SoFi just became the first nationally chartered US bank to launch in-app Crypto trading directly.

The company launched Bitcoin/Ethereum/Solana trading TODAY.

They're calling "bank-level confidence" their competitive edge.

Here's what's happening.

---

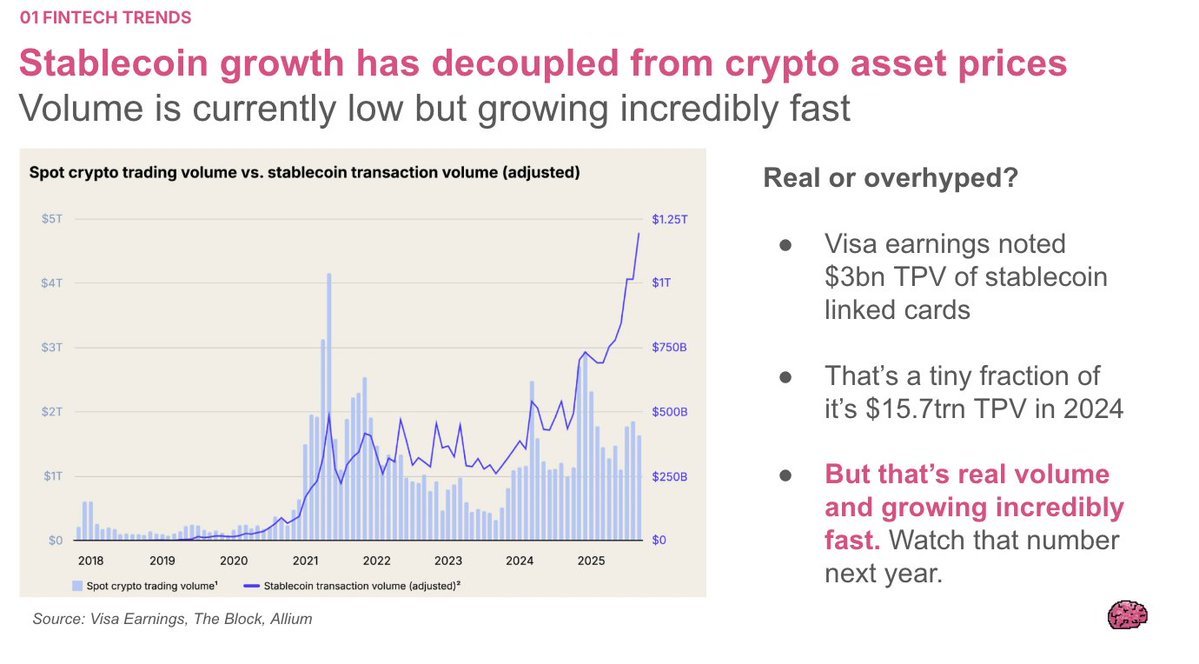

They're planning a SoFi USD stablecoin by mid-2026.

And they've had Lightning Network remittances live with Lightspark since August.

This is a remittances strategy that happens to use Bitcoin rails.

---

SoFi's Bet

They're attacking the $740 billion global remittance market.

The Lightspark Lightning partnership went live in August for Mexico transfers.

That's the real product. Bitcoin trading is the complement, not the core.

Send dollars, recipient gets pesos. Bitcoin is the plumbing, not the product.

Lightspark's UMA handles the complexity. Users never touch Bitcoin.

---

SoFi has something unique: a banking charter and 12.6 million users who trust it with checking, loans, and investments.

60% of SoFi members who own crypto prefer holding it with a licensed bank versus exchanges.

That's a lesson for *all banks*

(Note, PNC and a few others offer "buy/sell/hold through partnerships)

The company launched Bitcoin/Ethereum/Solana trading TODAY.

They're calling "bank-level confidence" their competitive edge.

Here's what's happening.

---

They're planning a SoFi USD stablecoin by mid-2026.

And they've had Lightning Network remittances live with Lightspark since August.

This is a remittances strategy that happens to use Bitcoin rails.

---

SoFi's Bet

They're attacking the $740 billion global remittance market.

The Lightspark Lightning partnership went live in August for Mexico transfers.

That's the real product. Bitcoin trading is the complement, not the core.

Send dollars, recipient gets pesos. Bitcoin is the plumbing, not the product.

Lightspark's UMA handles the complexity. Users never touch Bitcoin.

---

SoFi has something unique: a banking charter and 12.6 million users who trust it with checking, loans, and investments.

60% of SoFi members who own crypto prefer holding it with a licensed bank versus exchanges.

That's a lesson for *all banks*

(Note, PNC and a few others offer "buy/sell/hold through partnerships)

• • •

Missing some Tweet in this thread? You can try to

force a refresh