The old exportweltmeister has been dethroned -- and its economy is suffering at the hand of the new exportweltmeister (China).

That is the story told by both a new ECB paper and the FT in an excellent new piece

1/

That is the story told by both a new ECB paper and the FT in an excellent new piece

1/

Put simply, Germany is the most exposed large G-7 economy to the second China shock (Japan has been buffered by an incredibly weak yen).

2/

2/

The impact of the second China shock is in all the relevant data sets -- & it reflects a clear Chinese policy choice: “As a country, the Chinese have been in the last years much better, more proactive, more consistent in going after the big technologies and conquering them”

3/

3/

Germany's industrial economy has been in a 6 year slump, which corresponds well with China's pivot during the pandemic from an investment driven toan export driven economy

4/

4/

That corresponds with a swing in the euro area's trade with China -- falling exports (absolutely and relative to EA GDP,), a rising bilateral deficit that corresponds with a falling global surplus once Irish tax distortions are stripped out

5/

5/

The FT highlights the swing in Germany's capital goods balance with China -- an important point. The euro area's overall auto balance with China has also swung ...

6/

6/

Germany of course was the one major economy that really relied on exports to China from 2008 to 2018 -- so it is simply more exposed to the second China shock. Exports to China and HK are down a full p. point of German GDP

7/

7/

And German auto exports to China are on a trajectory that takes them to zero ... or at least back to the levels last seen when China was still quite poor

8/

8/

As an aside, auto imports are now down to about 2% of China's auto market (lots of import substitution) while China's exports are least 15% of non-Chinese auto demand globally if the closed US market is excluded (7m v 45m market)

9/

9/

The FT story focuses on what Germany itself needs to do to respond to the new China shock (defense spending alone won't quite cut it, the internal EU market needs to be reinforced with a less "naive" / VW driven trade policy)

10/

ft.com/content/239eed…

10/

ft.com/content/239eed…

The ECB's paper highlights the global dimension to Germany's industrial angst -- by highlighting how China's internal imbalances have fueled its export surplus (in a much clearer way than the IMF has ... )

11/

ecb.europa.eu/press/economic…

11/

ecb.europa.eu/press/economic…

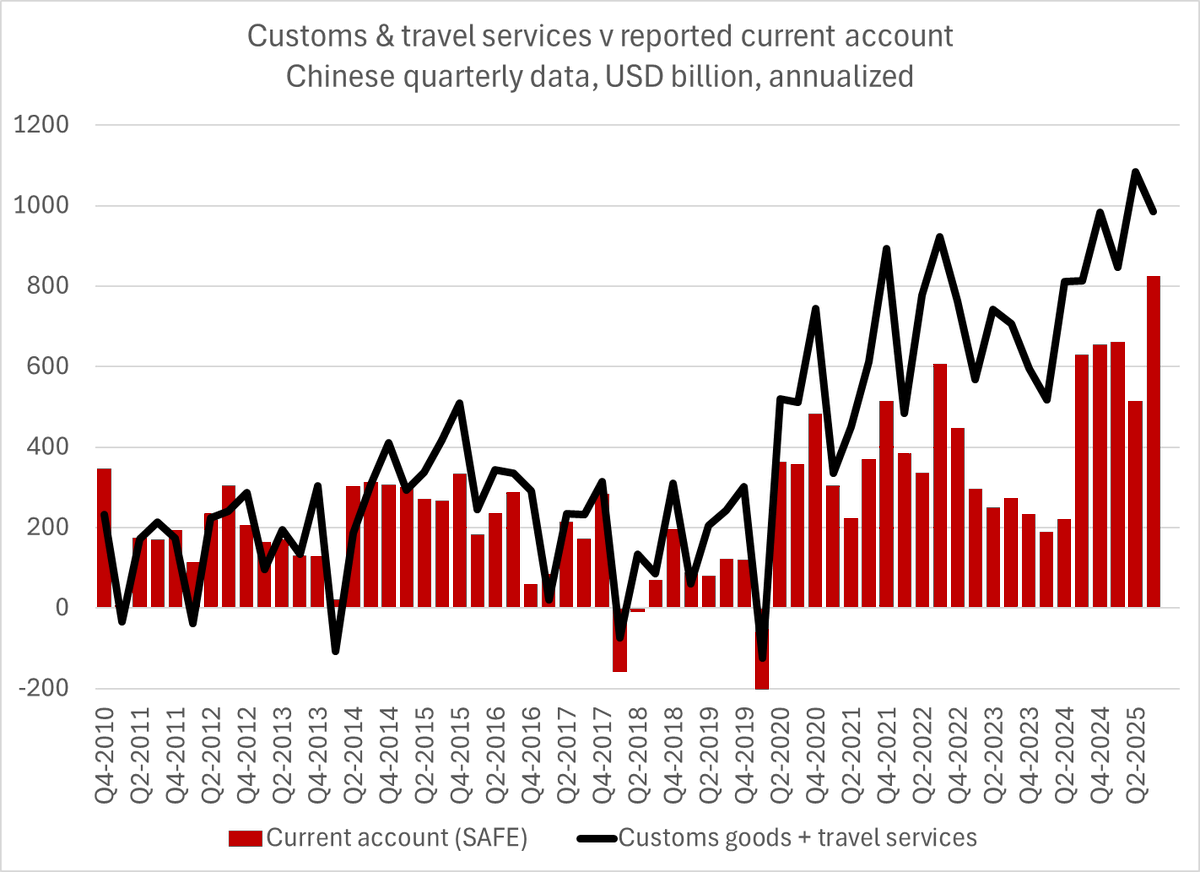

The ECB paper uses China's goods trade data (memo to the IMF, you cannot just use China's self reported current account numbers any more) to show that export growth and import growth have diverged, bigly

12/

12/

That divergence maps well to the real depreciation of the Chinese yuan by the way -- Germany cannot afford to ignore currency issues any more (incidentally, the ECB paper largely ignored this, which is my only real criticism of a v good piece)

13/

13/

Europe incidentally has not been rewarded for its relatively restraint (compared to the US) on trade protection -- China's imports from the EU have fallen by as much China's imports from the US since the pandemic (v trend)

14

14

The ECB paper also highlights something that is obvious in the data but that neither the IMF nor the WTO has been able to state clearly, namely that China is the deglobalizer in chief (import growth has massively lagged GDP growth)

15/

15/

And the ECB finds that China's exports are outperforming the domestic economy across the board -- but especially in sectors where the domestic side of the Chinese economy is weak ...

16/

16/

The ECB's paper more than justifies France's plan to make the return of global imbalances a focus on its G-7 Presidency next year

17/

ecb.europa.eu/press/economic…

17/

ecb.europa.eu/press/economic…

And the FT's Big Read should raise questions at the IMF about whether or not Germany is really still a big contributor to global imbalances (exports are falling, and domestic spending is set to increase) let alone a bigger contributor than China

18/

ft.com/content/239eed…

18/

ft.com/content/239eed…

And it also should raise questions about the IMF's advice to China over the last 2 or 3 years, which more or less was to export your way out of the property crash more aggressively (monetary easing & long-term fiscal consolidation = weaker CNY). More later

19/19

19/19

• • •

Missing some Tweet in this thread? You can try to

force a refresh