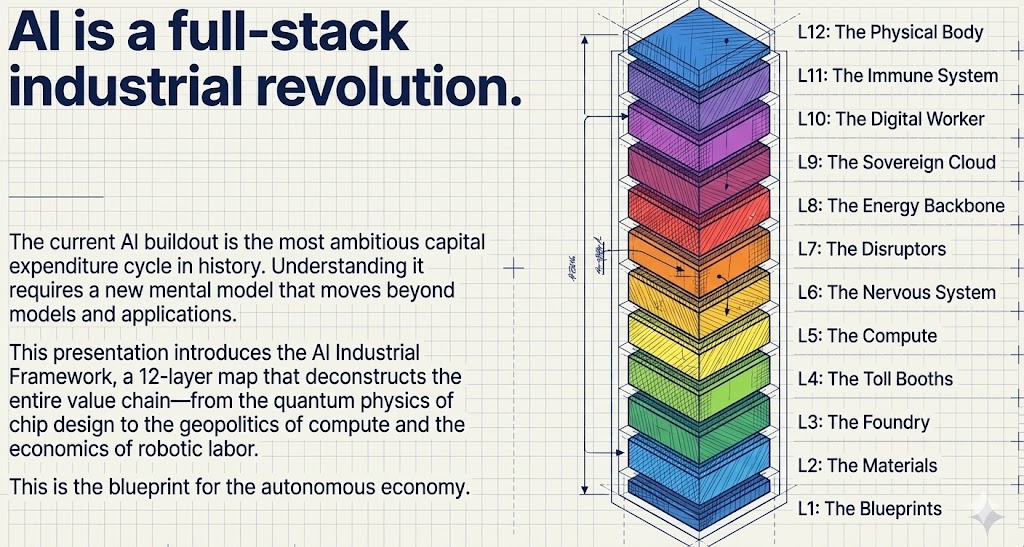

If you want to invest in AI with clarity, you need to see the entire system end to end

$POET $NVDA $GOOG $GFS $AMAT

I mapped the entire 12-Layer stack

Every bottleneck, every physics wall, every place value accrues.

Here’s the full system 🧵

$POET $NVDA $GOOG $GFS $AMAT

I mapped the entire 12-Layer stack

Every bottleneck, every physics wall, every place value accrues.

Here’s the full system 🧵

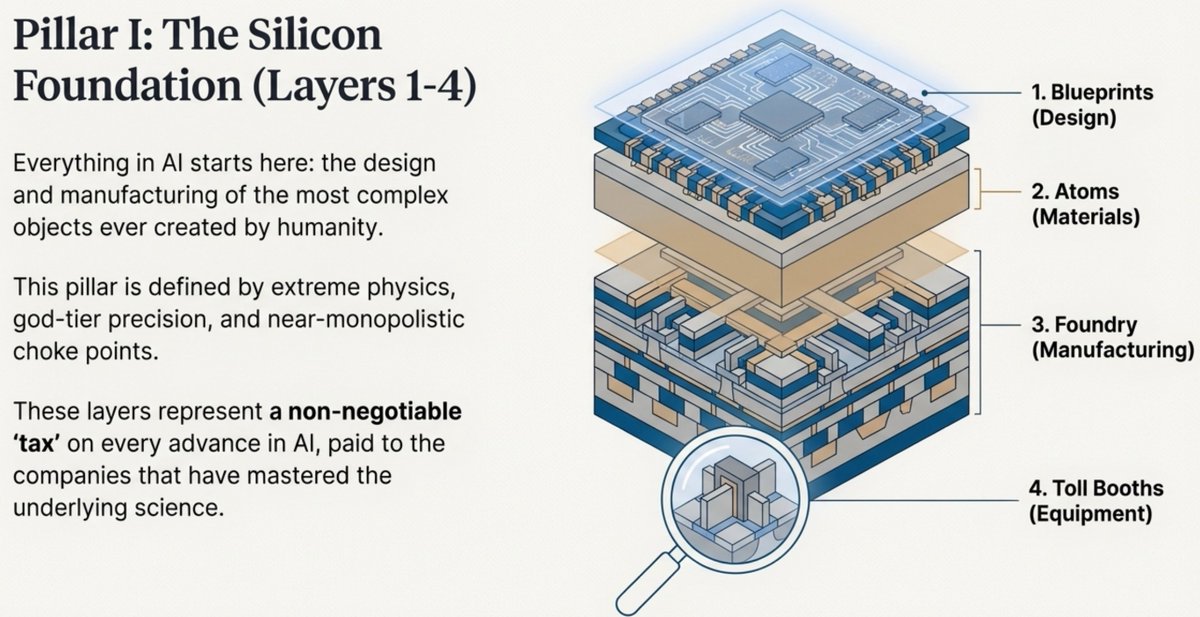

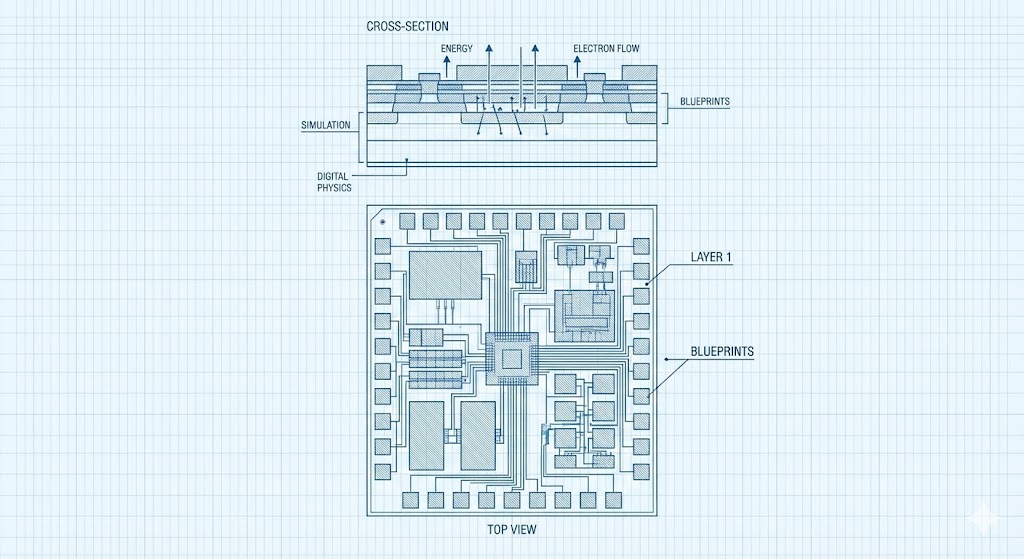

Layer 1 - The Blueprints (EDA / Chip Design Software)

$SNPS $CDNS

This is where every chip begins.

Before a wafer ever enters a fab, these tools simulate how electrons will behave at near-atomic scales.

They solve physics problems digitally long before billions are spent physically.

Why it matters - AI chips fail without accurate design. This layer shapes the limits of every processor built above it.

Investor angle: Recurring, unavoidable software revenue tied directly to each generation of silicon.

(Report posted on SS)

$SNPS $CDNS

This is where every chip begins.

Before a wafer ever enters a fab, these tools simulate how electrons will behave at near-atomic scales.

They solve physics problems digitally long before billions are spent physically.

Why it matters - AI chips fail without accurate design. This layer shapes the limits of every processor built above it.

Investor angle: Recurring, unavoidable software revenue tied directly to each generation of silicon.

(Report posted on SS)

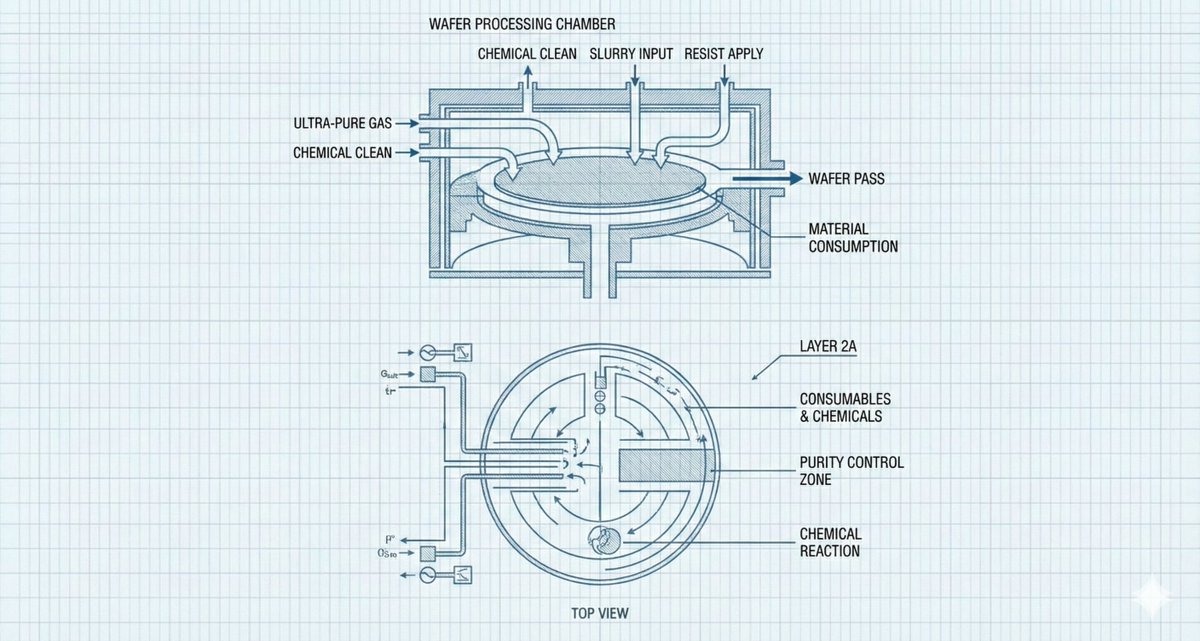

Layer 2A - The Atoms (Consumables & Chemicals)

$ENTG $LIN $CCMP

These are the ultra-pure chemicals, gases, slurries, cleans, and resists fabs use every hour.

Every wafer pass consumes materials that must meet near-perfect purity standards.

Why it matters - AI scaling depends just as much on chemical precision as transistor counts. Purity equals yield.

Investor angle - High recurrence, high visibility, and protected by strict “copy exact” rules.

(Report posted on SS)

$ENTG $LIN $CCMP

These are the ultra-pure chemicals, gases, slurries, cleans, and resists fabs use every hour.

Every wafer pass consumes materials that must meet near-perfect purity standards.

Why it matters - AI scaling depends just as much on chemical precision as transistor counts. Purity equals yield.

Investor angle - High recurrence, high visibility, and protected by strict “copy exact” rules.

(Report posted on SS)

Layer 2B - The Physics Wall (Structural & Enabling Materials)

$ASPI $GLW $COHR $ALMU $CRS

This layer contains the hard materials that keep the AI stack operating under massive heat, power, and bandwidth loads.

Isotopically pure silicon, immersion fluids, glass substrates, photonics materials, nuclear fuel, and advanced alloys all live here.

Why it matters - AI has reached physical limits. Scaling requires newer materials that manage heat, power, and mechanical stress.

Investor angle - Scarcity + irreplaceability define the economic moat.

(Report in progress, available by 12/7)

$ASPI $GLW $COHR $ALMU $CRS

This layer contains the hard materials that keep the AI stack operating under massive heat, power, and bandwidth loads.

Isotopically pure silicon, immersion fluids, glass substrates, photonics materials, nuclear fuel, and advanced alloys all live here.

Why it matters - AI has reached physical limits. Scaling requires newer materials that manage heat, power, and mechanical stress.

Investor angle - Scarcity + irreplaceability define the economic moat.

(Report in progress, available by 12/7)

Layer 3 - The Foundry (Manufacturing Across All Nodes)

$TSM $SKYT $TSEM $GFS

Where atoms turn into logic.

This includes leading-edge 2nm fabs and strategically important specialty fabs producing power, RF, sensors, BCD, mixed-signal, and defense silicon.

Why it matters - AI demand pressures every node, not just the cutting edge. The entire silicon spectrum scales together.

Investor angle - Multi-year capex pipelines, national-security support, and huge barriers to entry.

$TSM $SKYT $TSEM $GFS

Where atoms turn into logic.

This includes leading-edge 2nm fabs and strategically important specialty fabs producing power, RF, sensors, BCD, mixed-signal, and defense silicon.

Why it matters - AI demand pressures every node, not just the cutting edge. The entire silicon spectrum scales together.

Investor angle - Multi-year capex pipelines, national-security support, and huge barriers to entry.

Layer 4 - The Toll Booths (Fab Equipment + Test & Burn-In)

$ASML $AMAT $LRCX $AEHR

Every chip requires lithography, deposition, etch, metrology, packaging, and finally burn-in and reliability testing.

These companies supply the tools that make semiconductor production possible.

Why it matters - Without equipment, no fabs run. Without testing, no chip ships.

Investor angle - Oligopoly-level moats and consistent demand across every node and market cycle.

$ASML $AMAT $LRCX $AEHR

Every chip requires lithography, deposition, etch, metrology, packaging, and finally burn-in and reliability testing.

These companies supply the tools that make semiconductor production possible.

Why it matters - Without equipment, no fabs run. Without testing, no chip ships.

Investor angle - Oligopoly-level moats and consistent demand across every node and market cycle.

Layer 5 - The Compute (GPUs, Custom Silicon, HBM)

$NVDA $AMD $AVGO $MRVL $MU

This is the AI engine room: GPUs for training, custom ASICs for inference, and High Bandwidth Memory as the throughput lifeline.

Why it matters - AI performance depends on feeding chips fast data. Compute is evolving toward workload-specific architectures.

Investor angle - Explosive growth with major architectural shifts underway.

$NVDA $AMD $AVGO $MRVL $MU

This is the AI engine room: GPUs for training, custom ASICs for inference, and High Bandwidth Memory as the throughput lifeline.

Why it matters - AI performance depends on feeding chips fast data. Compute is evolving toward workload-specific architectures.

Investor angle - Explosive growth with major architectural shifts underway.

Layer 6 - The Nervous System (Networking, Optics, Interconnects)

$LITE $COHR $CRDO $ANET $CIEN

This moves data between chips, racks, and clusters.

Copper is strained at high speeds, pushing the industry toward photonics, optical switching, and ultra-low-latency fabrics.

Why it matters - Modern AI clusters are communication systems. Bandwidth and latency shape model performance as much as compute.

Investor angle: Massive TAM expansion driven by cluster density.

$LITE $COHR $CRDO $ANET $CIEN

This moves data between chips, racks, and clusters.

Copper is strained at high speeds, pushing the industry toward photonics, optical switching, and ultra-low-latency fabrics.

Why it matters - Modern AI clusters are communication systems. Bandwidth and latency shape model performance as much as compute.

Investor angle: Massive TAM expansion driven by cluster density.

Layer 7 - The Disruptors (Photonics & Physics Breakthroughs)

$POET $ALMU $LITE $LWLG

This layer captures emerging paradigm-shifting architectures: wafer-scale compute, photonic I/O, optical circuit switching, and physics-driven designs that break today’s limits.

Why it matters - These technologies change how entire AI systems are built and where the bottlenecks move.

Investor angle - High beta exposure to technologies that can reshape infrastructure.

$POET $ALMU $LITE $LWLG

This layer captures emerging paradigm-shifting architectures: wafer-scale compute, photonic I/O, optical circuit switching, and physics-driven designs that break today’s limits.

Why it matters - These technologies change how entire AI systems are built and where the bottlenecks move.

Investor angle - High beta exposure to technologies that can reshape infrastructure.

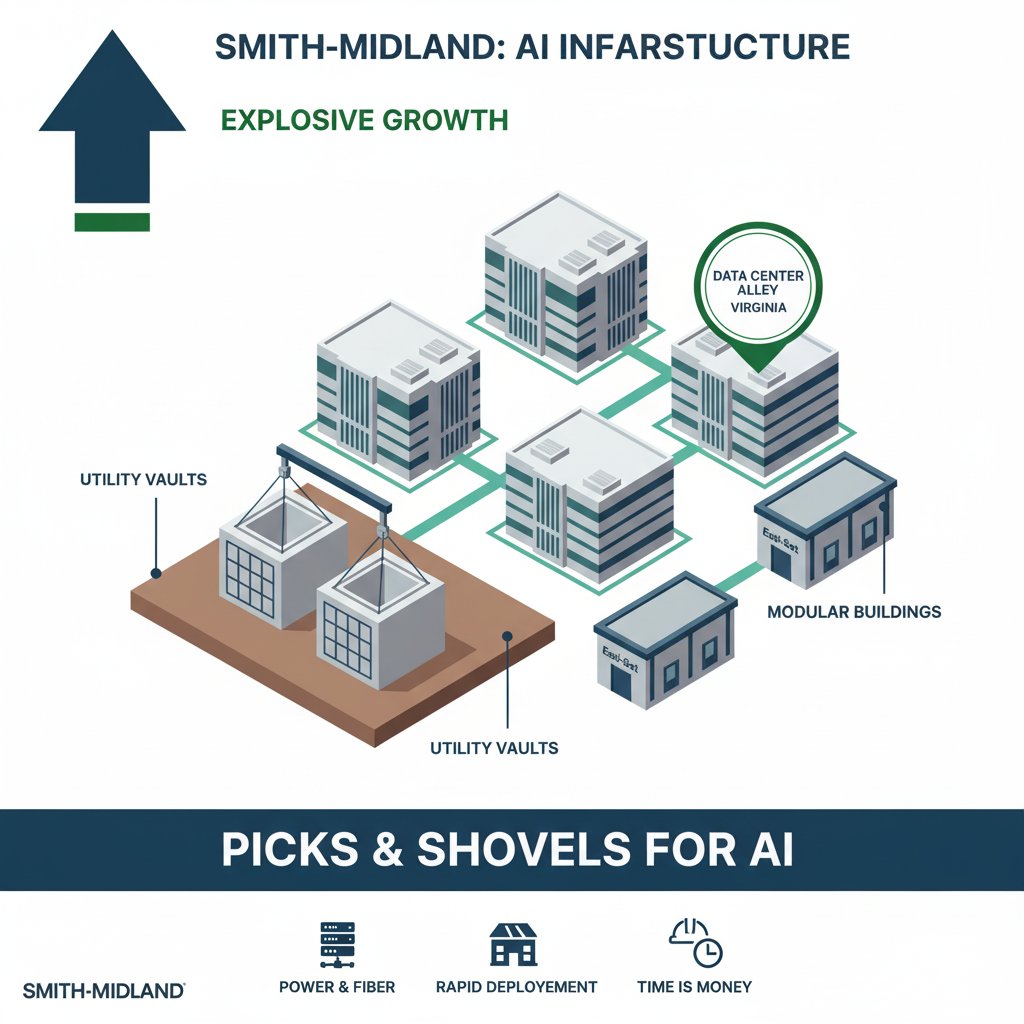

Layer 8 - The Power Plant (Energy & Grid)

$GEV $VRT $FLNC $LEU

AI demand is colliding with grid constraints. Hyperscalers are turning to behind-the-meter power: gas turbines, microgrids, HV gear, SMRs, solar deployments, batteries, and nuclear-grade materials.

Why it matters - Compute follows power. Energy availability determines which regions can support AI growth.

Investor angle - Turbines, transformers, substations, storage, nuclear fuel, and grid upgrades enter a multi-year capex boom.

$GEV $VRT $FLNC $LEU

AI demand is colliding with grid constraints. Hyperscalers are turning to behind-the-meter power: gas turbines, microgrids, HV gear, SMRs, solar deployments, batteries, and nuclear-grade materials.

Why it matters - Compute follows power. Energy availability determines which regions can support AI growth.

Investor angle - Turbines, transformers, substations, storage, nuclear fuel, and grid upgrades enter a multi-year capex boom.

Layer 9 - The Sovereign Cloud (Infrastructure & Borders)

$MSFT $AMZN $GOOGL $NBIS $ORCL

Countries are building their own AI factories: sovereign regions, regulated clouds, local data centers, and national compute capacity.

Why it matters - AI is now a national-power asset. Sovereignty drives duplicated infrastructure and long-term demand.

Investor angle - Nations overbuild for control, increasing TAM far beyond pure efficiency models.

$MSFT $AMZN $GOOGL $NBIS $ORCL

Countries are building their own AI factories: sovereign regions, regulated clouds, local data centers, and national compute capacity.

Why it matters - AI is now a national-power asset. Sovereignty drives duplicated infrastructure and long-term demand.

Investor angle - Nations overbuild for control, increasing TAM far beyond pure efficiency models.

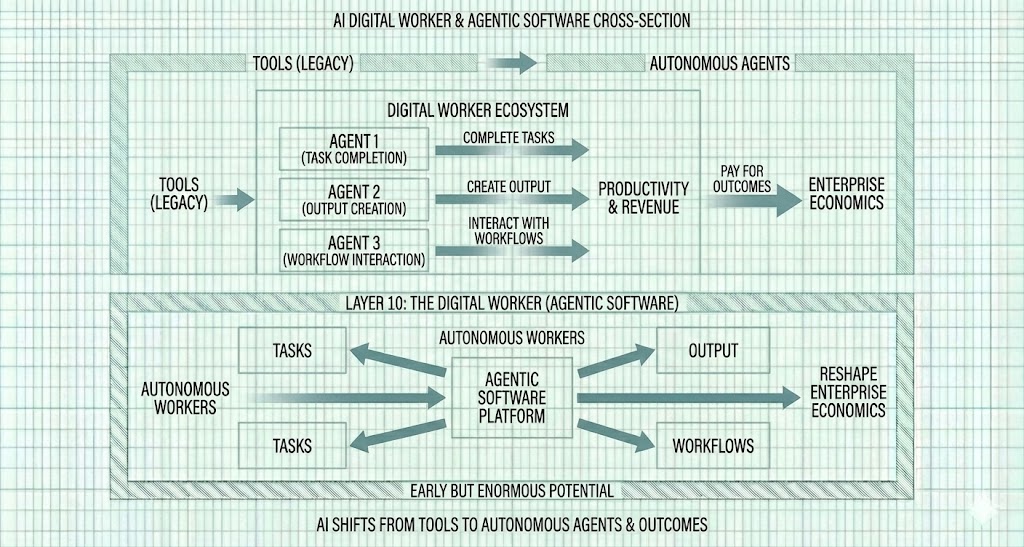

Layer 10 - The Digital Worker (Agentic Software)

$GOOG $MSFT $ADBE $CRM $PATH

AI shifts from tools to autonomous workers. Agents complete tasks, create output, and interact with workflows.

Pricing moves toward paying for outcomes rather than software seats.

Why it matters - This is the software layer where AI touches productivity and revenue directly.

Investor angle - Early but enormous potential to reshape enterprise economics.

$GOOG $MSFT $ADBE $CRM $PATH

AI shifts from tools to autonomous workers. Agents complete tasks, create output, and interact with workflows.

Pricing moves toward paying for outcomes rather than software seats.

Why it matters - This is the software layer where AI touches productivity and revenue directly.

Investor angle - Early but enormous potential to reshape enterprise economics.

Layer 11 - The Immune System (Security for Autonomous Systems)

$PANW $ZS $CRWD $OKTA

As agents proliferate, identity, permissions, and real-time trust become non-optional.

This layer protects autonomous systems from bad actors and bad outcomes.

Why it matters - AI expansion requires new security primitives built for machine decision-making.

Investor angle - Security budgets expand as enterprises adopt autonomous agents.

$PANW $ZS $CRWD $OKTA

As agents proliferate, identity, permissions, and real-time trust become non-optional.

This layer protects autonomous systems from bad actors and bad outcomes.

Why it matters - AI expansion requires new security primitives built for machine decision-making.

Investor angle - Security budgets expand as enterprises adopt autonomous agents.

Layer 12 - The Physical Body (Robotics & Automation)

$SYM $ROK $TSLA $TER $ISRG

AI leaves the data center and enters the physical world: humanoids, warehouse automation, manipulators, logistics robots, and real-world VLA stacks.

Why it matters - Robotics is a major link between AI and real GDP productivity.

Investor angle - A direct play on labor shortages, automation, and real-world deployment.

$SYM $ROK $TSLA $TER $ISRG

AI leaves the data center and enters the physical world: humanoids, warehouse automation, manipulators, logistics robots, and real-world VLA stacks.

Why it matters - Robotics is a major link between AI and real GDP productivity.

Investor angle - A direct play on labor shortages, automation, and real-world deployment.

On this page I will be diving really deep into each layer

I'll lay the ground work for the importance of each layer

Where each one fits into the overall AI trade

And uncover the Alpha in the companies that investors care about (the cashtags posted are only a very small group of the companies that I will cover in each layer)

I'll post summaries on X and full deep dives on my free SS (l!nk in bio)

You will gain massive knowledge and insight and edge if you follow along this series

Highly recommend turning on your post notification as well!

Bookmark this post!

I'll lay the ground work for the importance of each layer

Where each one fits into the overall AI trade

And uncover the Alpha in the companies that investors care about (the cashtags posted are only a very small group of the companies that I will cover in each layer)

I'll post summaries on X and full deep dives on my free SS (l!nk in bio)

You will gain massive knowledge and insight and edge if you follow along this series

Highly recommend turning on your post notification as well!

Bookmark this post!

• • •

Missing some Tweet in this thread? You can try to

force a refresh