You'd think the field that studies money would have a solid grasp of how it works.

But mainstream economics still teaches that banks are intermediaries, loans come from savings, and governments can run out of money.

None of that sh#t holds up.

🧵1/12

But mainstream economics still teaches that banks are intermediaries, loans come from savings, and governments can run out of money.

None of that sh#t holds up.

🧵1/12

The textbook story starts with loanable funds: households save, banks lend those savings, and interest rates tidy everything up.

Nice f#$king story.

Also wrong.

🧵2/12

Nice f#$king story.

Also wrong.

🧵2/12

Banks don't lend out savings.

They create new deposits when they make a loan, literally by typing numbers into an account.

What actually constrains them is capital rules, regulation, and credit risk.

📎 BIS (2016)

🧵3/12

They create new deposits when they make a loan, literally by typing numbers into an account.

What actually constrains them is capital rules, regulation, and credit risk.

📎 BIS (2016)

🧵3/12

This isn’t fringe.

Central banks are clear, loans create deposits, the need for reserves comes after and reserves are supplied as needed.

The whole sequence runs opposite of what most economists still learn.

📎 Bank of England (2014)

🧵4/12

Central banks are clear, loans create deposits, the need for reserves comes after and reserves are supplied as needed.

The whole sequence runs opposite of what most economists still learn.

📎 Bank of England (2014)

🧵4/12

Yet macro models keep leaning on a representative household whose savings supposedly fund investment.

This imaginary person is doing the work actual balance sheets do.

It's sh#tty physics envy. Nothing more than that.

🧵5/12

This imaginary person is doing the work actual balance sheets do.

It's sh#tty physics envy. Nothing more than that.

🧵5/12

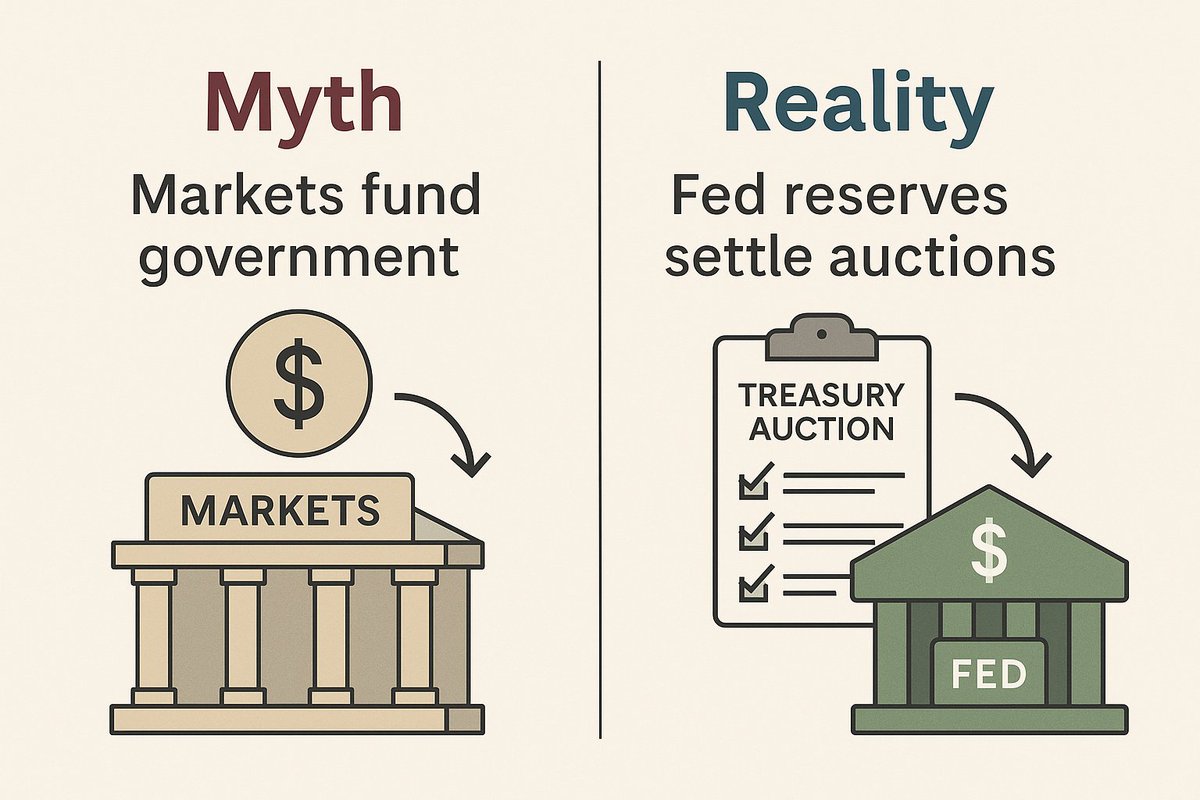

The confusion gets worse when it comes to government finance.

A currency-issuing government doesn't borrow like a household.

It spends by creating new liabilities and taxes by deleting them.

Bond sales just swap one type of private asset for another.

📎 Kelton (2020)

🧵6/12

A currency-issuing government doesn't borrow like a household.

It spends by creating new liabilities and taxes by deleting them.

Bond sales just swap one type of private asset for another.

📎 Kelton (2020)

🧵6/12

When the government sells bonds, it’s not raising money, it's just swapping bank reserves for interest-bearing securities.

All that changes is the form of the private sector's assets, not the government’s ability to spend.

The accounting moves, the capacity doesn't.

🧵7/12

All that changes is the form of the private sector's assets, not the government’s ability to spend.

The accounting moves, the capacity doesn't.

🧵7/12

Inflation gets the same treatment.

It’s still framed as too much money chasing too few goods, ignoring energy, supply chains, administered prices, and global shocks.

Money is blamed because it's the simplest story.

📎 Storm (2022)

🧵8/12

It’s still framed as too much money chasing too few goods, ignoring energy, supply chains, administered prices, and global shocks.

Money is blamed because it's the simplest story.

📎 Storm (2022)

🧵8/12

Why does all this persist?

Because the models came first, and reality was squeezed in later.

It's easier to bolt on frictions than rethink the core assumptions about equilibrium, rational expectations, and loanable funds.

🧵9/12

Because the models came first, and reality was squeezed in later.

It's easier to bolt on frictions than rethink the core assumptions about equilibrium, rational expectations, and loanable funds.

🧵9/12

The reality is simple:

Money is a set of balance-sheet relationships.

Its creation is institutional.

Its effects are distributional.

And the real constraint is resources, not financial assets.

🧵10/12

Money is a set of balance-sheet relationships.

Its creation is institutional.

Its effects are distributional.

And the real constraint is resources, not financial assets.

🧵10/12

Until macro takes money seriously, banks, balance sheets, liquidity, payment systems, instability, it'll keep missing what actually drives modern economies.

📎 Minsky (1986)

🧵11/12

📎 Minsky (1986)

🧵11/12

Economists don't misunderstand money because it's mysterious.

They misunderstand it because their models assume it away.

If you want to understand the real economy, follow the balance sheets, not the textbooks.

🧵12/12

patreon.com/c/relearningec…

They misunderstand it because their models assume it away.

If you want to understand the real economy, follow the balance sheets, not the textbooks.

🧵12/12

patreon.com/c/relearningec…

• • •

Missing some Tweet in this thread? You can try to

force a refresh