How to get URL link on X (Twitter) App

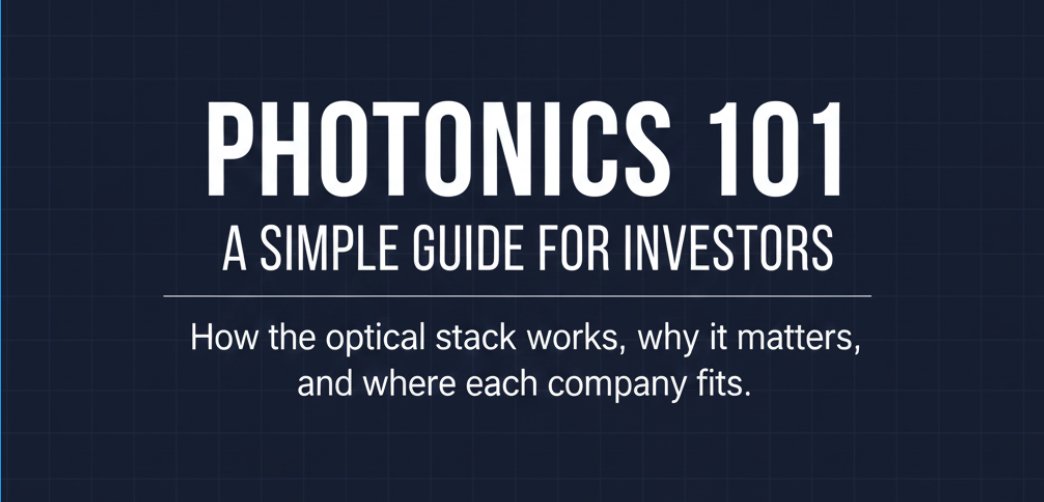

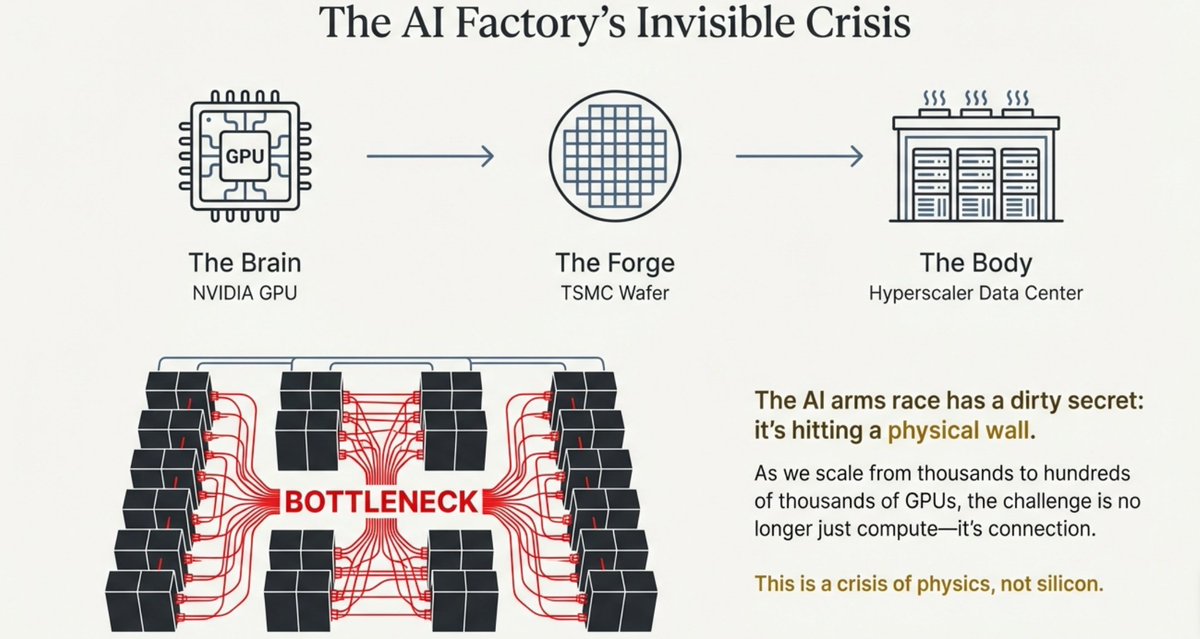

THE COPPER WALL IS THE SETUP $COHR

THE COPPER WALL IS THE SETUP $COHR

Why photonics exists...

Why photonics exists...

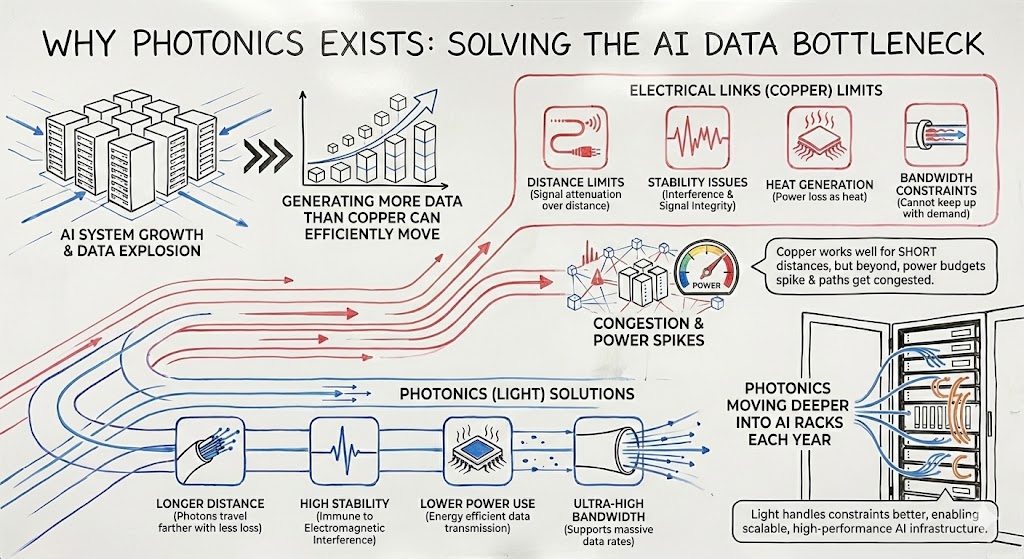

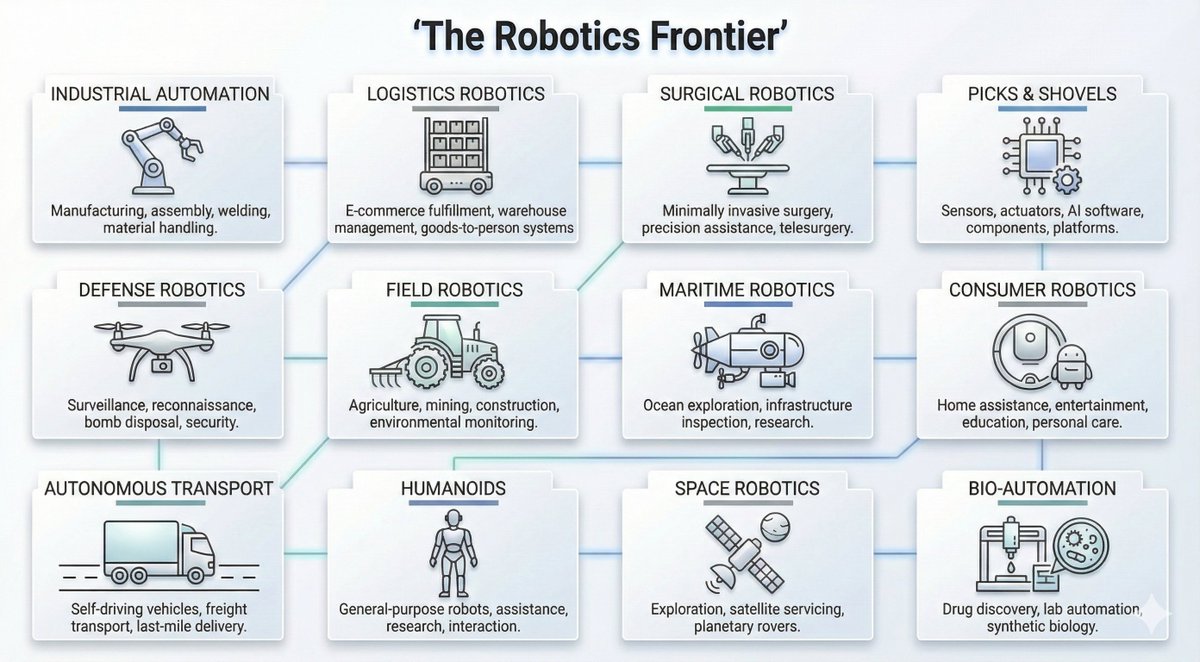

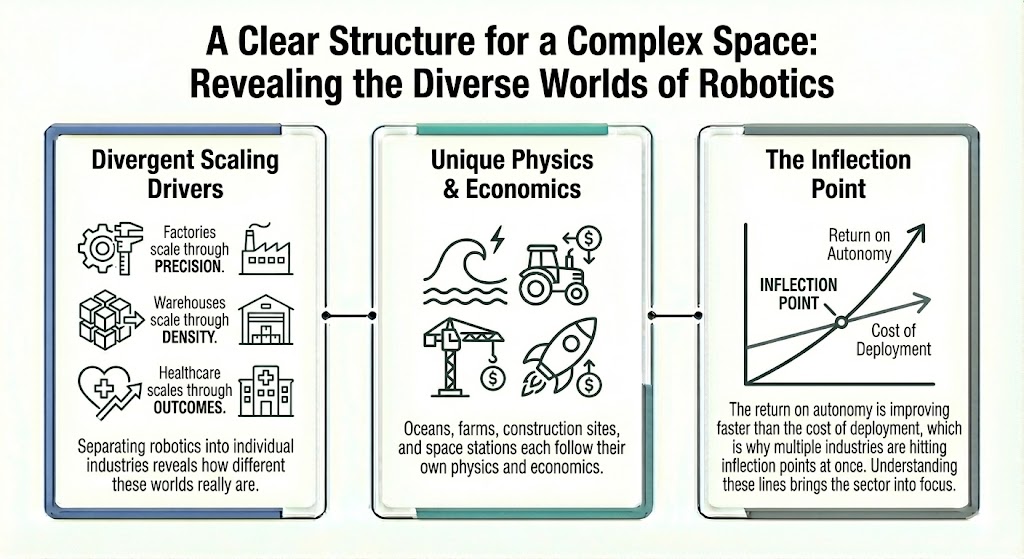

A clear structure for a complex space

A clear structure for a complex space

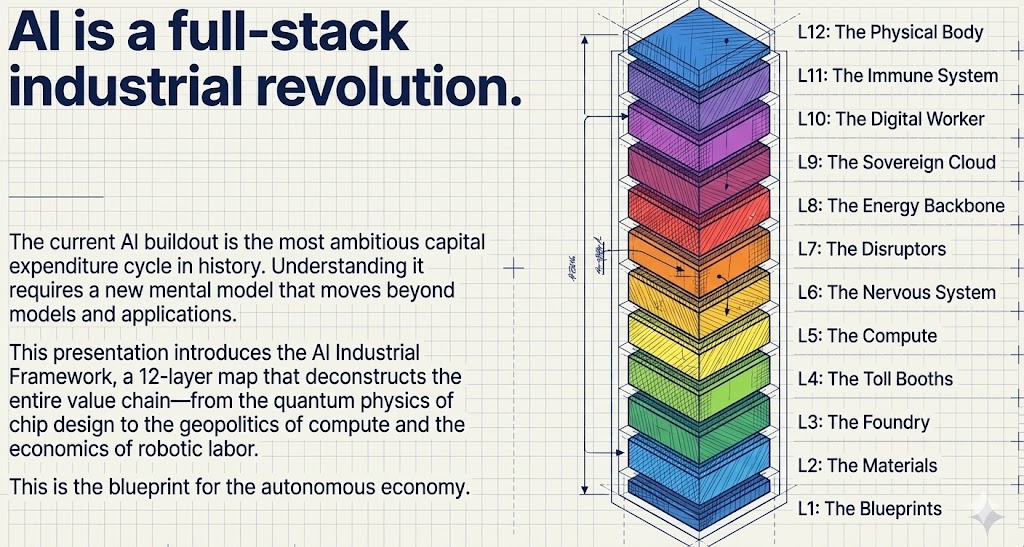

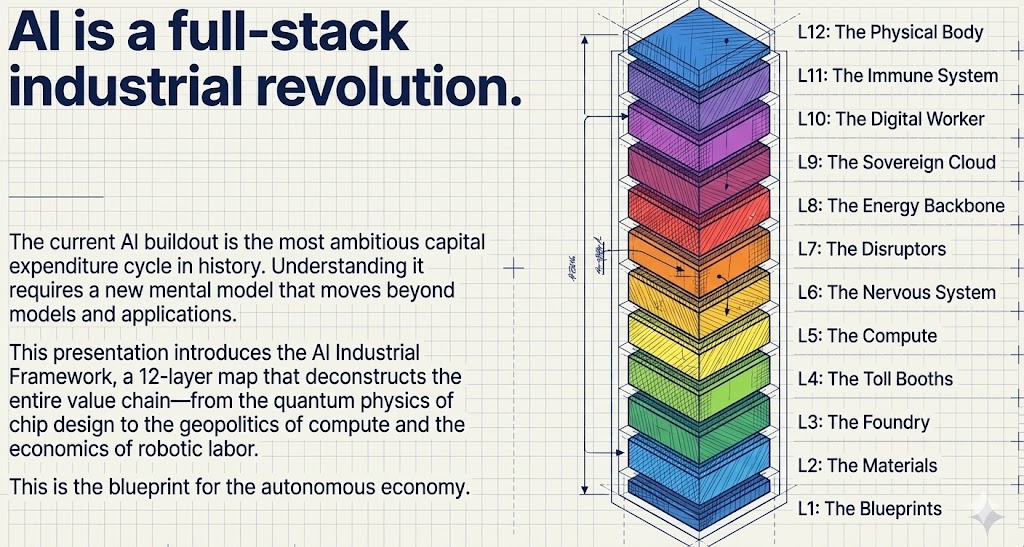

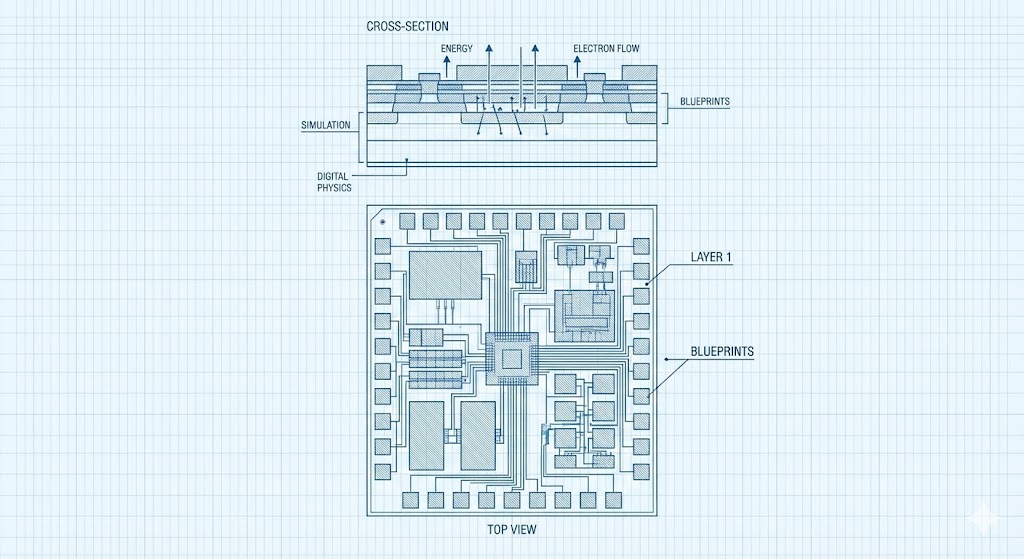

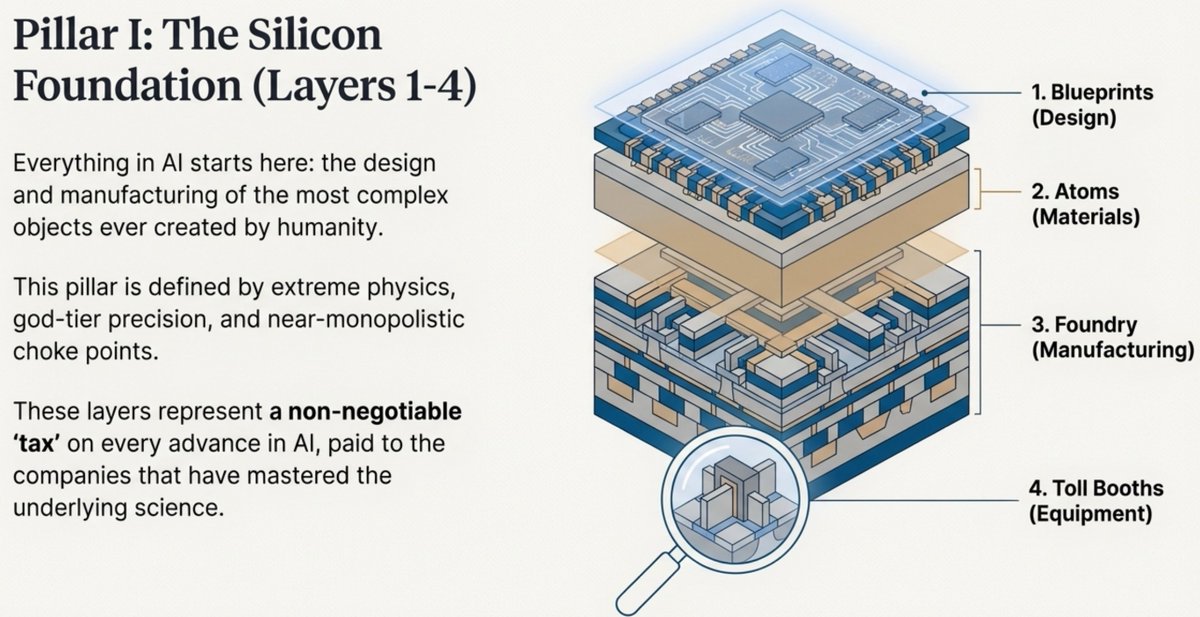

Layer 1 - The Blueprints (EDA / Chip Design Software)

Layer 1 - The Blueprints (EDA / Chip Design Software)

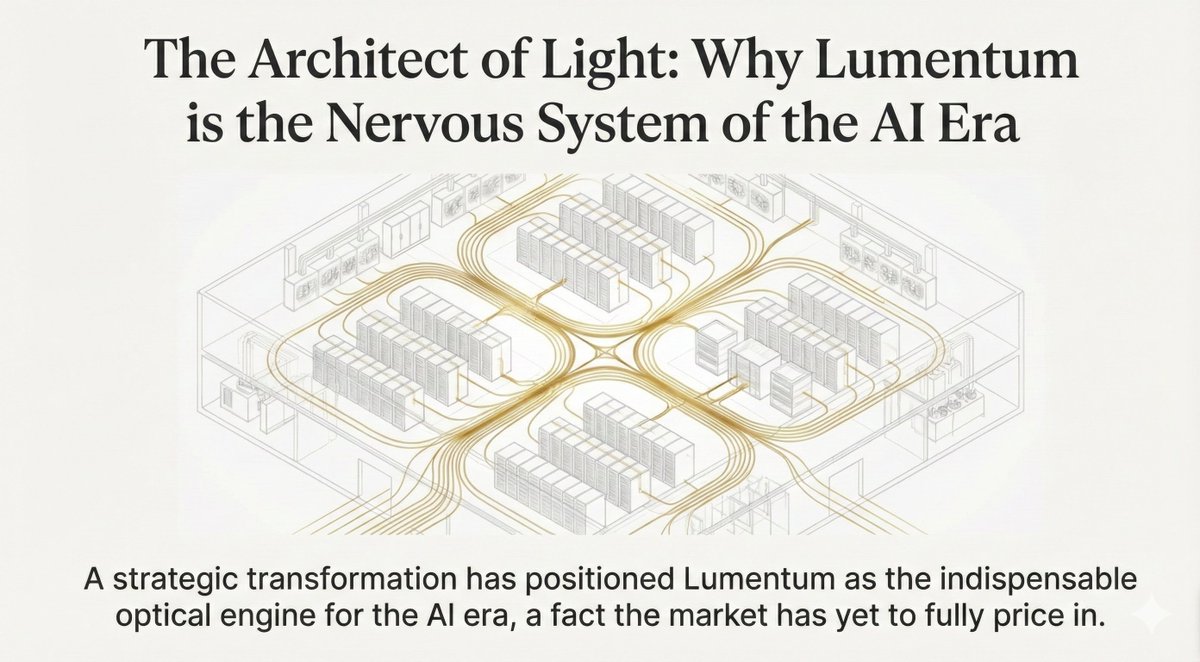

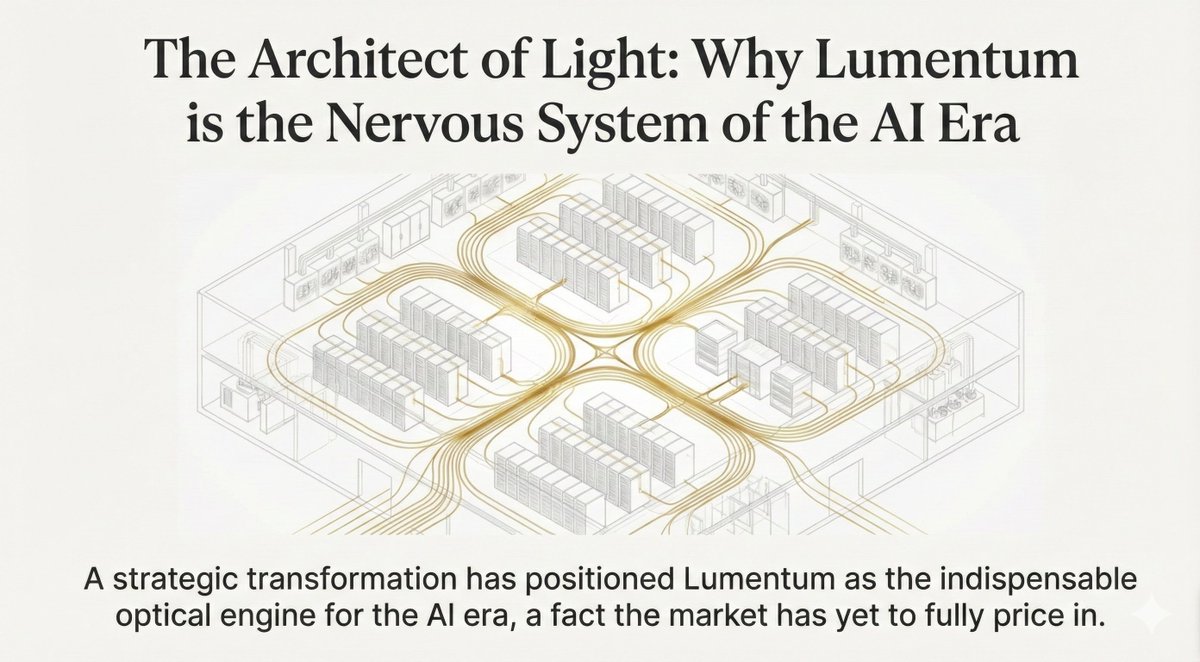

The Scale Problem $LITE

The Scale Problem $LITE

Pillar I represents the Silicon Foundation.

Pillar I represents the Silicon Foundation.

What is One Stop Systems? $OSS

What is One Stop Systems? $OSS

Cracking the Semiconductor Code $ALMU

Cracking the Semiconductor Code $ALMU

1/24 Innodata Inc. $INOD

1/24 Innodata Inc. $INOD

Strategy $WYFI

Strategy $WYFI

The Foundational Model - Pure-Play Mining $RIOT

The Foundational Model - Pure-Play Mining $RIOT

Think of $SMID as a three-legged stool.

Think of $SMID as a three-legged stool.

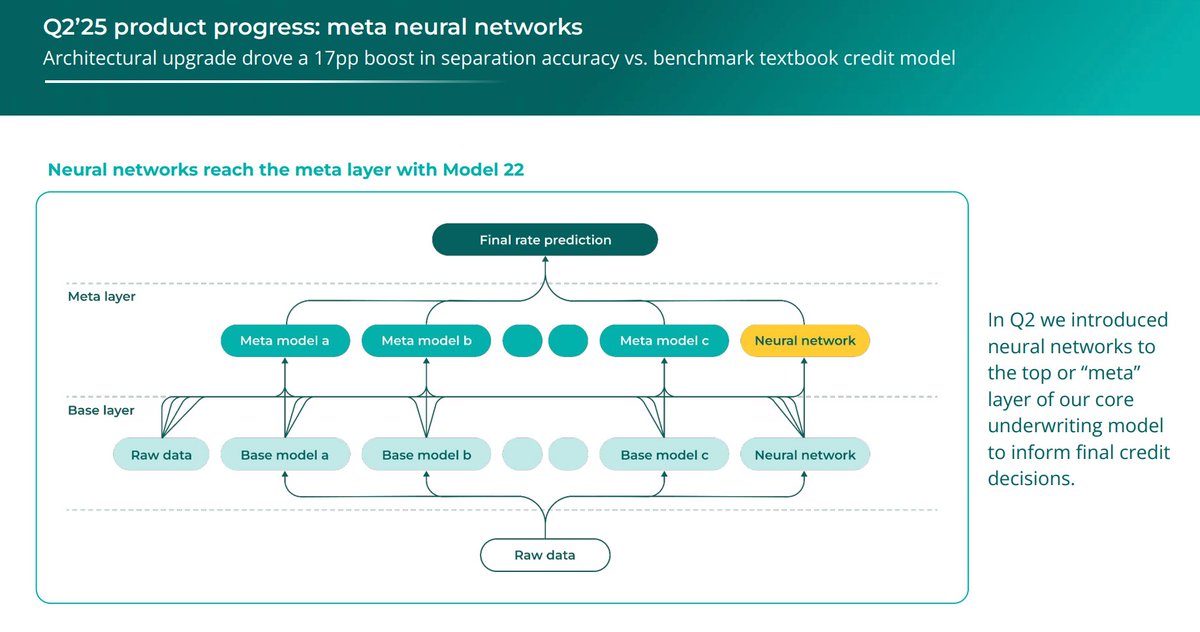

2/ $UPST

2/ $UPST

2/

2/