Oil forecasts for 2025 have a wide range of outcomes, from balanced to a surplus of 4mbpd (IEA). Which one is it?

I’ve counted too many barrels over the years to engage in the debate. The oil market is dynamic while forecasts are static by nature.

But…

1/n

I’ve counted too many barrels over the years to engage in the debate. The oil market is dynamic while forecasts are static by nature.

But…

1/n

https://twitter.com/burggrabenh/status/1979545937224638861

…we know that…

1) oil on water (includes floating storage) and oil in transit well surpassed Covid levels.

Part of it reflects inefficiency of the sanctioned Russian & Iranian oil trade as well as the recent US sanctions on Rosneft & Lukoil.

Part of it is an outright bearish oil market = too many barrels chasing too few buyers -> needs lower prices.

2/n: Oil in transit

1) oil on water (includes floating storage) and oil in transit well surpassed Covid levels.

Part of it reflects inefficiency of the sanctioned Russian & Iranian oil trade as well as the recent US sanctions on Rosneft & Lukoil.

Part of it is an outright bearish oil market = too many barrels chasing too few buyers -> needs lower prices.

2/n: Oil in transit

2) Weak Chinese petroleum product consumption:

China is in recession due to its property bust and despite the CCPs desire to steer clear of it by forcing every other industry to build what isn’t required domestically (overcapacity issue) and then dump goods onto global trade.

Because of the latter most observers still don’t get the painful economic status China is in. But China is in it.

Also, the CCP prefers coal fuelled transportation as well as LNG truck driving for the purpose of geopolitics.

Both requires less, not more, diesel and gasoline in 2026 vs 2025. Jet and Naphtha are different story but won’t drive oil buying by refineries => Oil demand by 2nd largest economy globally is bearish. Accept.

However, the CCP may take the absurd to the next level in 2026 and force refineries to build even more floating-roof oil tank storage (as part of meeting an artificial Soviet 2.0 plan within its Investment-led Growth Model) in which case refineries may buy more oil next year, but not for the purpose of producing more petroleum products but solely for storages. If they do so, however, their crude oil buying will be EXTREMELY price sensitive.

Time and State companies oil quotas will tell.

PS: If u care to understand China’s property bust structurally, here is a link to my 7 part Stack series. It remains as valid then as now.

3/n

open.substack.com/pub/alexanders…

China is in recession due to its property bust and despite the CCPs desire to steer clear of it by forcing every other industry to build what isn’t required domestically (overcapacity issue) and then dump goods onto global trade.

Because of the latter most observers still don’t get the painful economic status China is in. But China is in it.

Also, the CCP prefers coal fuelled transportation as well as LNG truck driving for the purpose of geopolitics.

Both requires less, not more, diesel and gasoline in 2026 vs 2025. Jet and Naphtha are different story but won’t drive oil buying by refineries => Oil demand by 2nd largest economy globally is bearish. Accept.

However, the CCP may take the absurd to the next level in 2026 and force refineries to build even more floating-roof oil tank storage (as part of meeting an artificial Soviet 2.0 plan within its Investment-led Growth Model) in which case refineries may buy more oil next year, but not for the purpose of producing more petroleum products but solely for storages. If they do so, however, their crude oil buying will be EXTREMELY price sensitive.

Time and State companies oil quotas will tell.

PS: If u care to understand China’s property bust structurally, here is a link to my 7 part Stack series. It remains as valid then as now.

3/n

open.substack.com/pub/alexanders…

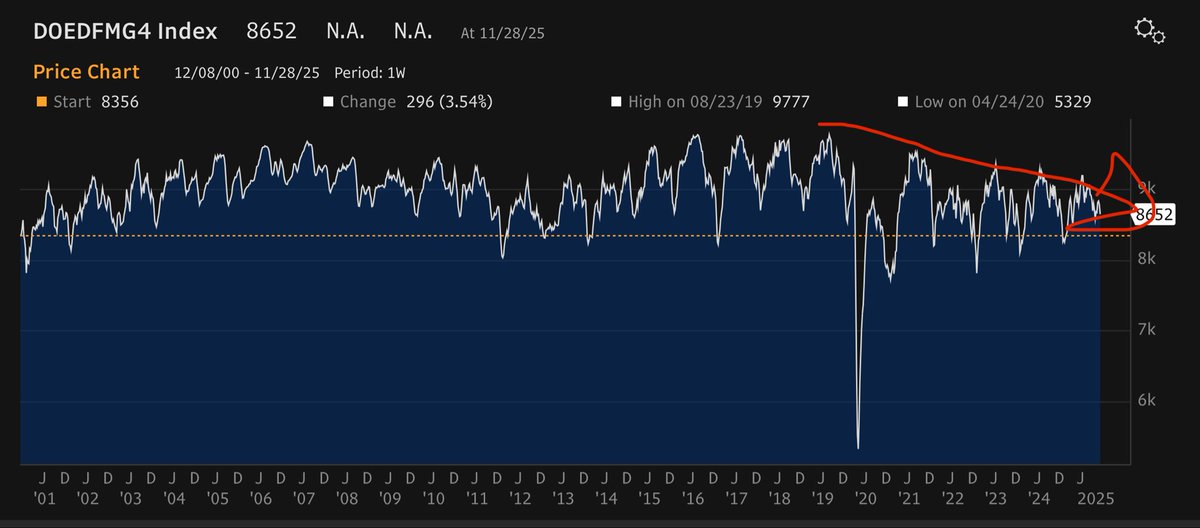

3) Meanwhile, OECD petroleum product demand is slowing faster than Non-OECD demand is growing, structurally that is.

Take the world’s largest petroleum demand market, the United States. Despite all the ridiculous gas dazzling car buying, the US consumer is hurting (affordability crisis) and this is here to stay in 2026.

Meanwhile, neither Europe, South Korea or Japan are growing product demand. If anything, they too are in a technical recession, certainly in Britain, France and Germany.

4/n

Graph: US 4-week average petroleum demand

Take the world’s largest petroleum demand market, the United States. Despite all the ridiculous gas dazzling car buying, the US consumer is hurting (affordability crisis) and this is here to stay in 2026.

Meanwhile, neither Europe, South Korea or Japan are growing product demand. If anything, they too are in a technical recession, certainly in Britain, France and Germany.

4/n

Graph: US 4-week average petroleum demand

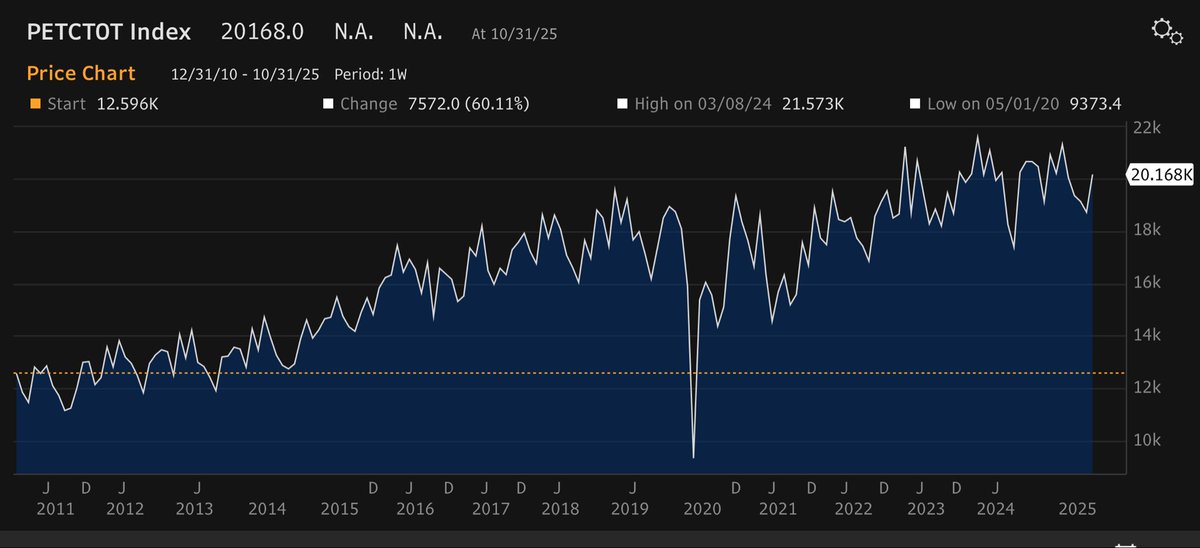

…and no, Indian Petroleum demand isn’t bailing out EM demand growth either this time (graph below; stagnation) and despite cheap crude prices around or below $60 per barrels.

One may argue crude at $50 will stimulate additional consumption but I have a hard time to see the incremental value for Indian consumers here.

I think oil is cheap enough already when compared to 2022 prices above $100/barrel. It’s the economy that must trigger it.

5/n

One may argue crude at $50 will stimulate additional consumption but I have a hard time to see the incremental value for Indian consumers here.

I think oil is cheap enough already when compared to 2022 prices above $100/barrel. It’s the economy that must trigger it.

5/n

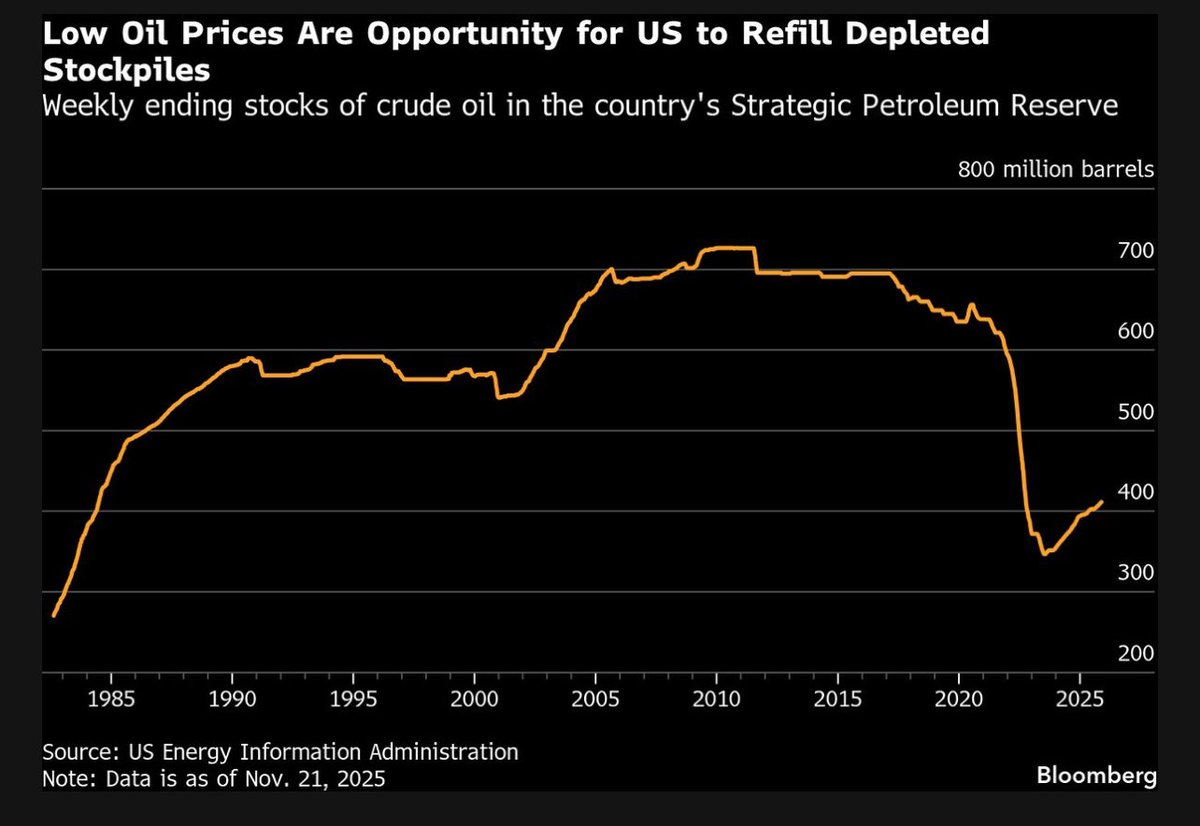

4) Trump may use this to fill up SPRs.

Low oil prices offer an opportunity for the US to replenish its store of emergency crude, which was only 60% full as of mid-Nov.

Reserves remain diminished after the Biden administration released supply into the market to try to tame the gasoline price spike that followed Russia’s full-scale invasion of Ukraine.

Trump vowed during his inaugural address to fill the SPR “right to the top.” Taking advantage of low oil prices, the Energy Department awarded contracts worth almost $56 million in Nov to procure 900k barrels for this stockpile.

However, as part of Trump’s sweeping tax-and-spending law passed over the summer, Congress only appropriated $171 million for oil purchases for the SPR between 2025 and 2029, a limit the government could hit very quickly.

That sum equates to less than 3 million barrels at current prices, which is a far cry from the roughly 300 million barrels needed to bring the SPR to full capacity.

I think US SPR noise is a distraction in 2026, not a key demand source.

6/n

Low oil prices offer an opportunity for the US to replenish its store of emergency crude, which was only 60% full as of mid-Nov.

Reserves remain diminished after the Biden administration released supply into the market to try to tame the gasoline price spike that followed Russia’s full-scale invasion of Ukraine.

Trump vowed during his inaugural address to fill the SPR “right to the top.” Taking advantage of low oil prices, the Energy Department awarded contracts worth almost $56 million in Nov to procure 900k barrels for this stockpile.

However, as part of Trump’s sweeping tax-and-spending law passed over the summer, Congress only appropriated $171 million for oil purchases for the SPR between 2025 and 2029, a limit the government could hit very quickly.

That sum equates to less than 3 million barrels at current prices, which is a far cry from the roughly 300 million barrels needed to bring the SPR to full capacity.

I think US SPR noise is a distraction in 2026, not a key demand source.

6/n

5) Supply Side Surpluses

Meanwhile, the oil market is swimming in supply. One reason is the market share game by core OPEC that I forecast in 2024 and which every self-declared oil expert on X denied while living in their own little OPEC love bubble.

But of course, I was proven right once more as math, not emotions, run oil ministries.

Let’s take Saudi Arabia, my favourite EM basket case: the “Kingdom” (ridiculous, I know), the world’s 2nd-largest oil producer after the US, is seeking to diversify its economy through the Vision 2030 program.

However, the massive investments being made in mega construction projects, such as the flagship Neom development nonsense, as well as other initiatives to build Red Sea tourism resorts, electric-vehicle factories and data centers, have left it MORE dependent on oil revenue.

While MBS is forced to rejigging its mega-project spending mania, i.e. delaying and scaling back some developments and accelerating others, such as pleasing Trump. it’s still expecting a national budget shortfall for the next few years.

Bloomberg Economics estimated in November that the Saudi government needs an oil price of $98 a barrel (!) to balance its budget and $115 when including domestic spending by its sovereign wealth fund, the Public Investment Fund.

That’s well above this year’s average of $69 a barrel for Brent through the start of December.

So what will they do next, when oil price doesn’t cooperate? I let u figure it out yourself this time. Not hard.

7a/n

Meanwhile, the oil market is swimming in supply. One reason is the market share game by core OPEC that I forecast in 2024 and which every self-declared oil expert on X denied while living in their own little OPEC love bubble.

But of course, I was proven right once more as math, not emotions, run oil ministries.

Let’s take Saudi Arabia, my favourite EM basket case: the “Kingdom” (ridiculous, I know), the world’s 2nd-largest oil producer after the US, is seeking to diversify its economy through the Vision 2030 program.

However, the massive investments being made in mega construction projects, such as the flagship Neom development nonsense, as well as other initiatives to build Red Sea tourism resorts, electric-vehicle factories and data centers, have left it MORE dependent on oil revenue.

While MBS is forced to rejigging its mega-project spending mania, i.e. delaying and scaling back some developments and accelerating others, such as pleasing Trump. it’s still expecting a national budget shortfall for the next few years.

Bloomberg Economics estimated in November that the Saudi government needs an oil price of $98 a barrel (!) to balance its budget and $115 when including domestic spending by its sovereign wealth fund, the Public Investment Fund.

That’s well above this year’s average of $69 a barrel for Brent through the start of December.

So what will they do next, when oil price doesn’t cooperate? I let u figure it out yourself this time. Not hard.

7a/n

https://x.com/BurggrabenH/status/1831360459733094610

Meanwhile, the Saudi Aramco is reported to reduce the price of its Arab Light grade for Asian customers to a 60-cent premium to the regional benchmark for January, according to a price list seen by Bloomberg.

It’s the lowest since January 2021 and a drop that was largely in-line with a survey of refiners and traders. Yes, that is bearish, not bullish 🤣…

7b/n

It’s the lowest since January 2021 and a drop that was largely in-line with a survey of refiners and traders. Yes, that is bearish, not bullish 🤣…

7b/n

6) Core OPEC isn’t alone pushing export volumes.

Most of “Americas” is pushing output too as yet another textbook boom-bust commodity capex-cycle is unfolding in real time post the 2020 bust.

Take Brazil’s deepwater reserves, the unlocking of which is taking the country into the big leagues of global oil exporters in the coming years and without OPEC membership.

Offshore projects such as Buzios field, the world’s largest offshore field, won’t stop bc of oil volatility. These are long-cycle projects, unlike US shale output, which is short-cycle.

8/n: Brazil Oil Production in Barrels per month = 4.1mbpd in Oct

Most of “Americas” is pushing output too as yet another textbook boom-bust commodity capex-cycle is unfolding in real time post the 2020 bust.

Take Brazil’s deepwater reserves, the unlocking of which is taking the country into the big leagues of global oil exporters in the coming years and without OPEC membership.

Offshore projects such as Buzios field, the world’s largest offshore field, won’t stop bc of oil volatility. These are long-cycle projects, unlike US shale output, which is short-cycle.

8/n: Brazil Oil Production in Barrels per month = 4.1mbpd in Oct

7) Canadian sands, some of the world’s largest oil reserves, are also steadily contributing to higher Canadian oil output, now at 5.4mbpd…!

Canada is a sleeping oil giant and its capable operators figured out how to produce oil at low breakevens over the years.

PS: if u see this as UAE oil minister, what do you do? Yes, you panic and order a reserve audit among OPEC members to get a higher quota as you know everyone’s oil reserves (which determine output quotas) such as Kuwait are overstated, as typical for ME low trust societies.

My point? UAE had it with cheaters. They too want to produce more oil or leave OPEC sooner rather than later.

9/n

Canada is a sleeping oil giant and its capable operators figured out how to produce oil at low breakevens over the years.

PS: if u see this as UAE oil minister, what do you do? Yes, you panic and order a reserve audit among OPEC members to get a higher quota as you know everyone’s oil reserves (which determine output quotas) such as Kuwait are overstated, as typical for ME low trust societies.

My point? UAE had it with cheaters. They too want to produce more oil or leave OPEC sooner rather than later.

9/n

8) Other nations that are set to produce more oil regardless of oil price volatility is Guayana, Argentina, Kazakhstan, potentially also Venezuela down the road. The latter possesses the largest oil reserves globally.

10/n

10/n

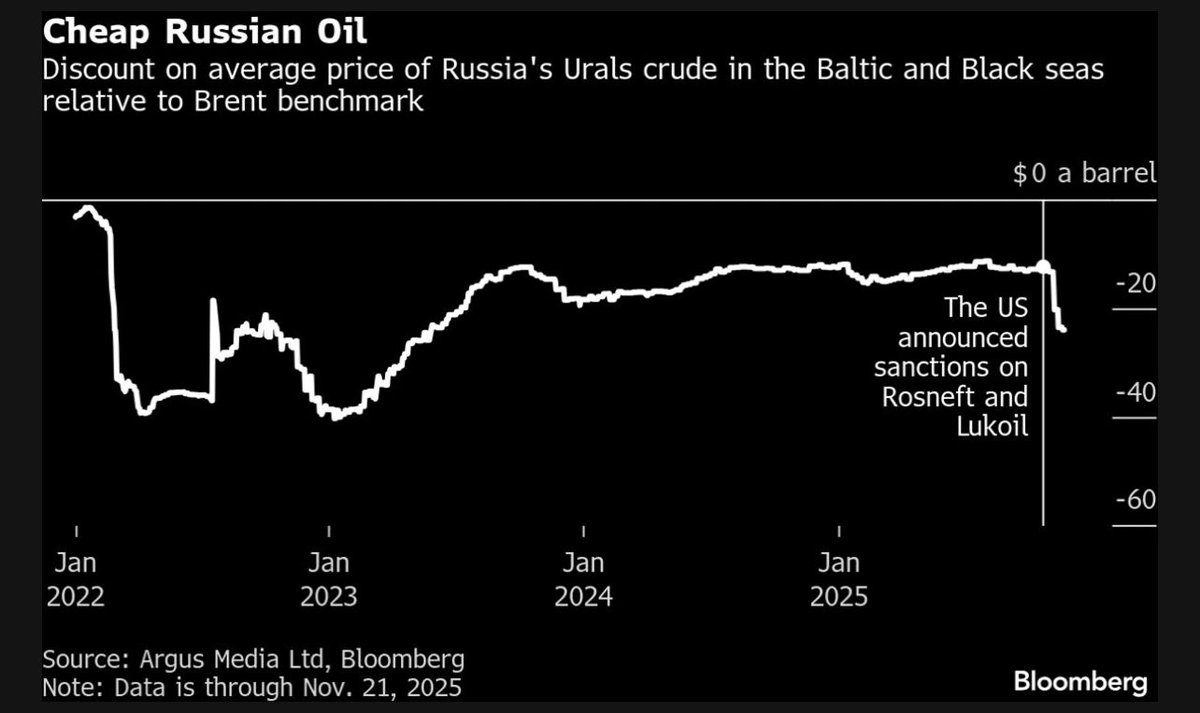

9) Russia, one of the top-three oil producers and exporters globally, is also worth understanding.

Western sanctions have made Russia’s 5mbpd oil exports heavily dependent on China and India, who demand big discounts to keep importing this seaborne crude. Note: Russia also exports 2-2.5mbpd products.

In the absence of a peace deal to end the war in Ukraine, recent US sanctions and an oversupplied global market will force Russian producers to cut their prices further.

As the US ban on dealings with Rosneft and Lukoil started to come into force in November, Russia’s flagship Urals blend was more than $20-25 a barrel cheaper than Brent.

While that gap is significantly smaller than in the earlier years of the war in Ukraine, it’s still markedly wider than the historical discount of $2 to $4.

Meanwhile, Russia is in a form of oil trap already. If Trump lifts sanction on Rosneft & Lukoil to suck up virtual Kremlin business, global balances are even more loose and prices go lower.

If not, the global crude surplus prevents higher benchmarks despite some Ural losses but keeps diesel markets tighter than without Sechin sanctions.

The way the Kremlin will address this is by charging excessive taxes on the sector nevertheless. All Russian producers are firmly Kremlin controlled and Patrushev wants to keep his war going one way or another.

But what that also means is that, at some point in the not too distant future, producers didn’t invest enough today to keep output stable tomorrow. With water cuts already at 90% in West Siberia, the Kremlin, too, will pay its invoices. Just be patient.

11/n

Western sanctions have made Russia’s 5mbpd oil exports heavily dependent on China and India, who demand big discounts to keep importing this seaborne crude. Note: Russia also exports 2-2.5mbpd products.

In the absence of a peace deal to end the war in Ukraine, recent US sanctions and an oversupplied global market will force Russian producers to cut their prices further.

As the US ban on dealings with Rosneft and Lukoil started to come into force in November, Russia’s flagship Urals blend was more than $20-25 a barrel cheaper than Brent.

While that gap is significantly smaller than in the earlier years of the war in Ukraine, it’s still markedly wider than the historical discount of $2 to $4.

Meanwhile, Russia is in a form of oil trap already. If Trump lifts sanction on Rosneft & Lukoil to suck up virtual Kremlin business, global balances are even more loose and prices go lower.

If not, the global crude surplus prevents higher benchmarks despite some Ural losses but keeps diesel markets tighter than without Sechin sanctions.

The way the Kremlin will address this is by charging excessive taxes on the sector nevertheless. All Russian producers are firmly Kremlin controlled and Patrushev wants to keep his war going one way or another.

But what that also means is that, at some point in the not too distant future, producers didn’t invest enough today to keep output stable tomorrow. With water cuts already at 90% in West Siberia, the Kremlin, too, will pay its invoices. Just be patient.

11/n

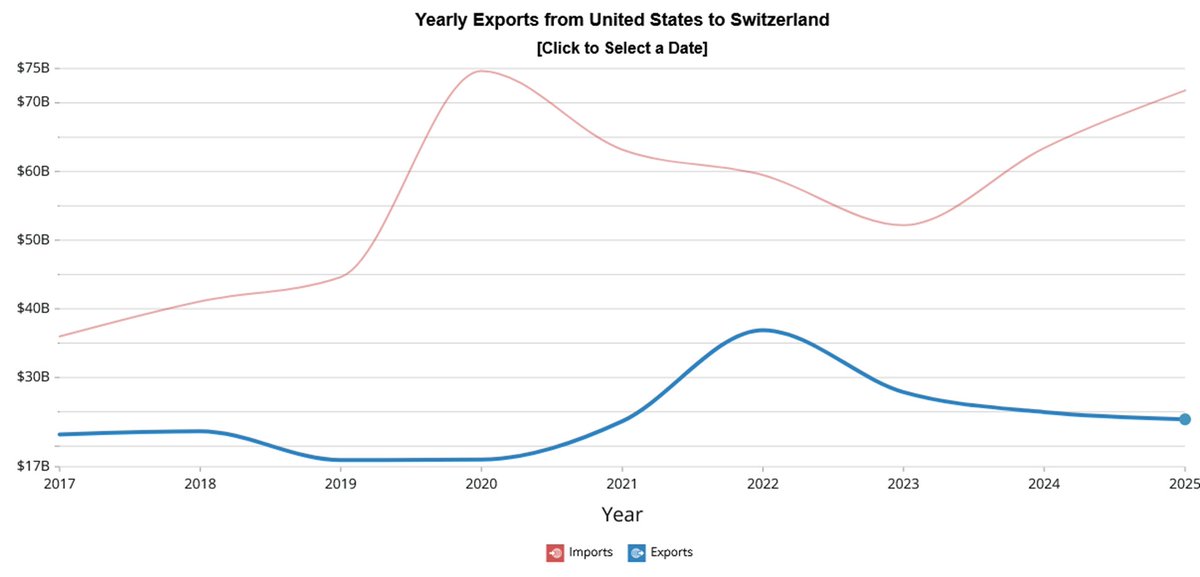

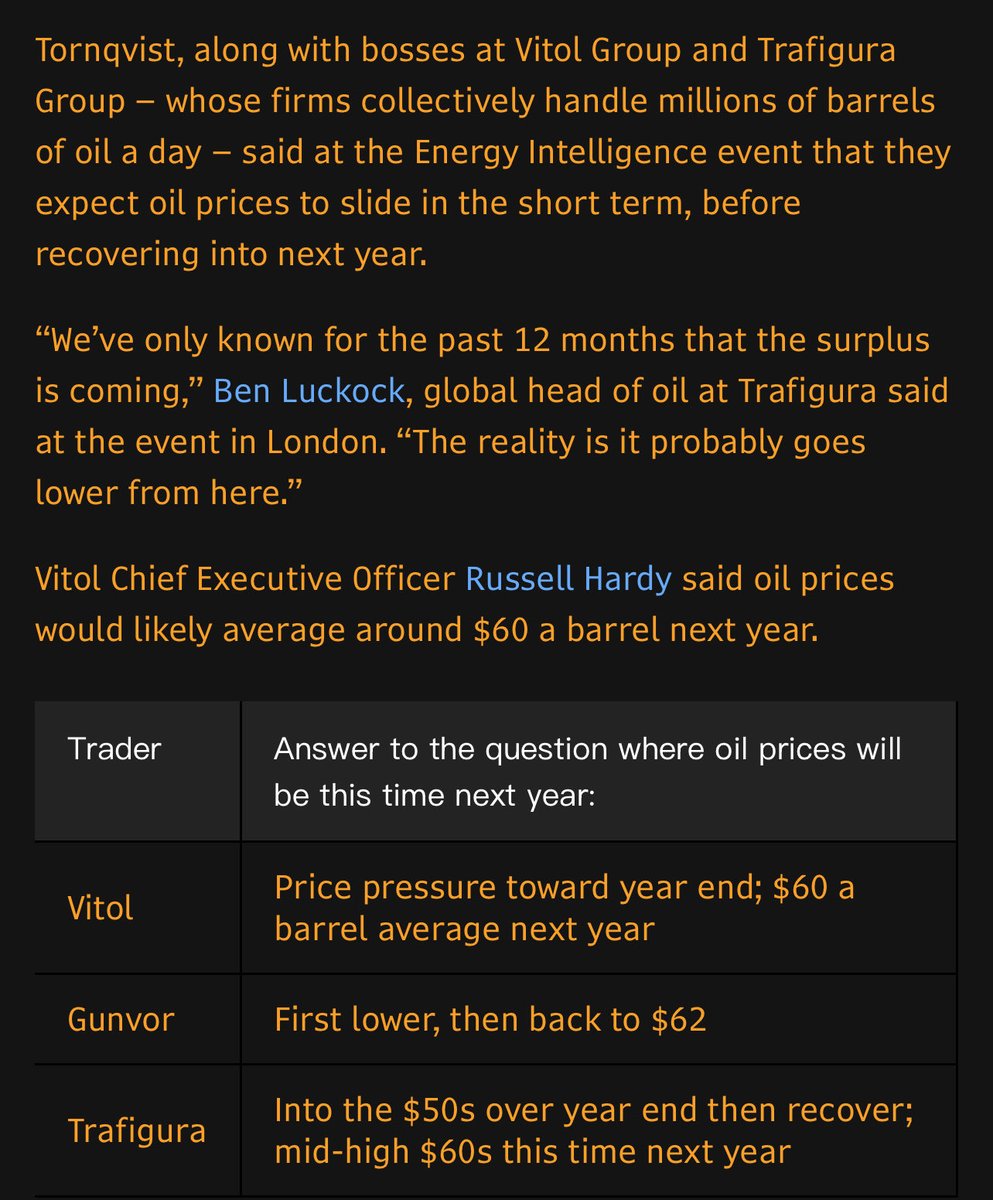

12) What does this now all mean for the crude surplus in 2026? I have no idea whatsoever.

What I do know is that the 4mbpd surplus as forecast by the IEA is typical agency rubbish.

Were we in such a surplus in a single month in 2026, Brent would crash below $30 and without hesitation. It would become a total massacre which isn’t in anyone’s interest.

But the warning of the big oil trading houses from Switzerland are big enough to assume 2026 is a bigger bear than 2025.

Expect lower prices and a dynamic market in a difficult setup as their are no magic adjustment cards such as a massive Chinese stimulus program to bail out weak fundamentals everywhere and also not for 2027 and until US Shale and Russian crude oil outputs finally rolls over in earnest.

This remains a structural bear we I sit.

12/n Thx/End

What I do know is that the 4mbpd surplus as forecast by the IEA is typical agency rubbish.

Were we in such a surplus in a single month in 2026, Brent would crash below $30 and without hesitation. It would become a total massacre which isn’t in anyone’s interest.

But the warning of the big oil trading houses from Switzerland are big enough to assume 2026 is a bigger bear than 2025.

Expect lower prices and a dynamic market in a difficult setup as their are no magic adjustment cards such as a massive Chinese stimulus program to bail out weak fundamentals everywhere and also not for 2027 and until US Shale and Russian crude oil outputs finally rolls over in earnest.

This remains a structural bear we I sit.

12/n Thx/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh