Selling Bitcoin right here is a tragic error. The case for selling is based upon:

1. breaking 50 DMA and potential death cross

2. potential further draw downs

3. FUD surrounding quantum computing hack risk

I will address all three. A thread.

@PrestonPysh @LukeGromen @dotkrueger

1. breaking 50 DMA and potential death cross

2. potential further draw downs

3. FUD surrounding quantum computing hack risk

I will address all three. A thread.

@PrestonPysh @LukeGromen @dotkrueger

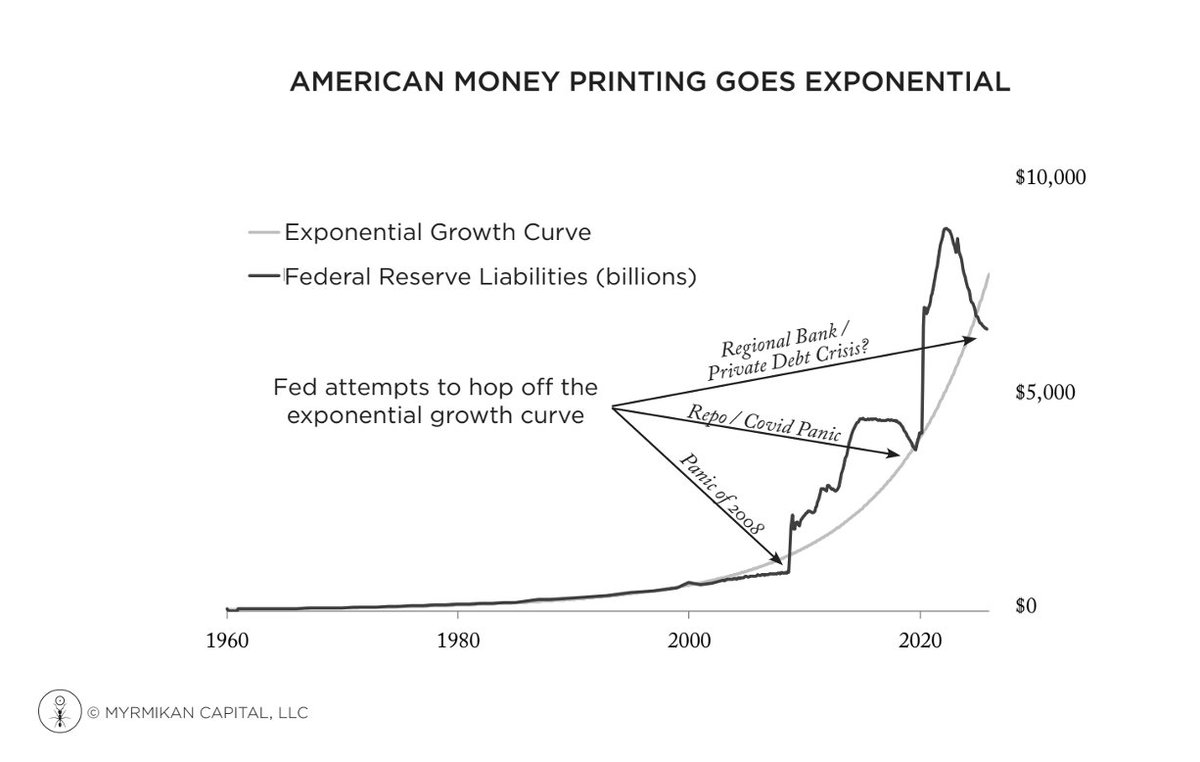

Bitcoin is the most asymmetric upside bet based upon the high probability of monetary debasement on the planet. We are very close to the point at which that debasement begins again. (The Big Print) that can be clearly seen in the following chart by Dan Oliver of Myrmikan Capital. As the following chart shows every time the Fed has tried to jump off the exponential monetary growth curve they have been forced into printing. We are there folks.

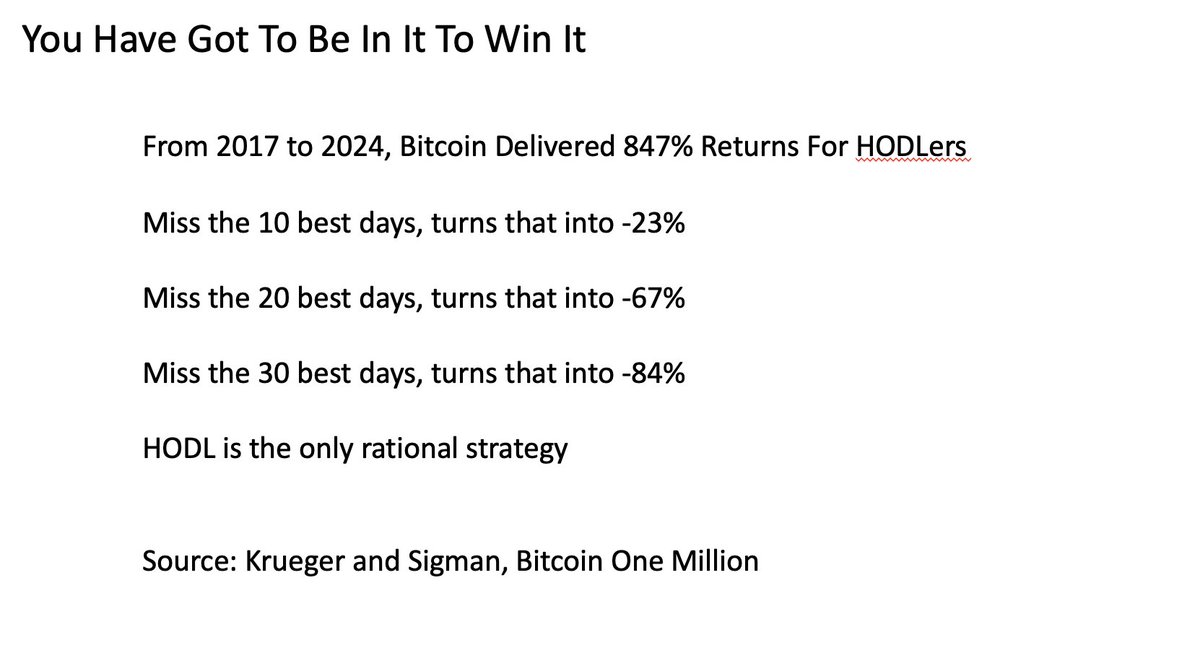

The return profile on Bitcoin is wildly asymmetric and happens quickly and on a few days. If you miss the key days you miss the upside. As Fred and Ben point out.

Bitcoin routinely has "God Candles". Pre 2017 they were often 10-25% daily moves in the price. As recently as 2021 there was a 19% one day god candle. In 2024 there was a 10% one day god candle. Sometimes these candles come in succession. So you sell today at $84k and have 2 rapid succession 10% god candles and you are looking at buying back at $101k, will you do it?

The FUD on Quantum is way over done in my opinion. It is years away, and there are solutions. This article does a nice job on that topic.

ten31.xyz/insights/quant…

ten31.xyz/insights/quant…

In my opinion the easy trade to day is to sell gold miners which are up 125% YTD and use the proceeds to buy Bitcoin and MSTR, and that is what I am doing.

@Myrmikan

• • •

Missing some Tweet in this thread? You can try to

force a refresh