India has 14 crore air travelers a year.

But 92% of them never fly business class. 40% don’t fly more than once a year.

Now imagine What if Reliance launched an airline?

This is not fantasy. This is a thought experiment in business dominance.

The same playbook that broke telecom (Jio), reshaped retail (Reliance Retail), and is now shaking up finance (Jio Financial) would be applied to aviation

Here’s the 7-step blueprint Mukesh Ambani would use to own the Indian skies:

Bookmark and retweet this thread to revisit it later

Liked this breakdown?

→ Hit Follow for daily deep dives

→ Join the Stockifi Community and find out a potential multi-bagger idea (live in the pinned post)

👉 Join Community for FREE: t.me/stockifi

But 92% of them never fly business class. 40% don’t fly more than once a year.

Now imagine What if Reliance launched an airline?

This is not fantasy. This is a thought experiment in business dominance.

The same playbook that broke telecom (Jio), reshaped retail (Reliance Retail), and is now shaking up finance (Jio Financial) would be applied to aviation

Here’s the 7-step blueprint Mukesh Ambani would use to own the Indian skies:

Bookmark and retweet this thread to revisit it later

Liked this breakdown?

→ Hit Follow for daily deep dives

→ Join the Stockifi Community and find out a potential multi-bagger idea (live in the pinned post)

👉 Join Community for FREE: t.me/stockifi

Step 1: Enter With a Controlled Explosion

Reliance doesn’t enter quietly. It nukes old pricing models.

Remember Jio’s ₹0 SIMs?

Now imagine this in aviation:

● ₹9999 domestic flight packs

● Buy 1 Get 1 free flights

● Free flights for Jio Postpaid Max users

● Cashback for using Jio Financial cards

● “₹1 ticket” flash sale events (like mega bus in Europe)

This isn’t marketing. It’s disruption as strategy.

Reliance doesn’t enter quietly. It nukes old pricing models.

Remember Jio’s ₹0 SIMs?

Now imagine this in aviation:

● ₹9999 domestic flight packs

● Buy 1 Get 1 free flights

● Free flights for Jio Postpaid Max users

● Cashback for using Jio Financial cards

● “₹1 ticket” flash sale events (like mega bus in Europe)

This isn’t marketing. It’s disruption as strategy.

Step 2: Build an Aviation Ecosystem, Not Just an Airline

Reliance doesn’t create products.

It builds ecosystems that lock you in.

Their airline would plug into:

● JioFiber + JioCinema for in-flight streaming

● JioMart for in-flight snacks

● AJIO for duty-free fashion

● Jio Financial for zero-cost EMI travel cards

● JioAir routers for 5G skies

● Reliance fuel at airports for discounted ATF

Every flight would be a Reliance ad, Reliance app, Reliance experience.

Reliance doesn’t create products.

It builds ecosystems that lock you in.

Their airline would plug into:

● JioFiber + JioCinema for in-flight streaming

● JioMart for in-flight snacks

● AJIO for duty-free fashion

● Jio Financial for zero-cost EMI travel cards

● JioAir routers for 5G skies

● Reliance fuel at airports for discounted ATF

Every flight would be a Reliance ad, Reliance app, Reliance experience.

Step 3: Target Tier 2–3 India, Not Just the Airports You Know

Delhi, Mumbai, Bangalore are saturated.

But Bharat isn’t.

Reliance already owns or has major influence in:

● Navi Mumbai Airport (under development)

● Jamnagar (refinery tronghold)

● Surat, Vadodara, Ahmedabad

● Tier 2–3 cities ignored by legacy airlines

Their airline would promise:

“From Bharat, for Bharat.”

Not elite luxury. Mass aspiration.

Delhi, Mumbai, Bangalore are saturated.

But Bharat isn’t.

Reliance already owns or has major influence in:

● Navi Mumbai Airport (under development)

● Jamnagar (refinery tronghold)

● Surat, Vadodara, Ahmedabad

● Tier 2–3 cities ignored by legacy airlines

Their airline would promise:

“From Bharat, for Bharat.”

Not elite luxury. Mass aspiration.

Step 4: Use Buying Power Like a Weapon

No Indian company negotiates bulk like Reliance.

Expect:

● Record aircraft order (100+ planes in one go)

● Fuel cost arbitrage via their own petroinfra

● Aircraft maintenance contracts copied from their Jio tower ops

Reliance doesn’t do one-off deals.

It locks 10-year costs when others haggle for quarters.

That’s how you beat Indigo on cost — not price.

No Indian company negotiates bulk like Reliance.

Expect:

● Record aircraft order (100+ planes in one go)

● Fuel cost arbitrage via their own petroinfra

● Aircraft maintenance contracts copied from their Jio tower ops

Reliance doesn’t do one-off deals.

It locks 10-year costs when others haggle for quarters.

That’s how you beat Indigo on cost — not price.

Step 5: Make Aviation Data-Driven

Reliance is India’s most underrated tech company.

Jio’s backend is one of the largest AI engines in the country.

They would bring the same firepower to aviation.

● AI-based dynamic pricing (like Amazon does for discounts)

● Predictive maintenance using IoT sensors

● Crew scheduling optimized by machine learning

● Flight time forecasts integrated with weather & traffic data

It’s not just about flying.

It’s about flying with data as the pilot.

Reliance is India’s most underrated tech company.

Jio’s backend is one of the largest AI engines in the country.

They would bring the same firepower to aviation.

● AI-based dynamic pricing (like Amazon does for discounts)

● Predictive maintenance using IoT sensors

● Crew scheduling optimized by machine learning

● Flight time forecasts integrated with weather & traffic data

It’s not just about flying.

It’s about flying with data as the pilot.

Step 6: Wrap It in National Emotion

Jio wasn’t just a telecom company.

It was marketed as “Digital Freedom.”

Expect the airline to be:

“India’s Own Airline”

or

“BharatFly – Swadeshi in the Skies”

They would use:

● Tricolour branding

● Ads with soldiers, farmers, families

● Zero-English, 100% emotion-heavy commercials

Because Reliance doesn’t sell products.

It sells pride.

Jio wasn’t just a telecom company.

It was marketed as “Digital Freedom.”

Expect the airline to be:

“India’s Own Airline”

or

“BharatFly – Swadeshi in the Skies”

They would use:

● Tricolour branding

● Ads with soldiers, farmers, families

● Zero-English, 100% emotion-heavy commercials

Because Reliance doesn’t sell products.

It sells pride.

Step 7: Bleed First. Then Rule Forever.

This is the Reliance DNA in action:

● Phase 1: Undercut and hurt the giants

● Phase 2: Offer better value, not just lower prices

● Phase 3: Create product addiction

● Phase 4: Become the default

Aviation becomes the Jio model in the skies.

Low cost. High volume. Full control.

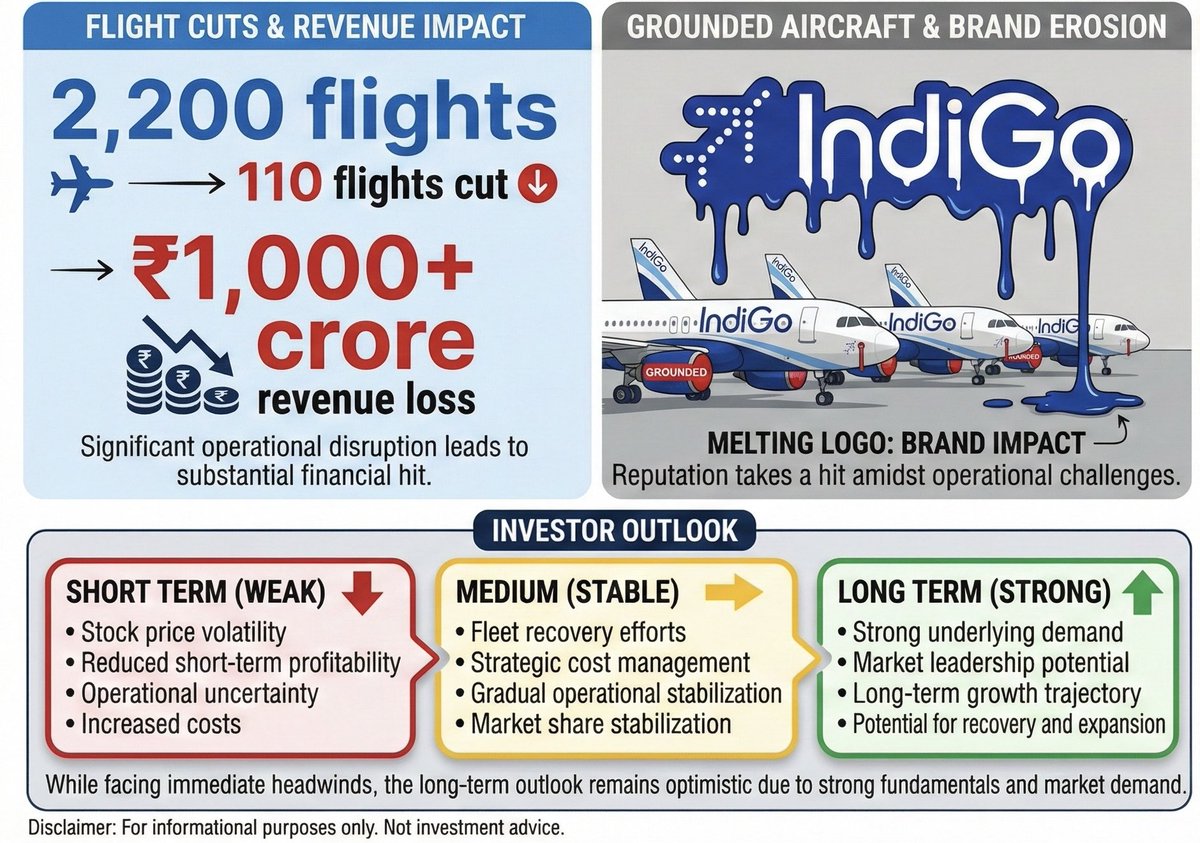

Indigo, Akasa, Air India — all would feel the chill.

This is the Reliance DNA in action:

● Phase 1: Undercut and hurt the giants

● Phase 2: Offer better value, not just lower prices

● Phase 3: Create product addiction

● Phase 4: Become the default

Aviation becomes the Jio model in the skies.

Low cost. High volume. Full control.

Indigo, Akasa, Air India — all would feel the chill.

India’s skies are crowded.

But none of them are doing what Reliance could.

If Mukesh Ambani ever launched an airline,

he wouldn’t just compete.

He would rewrite the aviation rulebook.

And history suggests — he may win.

If you found this insightful

→ Repost and Follow us for more such deep dives

→ Join Stockifi Community and find out our latest stock idea (Check pinned post)

👉 Join Now t.me/stockifi

But none of them are doing what Reliance could.

If Mukesh Ambani ever launched an airline,

he wouldn’t just compete.

He would rewrite the aviation rulebook.

And history suggests — he may win.

If you found this insightful

→ Repost and Follow us for more such deep dives

→ Join Stockifi Community and find out our latest stock idea (Check pinned post)

👉 Join Now t.me/stockifi

• • •

Missing some Tweet in this thread? You can try to

force a refresh