Carter-Ruck, the UK’s most notorious libel firm, used abusive litigation to silence criticism of a former Tory donor.

The Solicitors Regulation Authority is investigating - but Carter-Ruck just filed a judicial review. If successful, they'll have total impunity.

Thread:

The Solicitors Regulation Authority is investigating - but Carter-Ruck just filed a judicial review. If successful, they'll have total impunity.

Thread:

The donor is Mohamed Amersi.

Former Tory MP @CharlotteLeslie wrote a private note on Amersi's activities. As @DavidDavisMP said, Amersi then "used his wealth and influence to try to bully Charlotte Leslie into silence".

Former Tory MP @CharlotteLeslie wrote a private note on Amersi's activities. As @DavidDavisMP said, Amersi then "used his wealth and influence to try to bully Charlotte Leslie into silence".

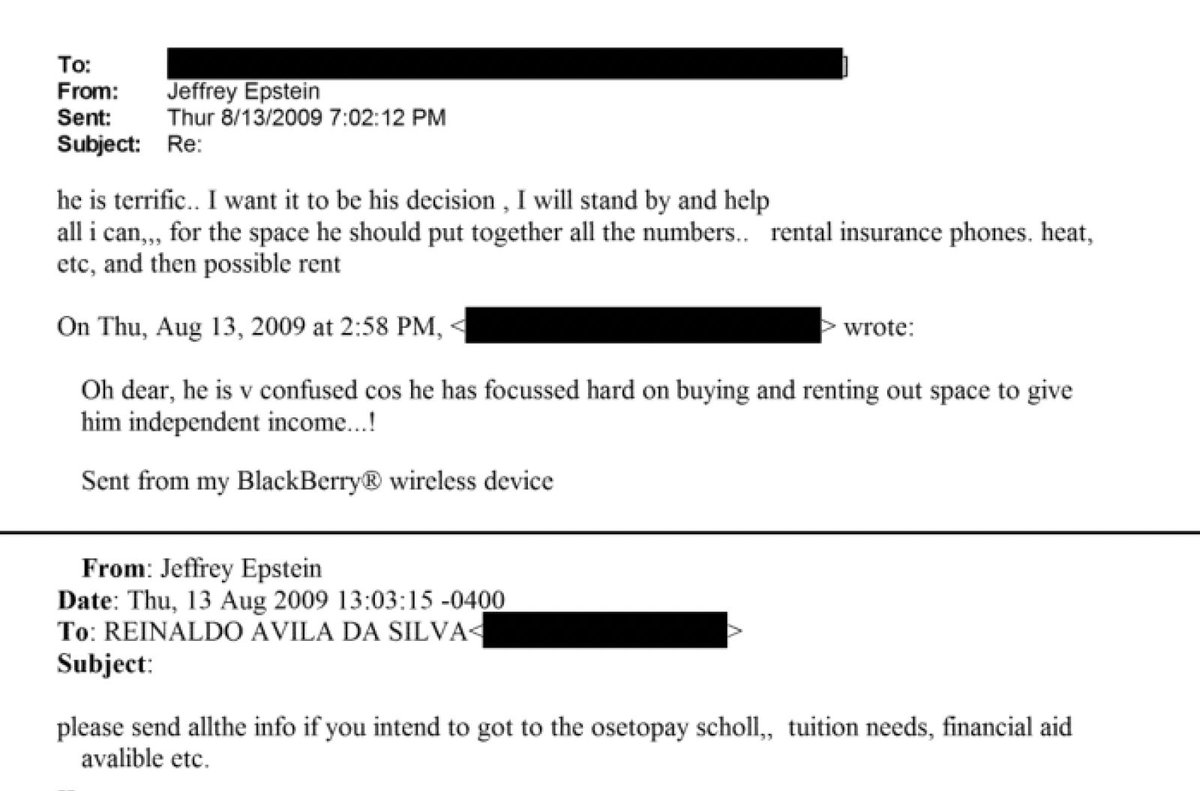

@CharlotteLeslie @DavidDavisMP Carter-Ruck acted for Amersi suing Ms Leslie for defamation. Carter-Ruck's approach was - in my view, and that of many others - designed to drain Ms Leslie's resources.

The High Court was extremely unimpressed.

The High Court was extremely unimpressed.

@CharlotteLeslie @DavidDavisMP David Davis said the litigation was a "SLAPP" - strategic litigation against public participation. Abusive litigation intended to silence someone.

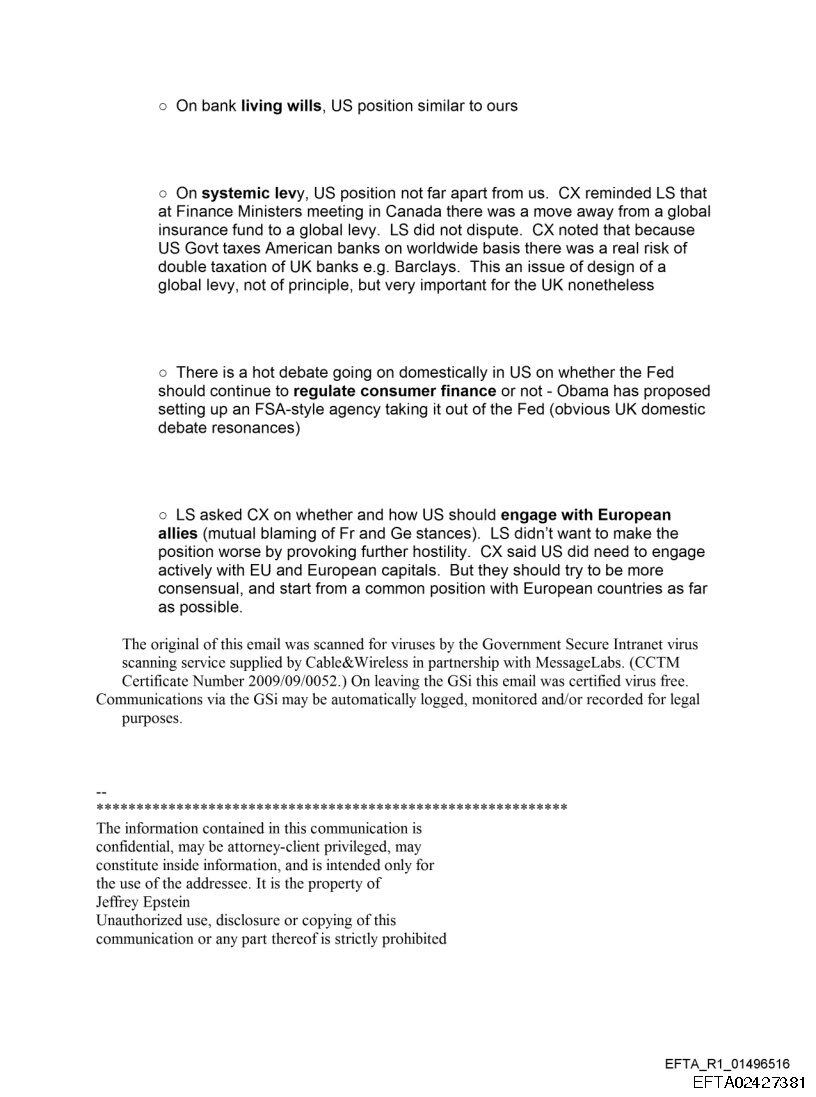

@CharlotteLeslie @DavidDavisMP This is the key paragraph of the High Court judgment. In my view, it backs what David Davis said:

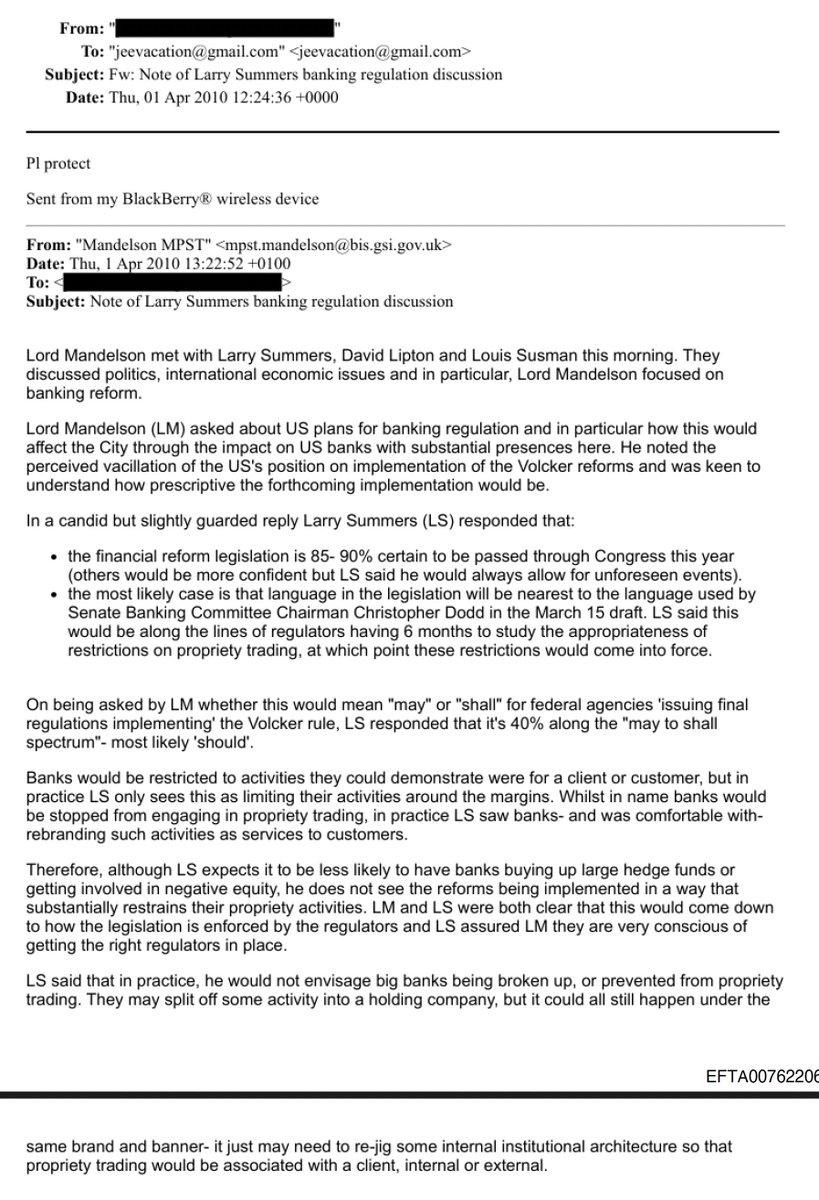

@CharlotteLeslie @DavidDavisMP David Davis then made a series of very serious allegations against Amersi in the House of Commons. It's protected by Parliamentary privilege - so Amersi can't sue Mr Davis.

He's been clear he'll sue anyone repeating them - and is currently suing the BBC (Carter-Ruck again)

He's been clear he'll sue anyone repeating them - and is currently suing the BBC (Carter-Ruck again)

@CharlotteLeslie @DavidDavisMP Abusive litigation is what Carter-Ruck do. In fact Amersi is one of their higher quality clients.

As we reported last month, Carter-Ruck acted for one of the world's largest ever fraudsters in circumstances where Carter-Ruck must have suspected they were helping the fraud.

As we reported last month, Carter-Ruck acted for one of the world's largest ever fraudsters in circumstances where Carter-Ruck must have suspected they were helping the fraud.

@CharlotteLeslie @DavidDavisMP There is no suggestion Amersi is a fraudster; just a bully.

I don't know if the allegations against him are true. I do think we should be able to discuss them.

I don't know if the allegations against him are true. I do think we should be able to discuss them.

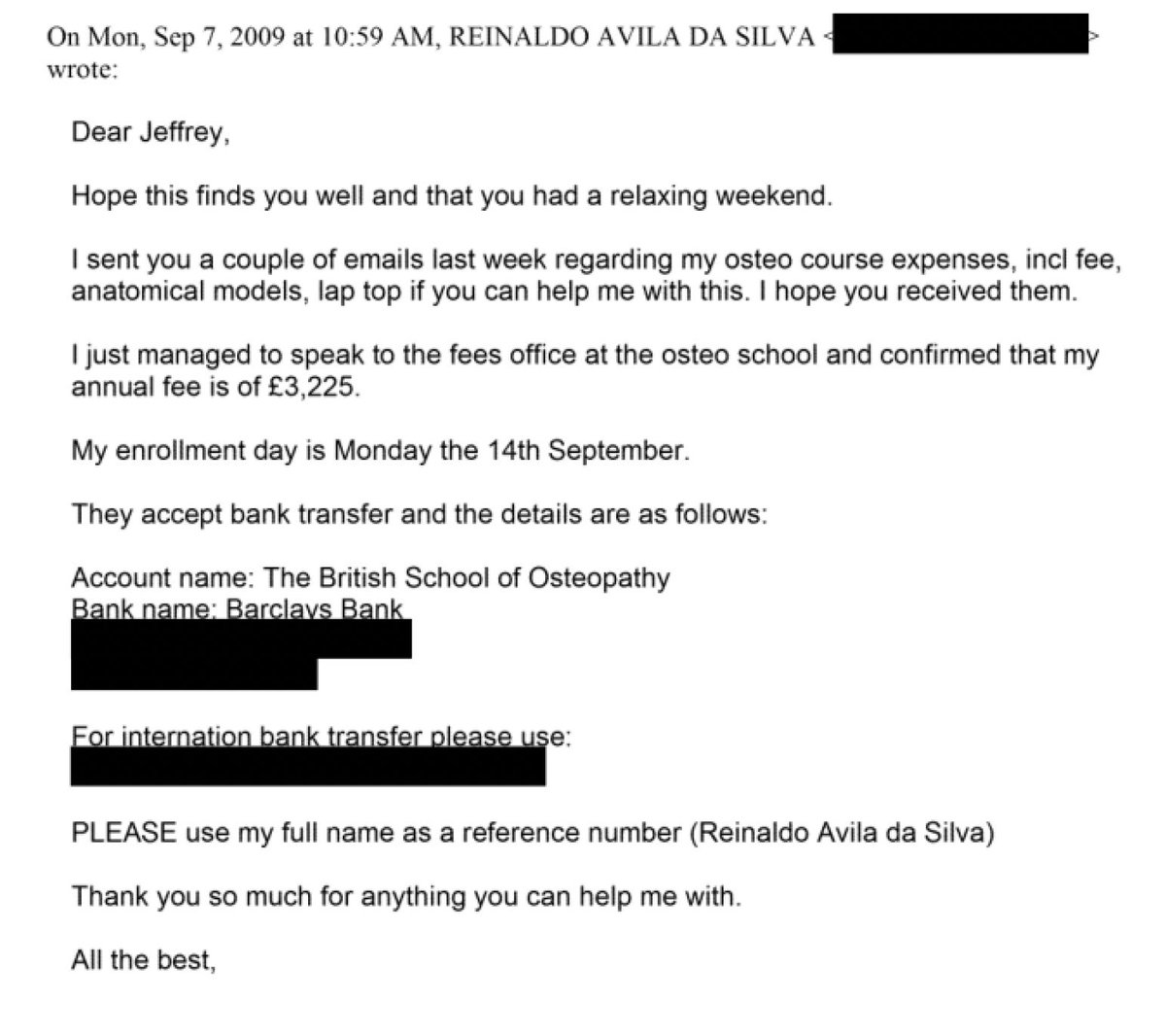

@CharlotteLeslie @DavidDavisMP After the collapse of the Amersi litigation, Ms Leslie referred Carter-Ruck to the Solicitors Regulation Authority.

@CharlotteLeslie @DavidDavisMP At this point a normal firm would explain its position to the SRA.

Carter-Ruck are not a normal firm.

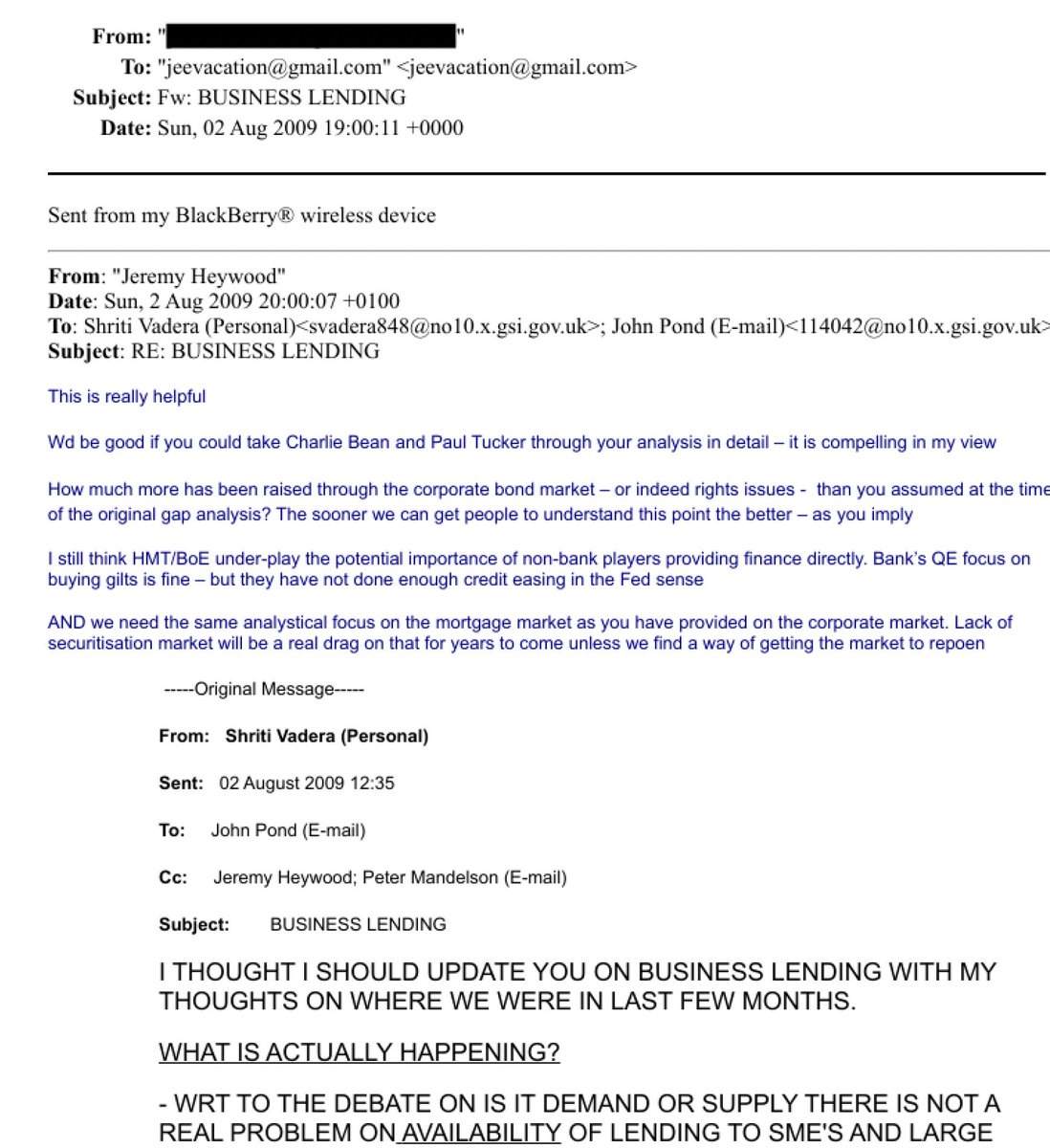

This is their response:

Carter-Ruck are not a normal firm.

This is their response:

@CharlotteLeslie @DavidDavisMP It's a judicial review to stop the SRA getting access to privileged documentation.

But the SRA can't possibly investigate a law firm unless it has access (unless the client agrees, which obviously Amersi won't).

But the SRA can't possibly investigate a law firm unless it has access (unless the client agrees, which obviously Amersi won't).

@CharlotteLeslie @DavidDavisMP Why are Carter-Ruck doing this?

I don't know. But I'd speculate: because they have something to hide. There's something in their client correspondence which (for example) proves that the litigation was abusive.

I don't know. But I'd speculate: because they have something to hide. There's something in their client correspondence which (for example) proves that the litigation was abusive.

@CharlotteLeslie @DavidDavisMP But - whatever the motivation - if Carter-Ruck are successful, then the SRA will never be able to investigate a law firm when it acts abusively and unethically.

Carter-Ruck have always acted with complete impunity. They'd like that to continue.

Carter-Ruck have always acted with complete impunity. They'd like that to continue.

@CharlotteLeslie @DavidDavisMP And so would Amersi. He threw a Twitter tantrum yesterday when The Lawyer magazine dared publish a report on the JR. Amersi appears to have forgotten that he lost, at the High Court and the Court of Appeal.

(but it's great he has two friends)

(but it's great he has two friends)

@CharlotteLeslie @DavidDavisMP If I had to guess, I'd say I expect Amersi will lose the BBC litigation too. The public interest defence was intended for cases like this.

@CharlotteLeslie @DavidDavisMP But the problem is that few people would publish a report on Amersi, or anyone like him, when it means years of expensive litigation - even if sure of eventual victory.

We should change the law. And we should reign in rogue firms like Carter-Ruck.

We should change the law. And we should reign in rogue firms like Carter-Ruck.

• • •

Missing some Tweet in this thread? You can try to

force a refresh