Good at math. Read a lot. Financial statements tell a story. Novice excel user.

How to get URL link on X (Twitter) App

https://twitter.com/trevor_rose_/status/1966194317627928592Here's the question:

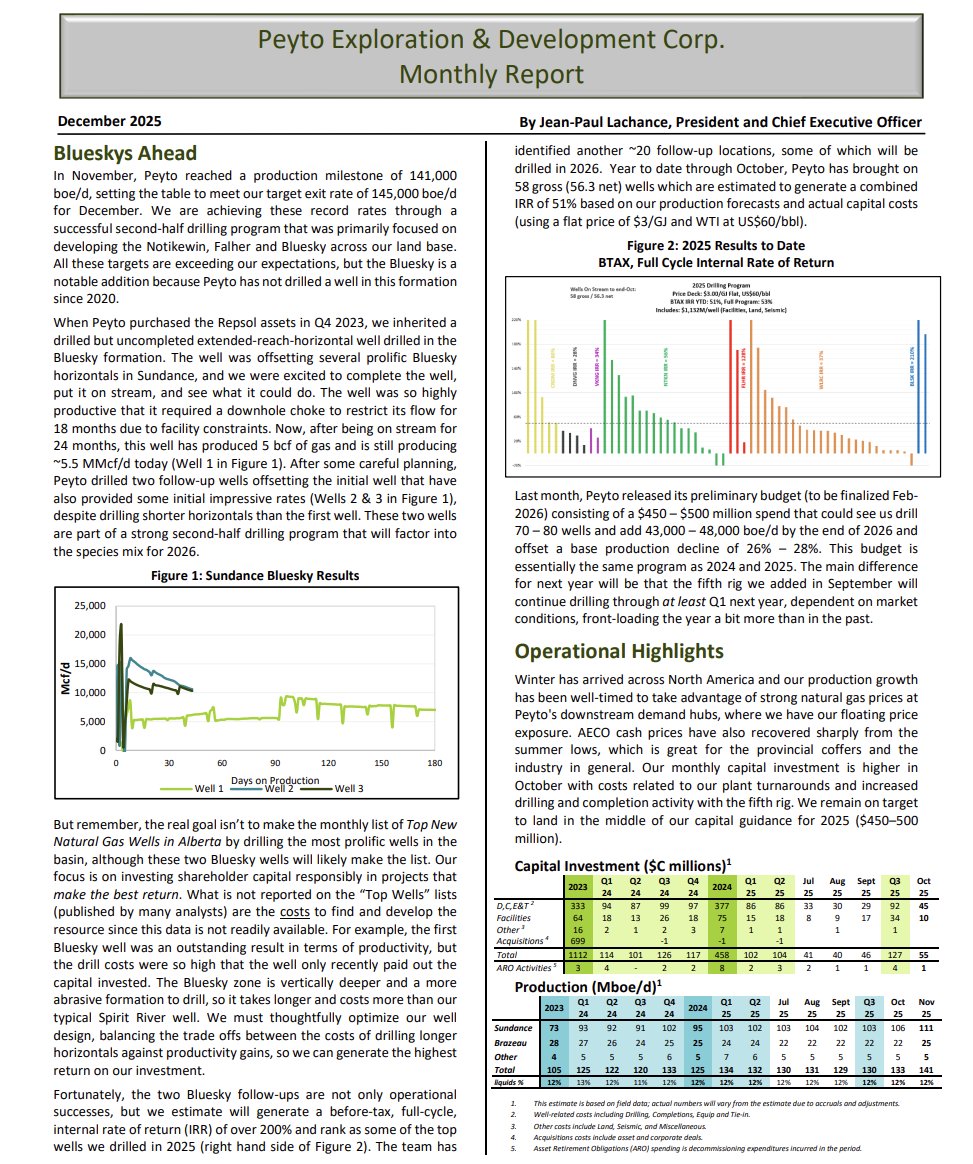

When Peyto aquired Repsol they inherited a drilled but uncompleted Bluesky ERH.

When Peyto aquired Repsol they inherited a drilled but uncompleted Bluesky ERH.

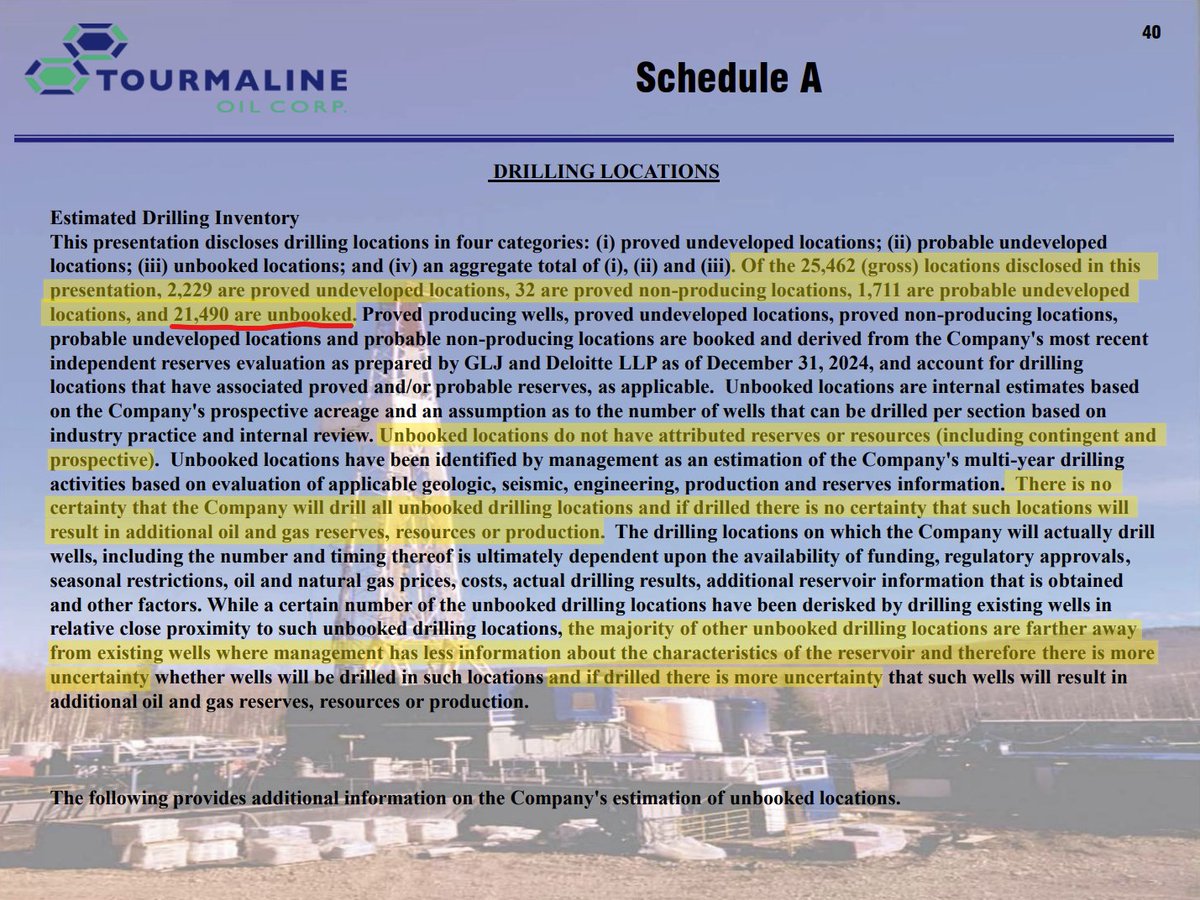

The first step of a proper analysis is to read the fine print and understand the assumptions.

The first step of a proper analysis is to read the fine print and understand the assumptions.

https://twitter.com/naubzie/status/1981882479779672530First two things I don't care about:

Breakdown of Repsol

Breakdown of Repsol

https://twitter.com/mackslann/status/1753937850054177062First, yes it is true that $TOU has more “liquids” than $PEY.

https://twitter.com/Mike02709735/status/1619022288879517696Peyto will supply via a direct connection which means low transport and fuel costs. It also means significant emissions savings of around 25,000 tonnes of CO2e/yr. 2/x

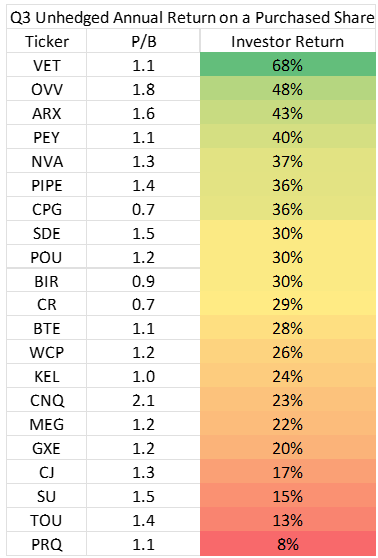

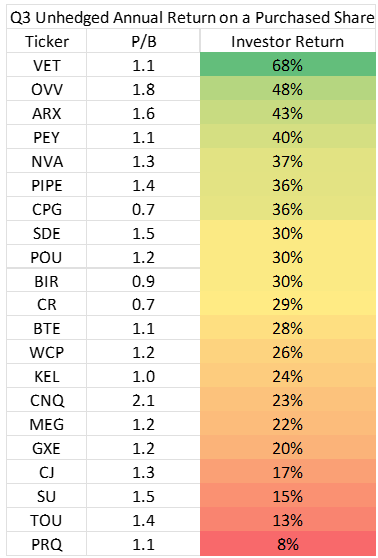

But commodity prices today are a lot lower than in Q3 2022.

But commodity prices today are a lot lower than in Q3 2022.