Stimulus checks are back:

President Trump just announced the "tariff dividend," a payment of AT LEAST $2,000 per American.

We expect 85%+ of US adults to receive this, resulting in $400+ BILLION handed out.

All as US debt nears $40 trillion.

What's next? Let us explain.

President Trump just announced the "tariff dividend," a payment of AT LEAST $2,000 per American.

We expect 85%+ of US adults to receive this, resulting in $400+ BILLION handed out.

All as US debt nears $40 trillion.

What's next? Let us explain.

This morning, President Trump made the below announcement:

A dividend of at least $2,000 per person will be paid, EXCLUDING "high income people."

The economic implications of such a massive "stimulus"-like payment are huge.

Especially with markets at record highs.

A dividend of at least $2,000 per person will be paid, EXCLUDING "high income people."

The economic implications of such a massive "stimulus"-like payment are huge.

Especially with markets at record highs.

First, who will be receiving this payment?

Let's take a look at the most recent stimulus payment, the March 2021 $1,400 stimulus check.

Full payments were only made to:

Single filers making up to $75,000, households making up to $112,500, and married earners up to $150,000.

Let's take a look at the most recent stimulus payment, the March 2021 $1,400 stimulus check.

Full payments were only made to:

Single filers making up to $75,000, households making up to $112,500, and married earners up to $150,000.

Now, let's apply this same criteria to 2025:

Currently, there are ~220 million US adults who fit these income criteria.

The top ~15% of earners would be excluded as "high income."

220 million x $2,000 = ~$440 BILLION handed out.

And, the check could be larger than $2,000.

Currently, there are ~220 million US adults who fit these income criteria.

The top ~15% of earners would be excluded as "high income."

220 million x $2,000 = ~$440 BILLION handed out.

And, the check could be larger than $2,000.

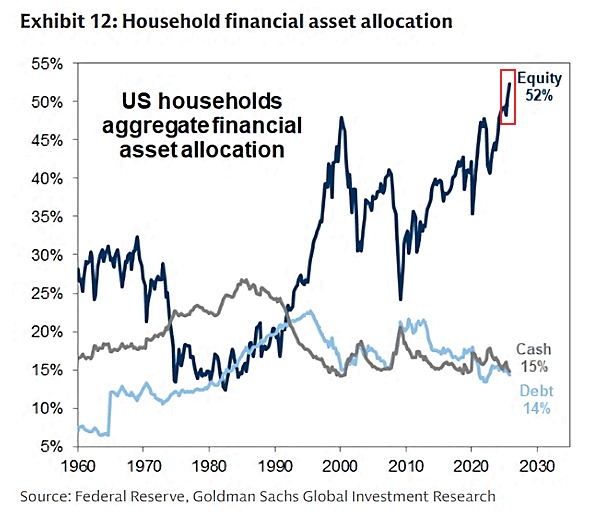

These payments come at a time where the wealth gap is at record highs.

In Q2 2025, consumers in the top 10% of the income distribution accounted for 49.2% of total US spending.

This marks the highest level in data going back to 1989.

But, there's a big problem here.

In Q2 2025, consumers in the top 10% of the income distribution accounted for 49.2% of total US spending.

This marks the highest level in data going back to 1989.

But, there's a big problem here.

As seen in 2021, stimulus checks massively boost spending.

However, the one-time "boost" is followed by a long period of high inflation.

Following the last round of stimulus, US inflation neared 10%.

Now, inflation is back on the rise, at 3%, and more stimulus is coming.

However, the one-time "boost" is followed by a long period of high inflation.

Following the last round of stimulus, US inflation neared 10%.

Now, inflation is back on the rise, at 3%, and more stimulus is coming.

Trump also states that after this payment, tariff revenue will go toward paying US debt.

Over the last 5 years alone, total US debt has surged +$10 TRILLION.

Since the government shutdown began on October 1st, US debt is up +$600 billion.

Can we really afford more stimulus?

Over the last 5 years alone, total US debt has surged +$10 TRILLION.

Since the government shutdown began on October 1st, US debt is up +$600 billion.

Can we really afford more stimulus?

In August, the US brought in a record $30 billion in tariff revenue.

However, the August 2025 US government deficit ALONE was a whopping $345 billion.

Tariff revenue is barely accounting for ~10% of our monthly deficits.

We believe the debt crisis should be the top priority.

However, the August 2025 US government deficit ALONE was a whopping $345 billion.

Tariff revenue is barely accounting for ~10% of our monthly deficits.

We believe the debt crisis should be the top priority.

In another similarity to 2020, the Fed is currently "pivoting."

In September 2024, the Fed began a rate cut cycle with a 50 bps cut for the first time since 2008.

Over the last two months, the Fed has cut rates by another 50 bps.

Stimulus payments will add fuel to the fire.

In September 2024, the Fed began a rate cut cycle with a 50 bps cut for the first time since 2008.

Over the last two months, the Fed has cut rates by another 50 bps.

Stimulus payments will add fuel to the fire.

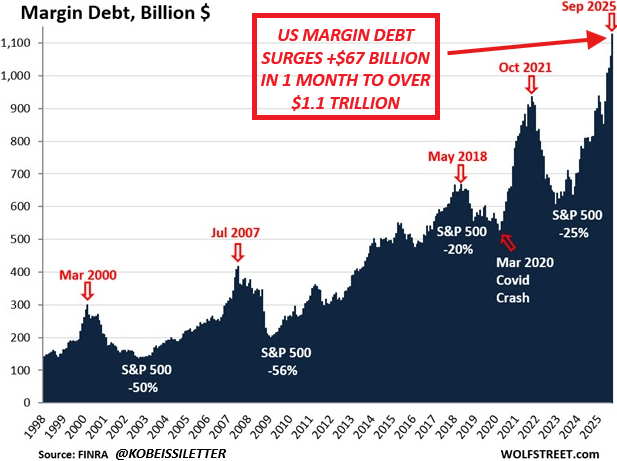

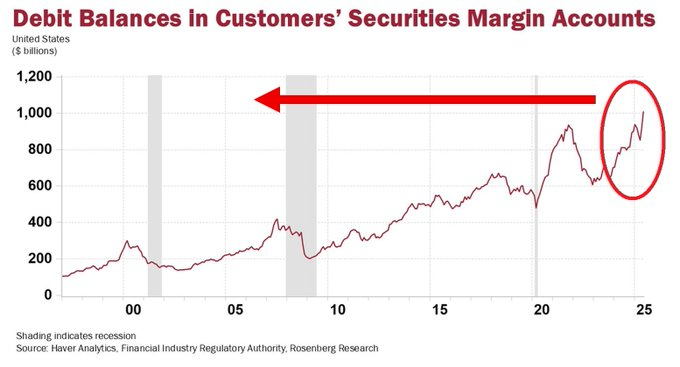

Never in history has the US paid out stimulus this large with stocks near record highs.

The S&P 500 is ~3% away from all time high territory and up +35% since the April bottom.

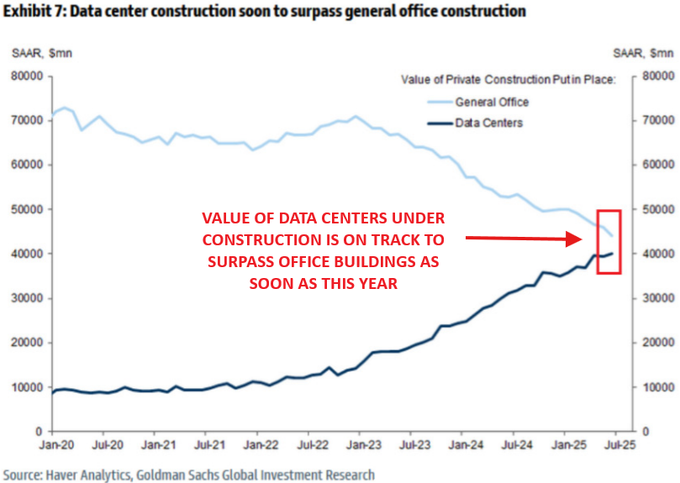

All as the AI Revolution is in full swing with $200B+ in quarterly tech CapEx.

Own assets.

The S&P 500 is ~3% away from all time high territory and up +35% since the April bottom.

All as the AI Revolution is in full swing with $200B+ in quarterly tech CapEx.

Own assets.

There has never been a better time than now to be an investor.

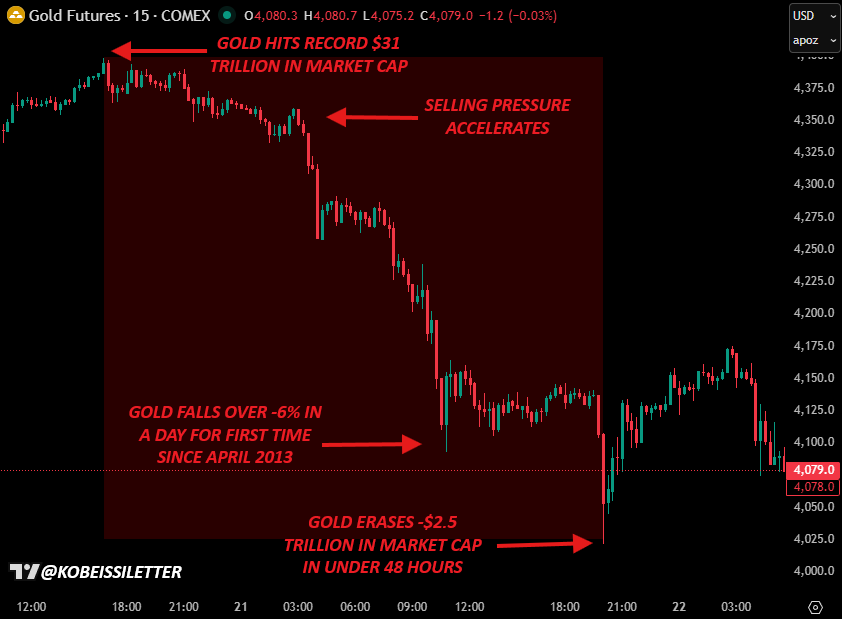

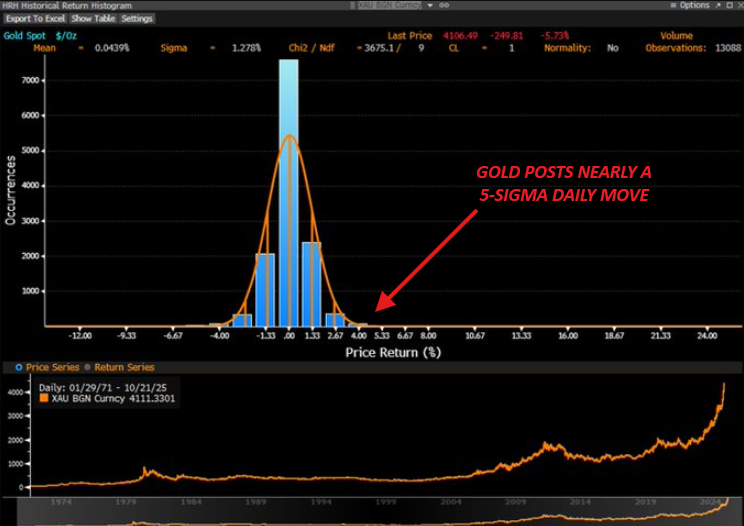

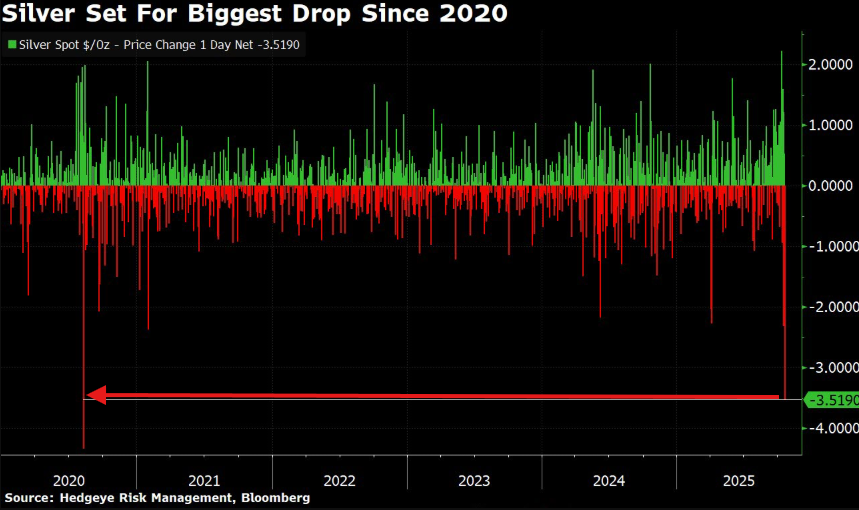

The macroeconomy is shifting and stocks, commodities, bonds, and crypto are investable.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The macroeconomy is shifting and stocks, commodities, bonds, and crypto are investable.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

Ultimately, stimulus payments almost always end up being massive "involuntary taxes."

That is; you pay multiples worth of your stimulus payment in the form of inflation.

Own assets or you will be left behind.

Follow us @KobeissiLetter for real time analysis as this develops.

That is; you pay multiples worth of your stimulus payment in the form of inflation.

Own assets or you will be left behind.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh