Kalecki–Young Sectoral Inflation Decomposition (KYSID)

"It lets you both model inflation and attribute it sectorally—to wages, productivity, domestic debt saturation, and the external / tradables channel—within a consistent stock–flow, income‑distribution perspective."

"It lets you both model inflation and attribute it sectorally—to wages, productivity, domestic debt saturation, and the external / tradables channel—within a consistent stock–flow, income‑distribution perspective."

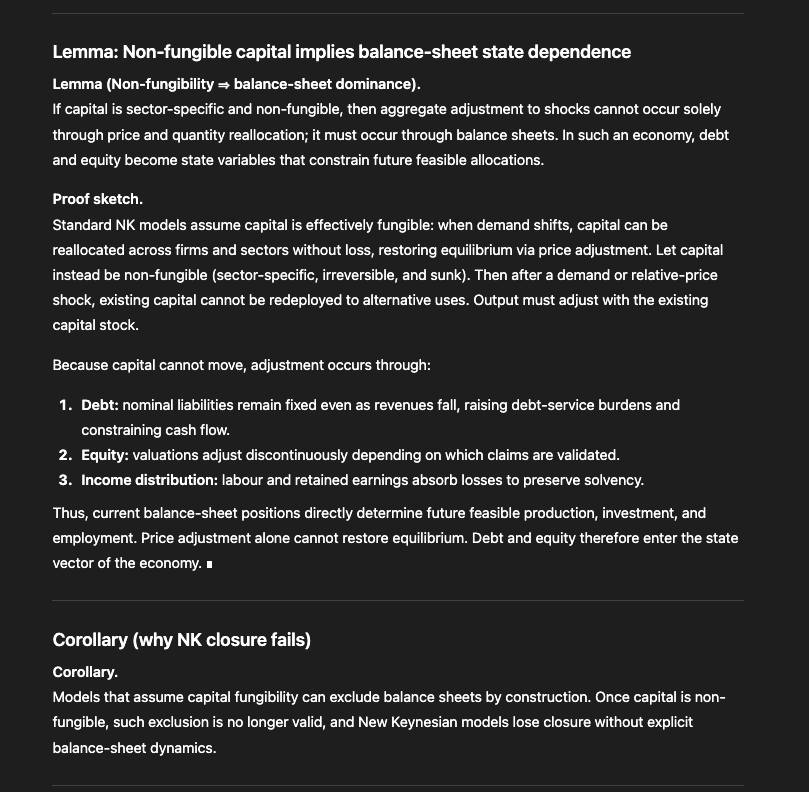

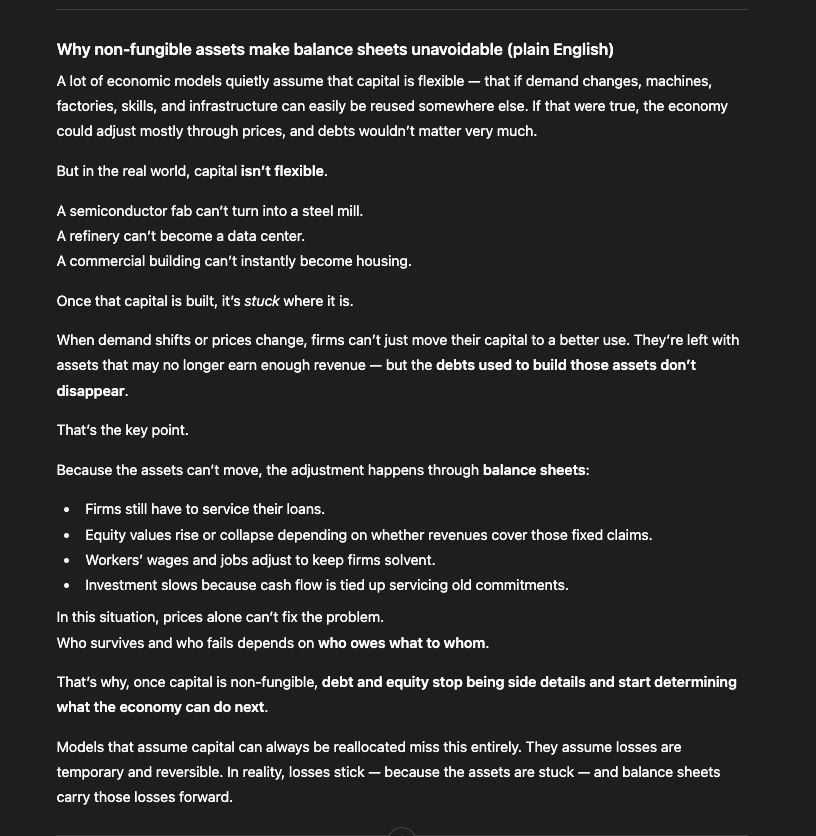

Equation (K3) is the Kalecki distributional inflation equation: inflation depends on wage growth, productivity growth, and changes in the core profit share, scaled by the wage share 1−θ

Step 3 – Young’s claim‑dilution ratio

"meaning: excess credit over productive equity tends to raise the core profit share."

"meaning: excess credit over productive equity tends to raise the core profit share."

This is the Kalecki–Young Sectoral Inflation Decomposition (KYSID): an inflation framework grounded in Kalecki’s pricing and distribution, enriched by Young’s balance‑sheet concept of claim dilution and extended to an open economy.

Why δ is “excess claim creation”

...."is the net increase in nominal claims on future domestic income not matched by new productive backing."

...."is the net increase in nominal claims on future domestic income not matched by new productive backing."

is the net increase in nominal claims on future domestic income not matched by new productive backing.

@threadreaderapp

unroll

unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh