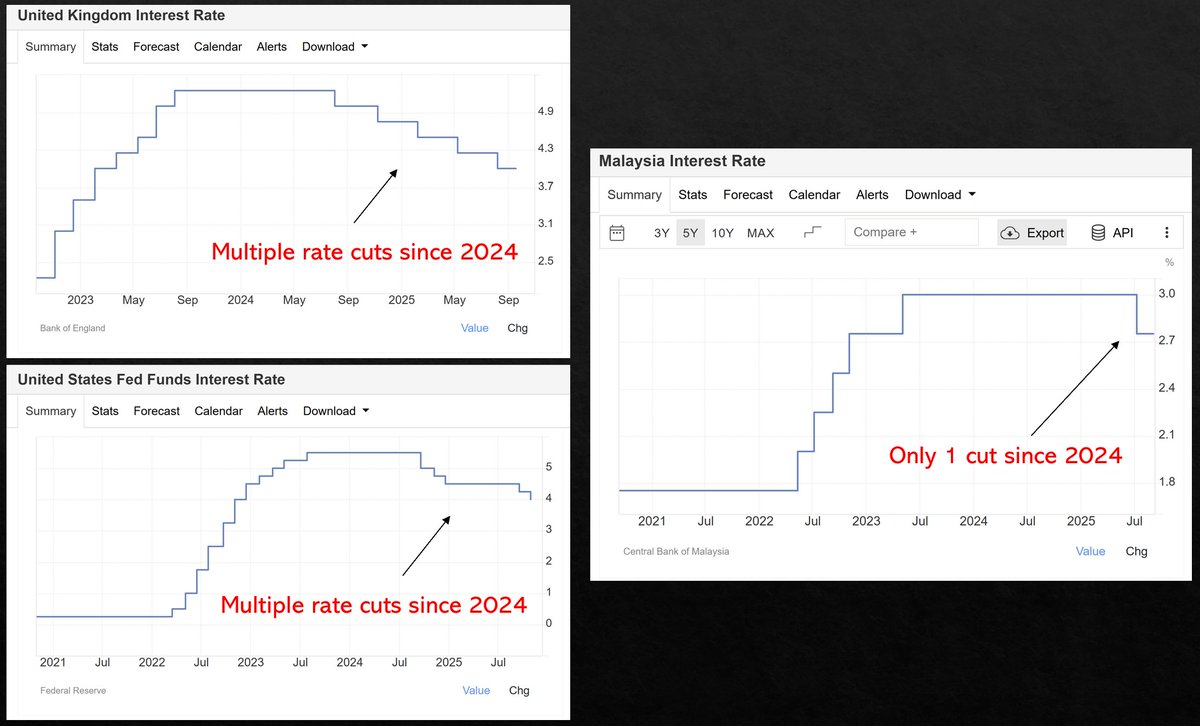

3. At the same time, central banks (United States and England) have also been cutting interest rates.

In simple terms: Lower rates make borrowing cheaper but also reduce returns on savings.

Investors earn less → so less demand for the dollar and pound.

In simple terms: Lower rates make borrowing cheaper but also reduce returns on savings.

Investors earn less → so less demand for the dollar and pound.

4. What about Bank Negara?

While BNM has cut interest rates in July, it is not planning any further cuts at the moment.

The US and UK, on the other hand, has already cut multiple times since 2024.

The narrowing difference of interest rates is one of the big drivers of the ringgit’s strength.

While BNM has cut interest rates in July, it is not planning any further cuts at the moment.

The US and UK, on the other hand, has already cut multiple times since 2024.

The narrowing difference of interest rates is one of the big drivers of the ringgit’s strength.

5. Malaysia has also shown strong economic fundamentals:

• Our economy expanded by 4.4% in Q2 2025

• Trade grew by 9.8% y-o-y in Sept

• Export growth rose for the 3rd straight month (12.2% y-o-y)

• We are in our 65th consecutive month of trade surplus.

• Our economy expanded by 4.4% in Q2 2025

• Trade grew by 9.8% y-o-y in Sept

• Export growth rose for the 3rd straight month (12.2% y-o-y)

• We are in our 65th consecutive month of trade surplus.

6. These numbers:

• Show Malaysia’s resilience amid Trump’s tariffs

• Boost investor confidence

• Increase demand for the local note.

That’s probably why you’re seeing the ringgit going up not only against the dollar, but many other currencies (yen, yuan, won, etc.).

• Show Malaysia’s resilience amid Trump’s tariffs

• Boost investor confidence

• Increase demand for the local note.

That’s probably why you’re seeing the ringgit going up not only against the dollar, but many other currencies (yen, yuan, won, etc.).

7. So where will the ringgit settle by year end?

Bank Negara is expecting the local note to hit RM4.00. 📈

This is not entirely out of the woods, as it “only” needs to appreciate by 5% in the next few weeks.

Either way, I’ll be watching closely and keeping you updated. 👌

Bank Negara is expecting the local note to hit RM4.00. 📈

This is not entirely out of the woods, as it “only” needs to appreciate by 5% in the next few weeks.

Either way, I’ll be watching closely and keeping you updated. 👌

Thanks for reading!

Follow us @TheFuturizts for more stuff like these. 😎

Follow us @TheFuturizts for more stuff like these. 😎

• • •

Missing some Tweet in this thread? You can try to

force a refresh