Buying a home is one of the biggest decisions of your life.

The Loan that comes with it can feel long and expensive.

What if I tell you, a handy little trick to make a home loan INTEREST FREE?!

This simple 0.2% SIP can literally neutralise the entire interest cost.

A 🧵

The Loan that comes with it can feel long and expensive.

What if I tell you, a handy little trick to make a home loan INTEREST FREE?!

This simple 0.2% SIP can literally neutralise the entire interest cost.

A 🧵

Suppose you take a home loan of ₹50 lakhs for 20 years.

Interest rate = 9%

EMI = ₹44,986

This is the fixed amount you will pay each month for the next 20 years.

₹44,986 × 12 × 20 years = ₹1.08 crore.

This means you will repay more than double the amount you borrowed.

Interest rate = 9%

EMI = ₹44,986

This is the fixed amount you will pay each month for the next 20 years.

₹44,986 × 12 × 20 years = ₹1.08 crore.

This means you will repay more than double the amount you borrowed.

Of this ₹1.08 crore, your principal amount is only ₹50 lakhs.

The remaining ₹58 lakhs is the interest cost.

As you can see, the interest cost alone is bigger than the entire home loan.

Here’s how to offset this interest by investing smartly alongside your EMIs 👇

The remaining ₹58 lakhs is the interest cost.

As you can see, the interest cost alone is bigger than the entire home loan.

Here’s how to offset this interest by investing smartly alongside your EMIs 👇

The idea is simple.

When you begin your home loan EMIs, start a small SIP at the same time.

The SIP amount should be roughly 0.16% of your loan amount.

For a ₹50 lakh loan, this works out to ₹8,000 per month.

This SIP should continue for the same 20-year period as your loan.

When you begin your home loan EMIs, start a small SIP at the same time.

The SIP amount should be roughly 0.16% of your loan amount.

For a ₹50 lakh loan, this works out to ₹8,000 per month.

This SIP should continue for the same 20-year period as your loan.

Now, let compounding do the heavy lifting.

We have assumed that the SIP earns 12% per annum, a reasonable long-term equity return.

At this rate, the ₹8,000 per month grows to around ₹79 lakhs in 20 years!

We have assumed that the SIP earns 12% per annum, a reasonable long-term equity return.

At this rate, the ₹8,000 per month grows to around ₹79 lakhs in 20 years!

Over 20 years, your total SIP investment comes to ₹19 lakhs.

Subtract this from the final corpus of ₹79 lakhs and you are still left with a gain of ₹60 lakhs.

That’s more than your total interest cost of ₹58 lakhs.

You’ve effectively neutralised the interest on your home loan.

Subtract this from the final corpus of ₹79 lakhs and you are still left with a gain of ₹60 lakhs.

That’s more than your total interest cost of ₹58 lakhs.

You’ve effectively neutralised the interest on your home loan.

You still repay the EMIs as usual.

But through the SIP, you earn back more than the interest you pay.

This is what makes your home loan “interest free”.

Not because the bank forgives the interest, but because your investments grow enough to offset it completely.

But through the SIP, you earn back more than the interest you pay.

This is what makes your home loan “interest free”.

Not because the bank forgives the interest, but because your investments grow enough to offset it completely.

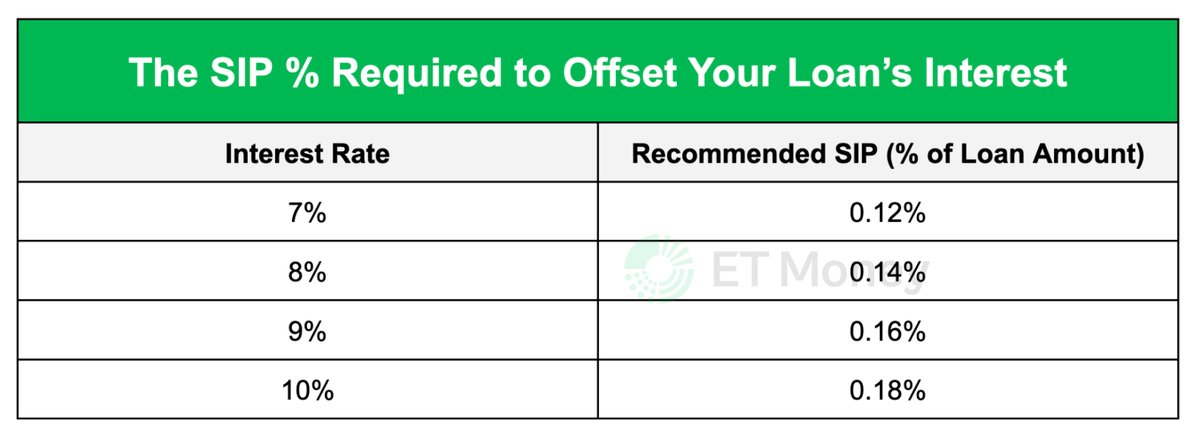

This rule is applicable on ANY loan amount.

However, there’s ONE point to keep in mind.

The SIP percentage is linked to your loan’s interest rate.

If your interest rate shifts by 1%, the SIP shifts by 0.02 percentage points 👇

However, there’s ONE point to keep in mind.

The SIP percentage is linked to your loan’s interest rate.

If your interest rate shifts by 1%, the SIP shifts by 0.02 percentage points 👇

At an interest rate of 9%, the SIP needed is 0.16% of the loan amount.

If the rates drop to 8%, reduce it to 0.14%.

If the rates rise to 10%, increase it to 0.18%.

If the rates drop to 8%, reduce it to 0.14%.

If the rates rise to 10%, increase it to 0.18%.

If you find this useful, show some love. ❤️

Please like, share, and retweet the first tweet.

Please like, share, and retweet the first tweet.

https://x.com/ETMONEY/status/1992612171264725225?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh