Tracking liquidity, debt cycles & stagflation. Gold, Silver & Macro trading insights. Funded Trader | Mentor. Timing beats Prediction

7 subscribers

How to get URL link on X (Twitter) App

2/

2/

2/12

2/12

POST 1 — Chart: Silver / Oil

POST 1 — Chart: Silver / Oil

1️⃣ PRICE IS NOT “RALLYING”, IT’S REPRICING

1️⃣ PRICE IS NOT “RALLYING”, IT’S REPRICING

2/

2/

2/

2/

2/

2/

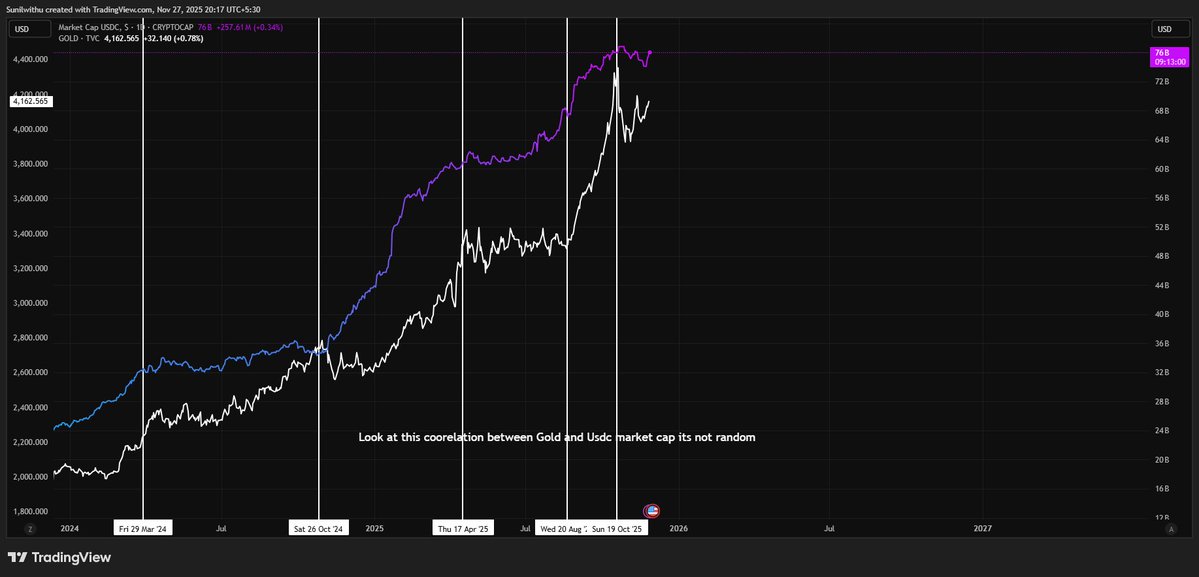

1️⃣ Stablecoins are not crypto toys anymore

1️⃣ Stablecoins are not crypto toys anymore

2/

2/

Tweet 2 — Clue 1: The jobs market stopped working as a signal

Tweet 2 — Clue 1: The jobs market stopped working as a signal

2️⃣

2️⃣

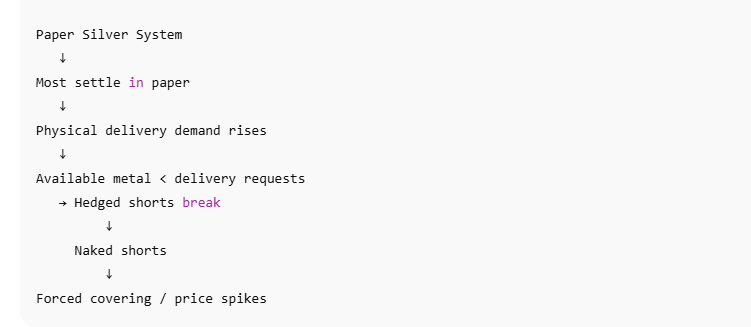

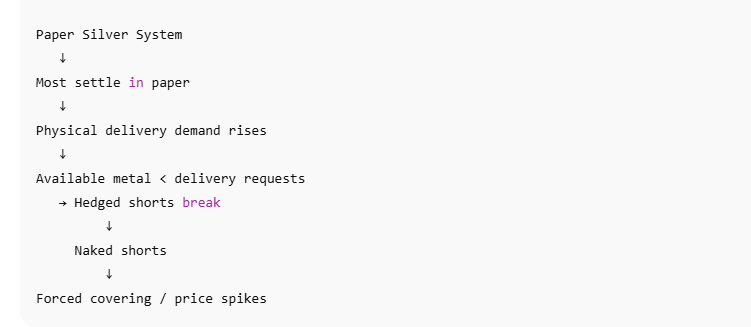

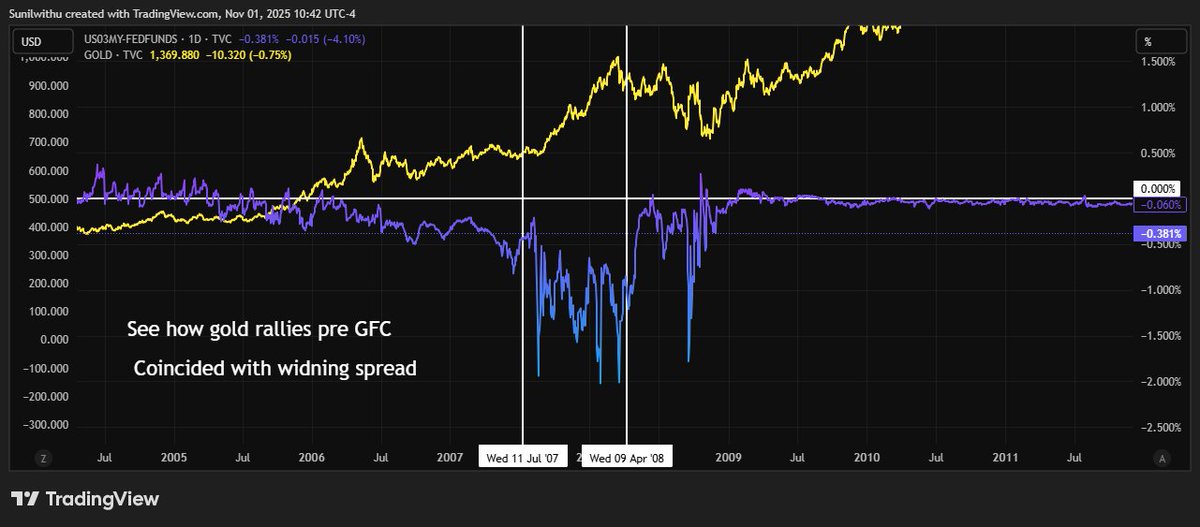

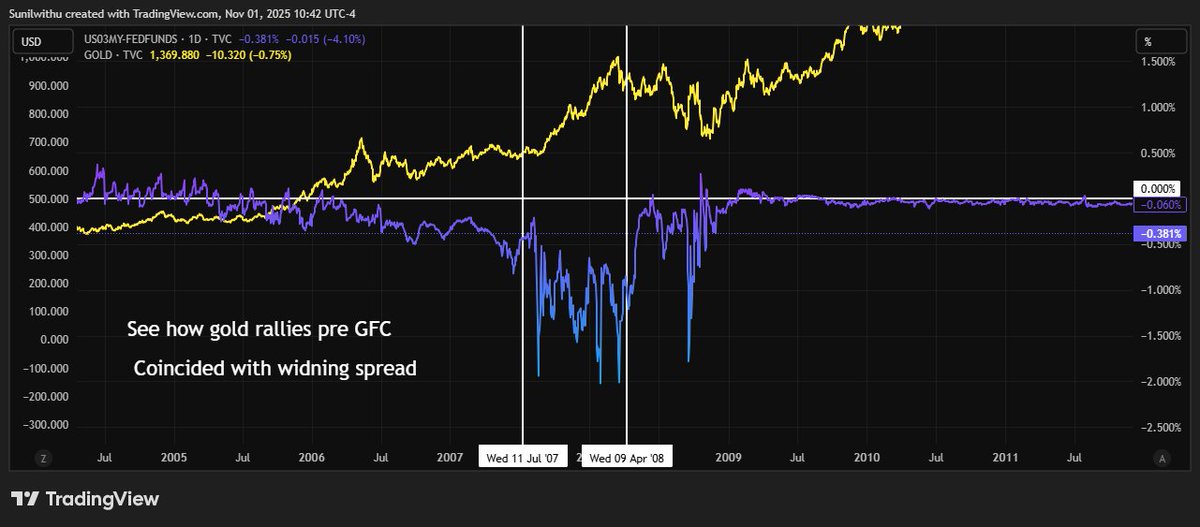

2️⃣ The pattern is clear:

2️⃣ The pattern is clear:

2/

2/

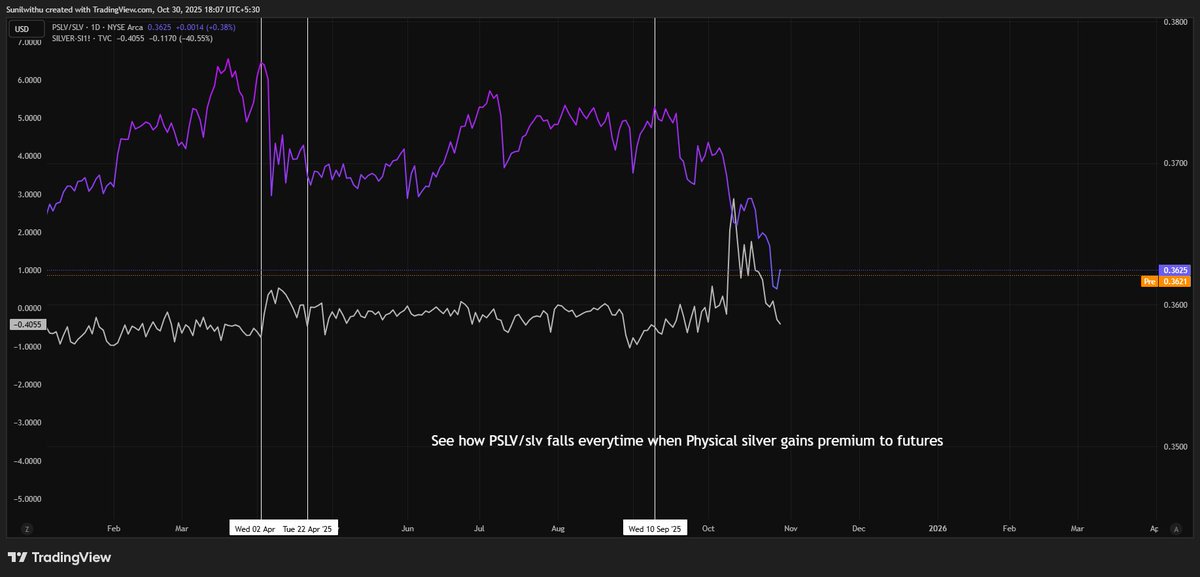

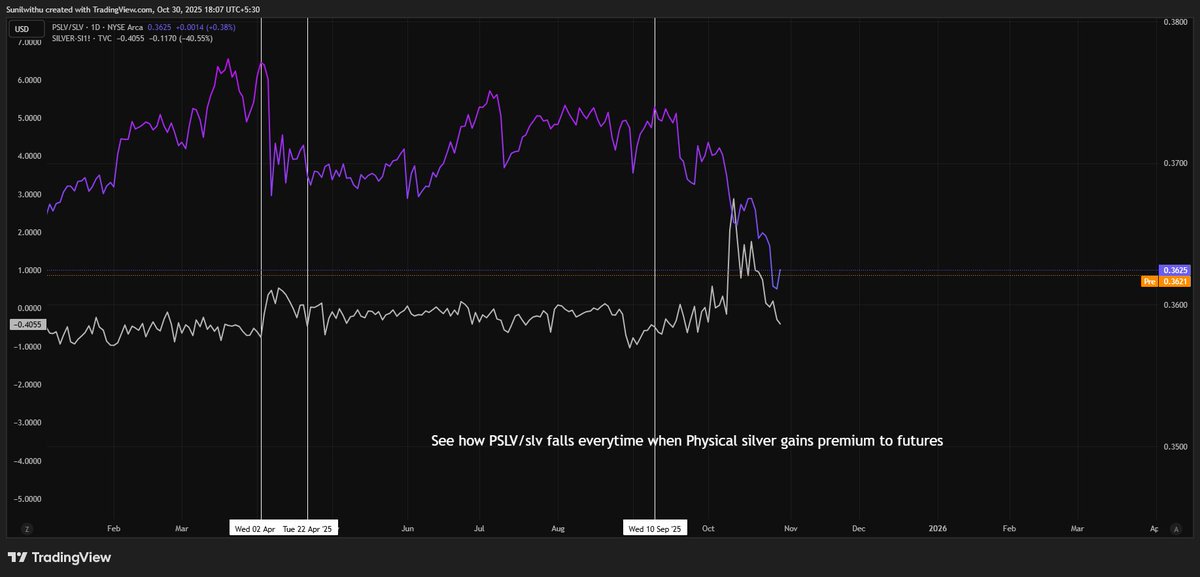

2️⃣

2️⃣

The SOFR–RRP spread — the heartbeat of the funding system — just surged to its highest level since the COVID crisis.

The SOFR–RRP spread — the heartbeat of the funding system — just surged to its highest level since the COVID crisis.

2/

2/

2/

2/