$IREN: Next steps after MSFT deal

IaaS will be a game won by operational excellence and scale. Landing MSFT gave IREN alot of credibility and allows IREN to build industry trust that they have high uptime. To look at the next steps for IREN, Nscale's path is very interesting to study. Nscale has some exciting developments that finX has missed. I am invested in IREN because IREN is going to do what Nscale is doing but at a 5-6GW scale.

Nscale

Nscale is similar to IREN in many ways. To start, it's founders Josh Payne and Nathan Townsend are Aussies (1, 2). It's misleading to label Nscale as a startup that startup that started May 2024 as they are a pivot (rebranding) from Josh and Nathan's previous company Akkon Energy (3). And yes, you guest it, Akkon energy was a failed BTC miner (4).

From their Akkon pivot, Nscale inheritted 117MW in Ohio with potential expansion to 307MW (5), 230 MW in Norway with exapansion potential to 520MW (6). Most recently it acquired 234MW powered land (7) from Ionic Digital with expansion with expansion potential that @TheKamaHsutra, @cryptomiami1 know more fine details about.

Deal Pipeline

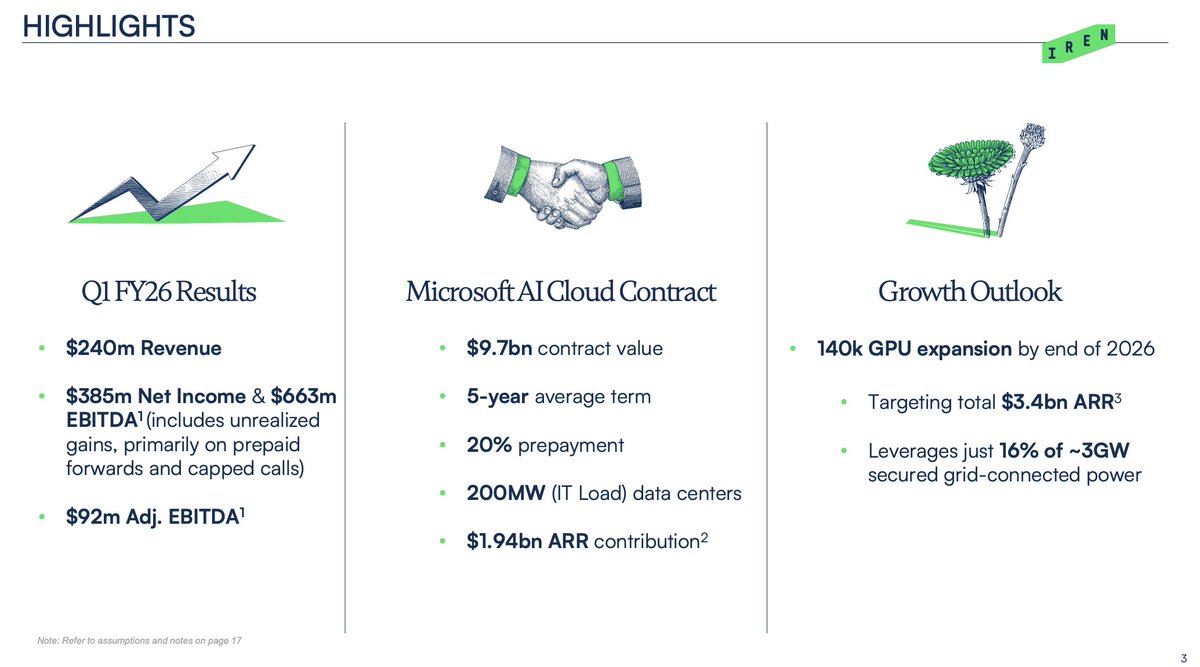

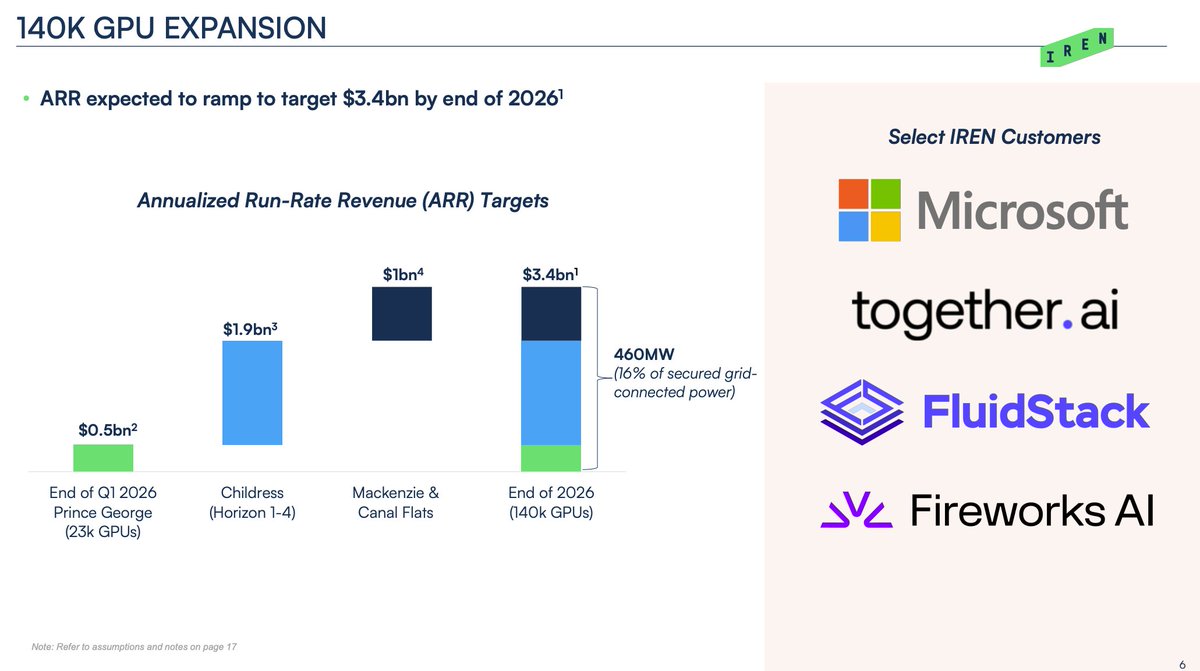

Nscale signed a five-year $14B dollar MSFT deal for 104k GPUs or 240MW. These terms are in line with IREN's with IREN getting a prepayment and Nscale's slightly higher/MW.

Remember the Norway site they have? With the Norway site they will sign a five-year $6.2B with OpenAI. They announced they they had started construction in July but haven't signed the official deal yet since deals. This is in line to what we are seeing across the industry where deals are signed very close to ready.

With MIcrosoft, they will eventually sign 200k GPUs (8) which will probably use up their Ohio site and is stated to use their Colocation in Portugal with Start Campus (9).

Then after their 290MW Norway expansion they will be on the market like everyone else bidding for power against $NBIS, MSFT, AWS, GCP, Meta, OpenAI, Anthropic, xAI, TogetherAI, Lambda, $CRWV.

They are targeting 2026 IPO and seemed to have rush a bit to showcase for the IPO.

IREN

You see the BTC/ETH miners that failed the earliest have earliest start and currently have the most contracts with $CRWV a failed ETH miner (lol) having more than Nscale who failed later. Failing earlier gave these two a head start, but from the perspective of not failing, operationally, IREN is likely going to end up being the best.

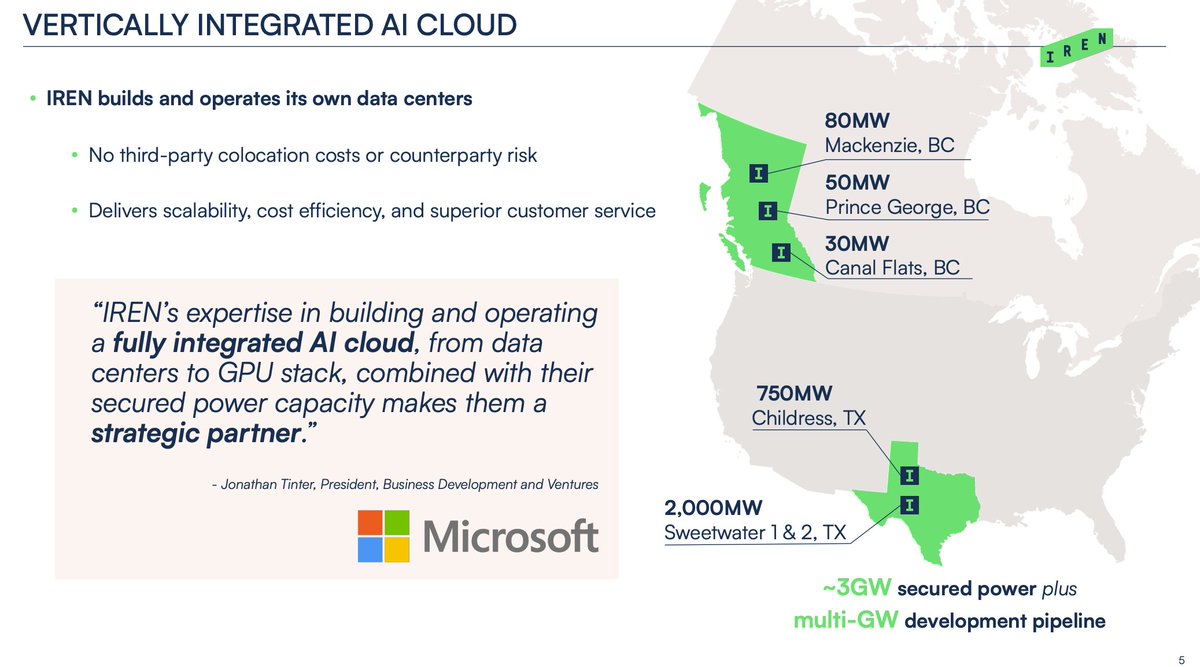

If Nscale can go from being a failed BTC miner with 347MW + 234 MW Ionic Digital Powered Land + 480MW pipeline to MSFT into OpenAI, IREN can go from being a successful BTC miner with 2.91GW and 2-3GW pipeline to MSFT into OpenAI/Meta/IREN Cloud.

95.1% invested in IREN for the long game: operational excellence at scale.

IaaS will be a game won by operational excellence and scale. Landing MSFT gave IREN alot of credibility and allows IREN to build industry trust that they have high uptime. To look at the next steps for IREN, Nscale's path is very interesting to study. Nscale has some exciting developments that finX has missed. I am invested in IREN because IREN is going to do what Nscale is doing but at a 5-6GW scale.

Nscale

Nscale is similar to IREN in many ways. To start, it's founders Josh Payne and Nathan Townsend are Aussies (1, 2). It's misleading to label Nscale as a startup that startup that started May 2024 as they are a pivot (rebranding) from Josh and Nathan's previous company Akkon Energy (3). And yes, you guest it, Akkon energy was a failed BTC miner (4).

From their Akkon pivot, Nscale inheritted 117MW in Ohio with potential expansion to 307MW (5), 230 MW in Norway with exapansion potential to 520MW (6). Most recently it acquired 234MW powered land (7) from Ionic Digital with expansion with expansion potential that @TheKamaHsutra, @cryptomiami1 know more fine details about.

Deal Pipeline

Nscale signed a five-year $14B dollar MSFT deal for 104k GPUs or 240MW. These terms are in line with IREN's with IREN getting a prepayment and Nscale's slightly higher/MW.

Remember the Norway site they have? With the Norway site they will sign a five-year $6.2B with OpenAI. They announced they they had started construction in July but haven't signed the official deal yet since deals. This is in line to what we are seeing across the industry where deals are signed very close to ready.

With MIcrosoft, they will eventually sign 200k GPUs (8) which will probably use up their Ohio site and is stated to use their Colocation in Portugal with Start Campus (9).

Then after their 290MW Norway expansion they will be on the market like everyone else bidding for power against $NBIS, MSFT, AWS, GCP, Meta, OpenAI, Anthropic, xAI, TogetherAI, Lambda, $CRWV.

They are targeting 2026 IPO and seemed to have rush a bit to showcase for the IPO.

IREN

You see the BTC/ETH miners that failed the earliest have earliest start and currently have the most contracts with $CRWV a failed ETH miner (lol) having more than Nscale who failed later. Failing earlier gave these two a head start, but from the perspective of not failing, operationally, IREN is likely going to end up being the best.

If Nscale can go from being a failed BTC miner with 347MW + 234 MW Ionic Digital Powered Land + 480MW pipeline to MSFT into OpenAI, IREN can go from being a successful BTC miner with 2.91GW and 2-3GW pipeline to MSFT into OpenAI/Meta/IREN Cloud.

95.1% invested in IREN for the long game: operational excellence at scale.

(1) linkedin.com/in/josh-payne/…

(2) linkedin.com/in/n-townsend/…

(3) datacenterdynamics.com/en/news/nscale…

(4) cypherhunter.com/en/p/arkon-ene…

(5) nscale.com/press-releases…

(6) bitcoinmagazine.com/business/arkon…

(7) businesswire.com/news/home/2025…

(8) nscale.com/press-releases…

(9) lp.startcampus.pt/start-campus-h…

(2) linkedin.com/in/n-townsend/…

(3) datacenterdynamics.com/en/news/nscale…

(4) cypherhunter.com/en/p/arkon-ene…

(5) nscale.com/press-releases…

(6) bitcoinmagazine.com/business/arkon…

(7) businesswire.com/news/home/2025…

(8) nscale.com/press-releases…

(9) lp.startcampus.pt/start-campus-h…

Important correction, deal size with OpenAI is not 6.2B, it's not disclosed yet. Will likely be much larger than 6.2B.

• • •

Missing some Tweet in this thread? You can try to

force a refresh