Exhicon Events Media Solutions Ltd | Empowering India’s Exhibition & Events Ecosystem 🌏 | H1 FY25 PAT Surges 2x YoY to ₹22 Cr | Expanding Global Footprint Across 5 Countries 🚀

Incorporated in 2010, Exhicon Events Media Solutions Ltd (EEMSL) provides 360° solutions to the Exhibitions, Conferences & Events industry.

⟶ Zero Net Debt | Positive Operating Cash Flow

⟶ Listed on BSE SME since 2023

Part of the Exhicon Group, which has diversified interests in MICE, Media, Real Estate, Solar Energy, FMCG, Healthcare & International Trading.

Incorporated in 2010, Exhicon Events Media Solutions Ltd (EEMSL) provides 360° solutions to the Exhibitions, Conferences & Events industry.

⟶ Zero Net Debt | Positive Operating Cash Flow

⟶ Listed on BSE SME since 2023

Part of the Exhicon Group, which has diversified interests in MICE, Media, Real Estate, Solar Energy, FMCG, Healthcare & International Trading.

Business Overview

⟶ End-to-end event & exhibition solutions — from Media, Marketing & Design to Infrastructure & Execution.

⟶ Provides turnkey setups for B2B & B2C events across India and abroad.

⟶ Assists clients with event permissions & licenses.

⟶ Serves Governments, Corporates & Trade Associations across 10+ industries.

Exhicon’s expertise includes large-span structures, event décor, CCTV, branding, audio-visuals, and modular infrastructure — spread across 5 Indian cities.

⟶ End-to-end event & exhibition solutions — from Media, Marketing & Design to Infrastructure & Execution.

⟶ Provides turnkey setups for B2B & B2C events across India and abroad.

⟶ Assists clients with event permissions & licenses.

⟶ Serves Governments, Corporates & Trade Associations across 10+ industries.

Exhicon’s expertise includes large-span structures, event décor, CCTV, branding, audio-visuals, and modular infrastructure — spread across 5 Indian cities.

Business Verticals

⟶ B2B Trade Shows

⟶ Event Venues / Real Estate

⟶ Event Media & Publications

⟶ End-to-End Exhibition Solutions

⟶ Exhibition Hospitality & F&B

⟶ International Expo Sales & Marketing

Presence in UAE, Switzerland, Thailand & Hong Kong, with a marketing network across 50+ countries.

⟶ B2B Trade Shows

⟶ Event Venues / Real Estate

⟶ Event Media & Publications

⟶ End-to-End Exhibition Solutions

⟶ Exhibition Hospitality & F&B

⟶ International Expo Sales & Marketing

Presence in UAE, Switzerland, Thailand & Hong Kong, with a marketing network across 50+ countries.

Clientele

Government: Ministry of Railways, NPCIL, Indian Army, GAIL, MTDC, UP Govt, Delhi Govt, Rajasthan Tourism.

Organisers: ABEC Exhibitions, CII, FICCI, ASSOCHAM, Fairfest Media, Futurex.

Corporates: Accenture, Canon, Godrej, HDFC Bank, HSBC, ICICI Bank, HCL, Amdocs.

Revenue Streams:

⟶ Exhibitors / Sponsors (Fees & Stall Mgmt)

⟶ Organisers (Sales, Venue & Event Mgmt Fees)

⟶ Corporates (Hospitality, Venue & Delegation Fees)

Government: Ministry of Railways, NPCIL, Indian Army, GAIL, MTDC, UP Govt, Delhi Govt, Rajasthan Tourism.

Organisers: ABEC Exhibitions, CII, FICCI, ASSOCHAM, Fairfest Media, Futurex.

Corporates: Accenture, Canon, Godrej, HDFC Bank, HSBC, ICICI Bank, HCL, Amdocs.

Revenue Streams:

⟶ Exhibitors / Sponsors (Fees & Stall Mgmt)

⟶ Organisers (Sales, Venue & Event Mgmt Fees)

⟶ Corporates (Hospitality, Venue & Delegation Fees)

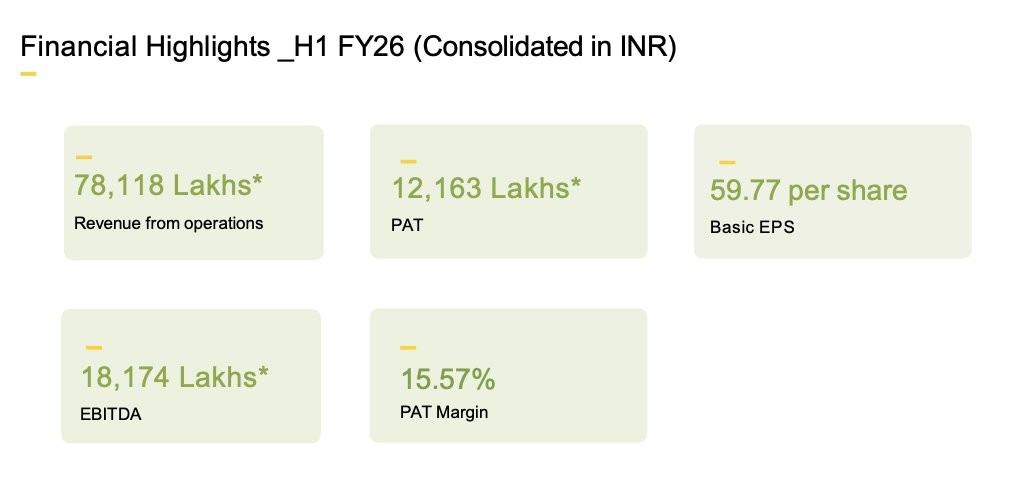

Financial Highlights (H1 FY25)

⟶ Consolidated Revenue ₹102.6 Cr vs ₹62.6 Cr YoY

⟶ Consolidated PAT ₹22.1 Cr vs ₹10.6 Cr YoY

⟶ Standalone Revenue ₹38.1 Cr vs ₹29.6 Cr YoY

⟶ Standalone PAT ₹7.27 Cr vs ₹5.06 Cr YoY

⟶ EPS (Consolidated) ₹12.99 | EPS (Standalone) ₹5.21

Acquisition of Impulse B2B cancelled due to unmet milestones — no material financial impact.

Positive OCF

⟶ Consolidated Revenue ₹102.6 Cr vs ₹62.6 Cr YoY

⟶ Consolidated PAT ₹22.1 Cr vs ₹10.6 Cr YoY

⟶ Standalone Revenue ₹38.1 Cr vs ₹29.6 Cr YoY

⟶ Standalone PAT ₹7.27 Cr vs ₹5.06 Cr YoY

⟶ EPS (Consolidated) ₹12.99 | EPS (Standalone) ₹5.21

Acquisition of Impulse B2B cancelled due to unmet milestones — no material financial impact.

Positive OCF

Operational Achievements

⟶ Created 1.2 Lakh Sqm of Temporary Event Infra

⟶ Managed 120 Events across India (June 2024–April 2025)

⟶ Served 2,400 Indian & 100 Foreign Companies

⟶ Handled 120,000+ B2B Visitors

⟶ Managed Govt Projects for NPCIL, Rajasthan Tourism, UP Expressway Industrial Dev Auth, Ministry of Textiles, etc.

⟶ Executed international delegations from Brazil, Iran, Italy & the US.

⟶ Created 1.2 Lakh Sqm of Temporary Event Infra

⟶ Managed 120 Events across India (June 2024–April 2025)

⟶ Served 2,400 Indian & 100 Foreign Companies

⟶ Handled 120,000+ B2B Visitors

⟶ Managed Govt Projects for NPCIL, Rajasthan Tourism, UP Expressway Industrial Dev Auth, Ministry of Textiles, etc.

⟶ Executed international delegations from Brazil, Iran, Italy & the US.

Strategic Projects & Milestones

⟶ Launched Phase 1 of Messe Global Convention Centre, Pune – one of India’s largest multipurpose venues.

⟶ Signed MoU with Govt. of Rajasthan for new venue.

⟶ Acquired 5 acres in Ayodhya for future event infrastructure.

⟶ Curated “Independent Together” Live Event Series with Hungama Digital Media (5-year IP).

⟶ Partnered with ANM Exhibitions for “Best of India” exhibitions in Cambodia, Vietnam, Russia, Brazil & South Africa.

⟶ Launched Phase 1 of Messe Global Convention Centre, Pune – one of India’s largest multipurpose venues.

⟶ Signed MoU with Govt. of Rajasthan for new venue.

⟶ Acquired 5 acres in Ayodhya for future event infrastructure.

⟶ Curated “Independent Together” Live Event Series with Hungama Digital Media (5-year IP).

⟶ Partnered with ANM Exhibitions for “Best of India” exhibitions in Cambodia, Vietnam, Russia, Brazil & South Africa.

Capex & Expansion Plans

⟶ ₹100 Cr rolling capex over next 3 years.

⟶ ₹50 Cr investment in modular & portable infrastructure (hangars, domes, prefab systems).

⟶ Expansion of “Messe Global Arena Pune” — city’s first dedicated concert venue (Operational Sept 2025).

⟶ United Helicharters Pvt Ltd (subsidiary) purchased pre-owned Eurocopter AS350 B3 from Sweden for MRO & tourism.

⟶ ₹100 Cr rolling capex over next 3 years.

⟶ ₹50 Cr investment in modular & portable infrastructure (hangars, domes, prefab systems).

⟶ Expansion of “Messe Global Arena Pune” — city’s first dedicated concert venue (Operational Sept 2025).

⟶ United Helicharters Pvt Ltd (subsidiary) purchased pre-owned Eurocopter AS350 B3 from Sweden for MRO & tourism.

Industry Outlook (B2B Exhibition Market)

⟶ India’s B2B Events Market expected to grow from $0.6 Bn in 2025 to $1.04 Bn by 2030 (CAGR 11.7%)

⟶ Contributes ~$7.8 Bn to GDP by 2029

⟶ Provides indirect employment to 10 Mn+ people

⟶ Driven by “Make in India”, “Digital India”, and infra expansion (India’s exhibition capacity ~1.2 Mn Sqm).

Key Sectors: Healthcare, Construction, Electricals, Automotive, Industrial Engineering.

⟶ India’s B2B Events Market expected to grow from $0.6 Bn in 2025 to $1.04 Bn by 2030 (CAGR 11.7%)

⟶ Contributes ~$7.8 Bn to GDP by 2029

⟶ Provides indirect employment to 10 Mn+ people

⟶ Driven by “Make in India”, “Digital India”, and infra expansion (India’s exhibition capacity ~1.2 Mn Sqm).

Key Sectors: Healthcare, Construction, Electricals, Automotive, Industrial Engineering.

Leadership & Management

⟶ CMD: Mohammad Quaim Syed — Founder, 20+ yrs in MICE industry, Editor-in-Chief of Trade Fair Times, active with UNCTAD & IIA.

⟶ WTD: Padma Mishra — Global Expo expert, “Women Power in MICE” Awardee.

⟶ ED: Nisha Quaim Syed — Editor & Exhibition Marketing Specialist.

⟶ Independent Directors: Pechimuthu Udaykumar (Ex-MD NSIC), Hussein Ahmad Sayed (Ex-Customs Superintendent), Raminder Singh (IIFT alumnus).

⟶ CFO: CA Sushil Shah — 30+ yrs experience.

⟶ CS: Pranjul Jain — Expert in SEBI & corporate restructuring.

⟶ CMD: Mohammad Quaim Syed — Founder, 20+ yrs in MICE industry, Editor-in-Chief of Trade Fair Times, active with UNCTAD & IIA.

⟶ WTD: Padma Mishra — Global Expo expert, “Women Power in MICE” Awardee.

⟶ ED: Nisha Quaim Syed — Editor & Exhibition Marketing Specialist.

⟶ Independent Directors: Pechimuthu Udaykumar (Ex-MD NSIC), Hussein Ahmad Sayed (Ex-Customs Superintendent), Raminder Singh (IIFT alumnus).

⟶ CFO: CA Sushil Shah — 30+ yrs experience.

⟶ CS: Pranjul Jain — Expert in SEBI & corporate restructuring.

Way Forward (3-Year Strategic Roadmap)

⟶ Targeting 40–50% Revenue CAGR driven by new venues & IPs.

⟶ Maintain PAT Margins at 15–20% & RoCE at 25–30%.

⟶ ₹100 Cr capex for venue expansion & infrastructure upgrades.

⟶ Focus on Venue Ops, Digital Integration & Working Capital Efficiency.

⟶ Strengthen global footprint via partnerships & international exhibitions.

⟶ Vision: To become the world’s most admired event & exhibition solutions provider 🌍

⟶ Targeting 40–50% Revenue CAGR driven by new venues & IPs.

⟶ Maintain PAT Margins at 15–20% & RoCE at 25–30%.

⟶ ₹100 Cr capex for venue expansion & infrastructure upgrades.

⟶ Focus on Venue Ops, Digital Integration & Working Capital Efficiency.

⟶ Strengthen global footprint via partnerships & international exhibitions.

⟶ Vision: To become the world’s most admired event & exhibition solutions provider 🌍

📢 Stay Connected with LNPR Capital🚀

🔹 WhatsApp Group: chat.whatsapp.com/GCqOsrfWZDiFOK…

🔹 WhatsApp Channel: whatsapp.com/channel/0029Vb…

🔹 Telegram: t.me/LNPRCap

🔹 Follow on Twitter for Updates:📈 @LnprCapital | @Rahul_Invest | @Rakesh_Invest

🔹 WhatsApp Group: chat.whatsapp.com/GCqOsrfWZDiFOK…

🔹 WhatsApp Channel: whatsapp.com/channel/0029Vb…

🔹 Telegram: t.me/LNPRCap

🔹 Follow on Twitter for Updates:📈 @LnprCapital | @Rahul_Invest | @Rakesh_Invest

• • •

Missing some Tweet in this thread? You can try to

force a refresh