Crypto market has wiped out $1.1 trillion since October 6th.

Prices are falling almost every day.

There’s no real rebound.

So what’s actually happening behind this entire move?

Let’s break it down properly. 🧵👇

Prices are falling almost every day.

There’s no real rebound.

So what’s actually happening behind this entire move?

Let’s break it down properly. 🧵👇

The first and biggest issue is liquidity.

The October 10th dump completely damaged liquidity across the market, especially in altcoins.

Many alts dropped 70 - 80%, wiping out investor confidence and removing liquidity from the order books.

When confidence is gone + liquidity is gone → markets become extremely easy to move.

The October 10th dump completely damaged liquidity across the market, especially in altcoins.

Many alts dropped 70 - 80%, wiping out investor confidence and removing liquidity from the order books.

When confidence is gone + liquidity is gone → markets become extremely easy to move.

After that dump, liquidity never recovered.

The orderbooks of BTC, ETH, and alts became very thin.

So even a small amount of selling can push prices down very fast.

This is exactly what we’re seeing right now, the moves look bigger than the actual sell volume.

The orderbooks of BTC, ETH, and alts became very thin.

So even a small amount of selling can push prices down very fast.

This is exactly what we’re seeing right now, the moves look bigger than the actual sell volume.

The second major point came from a statement by Tom Lee:

He mentioned that this entire correction might be coming from 1–2 large market makers who are facing big losses on their balance sheets.

If a market maker is in trouble → they exit positions aggressively → and the selling becomes very structured.

He mentioned that this entire correction might be coming from 1–2 large market makers who are facing big losses on their balance sheets.

If a market maker is in trouble → they exit positions aggressively → and the selling becomes very structured.

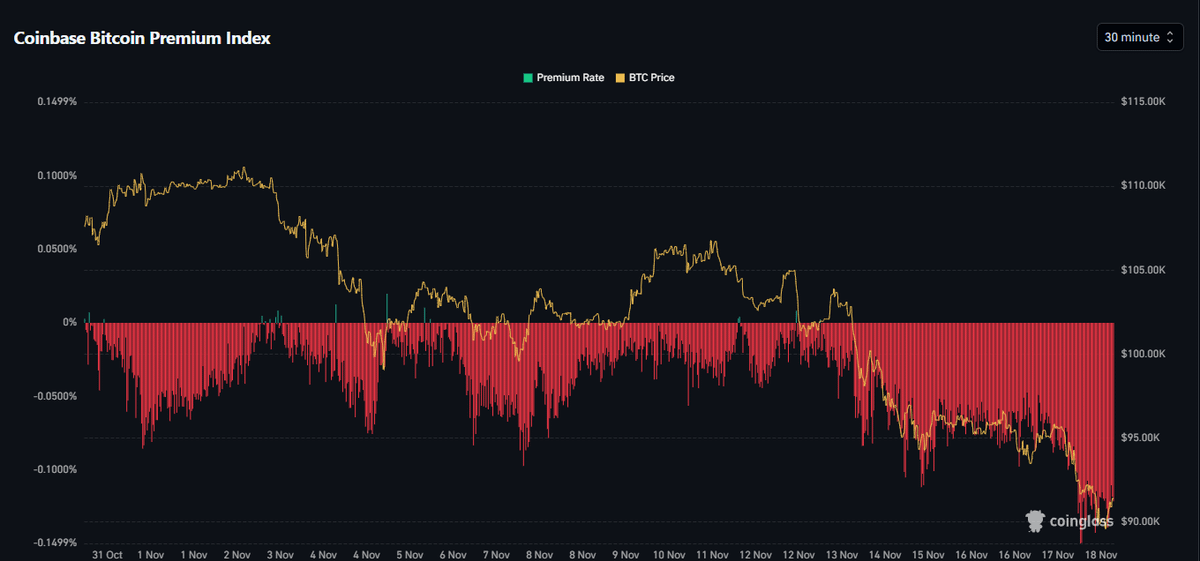

You can literally see this on the charts.

On one 15-minute BTC chart, 12–14 red candles came back-to-back.

This kind of clean, consistent selling does not come from retail.

This happens when a big entity unwinds positions in an organized way.

This is why the move looked controlled, not emotional.

On one 15-minute BTC chart, 12–14 red candles came back-to-back.

This kind of clean, consistent selling does not come from retail.

This happens when a big entity unwinds positions in an organized way.

This is why the move looked controlled, not emotional.

The third reason is excessive leverage.

Even after the massive liquidation on October 10th, the largest leverage wipeout in crypto history.

Traders came back and started adding even more leverage.

It’s the "I will make it all back" mentality.

Even after the massive liquidation on October 10th, the largest leverage wipeout in crypto history.

Traders came back and started adding even more leverage.

It’s the "I will make it all back" mentality.

If you check BTC open interest in BTC terms, not USD, it has almost climbed back to October 10th levels.

This means leverage is rebuilding again even though traders just got wiped.

This is the worst possible time to over leverage because liquidity is thin.

This means leverage is rebuilding again even though traders just got wiped.

This is the worst possible time to over leverage because liquidity is thin.

With thin liquidity + high leverage →

Market makers can liquidate positions very easily.

They need very little BTC to push the price down and activate thousands of liquidation levels.

That's why dumps look fast and painful.

Market makers can liquidate positions very easily.

They need very little BTC to push the price down and activate thousands of liquidation levels.

That's why dumps look fast and painful.

The fourth reason is FUD.

Right now, the market is filled with panic stories, especially around MicroStrategy.

People are spreading claims like:

"If BTC goes below $74K, MicroStrategy will be forced to sell."

This is simply false.

Right now, the market is filled with panic stories, especially around MicroStrategy.

People are spreading claims like:

"If BTC goes below $74K, MicroStrategy will be forced to sell."

This is simply false.

In 2020–2021 cycle, MicroStrategy’s cost basis was around $30K–$32K.

BTC went to $16K, almost 50% below their cost.

They still didn’t sell a single coin.

Because MicroStrategy doesn’t borrow against BTC to buy BTC.

So they don’t get forced into liquidations like people think.

BTC went to $16K, almost 50% below their cost.

They still didn’t sell a single coin.

Because MicroStrategy doesn’t borrow against BTC to buy BTC.

So they don’t get forced into liquidations like people think.

They would only consider selling if BTC stays below 50–60K for 3 - 4 years, which is extremely unlikely.

Current FUD is baseless, but it is creating panic selling across the market.

Retail is reacting emotionally, market makers are taking advantage.

Current FUD is baseless, but it is creating panic selling across the market.

Retail is reacting emotionally, market makers are taking advantage.

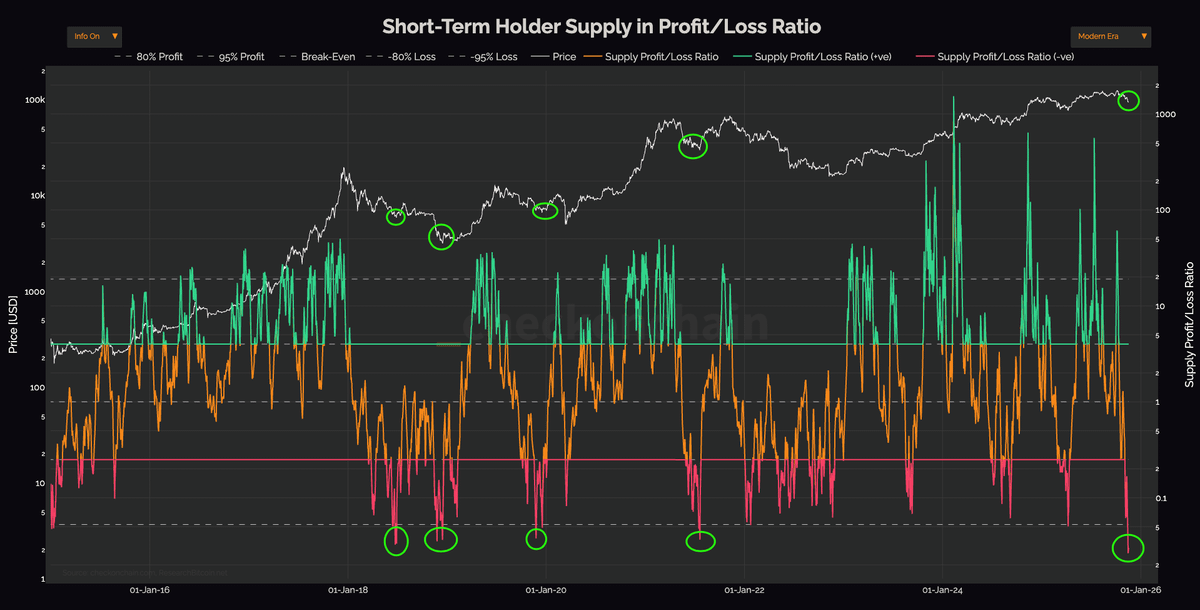

Fear is at extremes.

The Fear Index is at 10,

which is the lowest level in the last 3.5 years.

This only happens in two situations:

• When the market has bottomed

• Or when the bottom is very close

Historically, these fear levels do not stay for long.

The Fear Index is at 10,

which is the lowest level in the last 3.5 years.

This only happens in two situations:

• When the market has bottomed

• Or when the bottom is very close

Historically, these fear levels do not stay for long.

Look at the weekly RSI of BTC.

It is now equal to January 2023,

when BTC was trading around 20,000.

The market is extremely stretched on the downside.

It is now equal to January 2023,

when BTC was trading around 20,000.

The market is extremely stretched on the downside.

In altcoins, the situation is even worse.

Speculation is dead.

Retail is avoiding most altcoins.

Capitulation behaviour is everywhere.

People are scared to even touch coins that were hyped a few weeks ago.

This is exactly what happens near market bottoms.

Speculation is dead.

Retail is avoiding most altcoins.

Capitulation behaviour is everywhere.

People are scared to even touch coins that were hyped a few weeks ago.

This is exactly what happens near market bottoms.

Another behaviour we are starting to see:

Traders are shorting every single bounce.

Even strong bulls who bought dips earlier are now shorting because they lost confidence.

When everyone assumes BTC will only go down →

the market usually surprises in the opposite direction.

Traders are shorting every single bounce.

Even strong bulls who bought dips earlier are now shorting because they lost confidence.

When everyone assumes BTC will only go down →

the market usually surprises in the opposite direction.

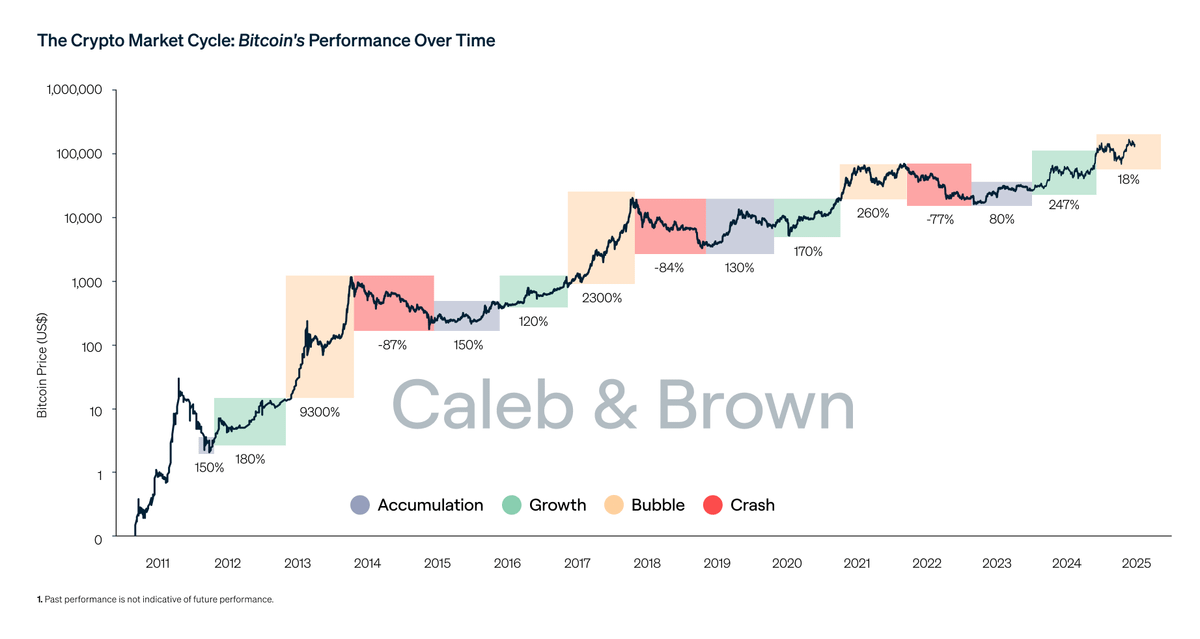

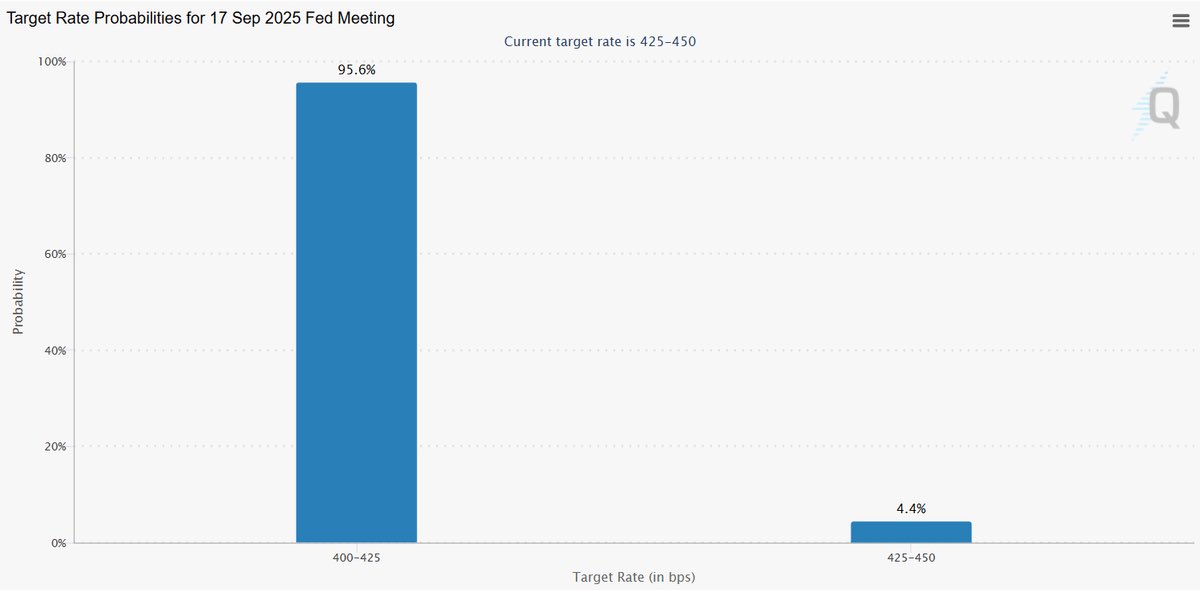

If you look deeper, nothing fundamental has changed.

• Bitcoin network is strong and hashrate is rising

• Institutions are still entering

• U.S. government is openly supporting regulated crypto

• Major ETFs are functioning normally

• Macro liquidity is getting better

The entire crash has been liquidity + leverage + panic, not fundamentals.

• Bitcoin network is strong and hashrate is rising

• Institutions are still entering

• U.S. government is openly supporting regulated crypto

• Major ETFs are functioning normally

• Macro liquidity is getting better

The entire crash has been liquidity + leverage + panic, not fundamentals.

So what does all this mean?

The early part of this dump was structured selling from big players.

Now the late part of this dump is panic selling from retail.

When markets move from structured selling → to emotional selling →

it usually signals the final stage of a downtrend.

The early part of this dump was structured selling from big players.

Now the late part of this dump is panic selling from retail.

When markets move from structured selling → to emotional selling →

it usually signals the final stage of a downtrend.

We’re now in a phase where:

• Fear is extreme

• Everyone expects lower prices

• Leverage is crowded on the short side

• Fundamentals are unchanged

• Panic is driving behaviour

This is the exact environment in which reversals begin.

• Fear is extreme

• Everyone expects lower prices

• Leverage is crowded on the short side

• Fundamentals are unchanged

• Panic is driving behaviour

This is the exact environment in which reversals begin.

This does NOT mean BTC will bounce tomorrow.

Bottoms take time.

But based on liquidity, leverage, RSI, fear, and market structure,

the market is much closer to the end of this correction than the beginning.

Bottoms take time.

But based on liquidity, leverage, RSI, fear, and market structure,

the market is much closer to the end of this correction than the beginning.

To wrap it up:

• Liquidity broke on Oct 10

• Big players possibly exited

• Leverage rebuilt fast

• Market makers are hunting liquidations

• FUD created unnecessary panic

• Fear index hit cycle lows

• RSI hit January 2023 levels

• Altcoin sentiment is at rock-bottom

• Fundamentals remain intact

This combination usually appears near a bottom.

• Liquidity broke on Oct 10

• Big players possibly exited

• Leverage rebuilt fast

• Market makers are hunting liquidations

• FUD created unnecessary panic

• Fear index hit cycle lows

• RSI hit January 2023 levels

• Altcoin sentiment is at rock-bottom

• Fundamentals remain intact

This combination usually appears near a bottom.

• • •

Missing some Tweet in this thread? You can try to

force a refresh