As the country prepares for Budget-geddon, there is one precedent that the govt is desperately clinging on to: 2002, when a Labour government raised income taxes - and shot up in the polls. How did they do it? (1/?)

In 2002, Gordon Brown raised NI by 1p to fund a historic expansion in NHS spending - in pursuit of Tony Blair's (impromptu) commitment to match European health spending. It was, as the then health secretary said, 'overwhelmingly popular'.

Today, things are v different. But polling by @SteveAkehurst suggests that voters in general - and Labour 2024 voters in particular - might be happier about the govt getting waiting lists down than they would be angry about taxes going up, esp if those taxes are on 'the rich'.

@SteveAkehurst This is why Reeves is now making the argument - as she did last year - that she needs to raise taxes to protect Our Precious NHS. Setting things up come election time for the familiar strategy: '24 hours to save the NHS', 'we'll protect it, Farage will privatise it' etc

@SteveAkehurst But as I say in my column today, there are two big problems.

The first is the politics. It isn't 2002. Everyone feels poorer. Angrier. Hates the govt. Brown really did roll the pitch, but they've haven't. Indeed, we all know they're raising taxes simply cos they're out of cash.

The first is the politics. It isn't 2002. Everyone feels poorer. Angrier. Hates the govt. Brown really did roll the pitch, but they've haven't. Indeed, we all know they're raising taxes simply cos they're out of cash.

@SteveAkehurst But the second problem is even bigger. If you're going to raise our taxes to fix the NHS - especially two Budgets in a row - you need to fix the bloody NHS. And they haven't, and almost certainly can't.

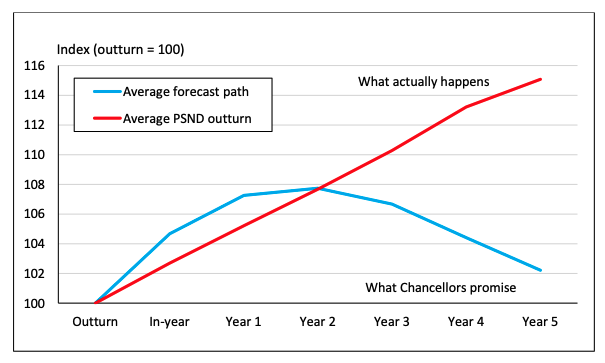

@SteveAkehurst In her speech last week, Reeves said falling waiting lists showed her plan was working. But waiting lists aren't falling! They came down by 200k between Sept 24 and Feb 25, and been basically flat since. And the tax rises to pay for that knackered the economy (as these will too).

The govt is claiming NHS productivity is up. But as I pointed out the other day, you only get to claim that by fiddling the figures. In fact, it's been going down.

https://x.com/rcolvile/status/1985293472493154562

And the cost pressures on the service are huge. Here's just a sampling of recent headlines from @thetimes.

Insiders say that Wes Streeting's big reform - the abolition of NHS England - is basically in limbo, and as @HSJEditor says there is huge uncertainty/confusion amid the top ranks

https://x.com/HSJEditor/status/1981315269956862147

More broadly: Blair/Brown raised taxes, cut waiting lists, and won re-election. But NHS spending in Blair's first two terms rose by 7% above inflation per year. Streeting is getting less than half of that. And the demographics are brutal - just look at A&E attendance/month.

In short, as I say in my column, the govt's message is: 'Your taxes are going up to save the NHS, no really this time'. I'm pretty sure the public won't buy it. But I'm very sure they won't buy it if the NHS doesn't actually get saved. Have a read here thetimes.com/comment/column…

PS My favourite thing about @SteveAkehurst's polling is the perennial finding that people would be more upset about a rise in National Insurance than income tax, even though they are taxing the same thing in the same way.

@SteveAkehurst Link here (originally via @NewStatesman) cdn.persuasionuk.org/budget_2025_dr…

• • •

Missing some Tweet in this thread? You can try to

force a refresh