The tokenized deposit vs stablecoin fight is a distraction.

Banks multiply money. Stablecoins move it. We need both.

---

The tokenized deposit maxi says:

"Stablecoins are unregulated shadow banking. Everyone will prefer banks when they tokenize."

Some banks and central banks love this narrative.

--

The stablecoin maxi says:

"Banks are dinosaurs. We don't need them on-chain. Stablecoins are the future of money."

Crypto natives love this narrative.

---

Both miss the point.

Banks create cheap credit

Your $100 deposit becomes $90 in loans (and more)

- F500 companies park $500M at JPM.

- Get giant credit lines in return.

- Below-market rates.

The deposits are the bank's business model.

Tokenized deposits preserve this on-chain - but they're ONLY for bank customers.

---

Stablecoins work like cash

Circle and Tether hold 100% reserves. $

- 200B in T-Bills.

- Capture 4-5% yield.

- Pay you zero.

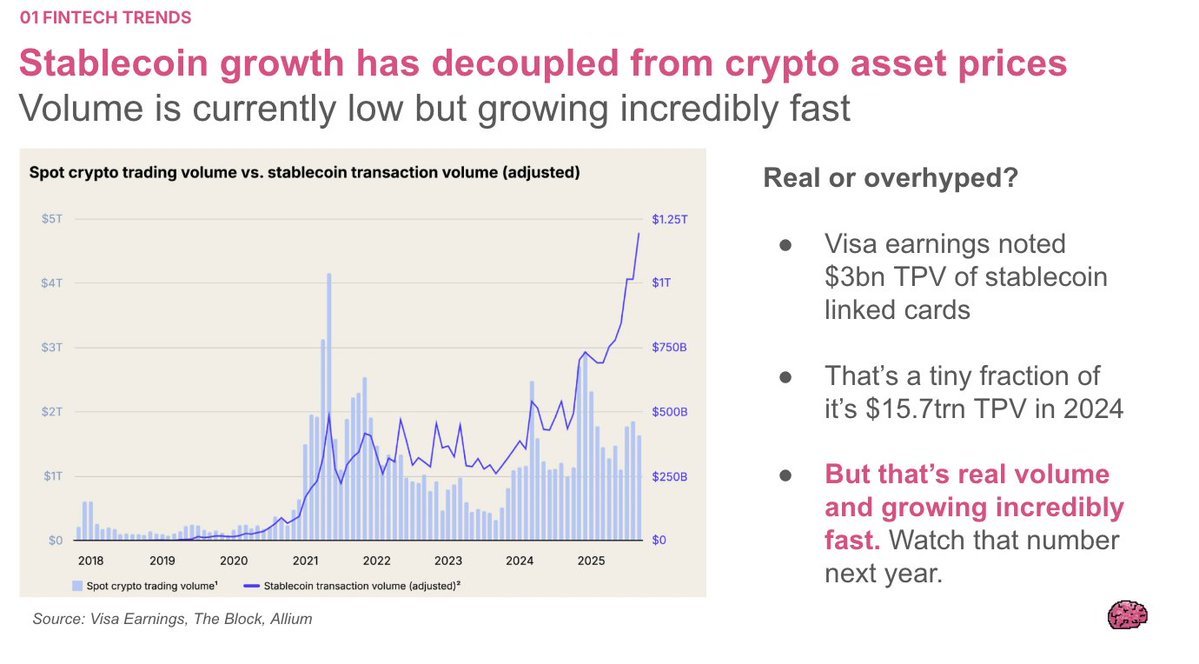

You get money outside any bank's perimeter. $9 trillion moved cross-border via stablecoins in 2025

Works anywhere with Internet. 24/7 without permission.

---

The future is both.

- F500 holds tokenized deposits at JPM.

- Gets favorable credit lines for US operations.

- Pays Argentine supplier.

- Swaps tokenized deposits for USDC.

On-chain. Atomic.

Best of both.

Use legacy rails where they work. Stables where they don't.

---

A rubric:

- Tokenized deposits → cheap credit inside bank perimeters

- Stablecoins → cash-like settlement outside bank rails

- On-chain swaps → instant conversion, zero settlement risk

---

Onchain > APIs

Smart contracts compose logic across multiple businesses and persons.

Deposit --> stablecoin --> invoice paid --> downstream payment happens.

---

e.g.

- When supplier's deposits land

- Smart contracts trigger inventory financing,

- Working capital lines, currency hedges.

From banks and non banks!

---

The future is on-chain

- Tokenized deposits solve for cheap credit.

- Deposits stay captive.

- Banks lend against them.

- Stablecoins solve for portability.

- Money moves anywhere without permission.

---

The tokenized deposit maxi wants regulated rails only.

The stablecoin maxi wants to kill banks.

The future needs both.

F500s want giant credit lines from their bank AND instant global settlement.

Emerging markets want local credit creation AND dollar access. DeFi wants composability AND real-world asset backing.

The fight over which one wins misses what's happening. The future of finance is on-chain. Both tokenized deposits and stablecoins are infrastructure for getting there.

Stop arguing about winners. Start building interoperability.

Composable money.

ST.

Banks multiply money. Stablecoins move it. We need both.

---

The tokenized deposit maxi says:

"Stablecoins are unregulated shadow banking. Everyone will prefer banks when they tokenize."

Some banks and central banks love this narrative.

--

The stablecoin maxi says:

"Banks are dinosaurs. We don't need them on-chain. Stablecoins are the future of money."

Crypto natives love this narrative.

---

Both miss the point.

Banks create cheap credit

Your $100 deposit becomes $90 in loans (and more)

- F500 companies park $500M at JPM.

- Get giant credit lines in return.

- Below-market rates.

The deposits are the bank's business model.

Tokenized deposits preserve this on-chain - but they're ONLY for bank customers.

---

Stablecoins work like cash

Circle and Tether hold 100% reserves. $

- 200B in T-Bills.

- Capture 4-5% yield.

- Pay you zero.

You get money outside any bank's perimeter. $9 trillion moved cross-border via stablecoins in 2025

Works anywhere with Internet. 24/7 without permission.

---

The future is both.

- F500 holds tokenized deposits at JPM.

- Gets favorable credit lines for US operations.

- Pays Argentine supplier.

- Swaps tokenized deposits for USDC.

On-chain. Atomic.

Best of both.

Use legacy rails where they work. Stables where they don't.

---

A rubric:

- Tokenized deposits → cheap credit inside bank perimeters

- Stablecoins → cash-like settlement outside bank rails

- On-chain swaps → instant conversion, zero settlement risk

---

Onchain > APIs

Smart contracts compose logic across multiple businesses and persons.

Deposit --> stablecoin --> invoice paid --> downstream payment happens.

---

e.g.

- When supplier's deposits land

- Smart contracts trigger inventory financing,

- Working capital lines, currency hedges.

From banks and non banks!

---

The future is on-chain

- Tokenized deposits solve for cheap credit.

- Deposits stay captive.

- Banks lend against them.

- Stablecoins solve for portability.

- Money moves anywhere without permission.

---

The tokenized deposit maxi wants regulated rails only.

The stablecoin maxi wants to kill banks.

The future needs both.

F500s want giant credit lines from their bank AND instant global settlement.

Emerging markets want local credit creation AND dollar access. DeFi wants composability AND real-world asset backing.

The fight over which one wins misses what's happening. The future of finance is on-chain. Both tokenized deposits and stablecoins are infrastructure for getting there.

Stop arguing about winners. Start building interoperability.

Composable money.

ST.

• • •

Missing some Tweet in this thread? You can try to

force a refresh