🚨 HUGE: The court just dismissed the FTC's case against Meta (related to Instagram/WhatsApp)🚨

It is mostly a market definition decision (boring), but the Judge looked to do a good job on the economics behind market definition.

Let's go through it 🧵

It is mostly a market definition decision (boring), but the Judge looked to do a good job on the economics behind market definition.

Let's go through it 🧵

The vibe is set in line 1: Heraclitus and never stepping in the same rivier twice.

Whatever you think of the initial decisions to not block acquiring WhatsApp, we're dealing with the world as it exists today.

Social networking overlaps with social media today.

Whatever you think of the initial decisions to not block acquiring WhatsApp, we're dealing with the world as it exists today.

Social networking overlaps with social media today.

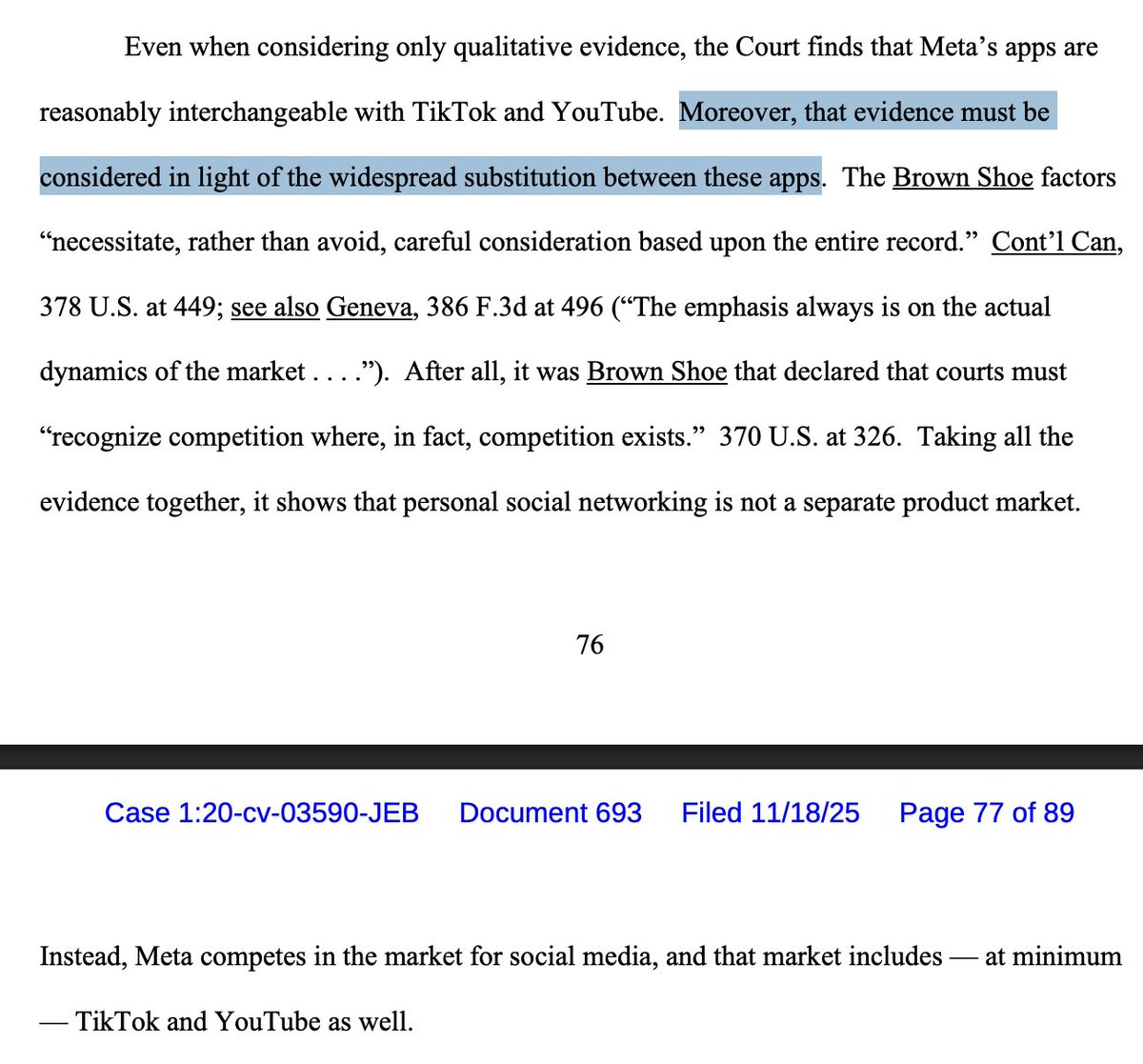

FTC tried to define a "personal social networking" market that excluded TikTok because it's about entertainment, not friends.

Judge rightly wasn't buying it.

To define markets today, you need to look at how consumers behave TODAY

Judge rightly wasn't buying it.

To define markets today, you need to look at how consumers behave TODAY

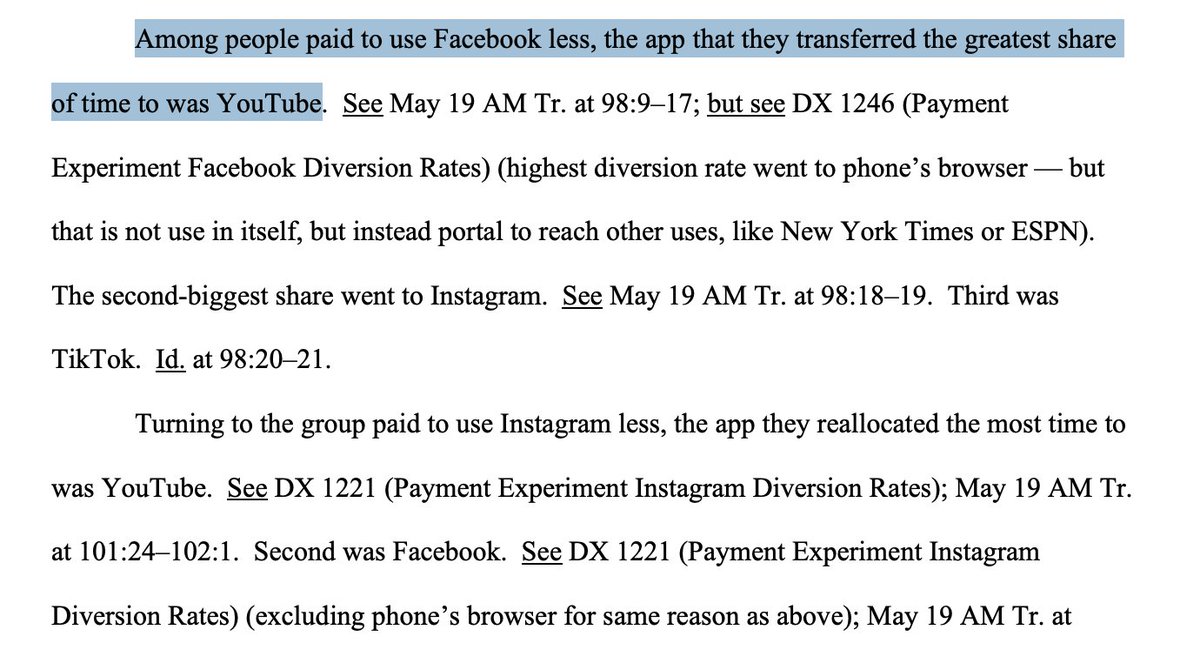

And there's lots of evidence consumers readily switch between Facebook and, say, YouTube.

We see this in two ways. @Econ_4_Everyone ran an experiment that paid people not to use Facebook. Where did they go? YouTube

We see this in two ways. @Econ_4_Everyone ran an experiment that paid people not to use Facebook. Where did they go? YouTube

@Econ_4_Everyone When Facebook and Instagram went down in 2021, where did users go? TikTok, then YouTube.

Much more than went to Snapchat, supposedly the only real competitor for Meta's products

Much more than went to Snapchat, supposedly the only real competitor for Meta's products

@Econ_4_Everyone It's good that courts require real evidence of substitution, not just stories about product features.

But it's also frustrating that so much hinges on these market definition games. I don't think the FTC had a good case if it had included TikTok and YouTube

But it's also frustrating that so much hinges on these market definition games. I don't think the FTC had a good case if it had included TikTok and YouTube

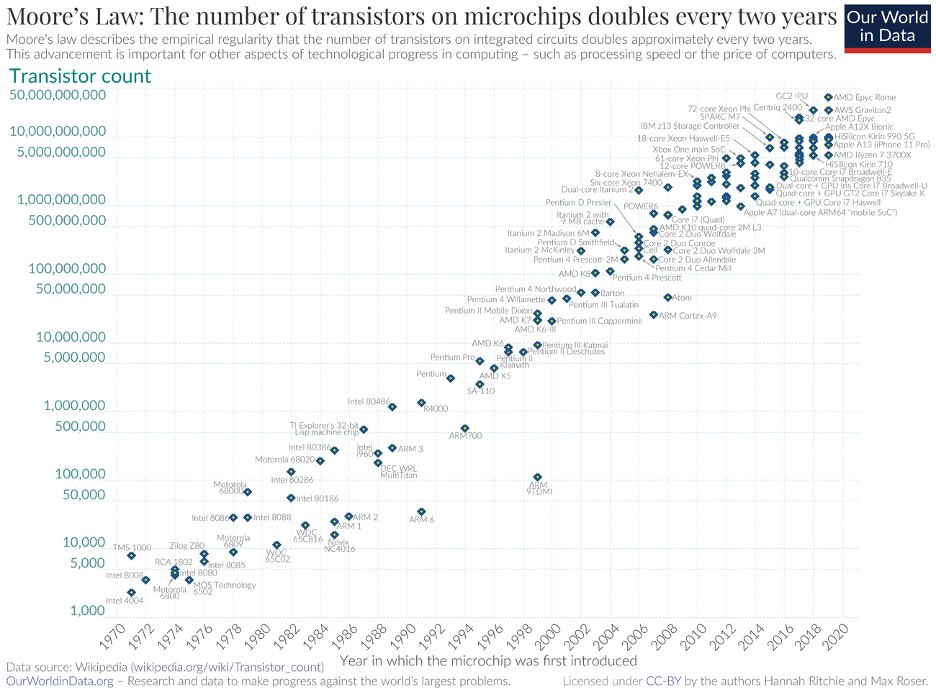

@Econ_4_Everyone There's interesting stuff on prices. What do you do when prices aren't normal prices?

They look at quality-adjusted prices. Basically, did quality improve? If it did, that's some evidence against Meta having monopoly power.

"All evidence points toward [features improving]."

They look at quality-adjusted prices. Basically, did quality improve? If it did, that's some evidence against Meta having monopoly power.

"All evidence points toward [features improving]."

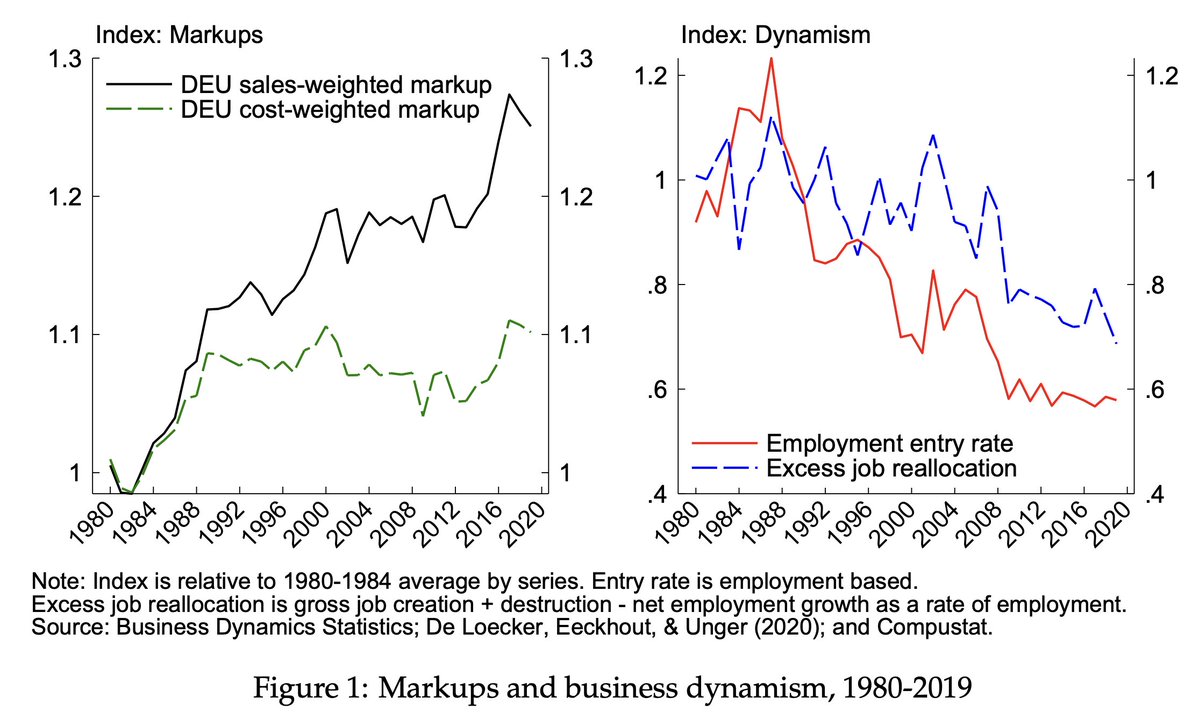

@Econ_4_Everyone The court's point about high profits was standard but worth noting:

High margins don't prove monopoly. Could be efficiency, good management, or lucky bets.

We've heard this before, but judges keep having to repeat it.

High margins don't prove monopoly. Could be efficiency, good management, or lucky bets.

We've heard this before, but judges keep having to repeat it.

@Econ_4_Everyone A few years back, @AuerDirk, @ericfruits, and @geoffmanne wrote a paper on "Doomsday Mergers" and Facebook-Instagram was one of our examples.

Basically, people are freaking out but competition is fine. The Judge agreed with us. laweconcenter.org/resources/doom…

Basically, people are freaking out but competition is fine. The Judge agreed with us. laweconcenter.org/resources/doom…

@Econ_4_Everyone @AuerDirk @ericfruits @geoffmanne This caught my eye as well. There was a lot of pre-judging in this case. The Judge say that

https://x.com/BenRemaly/status/1990861343231258978?s=20

@Econ_4_Everyone @AuerDirk @ericfruits @geoffmanne Speaking of pre-judging, this is full circle for Lina Khan's fight against Meta.

Her tenure started with a loss against Meta/Within.

In that case, she brought it, against the staff's recommendation (and didn't recuse herself for prejudgin)

thedispatch.com/article/the-ft…

Her tenure started with a loss against Meta/Within.

In that case, she brought it, against the staff's recommendation (and didn't recuse herself for prejudgin)

thedispatch.com/article/the-ft…

TBF, it's not just Khan's FTC. The current one has some reactions to the loss...

https://x.com/BenRemaly/status/1990869990791393761?s=20

I can't help but think back to @geoffmanne and @corbinkbarthold's discussion of this case

There was a lot of laughing about the market definition. And that basically was right!

podcasts.apple.com/us/podcast/384…

There was a lot of laughing about the market definition. And that basically was right!

podcasts.apple.com/us/podcast/384…

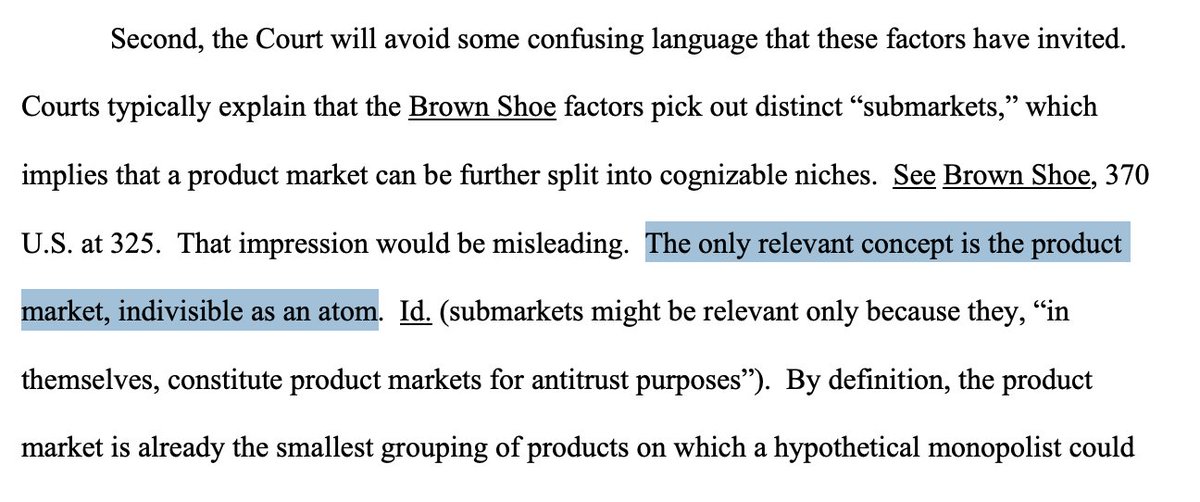

While I hate a market definition case, there are some bright spots. It wasn't about the qualitative features that

"the touchstone of market definition remains how consumers would respond to a price increase"

"the touchstone of market definition remains how consumers would respond to a price increase"

Let me clarify what I mean about not liking a market definition decision.

I don't think 90% or 50% or 30% tells us whether consumers would be better off if we split of Instagram. I don't think they would, but its not about market share

I don't think 90% or 50% or 30% tells us whether consumers would be better off if we split of Instagram. I don't think they would, but its not about market share

https://x.com/varma_ashwin97/status/1990875481592238167?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh