Markets with the biggest rent deflation over the last 3 years:

Austin: -21%

Fort Myers: -19%

CoSprings: -15%

Phoenix: -14%

Raleigh: -13%

San Antonio: -12%

Atlanta: -11%

Denver: -11%

Expect apartments rents in these markets to continue declining in 2026, as vacancy rates remain elevated.

Good news for renters, bad news for investors who bought near the peak.

Austin: -21%

Fort Myers: -19%

CoSprings: -15%

Phoenix: -14%

Raleigh: -13%

San Antonio: -12%

Atlanta: -11%

Denver: -11%

Expect apartments rents in these markets to continue declining in 2026, as vacancy rates remain elevated.

Good news for renters, bad news for investors who bought near the peak.

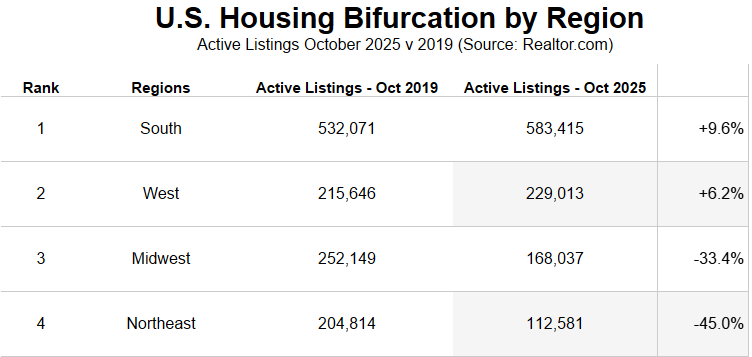

1) The deflationary rental environment, particularly in the Sun Belt area of America, is one reason why I believe we'll continue to see more inventory hit the market next year.

Simply put, many investors and landlords over-extended themselves during the pandemic boom, bought near peak values and low cap rates, and can't afford to hold properties through a declining rental environment.

Simply put, many investors and landlords over-extended themselves during the pandemic boom, bought near peak values and low cap rates, and can't afford to hold properties through a declining rental environment.

2) And it's likely we continue to see waves of homes hit the market for rent next year as well.

For instance, take a look at this property north of Nashville.

It was bought for $370k in 2021 and the owner has now listed it for rent at $2,300/month.

That's a poor gross rent yield, and the underlying cap rate is probably only around 4-5%.

But the reason the owner is doing it is because they have a 2.9% mortgage rate, and a low $1,450/month mortgage P&I payment as a result.

For instance, take a look at this property north of Nashville.

It was bought for $370k in 2021 and the owner has now listed it for rent at $2,300/month.

That's a poor gross rent yield, and the underlying cap rate is probably only around 4-5%.

But the reason the owner is doing it is because they have a 2.9% mortgage rate, and a low $1,450/month mortgage P&I payment as a result.

3) In the case of this rental, the profit will be only about $900 per year for this owner with typical rental expense assumptions.

It could be higher than that if the house sits vacant for longer than a month, or if the tenants who take the property have numerous maintenance requests.

In this case - the owner is likely thinking it's "worth it" to rent because they have a long-term view that the market is worth owning in.

However, the more individual owners that make this choice to rent their house instead of sell it, the more it will drive down rent growth, and turn rents negative.

Which will harm the market overall.

It could be higher than that if the house sits vacant for longer than a month, or if the tenants who take the property have numerous maintenance requests.

In this case - the owner is likely thinking it's "worth it" to rent because they have a long-term view that the market is worth owning in.

However, the more individual owners that make this choice to rent their house instead of sell it, the more it will drive down rent growth, and turn rents negative.

Which will harm the market overall.

4) In this way, you can see how important rent growth is for determining the future of the for sale housing market.

Declining rents puts pressure on investors to sell, and will create distressed situations for investors who bought near peak prices, especially after mortgage rates went up.

Moreover - declining rents makes the decision much easier for renter households to stay renting. Which suppresses buyer demand.

Declining rents puts pressure on investors to sell, and will create distressed situations for investors who bought near peak prices, especially after mortgage rates went up.

Moreover - declining rents makes the decision much easier for renter households to stay renting. Which suppresses buyer demand.

5) One reality of the increased rental inventory on the market, and declining rents, is that is has spared the for-sale housing market from a worse fate over the last 1-2 years.

Owners like in the house above, who would have normally been compelled to sell their house, are renting it because of their cheap mortgage rate.

However, one has to wonder how long the for-sale market (which is also declining in many Sun Belt markets) will be spared from its impending fate.

Owners like in the house above, who would have normally been compelled to sell their house, are renting it because of their cheap mortgage rate.

However, one has to wonder how long the for-sale market (which is also declining in many Sun Belt markets) will be spared from its impending fate.

6) The mortgage rate "lock-in" effect, which has suppressed inventory on the for sale market, eases with each passing day and month.

By the end of this year, it's likely there will be more mortgage holders in America with a 6%+ rate than a sub-3% rate.

Meaning more owners will feel the financial pressure to sell due to a higher mortgage payment.

By the end of this year, it's likely there will be more mortgage holders in America with a 6%+ rate than a sub-3% rate.

Meaning more owners will feel the financial pressure to sell due to a higher mortgage payment.

7) In some ways, you can think of the housing market right now as a "race" between how much rents go up and how much the payment for existing mortgage holders goes up.

Right now - the payments for existing mortgage holders are going up faster than rents, and now exceed rents.

Which means there will be more pressure for sale inventory to rise in the future, as more owners who move out of their homes face a financial decision to disfavor renting.

The reason the market has been frozen the last 3+ years is because the cost to buy a house has vaulted way higher than the cost to rent and the cost of existing owners.

Telling most renters and existing owners to stay in place.

(/also forcing the existing owners who do need to move to rent their house instead of sell it)

Right now - the payments for existing mortgage holders are going up faster than rents, and now exceed rents.

Which means there will be more pressure for sale inventory to rise in the future, as more owners who move out of their homes face a financial decision to disfavor renting.

The reason the market has been frozen the last 3+ years is because the cost to buy a house has vaulted way higher than the cost to rent and the cost of existing owners.

Telling most renters and existing owners to stay in place.

(/also forcing the existing owners who do need to move to rent their house instead of sell it)

8) But as downward pressure on rents increases, it will cause more existing owners to be forced to sell instead of rent when they move. Think about the example of the house in Nashville above. But fast forward 2 years.

The owner who bought the 2023 version of that house did so with a 6%+ mortgage rate, and has a P&I payment close to $2,000.

And when they move, they would lose around $6,000 per year if they rented. Meaning they'll be more inclined to sell.

The owner who bought the 2023 version of that house did so with a 6%+ mortgage rate, and has a P&I payment close to $2,000.

And when they move, they would lose around $6,000 per year if they rented. Meaning they'll be more inclined to sell.

9) This is why focusing on the rental market will help you as a buyer or investor in 2026.

A declining rental market is a strong suggestion that the for sale market will also decline in the future year, given the dynamics of the mortgage rate lock-in effect and the calculus made by first-time buyers on buying v renting.

Expect more inventory to hit the market for sale in areas where rents are declining, and buyer demand to be suppressed in these areas even if rates drop.

You can access the 12-month price forecast for your area, which takes into account inventory, DOM, and price cut trends, at reventure.app.

A declining rental market is a strong suggestion that the for sale market will also decline in the future year, given the dynamics of the mortgage rate lock-in effect and the calculus made by first-time buyers on buying v renting.

Expect more inventory to hit the market for sale in areas where rents are declining, and buyer demand to be suppressed in these areas even if rates drop.

You can access the 12-month price forecast for your area, which takes into account inventory, DOM, and price cut trends, at reventure.app.

• • •

Missing some Tweet in this thread? You can try to

force a refresh