🧵 Thread: The Silver Tug-of-War Nobody Is Ready For

1️⃣

Japan just detonated a global bomb.

A 2.75% yield on the 20-year JGB is a signal:

the world’s cheap-money era is OVER.

Liquidity is tightening everywhere — and the margin calls are just starting.

Prepare yourselves

1️⃣

Japan just detonated a global bomb.

A 2.75% yield on the 20-year JGB is a signal:

the world’s cheap-money era is OVER.

Liquidity is tightening everywhere — and the margin calls are just starting.

Prepare yourselves

2️⃣

So let’s talk #SILVER.

Because what’s coming is a brutal tug-of-war between:

paper manipulation

vs.

real-world physical fundamentals

…and the ending will not be a draw.

So let’s talk #SILVER.

Because what’s coming is a brutal tug-of-war between:

paper manipulation

vs.

real-world physical fundamentals

…and the ending will not be a draw.

3️⃣

On the paper side?

blatant price suppression

leveraged futures

forced selling during liquidity stress

margin calls hitting funds and banks across the board

This can temporarily push the price down, even when demand is exploding.

On the paper side?

blatant price suppression

leveraged futures

forced selling during liquidity stress

margin calls hitting funds and banks across the board

This can temporarily push the price down, even when demand is exploding.

4️⃣

But physical reality does not care about paper games.

And the fundamentals now are the strongest I’ve ever seen👇

But physical reality does not care about paper games.

And the fundamentals now are the strongest I’ve ever seen👇

5️⃣ LBMA vaults are draining

London has the lowest accessible silver stocks in modern records.

ETFs are borrowing metal they don’t have.

The “available float” is evaporating.

London has the lowest accessible silver stocks in modern records.

ETFs are borrowing metal they don’t have.

The “available float” is evaporating.

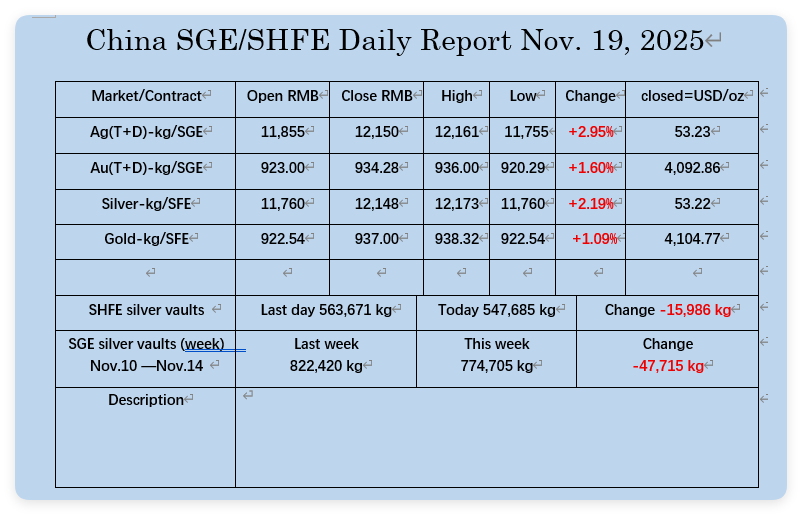

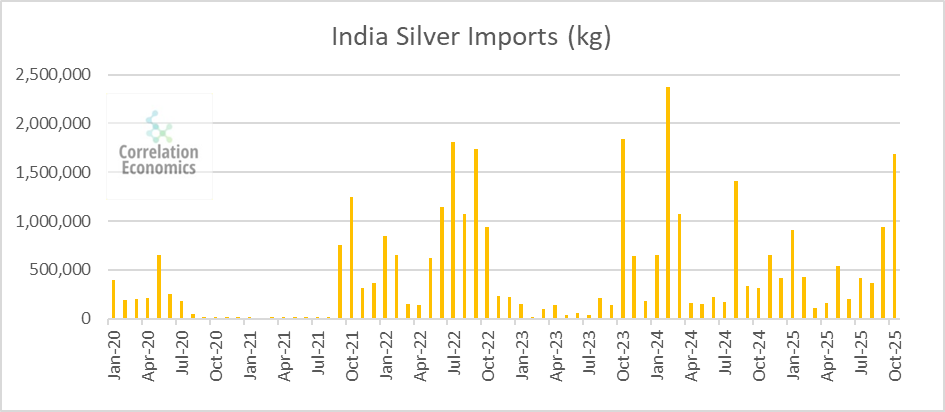

6️⃣ China is vacuuming the world

Shanghai inventories are collapsing.

Premiums are higher than in London.

Industrial demand is relentless.

Imports are surging.

This is structural — not speculative.

Shanghai inventories are collapsing.

Premiums are higher than in London.

Industrial demand is relentless.

Imports are surging.

This is structural — not speculative.

7️⃣

So what happens next?

You get a rope-pulling phase:

paper pushes down

physical pulls up

Both sides strain…

until one of them snaps.

So what happens next?

You get a rope-pulling phase:

paper pushes down

physical pulls up

Both sides strain…

until one of them snaps.

8️⃣

Paper can win for a while.

But physics always wins.

You cannot print metal.

You cannot “QE” an ounce of silver into existence.

You cannot satisfy industrial demand with futures contracts.

Paper can win for a while.

But physics always wins.

You cannot print metal.

You cannot “QE” an ounce of silver into existence.

You cannot satisfy industrial demand with futures contracts.

9️⃣

And once one COMEX player fails to deliver…

or once inventories hit the true red zone…

or once QE returns to rescue dollar liquidity…

the paper side folds instantly.

That’s when you get the vertical candle everyone pretends to be “surprised” by.

And once one COMEX player fails to deliver…

or once inventories hit the true red zone…

or once QE returns to rescue dollar liquidity…

the paper side folds instantly.

That’s when you get the vertical candle everyone pretends to be “surprised” by.

🔟

And this is JUST the silver story.

I’m not even mentioning:

the ticking AI bubble

tech margins under stress

credit spreads widening

global dollar shortages

the bond-market detonator Japan just activated

All of that only accelerates what’s coming.

And this is JUST the silver story.

I’m not even mentioning:

the ticking AI bubble

tech margins under stress

credit spreads widening

global dollar shortages

the bond-market detonator Japan just activated

All of that only accelerates what’s coming.

1️⃣1️⃣ Conclusion

We’re in the final phase of the illusion:

where paper still “sets the price”, but physical controls the outcome.

A short-term tug-of-war.

A long-term inevitability.

When the snap happens…

it will be too late to reposition.

🥈 Hold your own keys.

🥈 Hold your own metal.

🥈 And stay patient — the math is on our side.

We’re in the final phase of the illusion:

where paper still “sets the price”, but physical controls the outcome.

A short-term tug-of-war.

A long-term inevitability.

When the snap happens…

it will be too late to reposition.

🥈 Hold your own keys.

🥈 Hold your own metal.

🥈 And stay patient — the math is on our side.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh