How Delta Confirms Zimbabwe’s Economy Is Bigger Than You Think — And Gold Is a Major Reason Why

When Zimbabwe rebased its GDP this year, the numbers seemed almost too good to be true — Zimbabwe’s GDP increased by around 40% to $45 billion.

But was this real growth, or just creative accounting? Delta can help answer that question.

Let's Unpack!

When Zimbabwe rebased its GDP this year, the numbers seemed almost too good to be true — Zimbabwe’s GDP increased by around 40% to $45 billion.

But was this real growth, or just creative accounting? Delta can help answer that question.

Let's Unpack!

The Delta Test

Delta Corporation is Zimbabwe’s beverage giant and the largest listed company in Zimbabwe.

Its sales volumes serve as one of the most reliable indicators of Zimbabwe’s economic health.

When Zimbabwe grows, Delta's business grows and when the country takes a hit, so does Delta.

This makes sense: beer and soft drinks are constants in day-to-day life. If people aren’t buying drinks, they probably aren’t buying much else either.

Delta Corporation is Zimbabwe’s beverage giant and the largest listed company in Zimbabwe.

Its sales volumes serve as one of the most reliable indicators of Zimbabwe’s economic health.

When Zimbabwe grows, Delta's business grows and when the country takes a hit, so does Delta.

This makes sense: beer and soft drinks are constants in day-to-day life. If people aren’t buying drinks, they probably aren’t buying much else either.

With this in mind, I pulled Delta’s sales volumes over the last 20 years for Zimbabwe and layered them against GDP to cross-check if the economic growth made sense.

The blue line represents Delta’s sales volumes, while the blue bars indicate Zimbabwe’s GDP. It is important to note that these figures are based on Delta’s financial year, which ends in March.

For example, FY2005 includes nine months of 2004 and three months of 2005. In this case, the GDP data for 2004 has been layered over this timeline.

As you can see from the below, GDP and Delta’s volumes generally moved together.

When the Economy collapsed during 2008/2009, Delta’s volumes did the same. When the economy picked up quickly post-dollarisation, Delta’s volume followed suit.

What we also see is that from FY21, there was a sharp increase in Delta's volumes, and that rebased GDP number of $44 billion doesn't look out of place.

The blue line represents Delta’s sales volumes, while the blue bars indicate Zimbabwe’s GDP. It is important to note that these figures are based on Delta’s financial year, which ends in March.

For example, FY2005 includes nine months of 2004 and three months of 2005. In this case, the GDP data for 2004 has been layered over this timeline.

As you can see from the below, GDP and Delta’s volumes generally moved together.

When the Economy collapsed during 2008/2009, Delta’s volumes did the same. When the economy picked up quickly post-dollarisation, Delta’s volume followed suit.

What we also see is that from FY21, there was a sharp increase in Delta's volumes, and that rebased GDP number of $44 billion doesn't look out of place.

Delta’s volume growth validates that the economy is much bigger than was initially thought.

The rebasing wasn’t just a gimmick, but the new reality of the economy's size.

What is also interesting is that it also seems to be growing faster than we thought.

Currently, the IMF projects Zimbabwe to grow around 6% this year, one of the highest forecast growth rates in SADC and roughly double the regional average.

So what’s driving this?

The rebasing wasn’t just a gimmick, but the new reality of the economy's size.

What is also interesting is that it also seems to be growing faster than we thought.

Currently, the IMF projects Zimbabwe to grow around 6% this year, one of the highest forecast growth rates in SADC and roughly double the regional average.

So what’s driving this?

How Gold Is Fuelling Growth

Gold is having a spectacular year — we’ve talked about this before.

Global gold prices crossed multiple all-time highs, and gold-linked equities have followed.

Gold miner, Caledonia, has tripled in value over the past year, largely due to the surge in gold prices and improved operational output.

Gold has not just been good for individual stocks; it has also been good for the country.

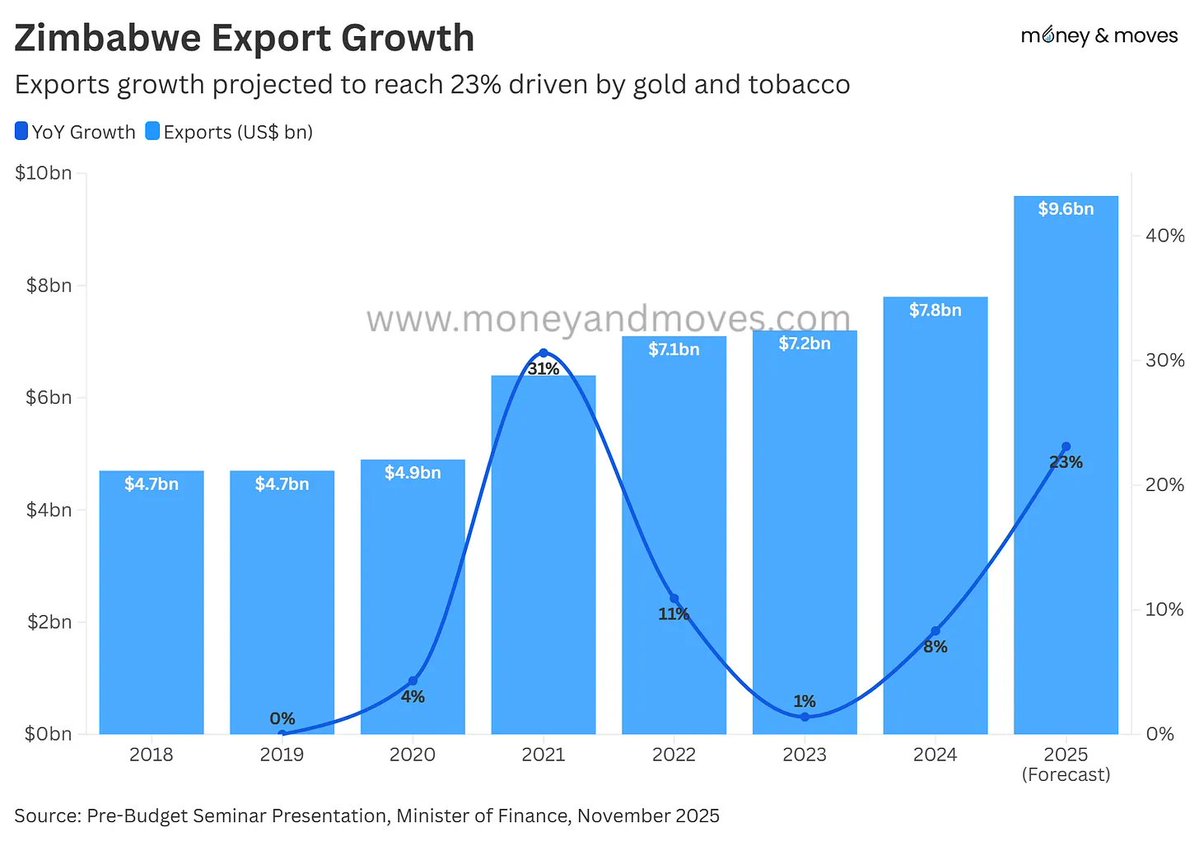

Zimbabwe’s export figures tell the story. Total exports are on track to reach roughly USD 9–10 billion, up 23% driven by gold and tobacco.

Gold is having a spectacular year — we’ve talked about this before.

Global gold prices crossed multiple all-time highs, and gold-linked equities have followed.

Gold miner, Caledonia, has tripled in value over the past year, largely due to the surge in gold prices and improved operational output.

Gold has not just been good for individual stocks; it has also been good for the country.

Zimbabwe’s export figures tell the story. Total exports are on track to reach roughly USD 9–10 billion, up 23% driven by gold and tobacco.

The catalyst has been record gold prices and a steady rise in gold production.

The following shows deliveries of Gold to Fidelity, Zimbabwe’s official buyer, on behalf of the government.

But here’s the thing.

Zimbabwe is still nowhere near its full gold potential.

The following shows deliveries of Gold to Fidelity, Zimbabwe’s official buyer, on behalf of the government.

But here’s the thing.

Zimbabwe is still nowhere near its full gold potential.

Zimbabwe and Western Australia were once part of the same ancient landmass, so they share very similar rock formations that are known to contain gold.

Western Australia has built a huge gold industry by exploring and mining these rock formations with modern technology.

Zimbabwe has similar potential, but large-scale exploration using the latest technology has been limited.

That means a lot of gold is still largely untouched. This, by the way, is part of the idea behind why VFEX-listed Kavongo Resources is betting on Zimbabwe.

Australia exports USD 25–30 billion in gold every year. Zimbabwe exports roughly 10–15 times less. There should be much more room for investment and growth.

Western Australia has built a huge gold industry by exploring and mining these rock formations with modern technology.

Zimbabwe has similar potential, but large-scale exploration using the latest technology has been limited.

That means a lot of gold is still largely untouched. This, by the way, is part of the idea behind why VFEX-listed Kavongo Resources is betting on Zimbabwe.

Australia exports USD 25–30 billion in gold every year. Zimbabwe exports roughly 10–15 times less. There should be much more room for investment and growth.

Tangent

Here is an event to watch out for. The Zimbabwe Gold Investment Conference is on November 17-18.

It gathers mining executives, investors, geologists, government reps, and exploration companies from Zimbabwe and the region. Google it for more info.

Here is an event to watch out for. The Zimbabwe Gold Investment Conference is on November 17-18.

It gathers mining executives, investors, geologists, government reps, and exploration companies from Zimbabwe and the region. Google it for more info.

Where’s the Money? What’s the Move?

Zimbabwe isn’t the easiest country to operate in, but its ability to grow despite the challenges shows there’s still significant untapped potential.

It’s a market worth watching - and perhaps explains why Dangote is reportedly still considering an investment after two false starts.

On gold, despite it reaching record highs, there may still be a case for portfolio exposure.

The world in which Trump is President of the USA is one of policy uncertainty, geopolitical risk, and volatility. This has historically been good for gold, and Goldman Sachs is maintaining its position that gold prices will rise in 2026.

"We maintain our $4,900/toz target by end-2026, supported by continued central bank demand and renewed investment inflows as the Fed cuts,” - Goldman Sachs.

Zimbabwe isn’t the easiest country to operate in, but its ability to grow despite the challenges shows there’s still significant untapped potential.

It’s a market worth watching - and perhaps explains why Dangote is reportedly still considering an investment after two false starts.

On gold, despite it reaching record highs, there may still be a case for portfolio exposure.

The world in which Trump is President of the USA is one of policy uncertainty, geopolitical risk, and volatility. This has historically been good for gold, and Goldman Sachs is maintaining its position that gold prices will rise in 2026.

"We maintain our $4,900/toz target by end-2026, supported by continued central bank demand and renewed investment inflows as the Fed cuts,” - Goldman Sachs.

At a national level, the US has Silicon Valley; Zimbabwe has Golden Valleys.

Both need venture capital — albeit of a different kind.

Gold exploration is risky (the success rate is less than 0.1%), but when it succeeds, it delivers decades of returns.

Zimbabwe needs more risk capital aimed at exploration — not just extraction.

Perhaps a national co-investment fund that derisks early-stage exploration could encourage more activity and unlock long-term value?

Both need venture capital — albeit of a different kind.

Gold exploration is risky (the success rate is less than 0.1%), but when it succeeds, it delivers decades of returns.

Zimbabwe needs more risk capital aimed at exploration — not just extraction.

Perhaps a national co-investment fund that derisks early-stage exploration could encourage more activity and unlock long-term value?

For businesses, the opportunity is equally clear.

If you sell any service that is mining relevant, now is the time to build relationships. It’s always easier to sell anything to a company that is doing well.

For the more adventurous, now could be the time to consider a mining venture.

Padenga went from selling crocodile skins in 2019 to mining for gold, and now the gold business brings in over 90% of its profits.

They say fortune favours the bold, and right now you could also say fortune favours the gold.

If you sell any service that is mining relevant, now is the time to build relationships. It’s always easier to sell anything to a company that is doing well.

For the more adventurous, now could be the time to consider a mining venture.

Padenga went from selling crocodile skins in 2019 to mining for gold, and now the gold business brings in over 90% of its profits.

They say fortune favours the bold, and right now you could also say fortune favours the gold.

Thanks for reading!

I write on the finance & strategy behind the most important companies in Africa and the World.

Follow me @tmukogo for more.

Please comment on / repost the below tweet! I would love to get your feedback!

I write on the finance & strategy behind the most important companies in Africa and the World.

Follow me @tmukogo for more.

Please comment on / repost the below tweet! I would love to get your feedback!

https://twitter.com/166012451/status/1987923453853528439

• • •

Missing some Tweet in this thread? You can try to

force a refresh