He was as smart as Buffett.

He was as skilled as Munger.

But he disappeared from history.

This is the forgotten story of Rick Guerin:

He was as skilled as Munger.

But he disappeared from history.

This is the forgotten story of Rick Guerin:

1. Rick Guerin was Buffett & Munger’s third partner in the 1970s.

Together, they took control of Blue Chip Stamps: an early “loyalty points” business.

They then used the company’s float (cash held between issuing & redeeming stamps) to buy See’s Candies in 1972 for $25M

Together, they took control of Blue Chip Stamps: an early “loyalty points” business.

They then used the company’s float (cash held between issuing & redeeming stamps) to buy See’s Candies in 1972 for $25M

2. Rick wasn’t just a sidekick.

His investment fund, Pacific Partners, delivered an incredible 32.9% annual return (1965–1983).

That’s a 22,200% total return!

He worked on legendary deals like See’s Candies and Blue Chip alongside Buffett & Munger.

His investment fund, Pacific Partners, delivered an incredible 32.9% annual return (1965–1983).

That’s a 22,200% total return!

He worked on legendary deals like See’s Candies and Blue Chip alongside Buffett & Munger.

3. But after these early wins, something changed.

Buffett and Munger became a two-man show.

Rick Guerin quietly faded from the spotlight.

Why?

Buffett and Munger became a two-man show.

Rick Guerin quietly faded from the spotlight.

Why?

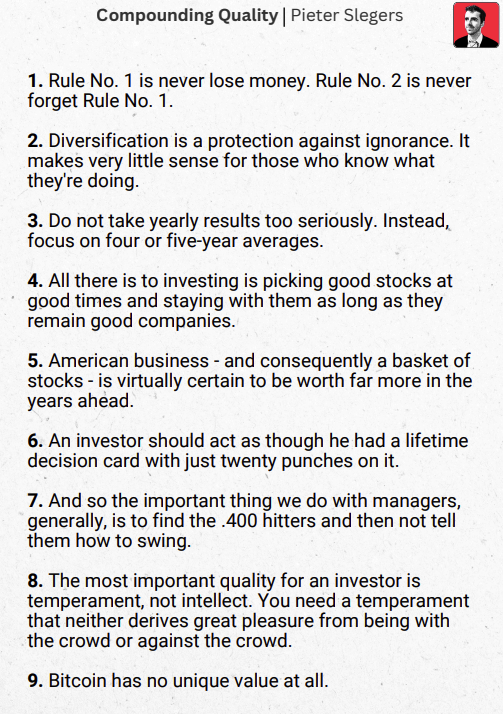

4. “Charlie and I always knew we would become incredibly wealthy.

We were not in a hurry.

Rick was just as smart as us, but he was in a hurry.”

Buffett then explained how leverage destroyed Rick’s position in the 1970s bear market.

We were not in a hurry.

Rick was just as smart as us, but he was in a hurry.”

Buffett then explained how leverage destroyed Rick’s position in the 1970s bear market.

5. In 1973, Rick’s fund dropped −42%.

In 1974, it dropped another −34%.

Because Rick used margin loans, he faced brutal margin calls and was forced to sell assets at the worst possible time.

In 1974, it dropped another −34%.

Because Rick used margin loans, he faced brutal margin calls and was forced to sell assets at the worst possible time.

6. One of those assets? Berkshire Hathaway stock.

Buffett bought Rick’s shares for under $40 each to help him cover the calls.

Today, those shares would be worth $700,000+ each.

This is the cost of leverage when markets crash.

Buffett bought Rick’s shares for under $40 each to help him cover the calls.

Today, those shares would be worth $700,000+ each.

This is the cost of leverage when markets crash.

7. The lesson?

“Even a slightly above-average investor who spends less than they earn, over a lifetime, cannot help but get rich if they are patient.” — Warren Buffett

Rick Guerin was brilliant. But leverage and impatience were his downfall.

“Even a slightly above-average investor who spends less than they earn, over a lifetime, cannot help but get rich if they are patient.” — Warren Buffett

Rick Guerin was brilliant. But leverage and impatience were his downfall.

8. In a world of meme stocks and instant gratification…

👉 Don’t rush wealth.

👉 Don’t gamble with leverage.

👉 Don’t sell when you have to, sell when you want to.

Be patient. Time is your biggest ally.

👉 Don’t rush wealth.

👉 Don’t gamble with leverage.

👉 Don’t sell when you have to, sell when you want to.

Be patient. Time is your biggest ally.

That's it for today. Did you like this?

Here are the top 10 most important lessons from Warren Buffett: compounding-quality.kit.com/9086fac79b

Here are the top 10 most important lessons from Warren Buffett: compounding-quality.kit.com/9086fac79b

• • •

Missing some Tweet in this thread? You can try to

force a refresh