Metadex03: The @AerodromeFi evolution of onchain exchange Infrastructure

@DromosLabs just shipped what might be the most comprehensive DEX update this cycle.

This isn't a UI refresh or a minor optimization. This is a fundamental architectural upgrade that changes AMM economics, institutional-grade onchain trading and revenue distribution.

The basics: DEXes capture up to 1.5b revenue.

Let's start with the baseline. Exchanges, as a business category, sit at ~$1.5B in value creation.

The question Metadex03 answers is simple: what happens when you build that infrastructure 100% onchain, with native composability and algorithmic optimization?

The answer is: you get something that looks nothing like traditional DEX economics.

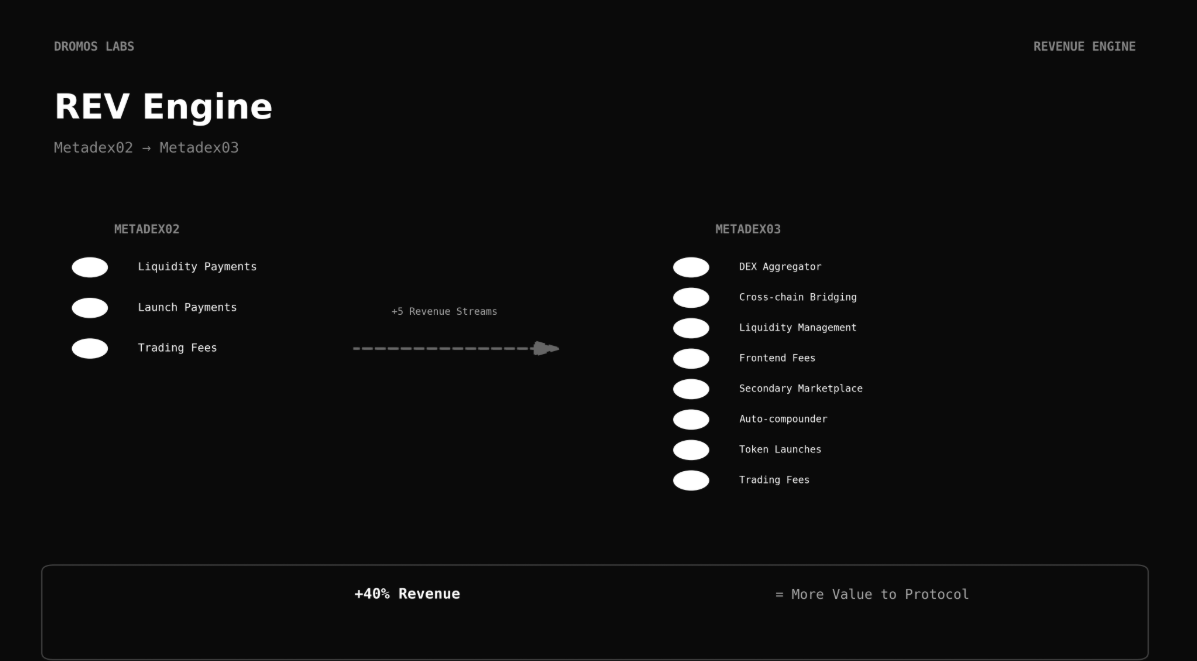

Revenue engine: From single stream to ecosystem play.

Metadex02's limitation was architectural. Revenue came from three sources: liquidity fees, launch payments, trading fees.

Metadex03 reverses this: introducing REV and AER

REV: capturing more revenue

• DEX aggregator fees

• Cross-chain bridging

• Liquidity management services

• Frontend fees

• Secondary marketplace

• Auto-compounder mechanisms

• Token launches

• Trading fees

All of this revenue is shared in one or another way (weekly rewards, buybacks and burns) with $AERO lockers.

AER: algorithmic reward optimization

This is where it gets interesting. Dromos built a system that continuously changes LP rewards based on onchain market dynamics in real-time.

Optimized Rewards: The system maintains Metadex03's reward APY consistently higher than competitor DEXes. Backtesting shows up to 50% higher rewards than alternatives.

Surging Rewards: The system simultaneously reduces emissions so you're not just printing tokens to pay LPs. It caps overpayment and normalizes reward distribution.

The math on AER and REV is incredible:

Revenue increase: +40% (REV engine)

Emissions decrease: -25% (AER engine)

Result: 2.8x more value creation for token operators.

Current inflation is 5.7% accounting for locks. With Metadex03, it drops to 85% lower than current levels.

Last year for reference: $258M revenue against $184M net emissions. That's $74M net value. With both engines running? $211M net revenue.

Slipstream V3: Improved AMM Infrastructure

Internal MEV Auction: Allows MEVs to bid for a no fee swap, generating additional revenue.

This could drive additional tens of millions in annualized revenue shared with token operators.

Institutional Economics: Citadel and Robinhood style?

• Fee rebates for institutional volume

• Orderflow payment mechanisms

• Superior execution guarantees at all times

• KYC-verified institutional pools

This changes the narrative. Institutions aren't choosing between onchain and TradFi liquidity anymore.

Supporting Infrastructure

Metaswaps: Cross-chain aggregator optimized across the entire EVM. Not another bridge. Not another wrapped token solution. An aggregator that thinks systemically about cross-chain execution.

Autopilot uptade: Now optimizes voting across all pools, claims from any chain, compounds automatically, or swaps to any asset.

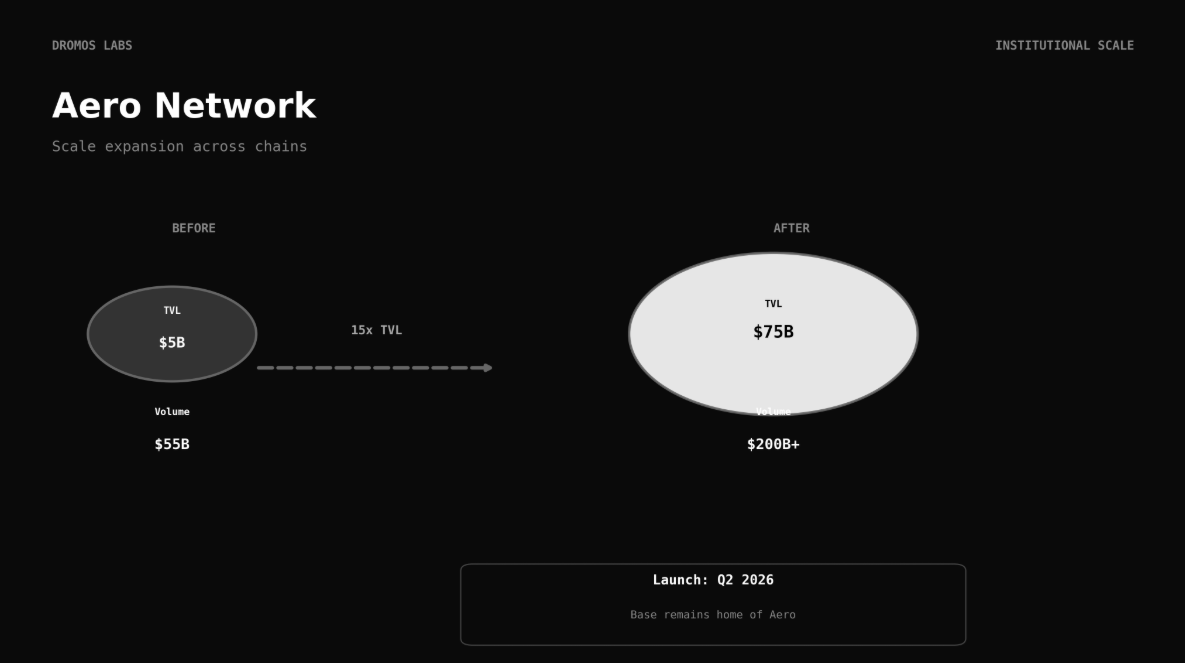

The Unification (lol): Aero, the unified network

Velodrome and Aerodrome are merging. One token. One network. One unified liquidity layer across the entire EVM.

The new ticker: $AERO.

New playing field Ethereum

Let's look at what this means economically:

• Before: $5B TVL split across Base and Optimism superchain. $55B monthly trading volume.

• After: Targeting $75B TVL across Ethereum mainnet and all connected chains. $200B+ monthly trading volume.

Launching becomes trivial

• Deploy in one minute directly on Aero. No complex setup. No deployment delays.

• Automatic graduated rewards. Fresh launches immediately qualify for Aero incentive mechanisms.

• Your pool builds liquidity organically.

• No hidden fees. Everything is transparent and onchain.

For projects, this becomes the default launchpad. For LPs, this becomes the default ecosystem to find the highest-quality launches with native Aero rewards.

Value Consolidation: Single Token, All Revenue

Every revenue stream, from every protocol, every chain, every interactio flows back to $AERO

This solves the problem that plagued DeFi tokenomics: fragmentation. You're not spread across five tokens trying to capture value. You're all-in on a network that captures everything.

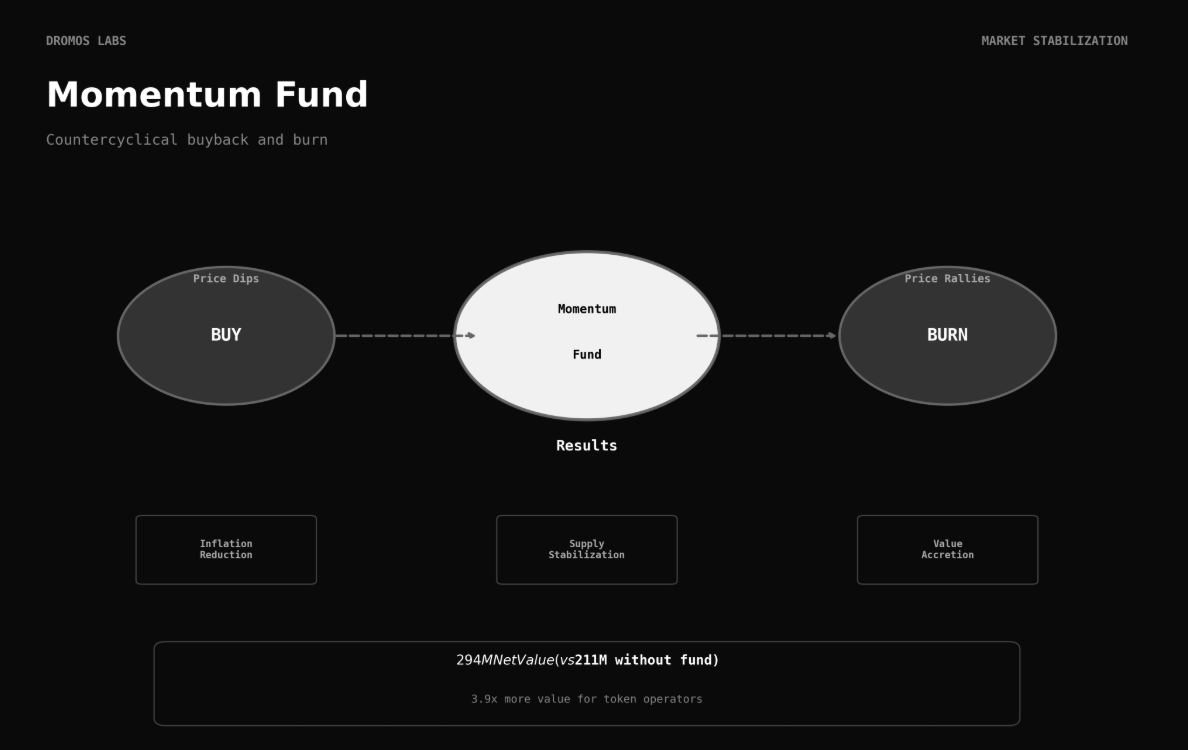

The momentum fund: Market stabilization through mechanism design

Dromos is building automated token stability mechanism. The Momentum Fund operates a countercyclical buyback and burn:

• When $AERO dips: Buy back tokens from the market.

• When $AERO rallies: Burn tokens from the treasury

The math compounds: with the Momentum Fund, projected net value for token operators increases from $211M (Metadex03 alone) to $294M.

That's a 3.9x multiplier on token holder value vs. current economics (note: these projections are backtested)

Timeline and Home Base

Q2 2026 launch. Base remains the home of Aero.

By then, Metadex03 will have been live. You'll have real-world data on REV and AER engine performance. Institutional integrations will be established.

You are not holding enough $AERO

Congratulations to @jack_anorak @wagmiAlexander and whole @DromosLabs team for this banger of an event!

@DromosLabs just shipped what might be the most comprehensive DEX update this cycle.

This isn't a UI refresh or a minor optimization. This is a fundamental architectural upgrade that changes AMM economics, institutional-grade onchain trading and revenue distribution.

The basics: DEXes capture up to 1.5b revenue.

Let's start with the baseline. Exchanges, as a business category, sit at ~$1.5B in value creation.

The question Metadex03 answers is simple: what happens when you build that infrastructure 100% onchain, with native composability and algorithmic optimization?

The answer is: you get something that looks nothing like traditional DEX economics.

Revenue engine: From single stream to ecosystem play.

Metadex02's limitation was architectural. Revenue came from three sources: liquidity fees, launch payments, trading fees.

Metadex03 reverses this: introducing REV and AER

REV: capturing more revenue

• DEX aggregator fees

• Cross-chain bridging

• Liquidity management services

• Frontend fees

• Secondary marketplace

• Auto-compounder mechanisms

• Token launches

• Trading fees

All of this revenue is shared in one or another way (weekly rewards, buybacks and burns) with $AERO lockers.

AER: algorithmic reward optimization

This is where it gets interesting. Dromos built a system that continuously changes LP rewards based on onchain market dynamics in real-time.

Optimized Rewards: The system maintains Metadex03's reward APY consistently higher than competitor DEXes. Backtesting shows up to 50% higher rewards than alternatives.

Surging Rewards: The system simultaneously reduces emissions so you're not just printing tokens to pay LPs. It caps overpayment and normalizes reward distribution.

The math on AER and REV is incredible:

Revenue increase: +40% (REV engine)

Emissions decrease: -25% (AER engine)

Result: 2.8x more value creation for token operators.

Current inflation is 5.7% accounting for locks. With Metadex03, it drops to 85% lower than current levels.

Last year for reference: $258M revenue against $184M net emissions. That's $74M net value. With both engines running? $211M net revenue.

Slipstream V3: Improved AMM Infrastructure

Internal MEV Auction: Allows MEVs to bid for a no fee swap, generating additional revenue.

This could drive additional tens of millions in annualized revenue shared with token operators.

Institutional Economics: Citadel and Robinhood style?

• Fee rebates for institutional volume

• Orderflow payment mechanisms

• Superior execution guarantees at all times

• KYC-verified institutional pools

This changes the narrative. Institutions aren't choosing between onchain and TradFi liquidity anymore.

Supporting Infrastructure

Metaswaps: Cross-chain aggregator optimized across the entire EVM. Not another bridge. Not another wrapped token solution. An aggregator that thinks systemically about cross-chain execution.

Autopilot uptade: Now optimizes voting across all pools, claims from any chain, compounds automatically, or swaps to any asset.

The Unification (lol): Aero, the unified network

Velodrome and Aerodrome are merging. One token. One network. One unified liquidity layer across the entire EVM.

The new ticker: $AERO.

New playing field Ethereum

Let's look at what this means economically:

• Before: $5B TVL split across Base and Optimism superchain. $55B monthly trading volume.

• After: Targeting $75B TVL across Ethereum mainnet and all connected chains. $200B+ monthly trading volume.

Launching becomes trivial

• Deploy in one minute directly on Aero. No complex setup. No deployment delays.

• Automatic graduated rewards. Fresh launches immediately qualify for Aero incentive mechanisms.

• Your pool builds liquidity organically.

• No hidden fees. Everything is transparent and onchain.

For projects, this becomes the default launchpad. For LPs, this becomes the default ecosystem to find the highest-quality launches with native Aero rewards.

Value Consolidation: Single Token, All Revenue

Every revenue stream, from every protocol, every chain, every interactio flows back to $AERO

This solves the problem that plagued DeFi tokenomics: fragmentation. You're not spread across five tokens trying to capture value. You're all-in on a network that captures everything.

The momentum fund: Market stabilization through mechanism design

Dromos is building automated token stability mechanism. The Momentum Fund operates a countercyclical buyback and burn:

• When $AERO dips: Buy back tokens from the market.

• When $AERO rallies: Burn tokens from the treasury

The math compounds: with the Momentum Fund, projected net value for token operators increases from $211M (Metadex03 alone) to $294M.

That's a 3.9x multiplier on token holder value vs. current economics (note: these projections are backtested)

Timeline and Home Base

Q2 2026 launch. Base remains the home of Aero.

By then, Metadex03 will have been live. You'll have real-world data on REV and AER engine performance. Institutional integrations will be established.

You are not holding enough $AERO

Congratulations to @jack_anorak @wagmiAlexander and whole @DromosLabs team for this banger of an event!

@AerodromeFi @DromosLabs I fr forgot to mention that Aerodrome also will be expanding to Arc lol. But they will.

• • •

Missing some Tweet in this thread? You can try to

force a refresh