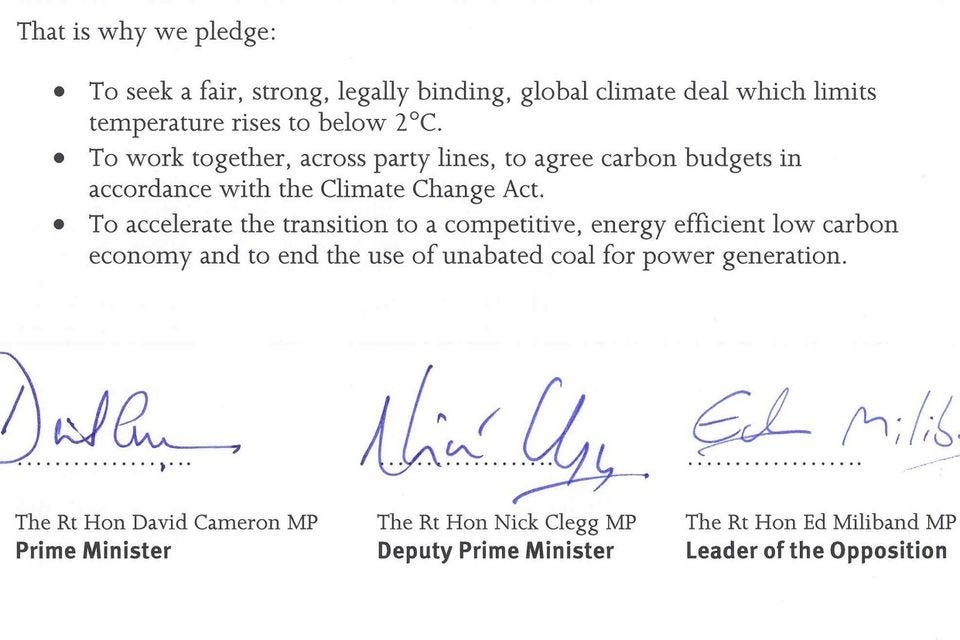

Both Reform and Tories have committed to getting rid of Net Zero. While these commitments are welcome, ending Net Zero brings some risks that need to be mitigated (1/n)

First up, cutting carbon taxes on gas-fired electricity and ending Renewables Obligation subsidies early will cut revenues for these generators and asset values will collapse (2/n)

This runs the risk of crystallising decommissioning costs. Neither the windfarms, operators or investment vehicles have set aside ring fenced cash to cover the liability. To mitigate this a new Government should ban dividend payments until decomm cash is built up (3/n)

CfD funded units should also be compelled to build up ring-fenced cash, particularly those that have not activated their CfD and are running on a merchant basis. These units will be vulnerable to cuts in carbon costs because wholesale rates will fall (4/n)

To find out more, you can sign up for free to read the full article on the link below (5/5)

open.substack.com/pub/davidturve…

open.substack.com/pub/davidturve…

Hi @threadreaderapp unroll please.

• • •

Missing some Tweet in this thread? You can try to

force a refresh