1/

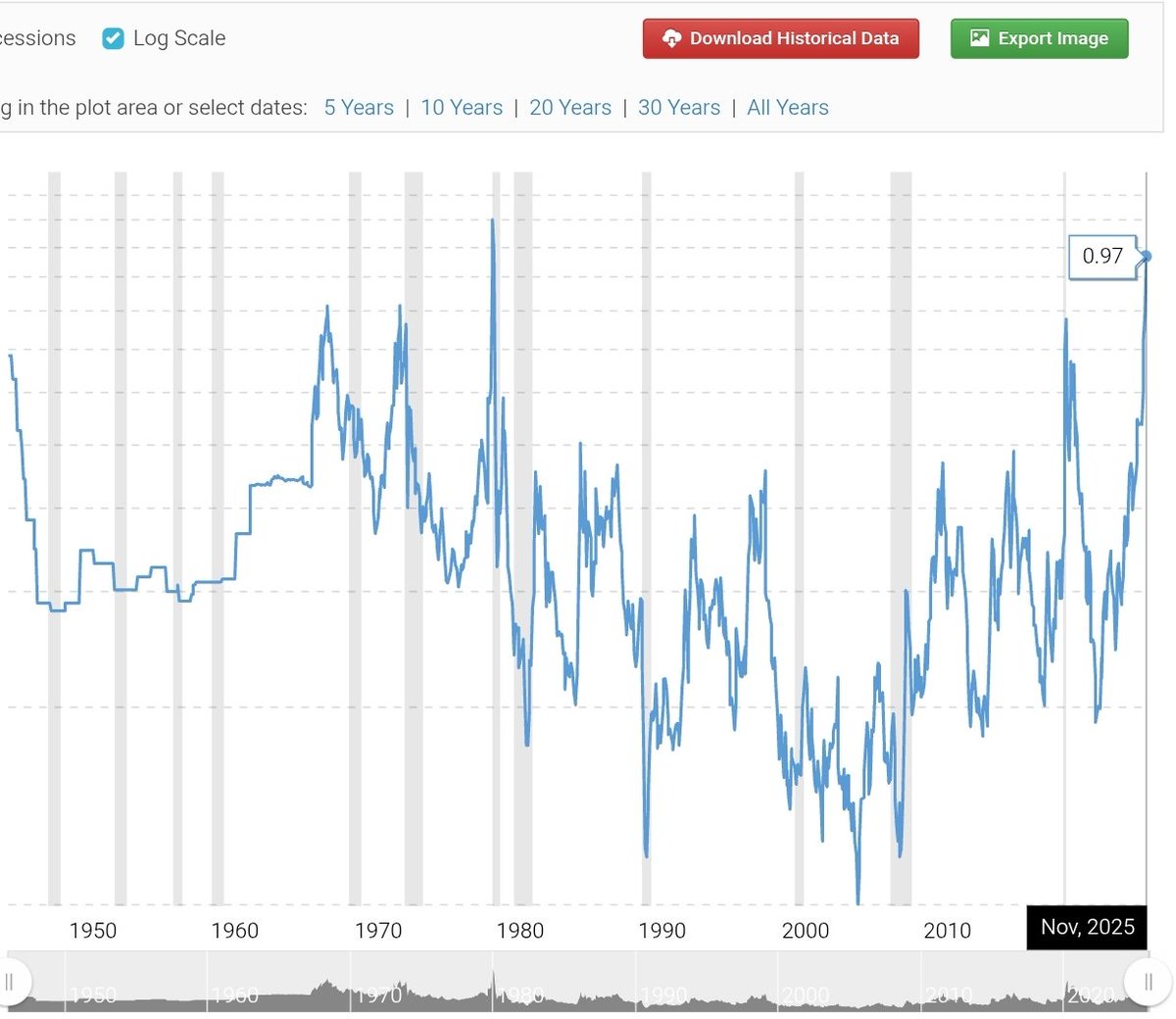

US small business bankruptcies just hit an all-time high.

2,221 filings under Subchapter V — the program designed to prevent small firms from dying.

If this is what “no recession” looks like… I don’t want to see the real one.

US small business bankruptcies just hit an all-time high.

2,221 filings under Subchapter V — the program designed to prevent small firms from dying.

If this is what “no recession” looks like… I don’t want to see the real one.

2/

Subchapter V was created to help distressed small companies survive.

Faster. Cheaper. More flexible than Chapter 11.

It was meant as a shield.

Now it’s becoming a funnel.

Subchapter V was created to help distressed small companies survive.

Faster. Cheaper. More flexible than Chapter 11.

It was meant as a shield.

Now it’s becoming a funnel.

3/

Bankruptcies are up +83% in five years.

Despite the debt limit shrinking from $7.5M → $3M last year (which made it HARDER for larger companies to qualify).

Meaning:

This surge is 100% small-business pain.

Bankruptcies are up +83% in five years.

Despite the debt limit shrinking from $7.5M → $3M last year (which made it HARDER for larger companies to qualify).

Meaning:

This surge is 100% small-business pain.

4/

What’s killing them?

• High borrowing costs

• Weak consumer spending

• Falling margins

• Inventories they can’t liquidate

• Rising input prices

• Economic uncertainty

This is the real economy — not the S&P cartoon.

What’s killing them?

• High borrowing costs

• Weak consumer spending

• Falling margins

• Inventories they can’t liquidate

• Rising input prices

• Economic uncertainty

This is the real economy — not the S&P cartoon.

5/

Small businesses are the backbone of the US economy:

🔹 99.9% of all firms

🔹 46% of private-sector jobs

🔹 43% of US GDP

When they break, the macro numbers follow.

Always.

Small businesses are the backbone of the US economy:

🔹 99.9% of all firms

🔹 46% of private-sector jobs

🔹 43% of US GDP

When they break, the macro numbers follow.

Always.

6/

Why does this matter for silver?

Because small business stress → recession risk → monetary response → liquidity wave.

And silver is the most interest-rate-sensitive metal on the planet.

Why does this matter for silver?

Because small business stress → recession risk → monetary response → liquidity wave.

And silver is the most interest-rate-sensitive metal on the planet.

7/

Every recession in the last 50 years triggered the same pattern:

1️⃣ Real-economy stress

2️⃣ Central bank panic

3️⃣ Liquidity flood

4️⃣ Hard assets pump

5️⃣ Silver outperforms gold

Because silver is where monetary panic meets industrial demand.

Every recession in the last 50 years triggered the same pattern:

1️⃣ Real-economy stress

2️⃣ Central bank panic

3️⃣ Liquidity flood

4️⃣ Hard assets pump

5️⃣ Silver outperforms gold

Because silver is where monetary panic meets industrial demand.

8/

And don’t forget:

Recessions also hit mining.

Mines go offline.

Capex collapses.

Output drops.

Industrial demand doesn’t.

Monetary demand explodes.

That's why silver behaves like a compressed spring.

And don’t forget:

Recessions also hit mining.

Mines go offline.

Capex collapses.

Output drops.

Industrial demand doesn’t.

Monetary demand explodes.

That's why silver behaves like a compressed spring.

9/

This Subchapter V chart is not just about bankruptcy.

It’s a warning about the thing everyone ignores:

The system is breaking at the bottom first.

And bottom-up stress always becomes top-down panic.

This Subchapter V chart is not just about bankruptcy.

It’s a warning about the thing everyone ignores:

The system is breaking at the bottom first.

And bottom-up stress always becomes top-down panic.

10/

Stackers understand something Wall Street doesn’t:

If small businesses suffer…

If liquidity dries up…

If borrowing costs stay high…

The “soft landing” is dead.

And when the Fed returns with the firehose, silver will not ask for permission.

Stackers understand something Wall Street doesn’t:

If small businesses suffer…

If liquidity dries up…

If borrowing costs stay high…

The “soft landing” is dead.

And when the Fed returns with the firehose, silver will not ask for permission.

11/

Small businesses breaking is not a headline.

It’s a signal.

And silver has always been the asset that benefits when signals turn into crises.

Stack accordingly. 🪙🔥

#Silver #SilverSqueeze #Economy #RecessionWatch

Small businesses breaking is not a headline.

It’s a signal.

And silver has always been the asset that benefits when signals turn into crises.

Stack accordingly. 🪙🔥

#Silver #SilverSqueeze #Economy #RecessionWatch

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh