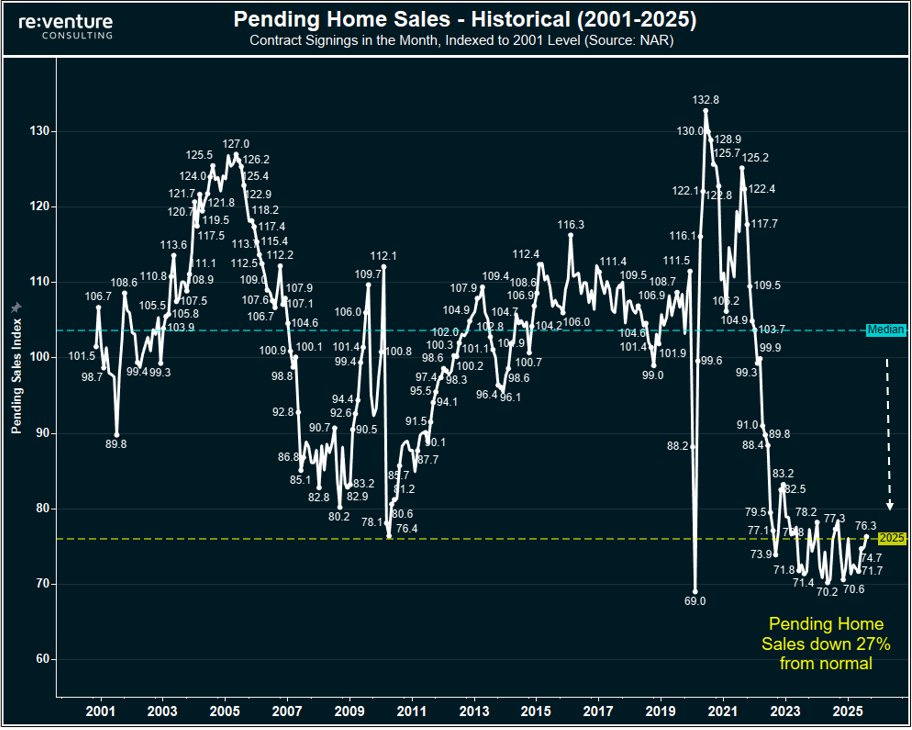

Why has the housing market been frozen since 2022?

Because the cost to buy a house with a mortgage (green) vaulted way above the a) cost to rent and b) the mortgage cost for existing owners.

The net result is that few people have a financial incentive to move. Cheaper to stay renting, cheaper to stay in current house/mortgage.

But - one interesting trend we are beginning to notice is the mortgage payment for existing owners (orange) is now growing faster than rent.

This is reversed from the post-pandemic period. Where sub-3% mortgages and still cheap taxes/insurance made for a very low cost to own for existing mortgage holders.

Now - taxes and insurance are up, and more of the mortgaged population is holding a 6%+ rate. So the costs for existing mortgage holders are rising.

This likely means we'll see more existing owners elect to sell in 2026, as it becomes less profitable for the average homeowner to rent out their house. And more profitable to cash out on your equity, sell, and rent for a bit until market corrects.

Translation: expect more for sale inventory, and more downward price pressure in the for sale market.

Because the cost to buy a house with a mortgage (green) vaulted way above the a) cost to rent and b) the mortgage cost for existing owners.

The net result is that few people have a financial incentive to move. Cheaper to stay renting, cheaper to stay in current house/mortgage.

But - one interesting trend we are beginning to notice is the mortgage payment for existing owners (orange) is now growing faster than rent.

This is reversed from the post-pandemic period. Where sub-3% mortgages and still cheap taxes/insurance made for a very low cost to own for existing mortgage holders.

Now - taxes and insurance are up, and more of the mortgaged population is holding a 6%+ rate. So the costs for existing mortgage holders are rising.

This likely means we'll see more existing owners elect to sell in 2026, as it becomes less profitable for the average homeowner to rent out their house. And more profitable to cash out on your equity, sell, and rent for a bit until market corrects.

Translation: expect more for sale inventory, and more downward price pressure in the for sale market.

1) The other obvious conclusion from the graph above is that finding a way to drive down the cost to buy a house would help unlock the housing market.

e.g., the closer the Mortgage Payment to Buy goes to Monthly Rent and Mortgage Cost for Current Owners, the more home sale transactions will take place.

As the financial incentive to move increases.

e.g., the closer the Mortgage Payment to Buy goes to Monthly Rent and Mortgage Cost for Current Owners, the more home sale transactions will take place.

As the financial incentive to move increases.

2) But that's proving harder to do to than anticipated.

The Fed has cut rates by 1.50% over the last year+, and there has been no meaningful decline in Mortgage Rates.

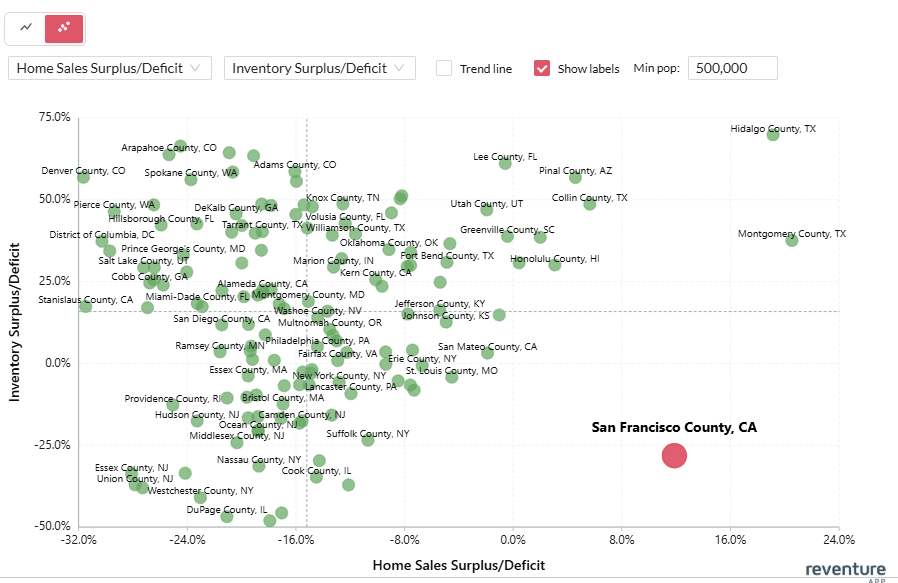

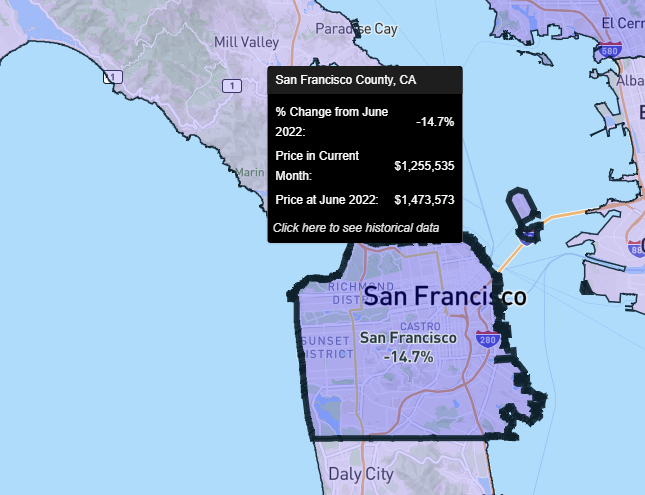

Meanwhile - national prices are still at near a record high, even if values are dropping in some markets.

The Fed has cut rates by 1.50% over the last year+, and there has been no meaningful decline in Mortgage Rates.

Meanwhile - national prices are still at near a record high, even if values are dropping in some markets.

3) The likely solution at this point seems to be a slow grind down on the cost to buy, through incremental cuts in prices and rates.

This will bring more buyers out of the woodwork, slowly.

The thing that would bring lots of buyers out of the market, quickly, is if rents were going up fast. Because that greatly increase the financial incentive to purchase.

(e.g., if you're thinking about buying, and your landlord increases your renewal rent by 10%, you'll start seriously looking to buy. Conversely, if your landlord keeps your rents to same or cuts the rent, you'll stay put)

This will bring more buyers out of the woodwork, slowly.

The thing that would bring lots of buyers out of the market, quickly, is if rents were going up fast. Because that greatly increase the financial incentive to purchase.

(e.g., if you're thinking about buying, and your landlord increases your renewal rent by 10%, you'll start seriously looking to buy. Conversely, if your landlord keeps your rents to same or cuts the rent, you'll stay put)

4) This type of thing happened in the late 1970s/early 1980s. Rents were surging during this period of massive inflation, which is what kept the buyer demand continually flooding into the housing market. Even at poor affordability levels.

However, today is not like the late 1970s/early 1980s.

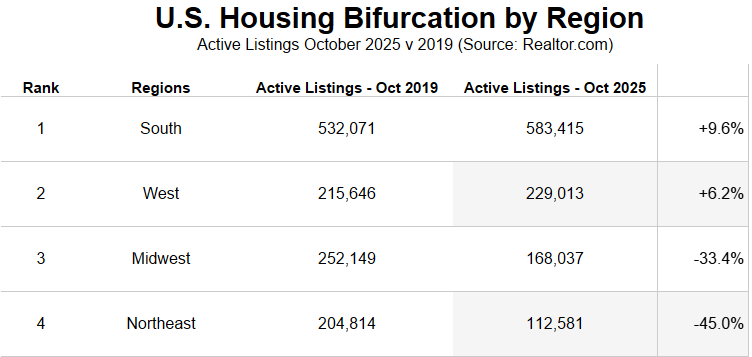

Rents, instead of inflating, are disinflating, and even going negative in many markets.

However, today is not like the late 1970s/early 1980s.

Rents, instead of inflating, are disinflating, and even going negative in many markets.

5) Which is of course great news for regular Americans. For the first time in a long time, affordability is increasing.

Especially in a market like Austin, TX, where rents have now dropped to pre-pandemic levels.

Rents are down 21% in this market since peak, while wages have kept growing.

Now - it has become very affordable to rent in a market like Austin. A huge win for locals and those looking to move there.

Especially in a market like Austin, TX, where rents have now dropped to pre-pandemic levels.

Rents are down 21% in this market since peak, while wages have kept growing.

Now - it has become very affordable to rent in a market like Austin. A huge win for locals and those looking to move there.

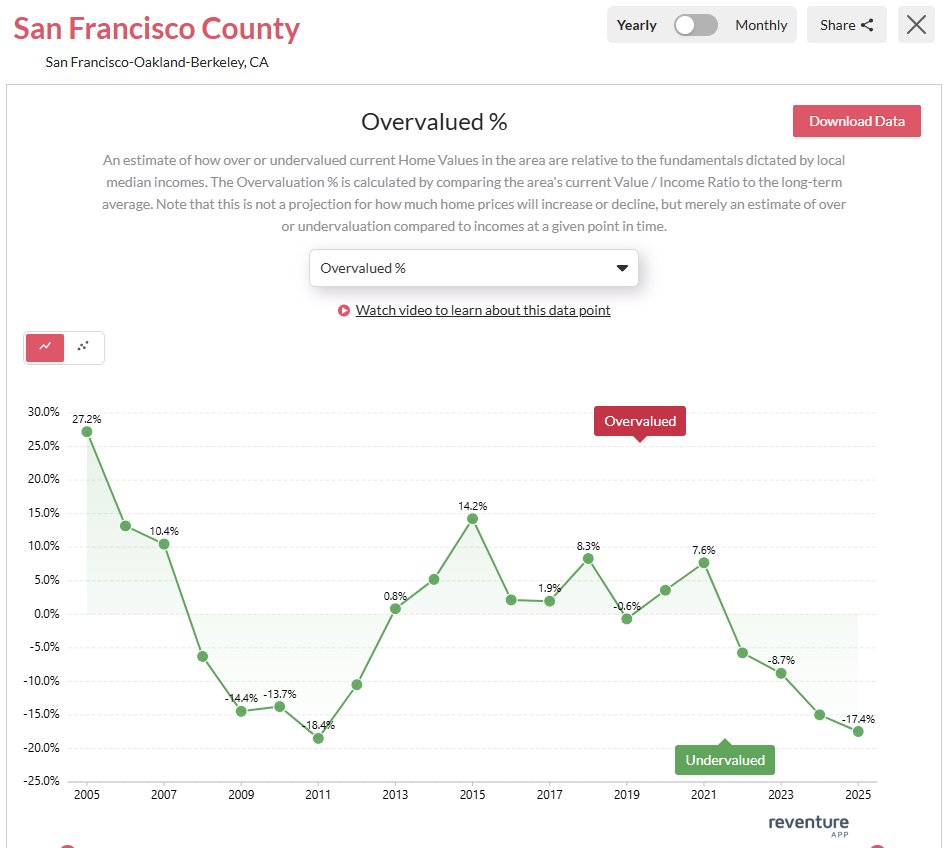

6) But this is bad news for home prices and incremental homebuyer demand.

Cheaper rents means there is no real incentive to buy.

Especially when the cost to buy is already 30-40% more expensive than the cost to rent on a monthly basis, and when nominal prices are overvalued relative to income.

Cheaper rents means there is no real incentive to buy.

Especially when the cost to buy is already 30-40% more expensive than the cost to rent on a monthly basis, and when nominal prices are overvalued relative to income.

7) Reventure calculates the U.S. Housing Market as 13% overvalued right now compared to median income, based on multiples going back the last two+ decades.

What this means, intuitively, is that when Americans look on Zillow they think the prices look high relative to how much money they make.

So long as this situation of overvaluation persists, especially in the context of flat or declining rents, buyer demand will stay muted.

What this means, intuitively, is that when Americans look on Zillow they think the prices look high relative to how much money they make.

So long as this situation of overvaluation persists, especially in the context of flat or declining rents, buyer demand will stay muted.

8) Some other things to think about in this equation on buyer/renter demand, and home price/rent deflation, is the following:

-immigration (slowing, potentially negative in 2025)

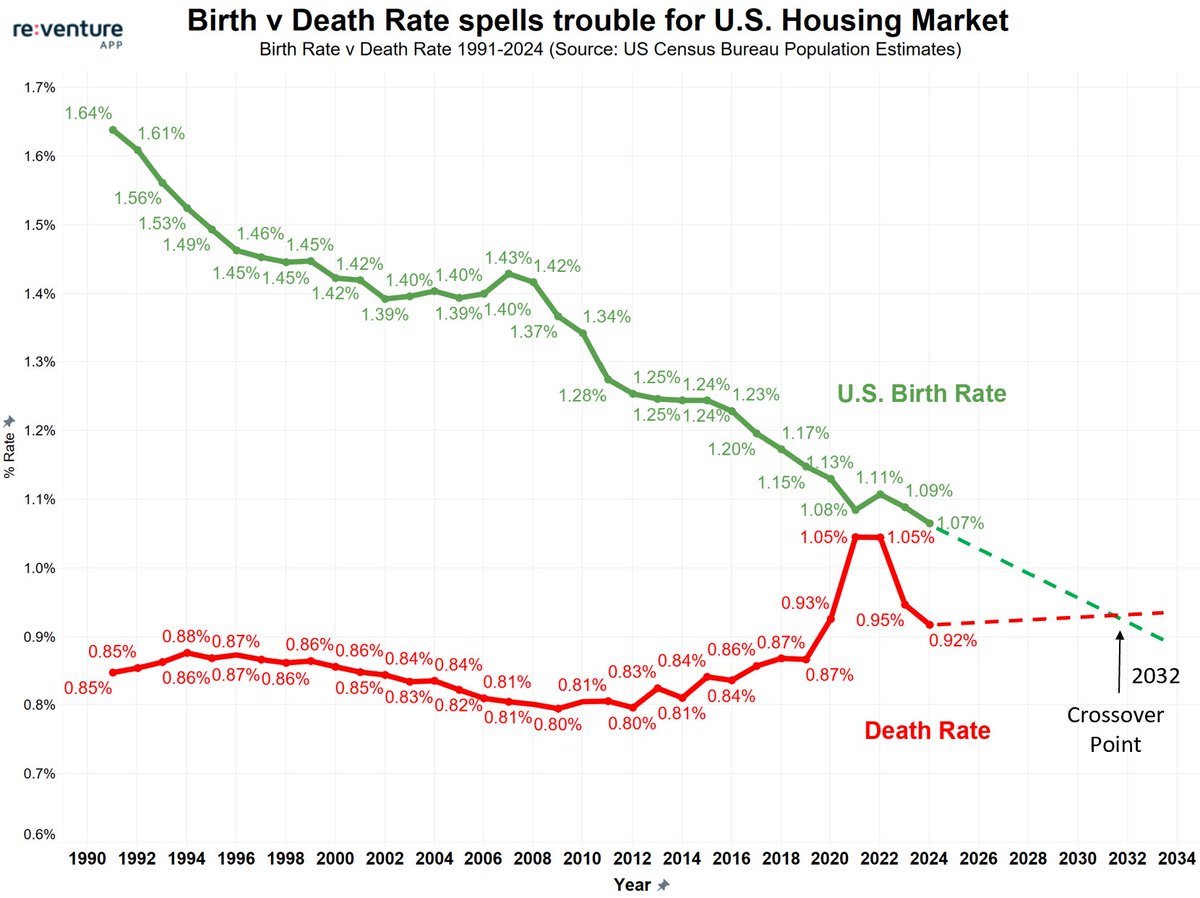

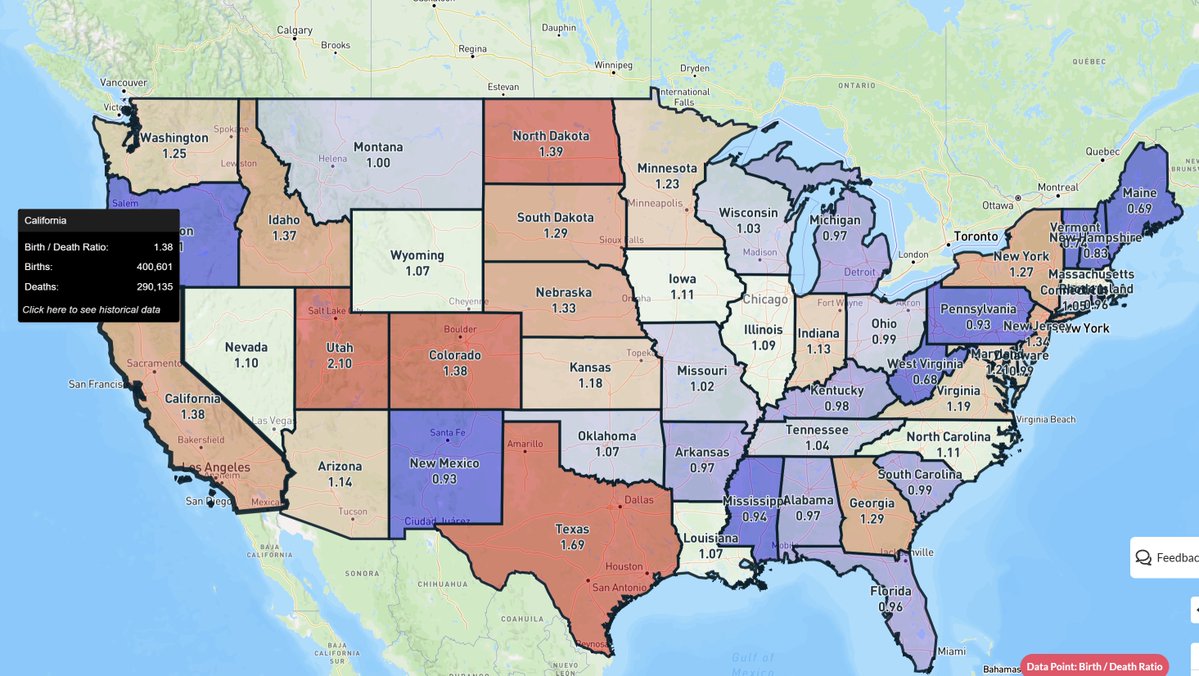

-family formation/births (slowing, near lowest on record)

-job insecurity. (favors household consolidation, less demand to rent and buy)

All of these trends are pressing their thumb down on the housing market at once.

-immigration (slowing, potentially negative in 2025)

-family formation/births (slowing, near lowest on record)

-job insecurity. (favors household consolidation, less demand to rent and buy)

All of these trends are pressing their thumb down on the housing market at once.

9) From speaking to homebuyers and prospective buyers around the U.S., I am getting the following anecdotal sense of the market:

-many people in white collar, high income finance and tech jobs do not feel secure in their job. Many feel like, tomorrow, or 12 months from now, the job might be gone. As a result, they are staying renting and electing not to buy.

-more young people are staying single, exiting the dating market, focusing on developing their careers. (maybe also a result of job insecurity). the result is lower relationship and family formation, and lower birth rates, which is suppressing homebuyer demand.

-however, in some ways, this lower family formation increases household formation, as more people live on their own. which is good for rental market.

-immigration is definitely way down, we don't know by exactly how much yet. Trump Admin says 2 million people have been actually deported, or self-deported. Border crossings have dropped to almost 0. lower immigration has a lagged effect on housing market, and most of its impact is through lower renter demand.

-many people in white collar, high income finance and tech jobs do not feel secure in their job. Many feel like, tomorrow, or 12 months from now, the job might be gone. As a result, they are staying renting and electing not to buy.

-more young people are staying single, exiting the dating market, focusing on developing their careers. (maybe also a result of job insecurity). the result is lower relationship and family formation, and lower birth rates, which is suppressing homebuyer demand.

-however, in some ways, this lower family formation increases household formation, as more people live on their own. which is good for rental market.

-immigration is definitely way down, we don't know by exactly how much yet. Trump Admin says 2 million people have been actually deported, or self-deported. Border crossings have dropped to almost 0. lower immigration has a lagged effect on housing market, and most of its impact is through lower renter demand.

10) So the demographic/economic climate right now is definitely a negative for homebuyer demand. Lower family formation means lower structural buyer demand, more job insecurity means lower buyer demand, and the affordability calc also says lower buyer demand.

So it's 3 strikes on homebuyer demand, which explains why it has been so low the last 3 years.

We might see a bit of a bounceback in demand in 2026, as some people who have been waiting will simply have to buy at some point.

But I don't anticipate a rapid improvement in buyer demand next year given the current conditions.

So it's 3 strikes on homebuyer demand, which explains why it has been so low the last 3 years.

We might see a bit of a bounceback in demand in 2026, as some people who have been waiting will simply have to buy at some point.

But I don't anticipate a rapid improvement in buyer demand next year given the current conditions.

11) The rental market is more complex.

The demographic forces favor it immensely, as lower family formation and births means more people will be renting, structurally.

The affordability calculus also says more people should be renting.

However - the plunge in immigration and job insecurity are outweighing these factors right now. And causing vacancies to go up and rents to drop in many markets.

The demographic forces favor it immensely, as lower family formation and births means more people will be renting, structurally.

The affordability calculus also says more people should be renting.

However - the plunge in immigration and job insecurity are outweighing these factors right now. And causing vacancies to go up and rents to drop in many markets.

12) If 2026 is another year with low immigration and continued job insecurity, I think we could see outright deflation across the entire U.S. Housing Market, both on for sale and rent side.

Personally, I think this would be a good thing, as it would mean Americans would finally be receiving the affordable gains they've been looking for the last 4-5 years.

However, many in the housing industry might not like it. As it will likely mean more investors selling, lower home prices, lower rents, and another year of low buyer demand.

But it's probably what needs to happen to set the housing market up for a rebound in 2027 and beyond. So let's get it over with.

Personally, I think this would be a good thing, as it would mean Americans would finally be receiving the affordable gains they've been looking for the last 4-5 years.

However, many in the housing industry might not like it. As it will likely mean more investors selling, lower home prices, lower rents, and another year of low buyer demand.

But it's probably what needs to happen to set the housing market up for a rebound in 2027 and beyond. So let's get it over with.

• • •

Missing some Tweet in this thread? You can try to

force a refresh