I coach investors to help them make 4 to 5 figures of monthly income by trading options

3 subscribers

How to get URL link on X (Twitter) App

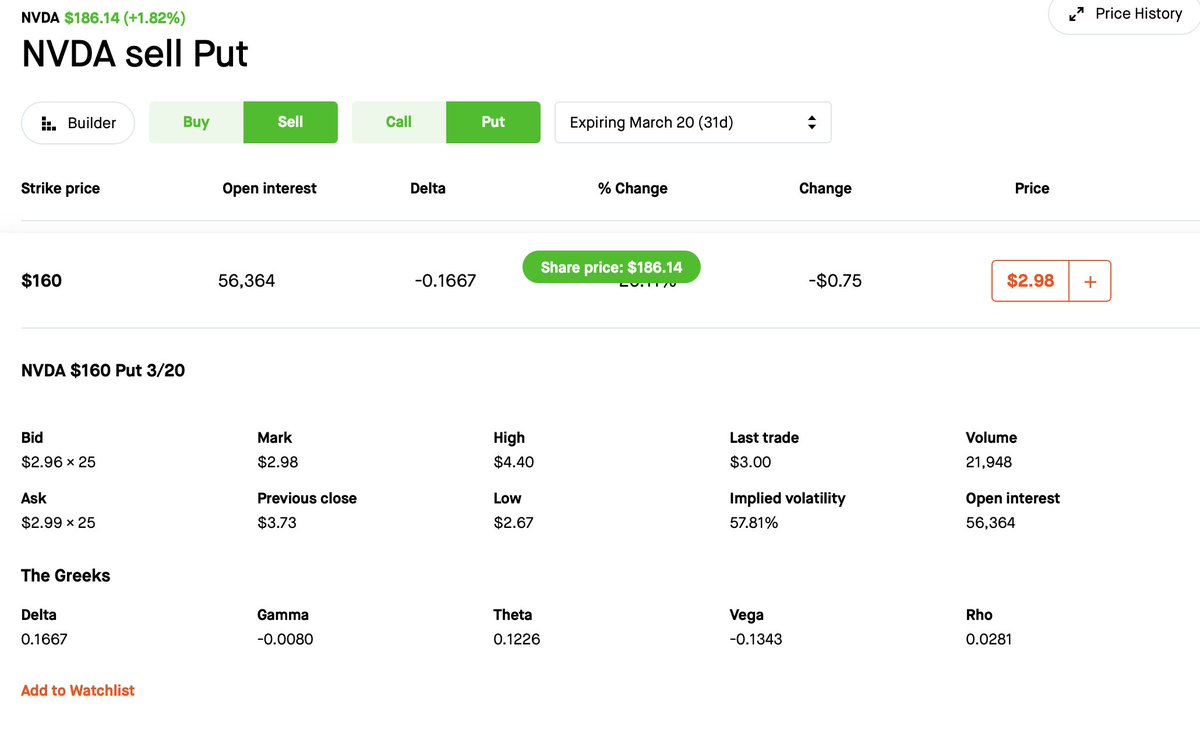

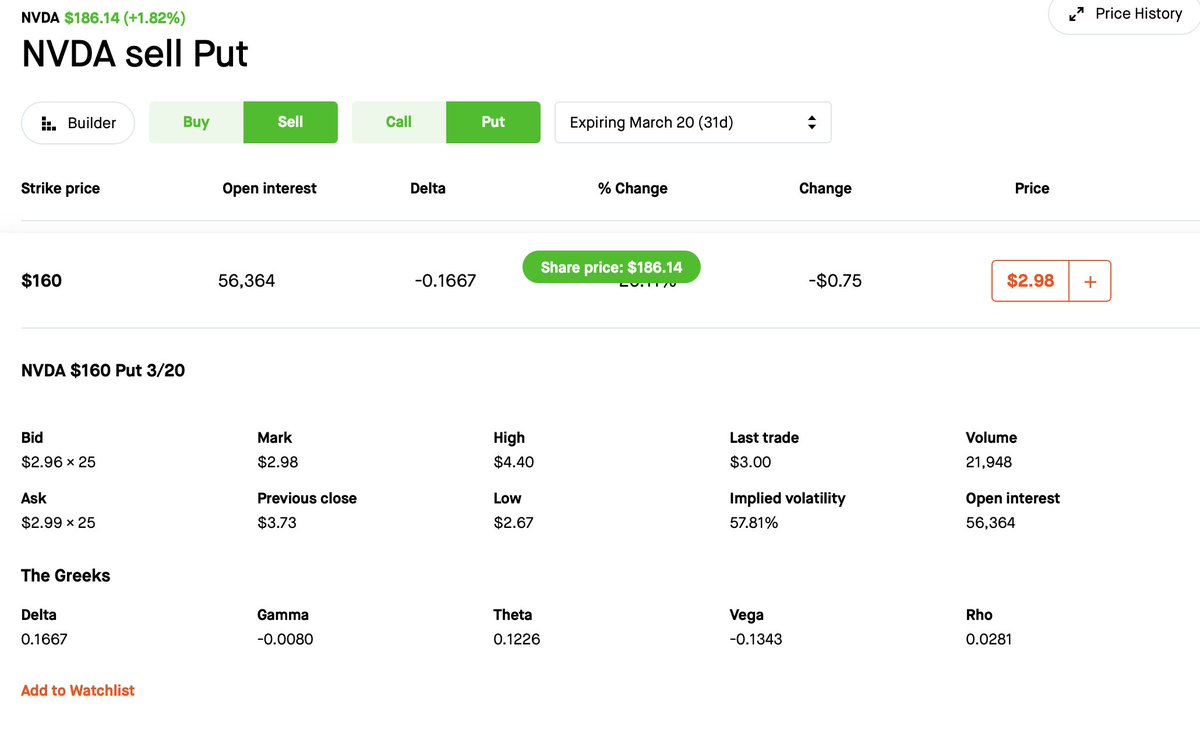

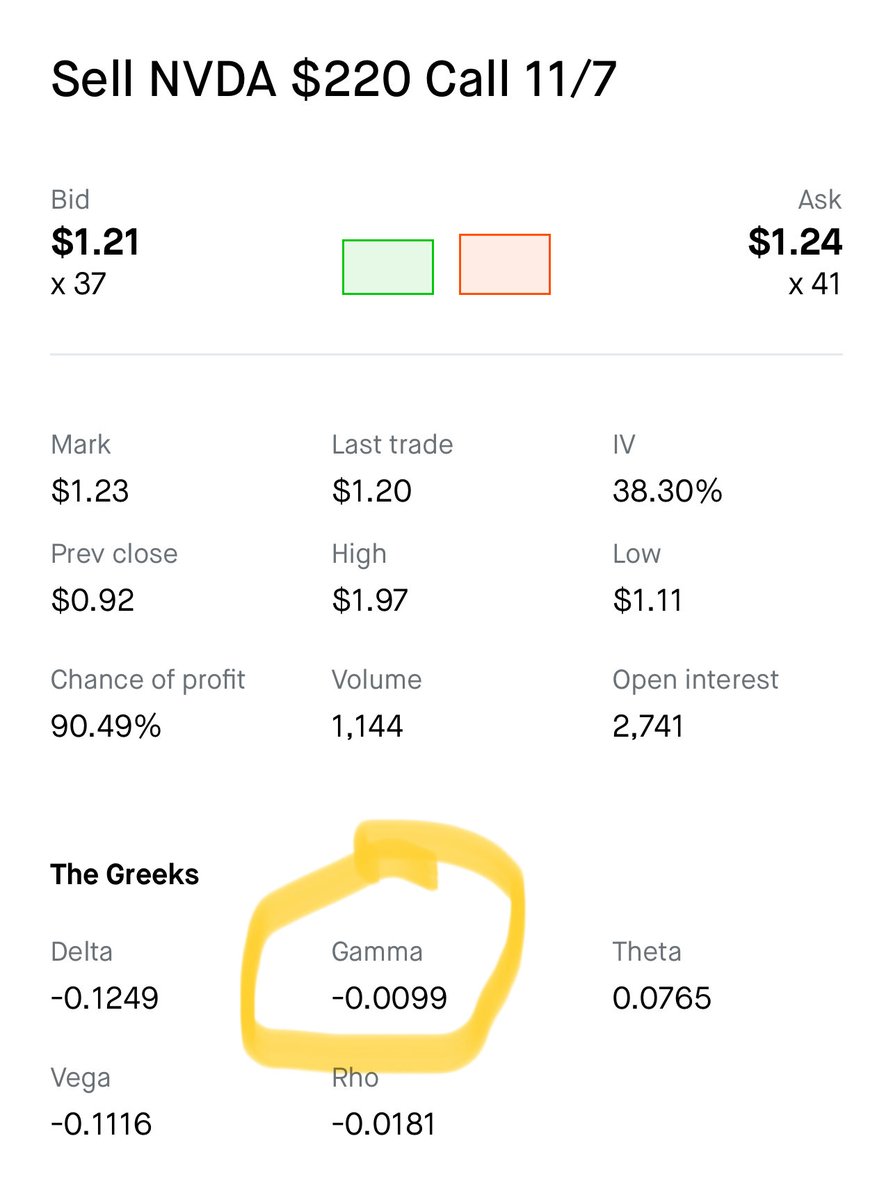

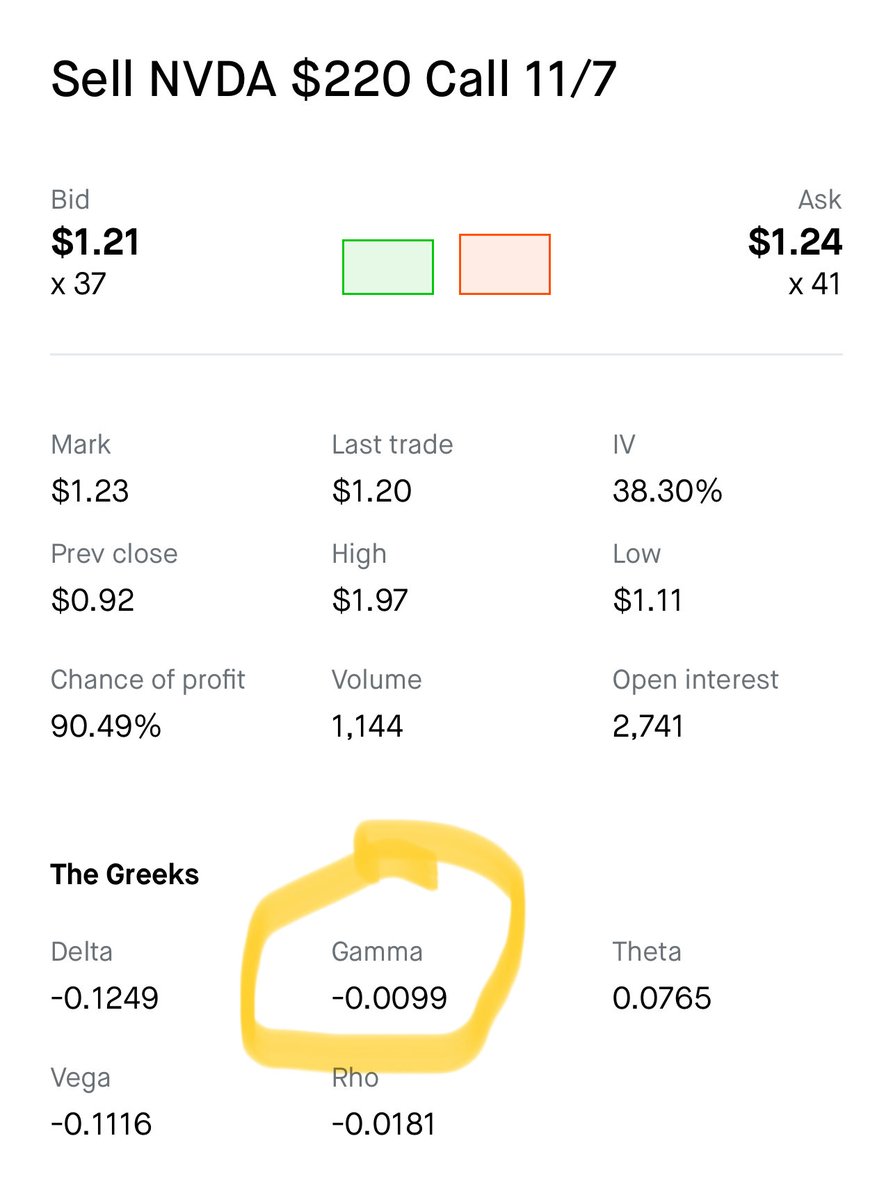

Quick note about Gamma in Options trading:

Quick note about Gamma in Options trading:

First up: What’s Delta? 🤔

First up: What’s Delta? 🤔

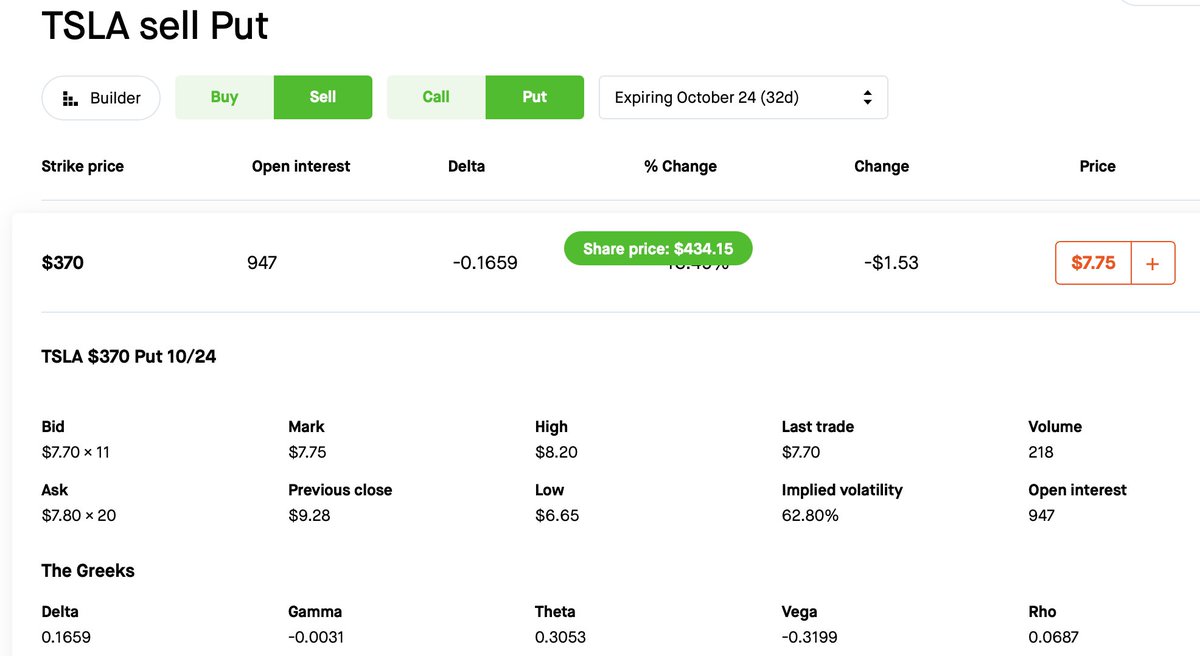

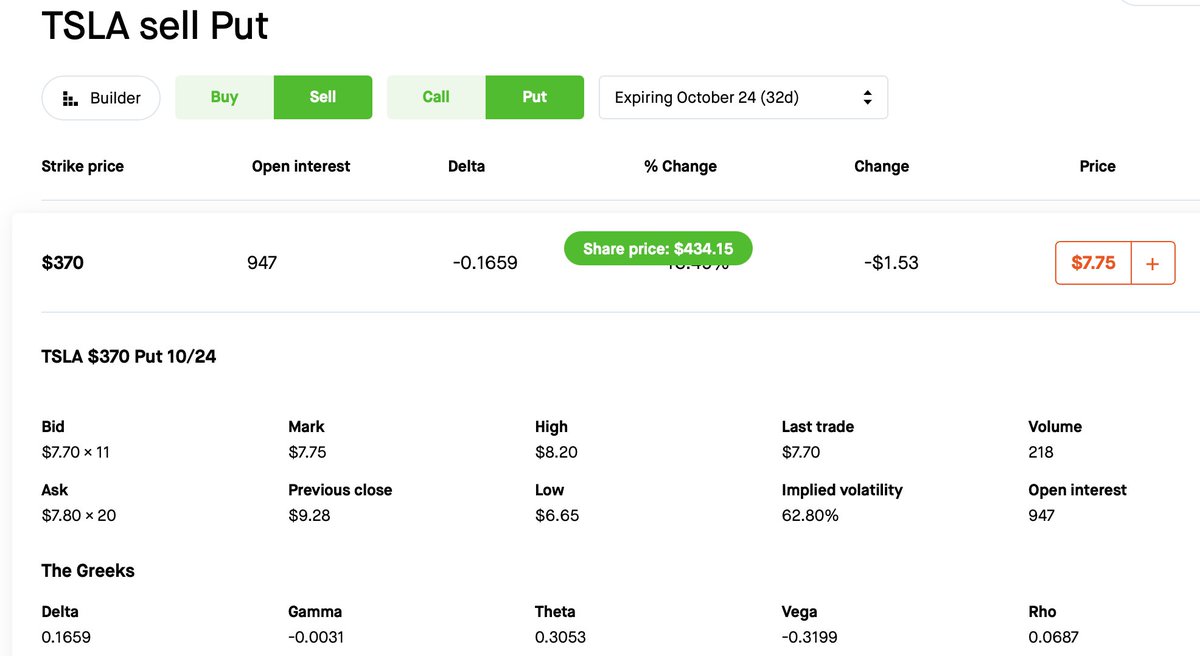

On 5/2 $TSLA stock was around $288-300

On 5/2 $TSLA stock was around $288-300

You sell a short call a month out in expiration

You sell a short call a month out in expiration

Little or no Open Interest?

Little or no Open Interest?

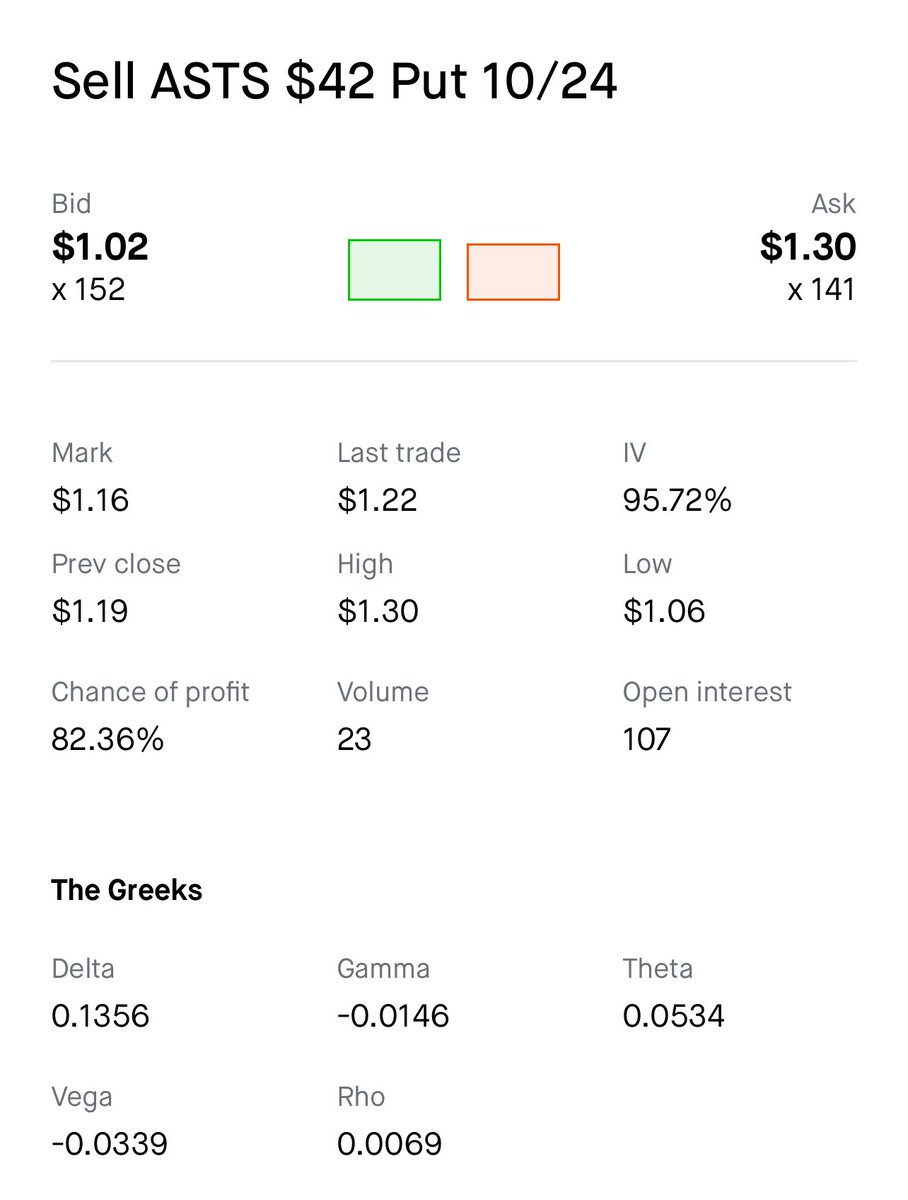

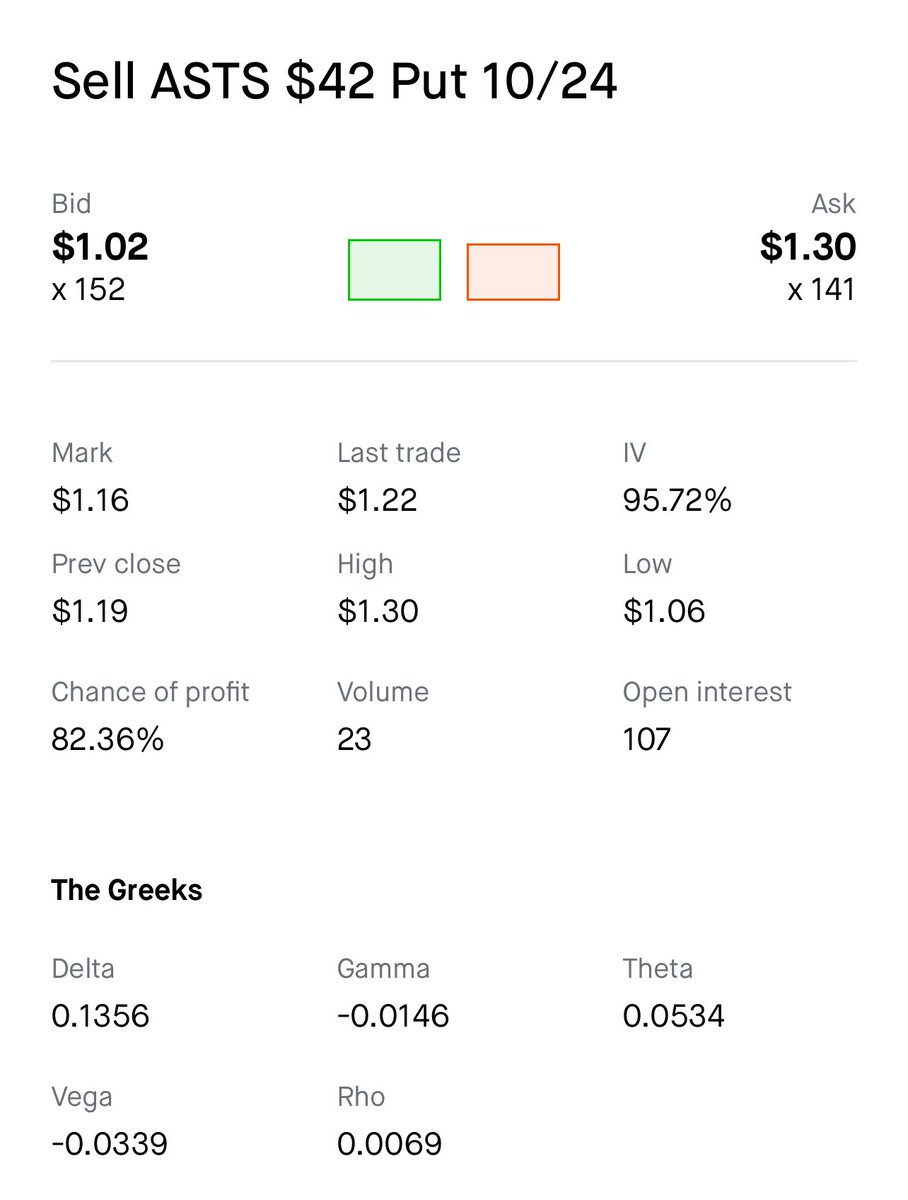

Theta...

Theta...