During this interview, Trevor graciously asked JP from $PEY.to a question about decline rates.

This is an important and telling thread for many reasons, including misinformation on X and the truth about resource plays.

Buckle up 🧵 1/x

This is an important and telling thread for many reasons, including misinformation on X and the truth about resource plays.

Buckle up 🧵 1/x

https://twitter.com/trevor_rose_/status/1966194317627928592

Here's the question:

“Why is Peyto’s decline rates higher than your peers (if that’s the case)?

Trevor followed, “I don’t think it is”

And JP responds, “I don’t think it is either so I don’t know how to answer that”

In short JP said… What the hell is he talking about?

3/x

“Why is Peyto’s decline rates higher than your peers (if that’s the case)?

Trevor followed, “I don’t think it is”

And JP responds, “I don’t think it is either so I don’t know how to answer that”

In short JP said… What the hell is he talking about?

3/x

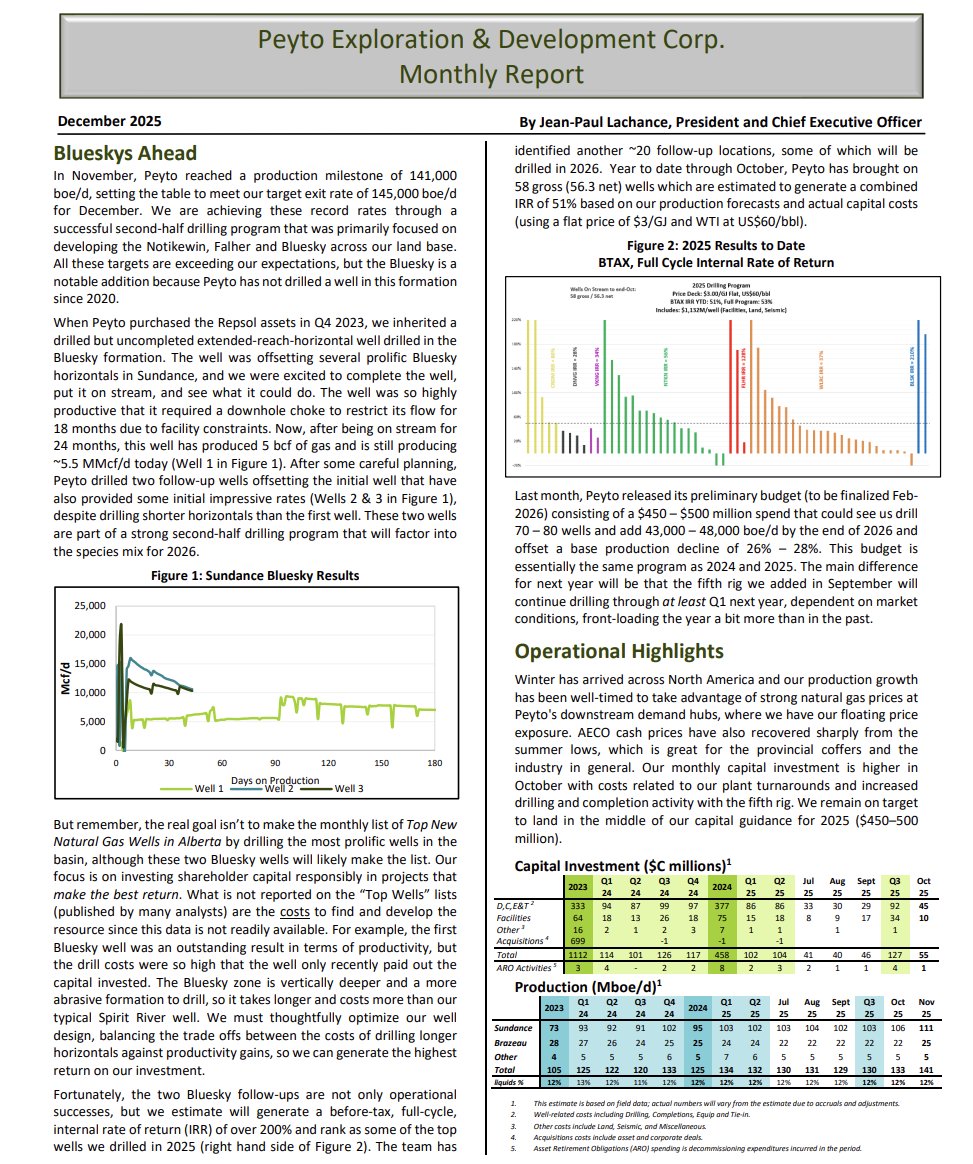

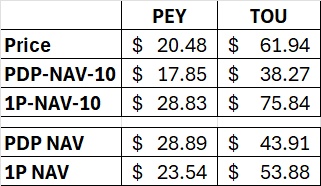

JP then explains how Peyto has a 10 yr PDP reserve life index and concludes, “so I wouldn’t consider our decline rates higher.”

(For ref. - $TOU 6 yrs & $ARX 4 yrs PDP RLI)

He ends by says Peyto is also transparent, the decline rate is in the corporate presentation. 😂

4/x

(For ref. - $TOU 6 yrs & $ARX 4 yrs PDP RLI)

He ends by says Peyto is also transparent, the decline rate is in the corporate presentation. 😂

4/x

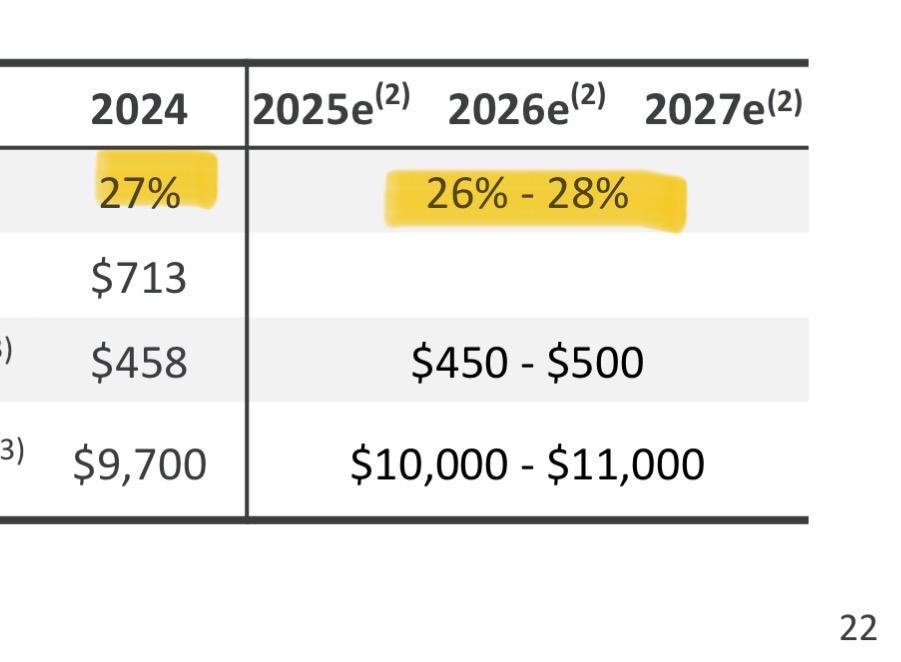

Here is the slide in the $PEY.to corp deck.

Decline rate of 27% in 2024 and expected decline rate of 26-28% in 2025-2027

5/x

Decline rate of 27% in 2024 and expected decline rate of 26-28% in 2025-2027

5/x

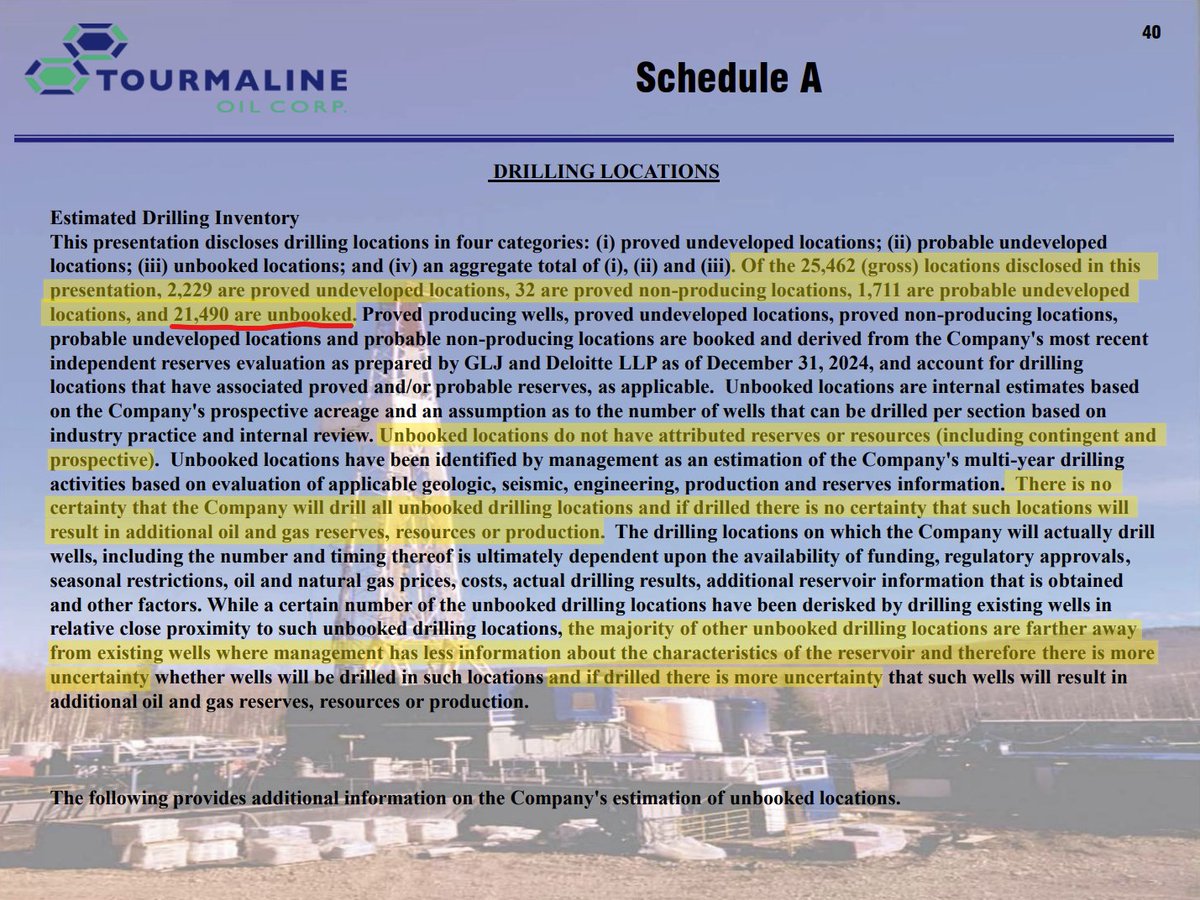

So how does this compare to other NG peers?

Here is the data from Peter’s & Co:

BIR = 25%

PEY = 27%

TOU = 33%

ARX = 35%

NVA = 40%

This is remarkable. Far from having a high decline rate, Peyto actually has a very low decline rate.

But that's not all, let’s continue 🫡

6/x

Here is the data from Peter’s & Co:

BIR = 25%

PEY = 27%

TOU = 33%

ARX = 35%

NVA = 40%

This is remarkable. Far from having a high decline rate, Peyto actually has a very low decline rate.

But that's not all, let’s continue 🫡

6/x

Mike Rose from In the Money Podcast, on the Montney:

“…you have to replace a third (33%) or your production every year”

And, “...the gas business with resource plays, it’s a treadmill and it’s a REALLY BIG TREADMILL and it GOES REALLY FAST.” (Added emphasis)

7/x

“…you have to replace a third (33%) or your production every year”

And, “...the gas business with resource plays, it’s a treadmill and it’s a REALLY BIG TREADMILL and it GOES REALLY FAST.” (Added emphasis)

7/x

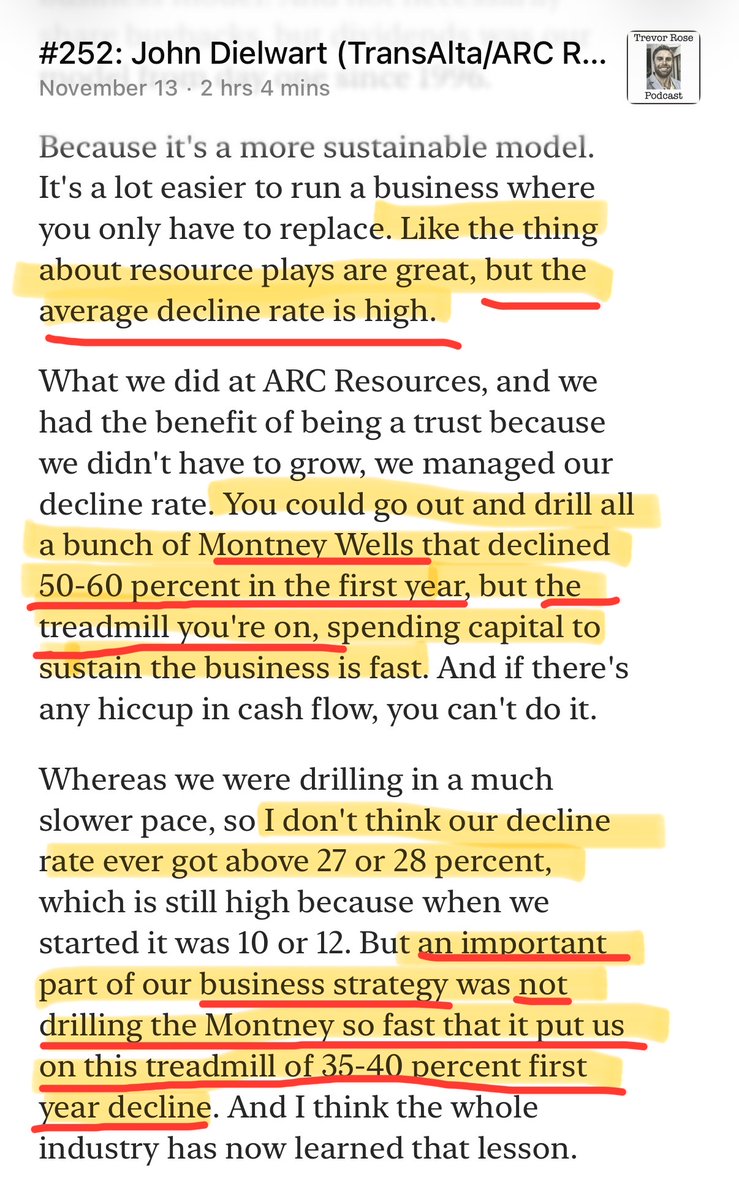

John Dielwart - Arc Resources on the Montney:

“…resource plays are great, but the average decline rate is HIGH”

“You could go and drill a bunch of Montney wells that decline 50-60% in the first year, but THE TREADMILL THAT YOUR ON spending capital to SUSTAIN the business"

8/x

“…resource plays are great, but the average decline rate is HIGH”

“You could go and drill a bunch of Montney wells that decline 50-60% in the first year, but THE TREADMILL THAT YOUR ON spending capital to SUSTAIN the business"

8/x

John Dielwart continues…

“…an important part of our business strategy was not drilling the Montney so fast that it put on this treadmill of 35-40% first year declines” 😮 😮 😮

This might explain why so many are bullish OFS...😂

9/x

“…an important part of our business strategy was not drilling the Montney so fast that it put on this treadmill of 35-40% first year declines” 😮 😮 😮

This might explain why so many are bullish OFS...😂

9/x

So Peyto doesn't have a high decline rate, unlike others.

High decline rate = High CAPEX

Low decline rate = Low CAPEX

So while some enjoy the treadmill, the $PEY.to camp prefers:

✅Lower declines

✅Profitable growth

✅High FCF

✅More dividends

Have a great weekend!

/end

High decline rate = High CAPEX

Low decline rate = Low CAPEX

So while some enjoy the treadmill, the $PEY.to camp prefers:

✅Lower declines

✅Profitable growth

✅High FCF

✅More dividends

Have a great weekend!

/end

• • •

Missing some Tweet in this thread? You can try to

force a refresh