CoreWeave’s Warning: When AI Demand Meets Infrastructure Reality

The AI boom of 2025 reshaped markets. But the next phase won’t be about capital—it’s about concrete.

We’ve entered a supply-constrained revolution.

🧵👇

The AI boom of 2025 reshaped markets. But the next phase won’t be about capital—it’s about concrete.

We’ve entered a supply-constrained revolution.

🧵👇

1/ Today I published a paper for 22V on CRWV and why for me this was an important inflection point in the AI trade.

2/ For three years, the trade was simple: bet on AI demand and capex.

Now, that demand is colliding with physical limits.

CoreWeave’s update showed the constraint has moved from capital to execution.

They cut 2025 capex by 40%, not for lack of demand, but because data-center builders missed deadlines.

Now, that demand is colliding with physical limits.

CoreWeave’s update showed the constraint has moved from capital to execution.

They cut 2025 capex by 40%, not for lack of demand, but because data-center builders missed deadlines.

3/ This isn’t a bubble in profits, it’s a bubble in time.

AI’s exponential demand is running into the linear reality of transformers, turbines, and transmission.

GPU scarcity is easing.

The new choke points: power shells, grid capacity, transformers.

The digital economy is growing faster than the physical one can respond.

AI’s exponential demand is running into the linear reality of transformers, turbines, and transmission.

GPU scarcity is easing.

The new choke points: power shells, grid capacity, transformers.

The digital economy is growing faster than the physical one can respond.

4/ CoreWeave’s backlog surged 85% to $55B.

Oracle’s backlog hit $455B.

Both are rationing customers.

CEO Safra Catz: “We’re still waving off customers… putting out as much capacity as we can.”

Execution risk, not funding, is now the biggest risk in AI.

Oracle’s backlog hit $455B.

Both are rationing customers.

CEO Safra Catz: “We’re still waving off customers… putting out as much capacity as we can.”

Execution risk, not funding, is now the biggest risk in AI.

5/ GE Vernova reveals the deeper issue:

“No transformer = no project.”

Gas turbine lead times: 3–7 years

Large power transformers: up to 4 years

Distribution transformers: 2 years

Even with $500B+ in contracts, there’s nowhere to deploy them fast enough.

“No transformer = no project.”

Gas turbine lead times: 3–7 years

Large power transformers: up to 4 years

Distribution transformers: 2 years

Even with $500B+ in contracts, there’s nowhere to deploy them fast enough.

6/ The paradox of 2026: AI’s success is now its greatest vulnerability.

Winners will be those who execute through constraint, who convert backlog into capacity while protecting margins.

This is the K-shaped economy in real time.

Time, transformers, and transmission are now the new scarcity premiums in the age of AI.

Winners will be those who execute through constraint, who convert backlog into capacity while protecting margins.

This is the K-shaped economy in real time.

Time, transformers, and transmission are now the new scarcity premiums in the age of AI.

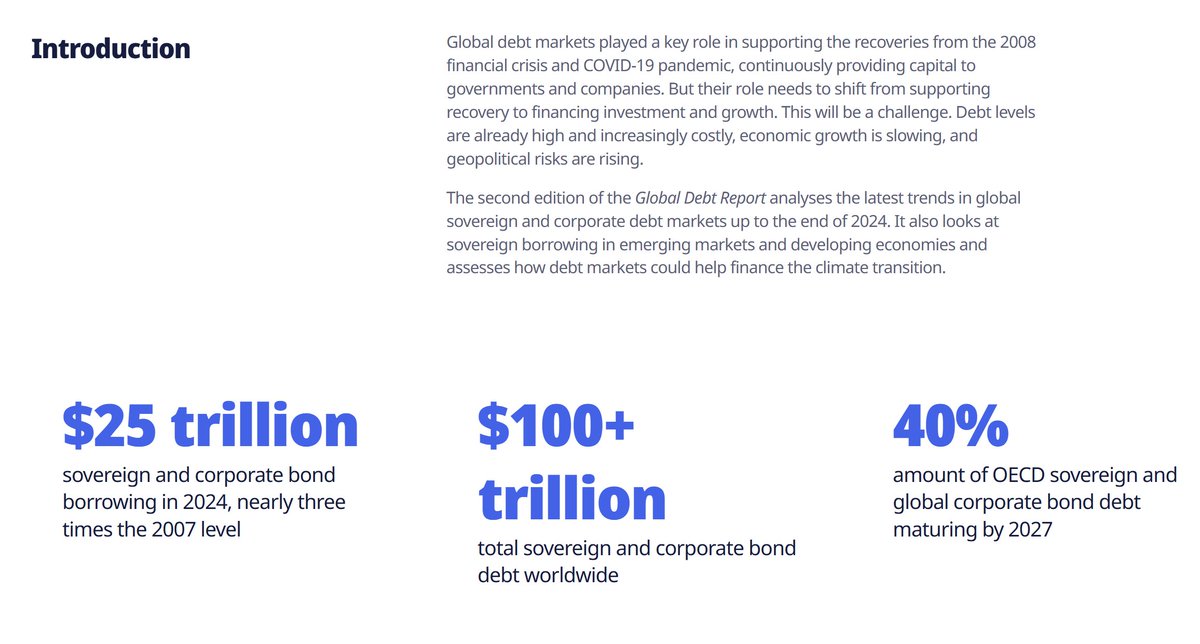

7/ This is showing up in momentum since CRWV reported. Pure Momentum has been hit hard all three days regardless of what the SPX was doing

8/ Here is a chart of Pure Mo overlaid with the three major players in the buildout ORCL, GEV and NVDA

10/ Here are the sector returns so far this month. I think Pharma is entering a new AI bull phase which I will cover in my Youtube video this week. S&P 1500 Pharma having best month since 2020 and 2nd best since 1999 so far in Nov!

11/ I expect higher PMIs next year after 3 years of below 50 and we have XLE up 3% for the month and the lowly Transports up as well. Momentum is a chameleon factor shifts at important points particularly when people are long IT and short PMI. I think it is time to be wary of being long the legacy AI winners for 2026.

• • •

Missing some Tweet in this thread? You can try to

force a refresh