SDE. BTC is a better ponzi than fiat. 11/4/25: 95.1% IREN, 4.13% TSLA, 0.61% KRKNF, 0.09% EOSE, 0.08% TEM. Not financial advice.

How to get URL link on X (Twitter) App

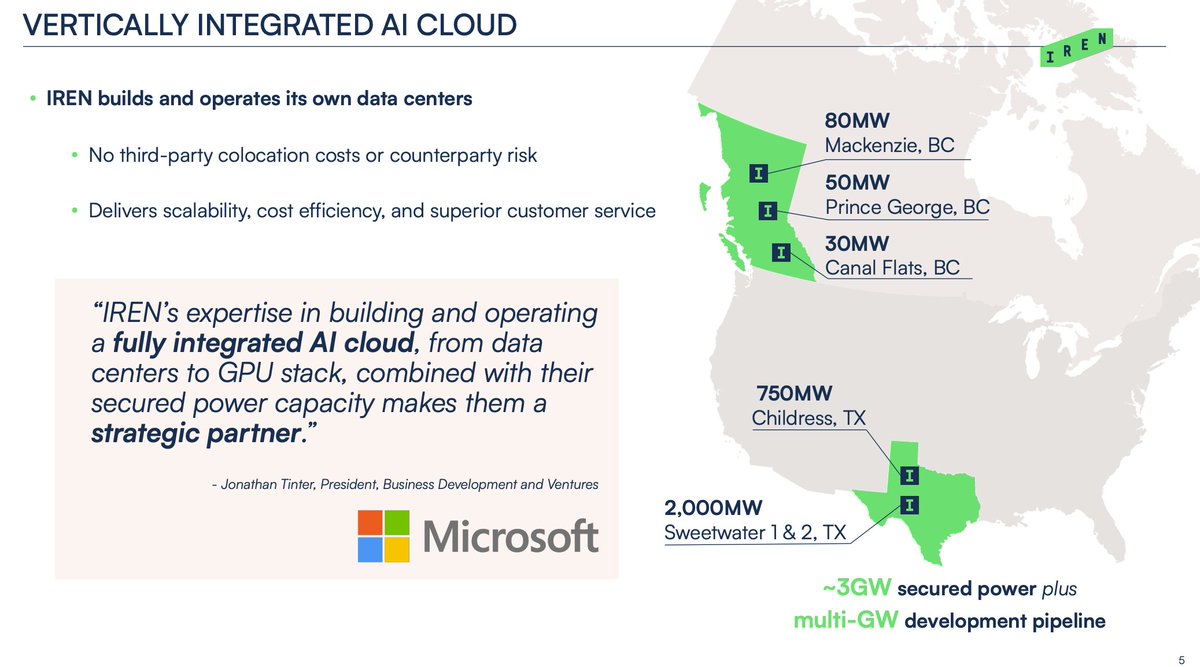

- Official announced multi-GW development pipeline for first time.

- Official announced multi-GW development pipeline for first time.