The Power of Trading Stock Options

$200 to $500 a month while using $10,000 in capital

Let me show you my 5 favorite ways to do this with some examples

👇👇👇

$200 to $500 a month while using $10,000 in capital

Let me show you my 5 favorite ways to do this with some examples

👇👇👇

You can simultaneously manage risk while also generating a good income stream

And once you learn it and master it…you can scale it

Here are my 5 favorite strategies:

And once you learn it and master it…you can scale it

Here are my 5 favorite strategies:

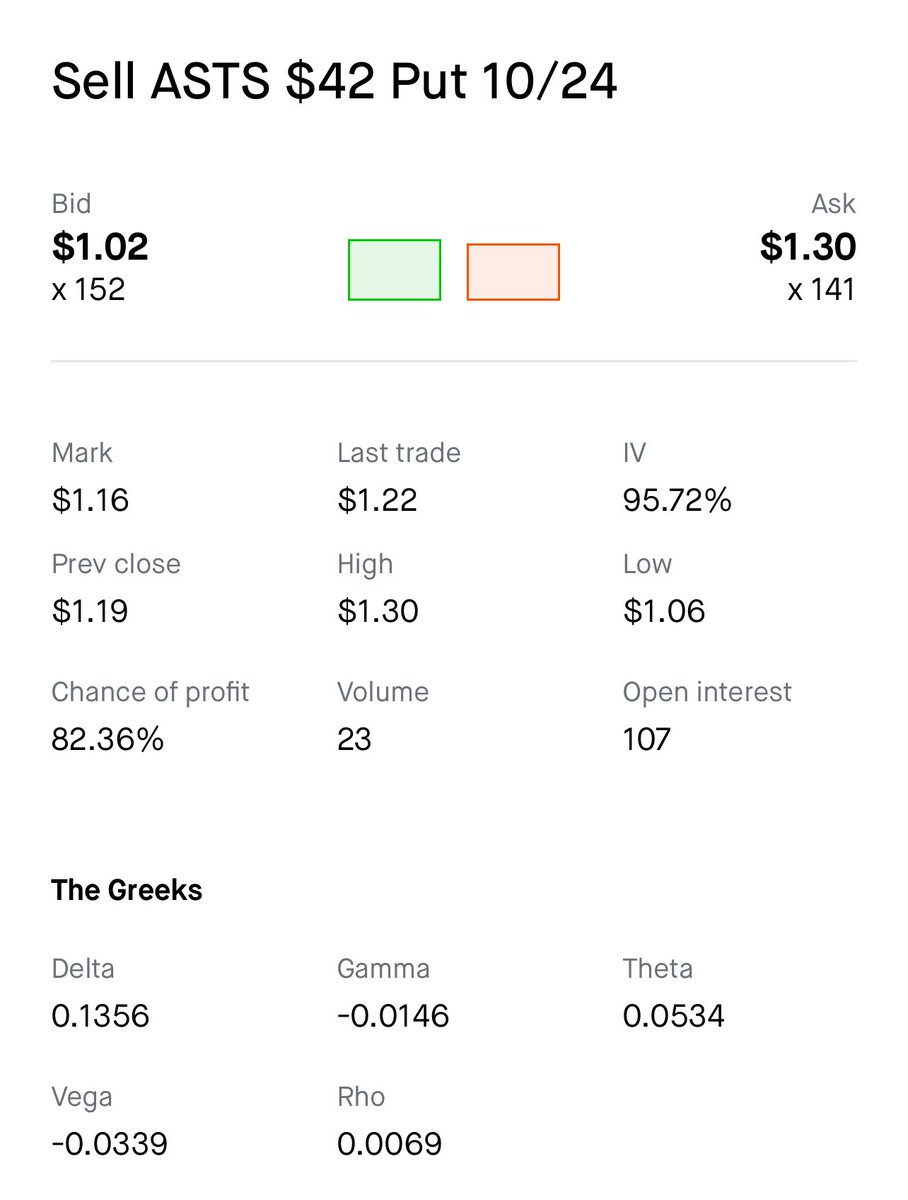

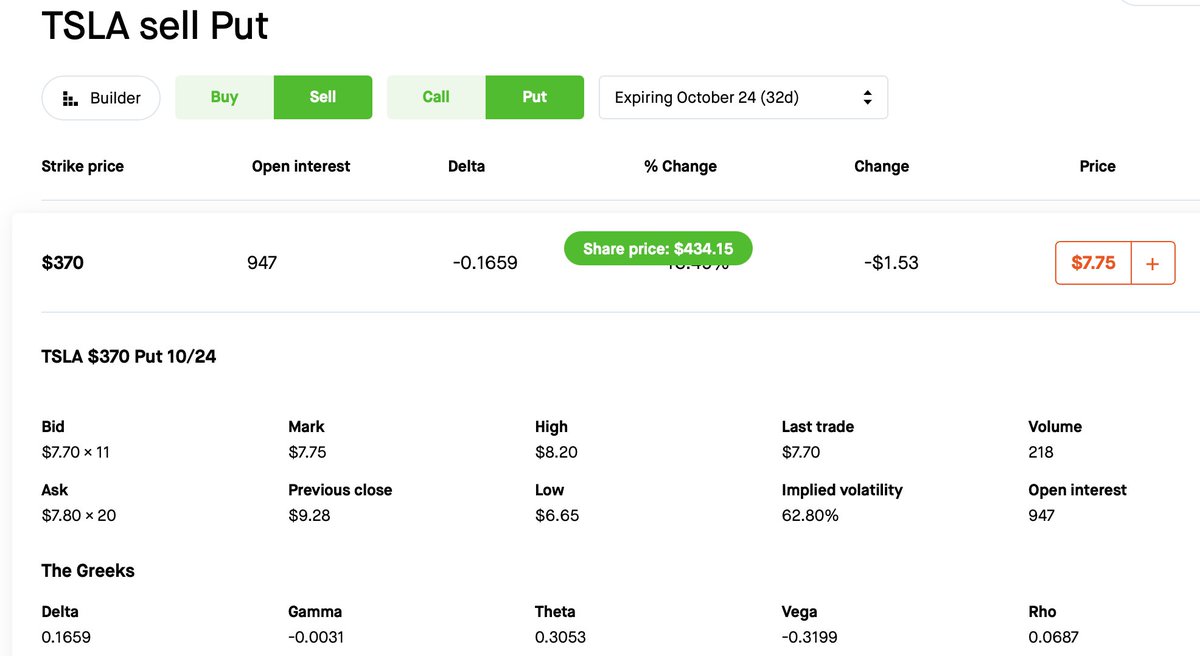

✅ Cash-Secured Puts:

Selling cash-secured puts is an income-generating strategy

Receive cash for selling put options

If the stock remains above the strike you keep the premium as profit

My top 5 stocks: $TSLA $AMZN $AMD $NVDA $GOOGL

Selling cash-secured puts is an income-generating strategy

Receive cash for selling put options

If the stock remains above the strike you keep the premium as profit

My top 5 stocks: $TSLA $AMZN $AMD $NVDA $GOOGL

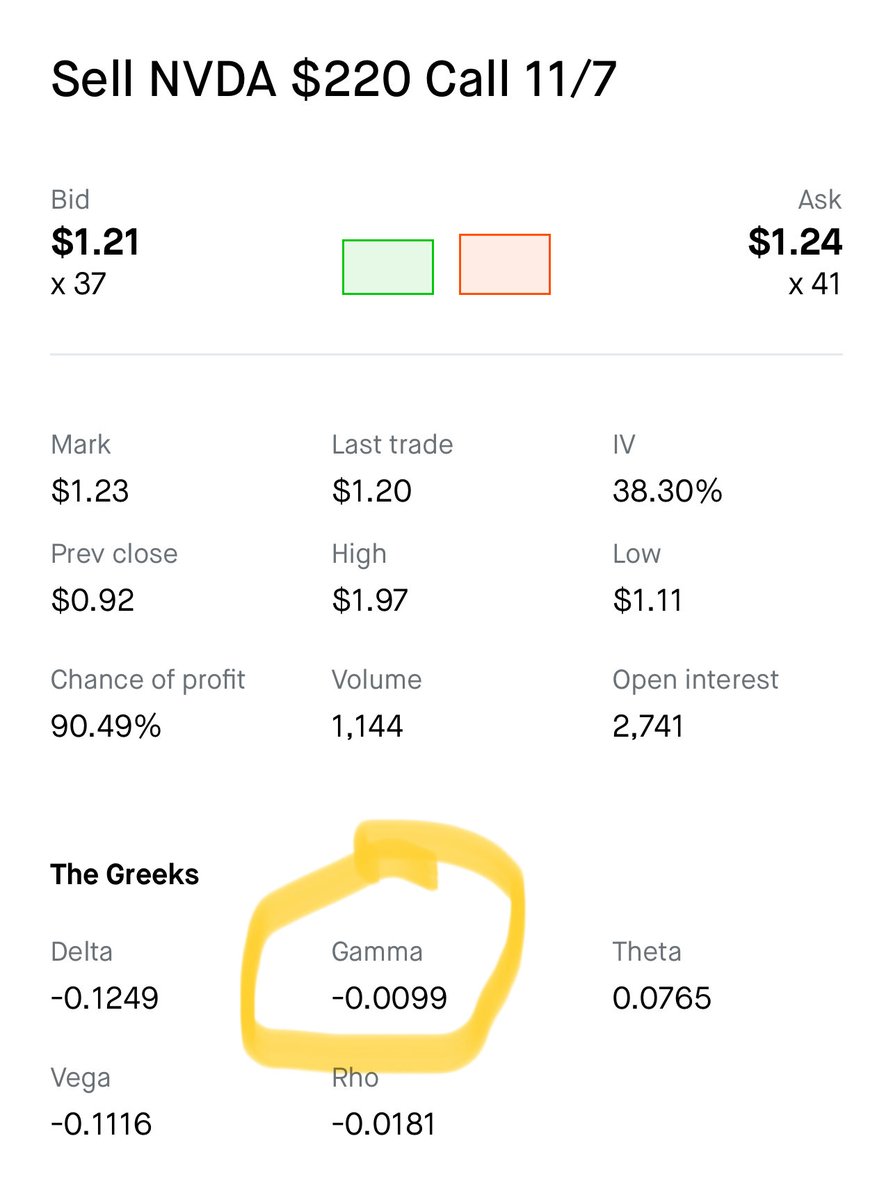

✅ Covered Calls:

By selling covered calls you can potentially earn income regardless of market direction

If the stock price remains below the strike price you retain the premium received effectively boosting your returns

My top 5 stocks: $TSLA $AMZN $GOOG $AMD $NVDA

By selling covered calls you can potentially earn income regardless of market direction

If the stock price remains below the strike price you retain the premium received effectively boosting your returns

My top 5 stocks: $TSLA $AMZN $GOOG $AMD $NVDA

✅ Credit Spreads:

Credit spreads involve selling one option and buying another to receive a net credit

This strategy generates income if the options expire worthless

They are powerful because they are hedged

You can trade them on both puts and calls

Example: $TSLA

Credit spreads involve selling one option and buying another to receive a net credit

This strategy generates income if the options expire worthless

They are powerful because they are hedged

You can trade them on both puts and calls

Example: $TSLA

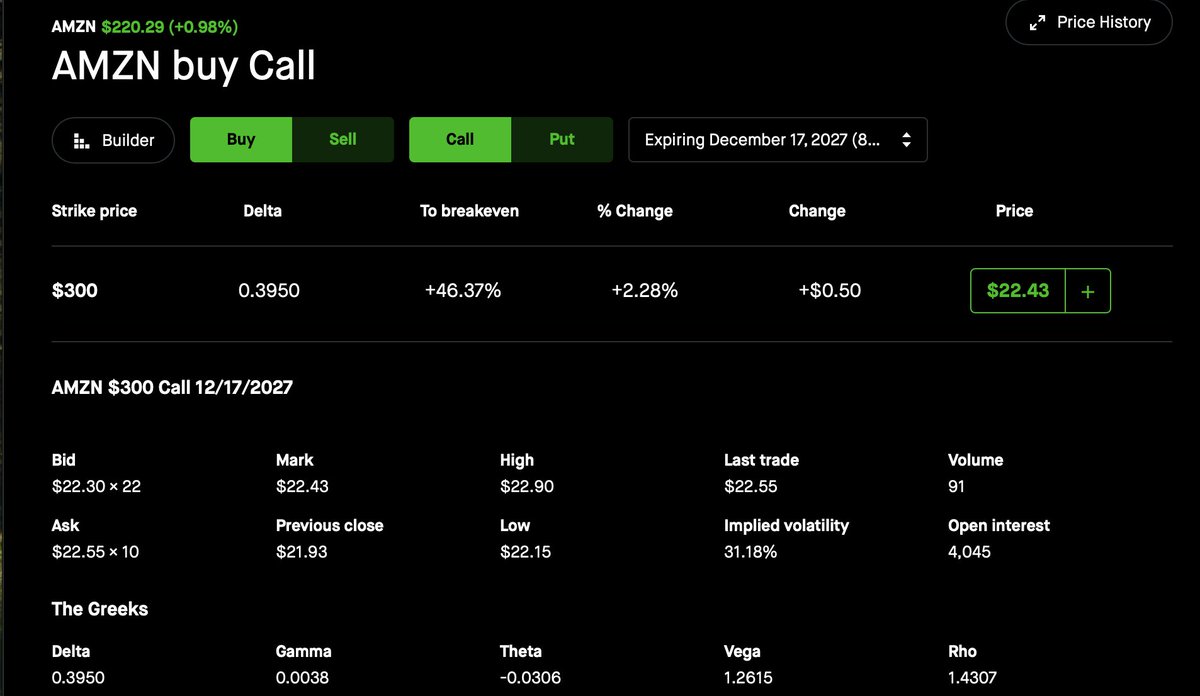

✅ Long Calls:

Buying Calls often get a bad rap

But if you buy them 3-6+ out for your swing trades

And 18+ months out for your long term LEAPS

They are a GREAT asset

Low collateral and outsized returns

These are a perfect mix with the CSPs and CCs

Buying Calls often get a bad rap

But if you buy them 3-6+ out for your swing trades

And 18+ months out for your long term LEAPS

They are a GREAT asset

Low collateral and outsized returns

These are a perfect mix with the CSPs and CCs

✅ Iron Condors:

An options trading strategy that involves the combination of two credit spreads on the same stock

It's a neutral strategy designed to profit when the stock moves sideways

It’s a theta decay play and you profit when the stock stays within the defined range

$TSLA

An options trading strategy that involves the combination of two credit spreads on the same stock

It's a neutral strategy designed to profit when the stock moves sideways

It’s a theta decay play and you profit when the stock stays within the defined range

$TSLA

Managing Risk with Options:

Beyond income generation options can be a potent tool for managing risk in your investment portfolio

Options are absolutely not risky

If you think they are then you are using them to speculate and bet

Beyond income generation options can be a potent tool for managing risk in your investment portfolio

Options are absolutely not risky

If you think they are then you are using them to speculate and bet

If you like content like this please like the first post and repost it

Follow me for more content like this

I share many educational posts and my real trades of all my strategies

@WealthCoachMak

Follow me for more content like this

I share many educational posts and my real trades of all my strategies

@WealthCoachMak

• • •

Missing some Tweet in this thread? You can try to

force a refresh