Stock–Flow Consistent Formulation of

Kalecki–Young Sectoral Inflation Decomposition (KYSID)

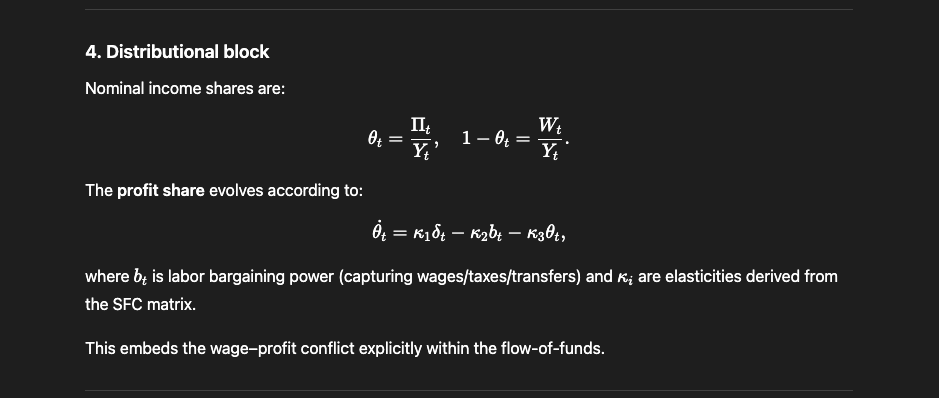

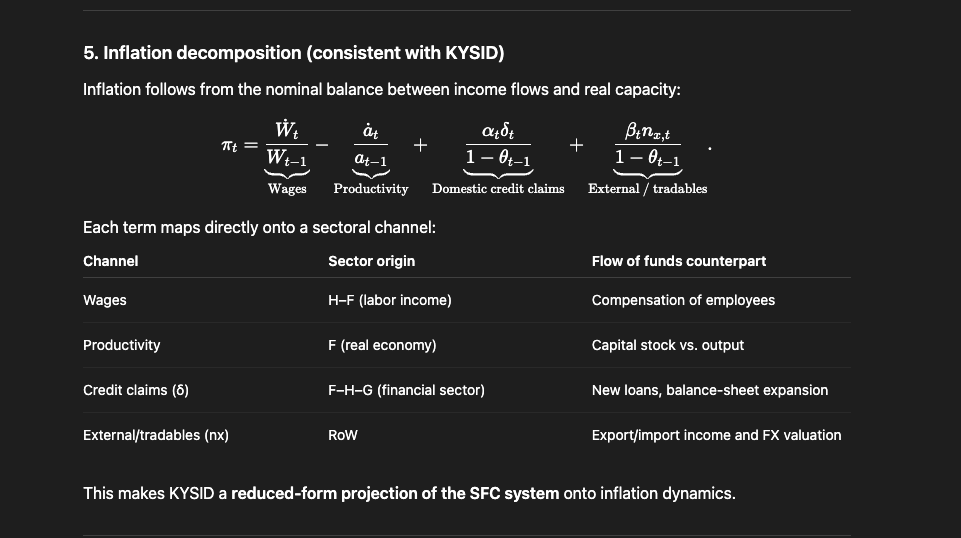

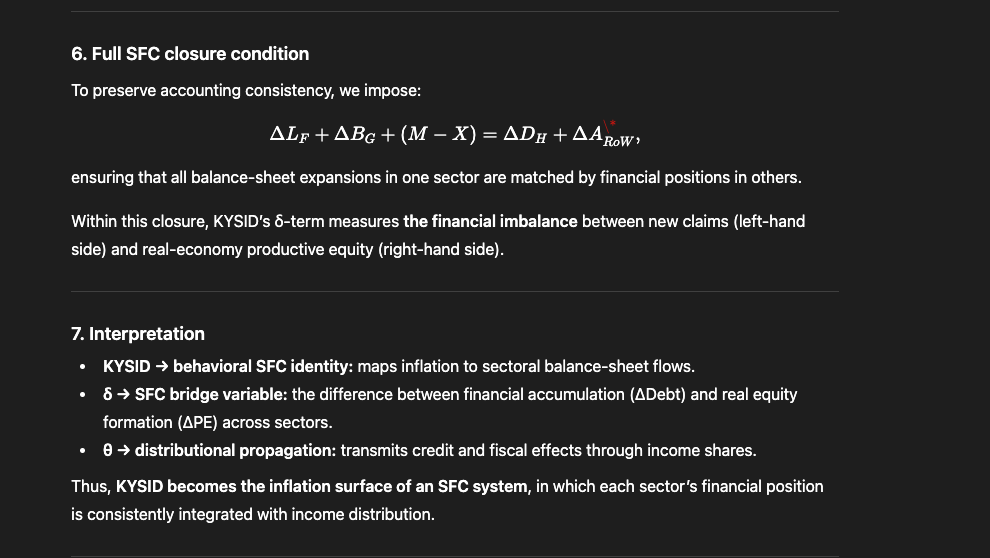

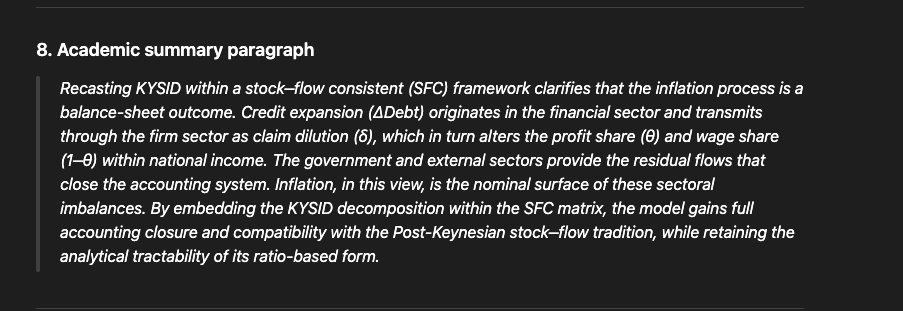

"Recasting KYSID within a stock–flow consistent (SFC) framework clarifies that the inflation process is a balance-sheet outcome."

Kalecki–Young Sectoral Inflation Decomposition (KYSID)

"Recasting KYSID within a stock–flow consistent (SFC) framework clarifies that the inflation process is a balance-sheet outcome."

By embedding the KYSID decomposition within the SFC matrix, the model gains full accounting closure and compatibility with the Post-Keynesian stock–flow tradition, while retaining the analytical tractability of its ratio-based form.

@threadreaderapp

unroll

unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh