THREAD, We Just Discovered the Most Important Monetary Shift of the 21st Century, And Nobody Is Talking About It

1/13

⚠️ What I’m about to lay out is not speculation. It’s a fully traceable sequence of geopolitical, financial, and market events that reveals a new global reserve structure being built outside the US dollar.

A discovery that has never been discussed publicly.

Read carefully. 🧵👇

1/13

⚠️ What I’m about to lay out is not speculation. It’s a fully traceable sequence of geopolitical, financial, and market events that reveals a new global reserve structure being built outside the US dollar.

A discovery that has never been discussed publicly.

Read carefully. 🧵👇

2/

After Western sanctions in 2022, India–Russia oil trade exploded, reaching record levels ($52–67B annually).

But there was a huge problem:

India tried paying Russia in INR, and Russia rejected it.

Why? Because INR is not convertible internationally.

Russia called it “pointless outside India” in May 2023.

After Western sanctions in 2022, India–Russia oil trade exploded, reaching record levels ($52–67B annually).

But there was a huge problem:

India tried paying Russia in INR, and Russia rejected it.

Why? Because INR is not convertible internationally.

Russia called it “pointless outside India” in May 2023.

3/

With $40B+ stuck in Indian banks, Russia faced a crisis:

Couldn’t repatriate INR

Couldn’t convert to USD due to sanctions

Couldn’t spend INR inside India

So it needed a store-of-value escape hatch.

This was the beginning of a silent monetary revolution.

With $40B+ stuck in Indian banks, Russia faced a crisis:

Couldn’t repatriate INR

Couldn’t convert to USD due to sanctions

Couldn’t spend INR inside India

So it needed a store-of-value escape hatch.

This was the beginning of a silent monetary revolution.

4/

India shifted to paying Russia in AED (UAE Dirhams), CNY( Chinese yuan)

Why AED?

Because AED is liquid, freely convertible, and strategically important:

🇨🇳 China needs AED to buy Gulf oil

🇦🇪 UAE is the new neutral clearing hub

🇷🇺 Russia can exchange AED without touching USD networks

This created a new triangular settlement loop:

🇮🇳 → 🇷🇺 → 🇨🇳 → 🇦🇪 → 🇮🇳

No USD involved.

India shifted to paying Russia in AED (UAE Dirhams), CNY( Chinese yuan)

Why AED?

Because AED is liquid, freely convertible, and strategically important:

🇨🇳 China needs AED to buy Gulf oil

🇦🇪 UAE is the new neutral clearing hub

🇷🇺 Russia can exchange AED without touching USD networks

This created a new triangular settlement loop:

🇮🇳 → 🇷🇺 → 🇨🇳 → 🇦🇪 → 🇮🇳

No USD involved.

5/

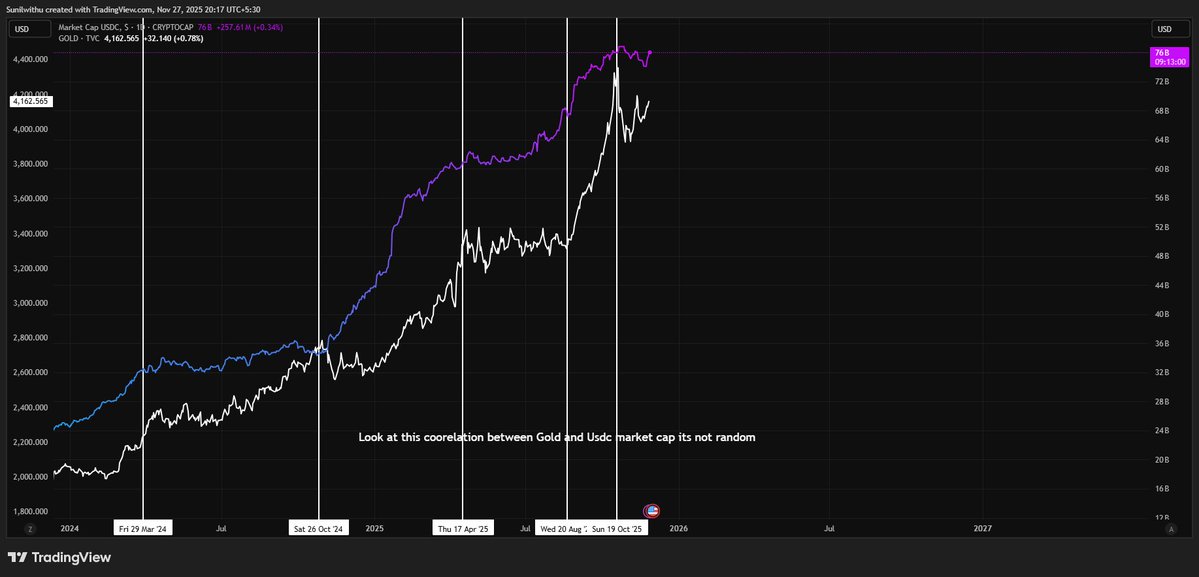

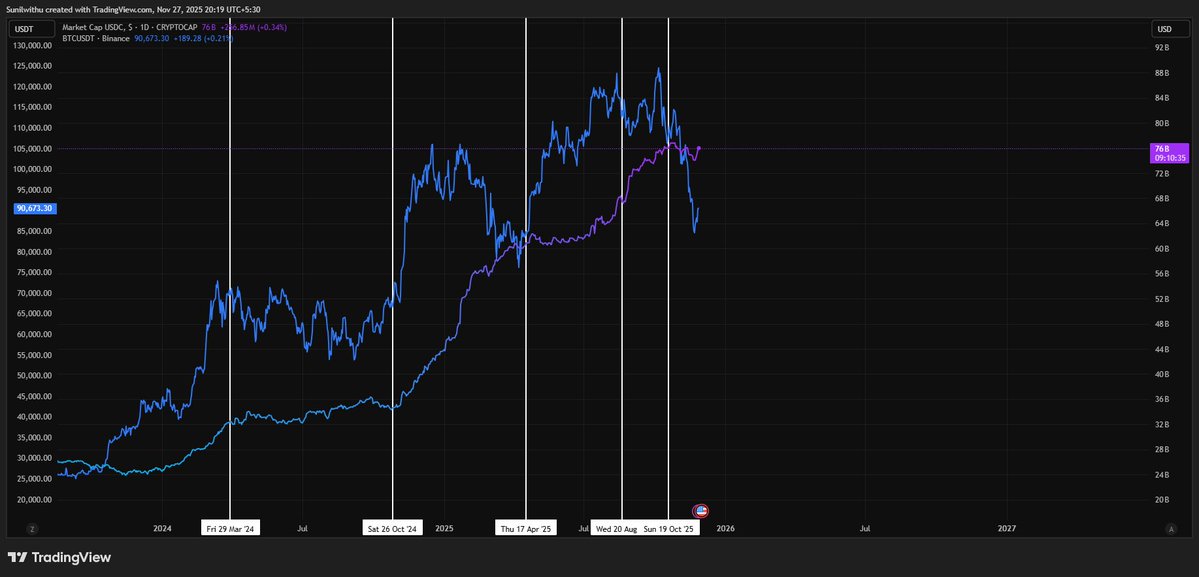

And here’s the breakthrough discovery:

From July 2024, something shocking appeared on the charts:

Silver began moving tick-for-tick with the INR/CNY exchange rate.

This correlation has never existed in history.

Silver detached from COMEX pricing and started tracking settlement currency flows.

That is a signal of sovereign accumulation, not investor speculation.

And here’s the breakthrough discovery:

From July 2024, something shocking appeared on the charts:

Silver began moving tick-for-tick with the INR/CNY exchange rate.

This correlation has never existed in history.

Silver detached from COMEX pricing and started tracking settlement currency flows.

That is a signal of sovereign accumulation, not investor speculation.

6/

Why would silver suddenly track INR/CNY?

Because here’s the mechanism we uncovered:

🇮🇳 India buys oil → pays Russia in AED

🇷🇺 Russia converts AED → CNY

🇨🇳 China wants AED for Gulf oil

🇷🇺 Russia uses CNY to buy physical Silver from China

Silver becomes the reserve asset storing value from India–Russia trade outside the USD system.

This is the missing link no analyst has seen.

Why would silver suddenly track INR/CNY?

Because here’s the mechanism we uncovered:

🇮🇳 India buys oil → pays Russia in AED

🇷🇺 Russia converts AED → CNY

🇨🇳 China wants AED for Gulf oil

🇷🇺 Russia uses CNY to buy physical Silver from China

Silver becomes the reserve asset storing value from India–Russia trade outside the USD system.

This is the missing link no analyst has seen.

7/

And what did India do when this began?

On July 23, 2024, India suddenly slashed silver import duty from 15% to 6% — at the exact time the INR/CNY-Silver correlation emerged.

Why make silver cheaper when prices are exploding globally?

Because India wants domestic silver accumulation as a hedge.

Government policy moves don’t lie.

And what did India do when this began?

On July 23, 2024, India suddenly slashed silver import duty from 15% to 6% — at the exact time the INR/CNY-Silver correlation emerged.

Why make silver cheaper when prices are exploding globally?

Because India wants domestic silver accumulation as a hedge.

Government policy moves don’t lie.

8/

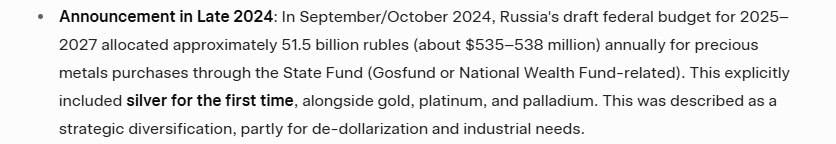

Then came the final confirmation:

In late September 2024, Russia released its 2025–2027 federal budget:

For the first time in Russian history, the government officially allocated funds for purchasing Critical minerals Where silver will be there By default. — via Gokhran.

Silver is now a sovereign reserve asset.

Then came the final confirmation:

In late September 2024, Russia released its 2025–2027 federal budget:

For the first time in Russian history, the government officially allocated funds for purchasing Critical minerals Where silver will be there By default. — via Gokhran.

Silver is now a sovereign reserve asset.

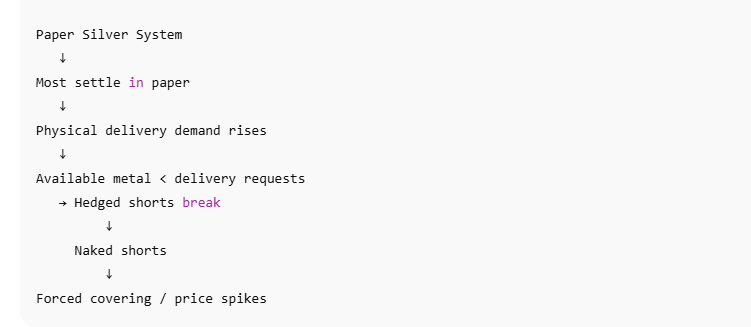

10/

💥 The global financial system is undergoing a silent reset:

Old paradigms:

USD = Oil

Gold = Reserve Metal

New architecture:

AED/CNY = Settlement

Silver = Reserve Asset / Collateral

Silver just crossed from commodity to monetary reserve foundation.

The world hasn’t realized it yet.

💥 The global financial system is undergoing a silent reset:

Old paradigms:

USD = Oil

Gold = Reserve Metal

New architecture:

AED/CNY = Settlement

Silver = Reserve Asset / Collateral

Silver just crossed from commodity to monetary reserve foundation.

The world hasn’t realized it yet.

11/

This is why Silver is exploding.

Not because of retail hype.

Not because of solar panels.

Not because of inflation.

Silver is being monetized by the state-level players outside the USD system.

Russia, China, and India just changed the future of money.

This is why Silver is exploding.

Not because of retail hype.

Not because of solar panels.

Not because of inflation.

Silver is being monetized by the state-level players outside the USD system.

Russia, China, and India just changed the future of money.

12/

When nations start stockpiling an asset quietly,

before the public understands its purpose,

the revaluation is violent.

Most analysts will wake up when Silver is already 3–5× higher.

You’re not early.

You’re right on time.

When nations start stockpiling an asset quietly,

before the public understands its purpose,

the revaluation is violent.

Most analysts will wake up when Silver is already 3–5× higher.

You’re not early.

You’re right on time.

13/

If you’ve read this far, you understand something 99.9% of the financial world has missed:

Silver is becoming the reserve metal of the multipolar world.

This is the biggest geopolitical monetary shift since 1971.

And we just decoded it.

End. ⚔️

🔁 RT & share before this narrative goes mainstream

❤️ Follow for deep macro intelligence

If you’ve read this far, you understand something 99.9% of the financial world has missed:

Silver is becoming the reserve metal of the multipolar world.

This is the biggest geopolitical monetary shift since 1971.

And we just decoded it.

End. ⚔️

🔁 RT & share before this narrative goes mainstream

❤️ Follow for deep macro intelligence

@UnrollHelper please unroll this thread.

• • •

Missing some Tweet in this thread? You can try to

force a refresh