THREAD: Japan Just Broke the Global Money Machine — Here’s What It Means 🧵🌍

1/

Japan’s 10-year bond yield just hit 1.73% — the highest since 2008.

Most people don’t realize it, but this number can shake the entire world economy.

Here’s why. 👇

1/

Japan’s 10-year bond yield just hit 1.73% — the highest since 2008.

Most people don’t realize it, but this number can shake the entire world economy.

Here’s why. 👇

2/

For 30 years, Japan kept interest rates at 0% and printed money endlessly.

That cheap money was exported everywhere:

• US Treasuries

• European bonds

• Emerging markets

• Global stock markets

Japan was the world’s “silent buyer.”

For 30 years, Japan kept interest rates at 0% and printed money endlessly.

That cheap money was exported everywhere:

• US Treasuries

• European bonds

• Emerging markets

• Global stock markets

Japan was the world’s “silent buyer.”

3/

Now that Japanese yields are rising, everything changes.

When yields go up, Japanese investors stop buying foreign debt and start pulling money back home.

This is already happening.

Now that Japanese yields are rising, everything changes.

When yields go up, Japanese investors stop buying foreign debt and start pulling money back home.

This is already happening.

4/

Japan is the largest foreign holder of US Treasuries.

If they stop buying — or start selling — US interest rates must go UP to attract new buyers.

Higher US rates =

• higher mortgages

• higher corporate borrowing

• more defaults

• lower stock valuations

Japan is the largest foreign holder of US Treasuries.

If they stop buying — or start selling — US interest rates must go UP to attract new buyers.

Higher US rates =

• higher mortgages

• higher corporate borrowing

• more defaults

• lower stock valuations

5/

Europe is even more exposed.

Japan buys huge amounts of:

• French debt

• Italian debt

• Spanish debt

If that money leaves, Europe faces a new debt crisis — with France likely being the first domino.

Europe is even more exposed.

Japan buys huge amounts of:

• French debt

• Italian debt

• Spanish debt

If that money leaves, Europe faces a new debt crisis — with France likely being the first domino.

6/

Then there’s the yen carry trade.

For years, investors borrowed cheap yen (0%) and used it to buy:

• crypto

• tech stocks

• emerging markets

• risky bonds

Now yields are rising — and these trades unwind.

That means selling pressure everywhere.

Then there’s the yen carry trade.

For years, investors borrowed cheap yen (0%) and used it to buy:

• crypto

• tech stocks

• emerging markets

• risky bonds

Now yields are rising — and these trades unwind.

That means selling pressure everywhere.

7/

Put simply:

➡️ Japan was the global money printer

➡️ Now they are turning the printer OFF

➡️ Liquidity is leaving the world economy

➡️ Interest rates will stay higher for longer

This is a global tightening nobody is prepared for.

Put simply:

➡️ Japan was the global money printer

➡️ Now they are turning the printer OFF

➡️ Liquidity is leaving the world economy

➡️ Interest rates will stay higher for longer

This is a global tightening nobody is prepared for.

8/

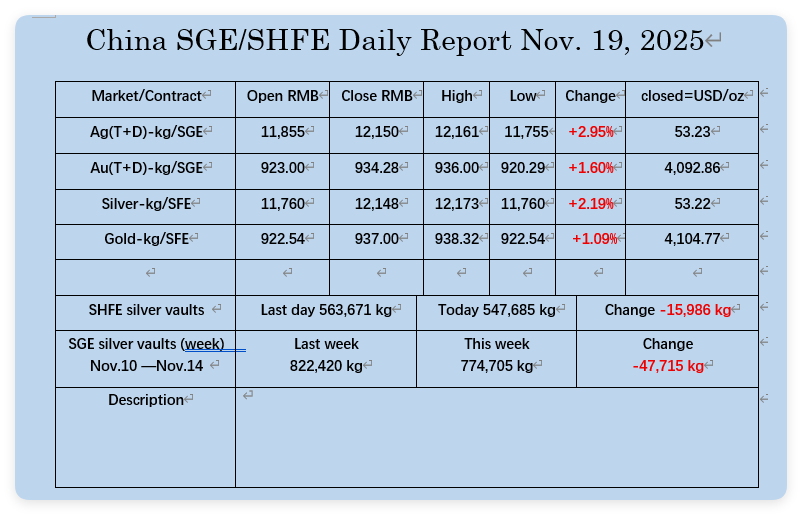

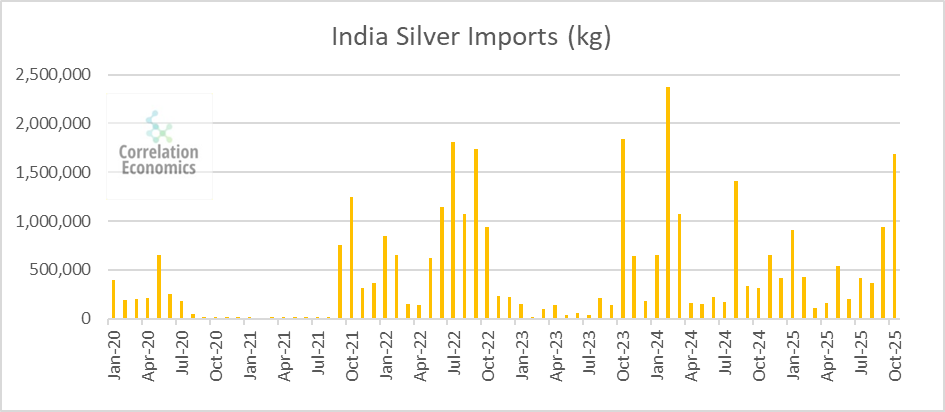

What benefits from this?

Hard assets.

Gold, silver, commodities, energy — anything real.

Why?

Because when debt gets expensive and money stops flowing freely, capital returns to tangible stores of value.

What benefits from this?

Hard assets.

Gold, silver, commodities, energy — anything real.

Why?

Because when debt gets expensive and money stops flowing freely, capital returns to tangible stores of value.

9/

Japan didn’t just move rates.

They changed the direction of global liquidity.

The world’s biggest piggy bank is closing — and the money is flowing backwards.

Expect:

• higher rates

• more volatility

• weaker currencies

• stress in Europe

• pressure on stocks

• stronger precious metals

Japan didn’t just move rates.

They changed the direction of global liquidity.

The world’s biggest piggy bank is closing — and the money is flowing backwards.

Expect:

• higher rates

• more volatility

• weaker currencies

• stress in Europe

• pressure on stocks

• stronger precious metals

10/

You don’t need to be a macro expert to understand this:

When the biggest buyer of global debt steps away…

the rest of the market has to pay the price.

Stay alert. The next months will be volatile.

#Japan #BOJ #Bonds #GlobalMarkets #LiquidityCrisis #USD #Silver #Gold #Commodities

You don’t need to be a macro expert to understand this:

When the biggest buyer of global debt steps away…

the rest of the market has to pay the price.

Stay alert. The next months will be volatile.

#Japan #BOJ #Bonds #GlobalMarkets #LiquidityCrisis #USD #Silver #Gold #Commodities

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh