I study markets so you don’t lose your hard-earned money | Follow for long-term investment ideas to protect and compound your wealth | 📧 info@stockifi.in

30 subscribers

How to get URL link on X (Twitter) App

So what’s the Trump play?

So what’s the Trump play?

Thyssenkrupp is facing a brutal mix of structural problems:

Thyssenkrupp is facing a brutal mix of structural problems:

Let’s run the real numbers.

Let’s run the real numbers.

For decades, India’s biggest groups ran like empires.

For decades, India’s biggest groups ran like empires.

Covid: Debt-to-GDP crossed 60%

Covid: Debt-to-GDP crossed 60%

At the heart of the collapse: a man named Dilip Pendse.

At the heart of the collapse: a man named Dilip Pendse.

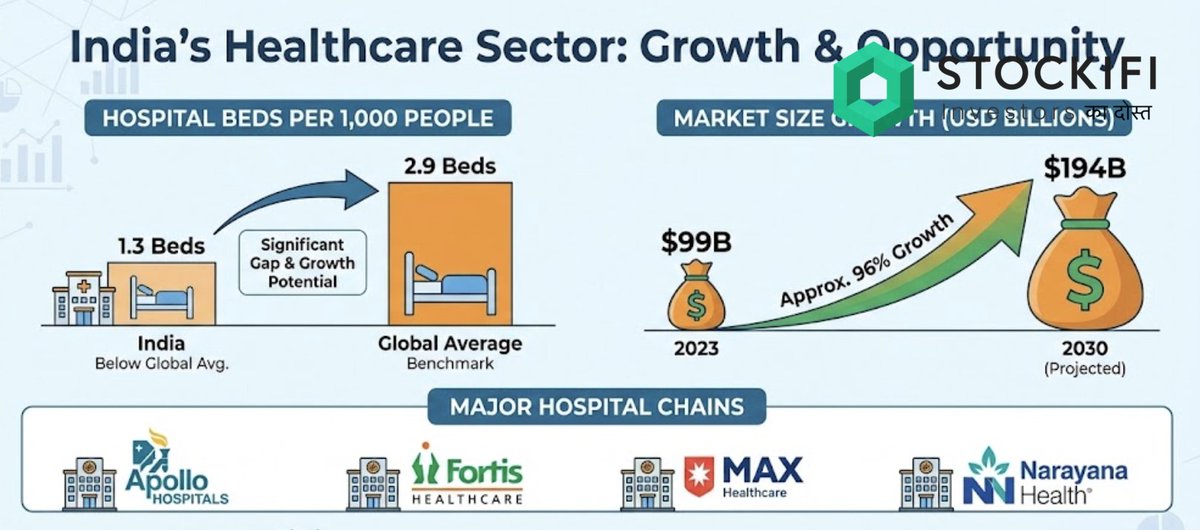

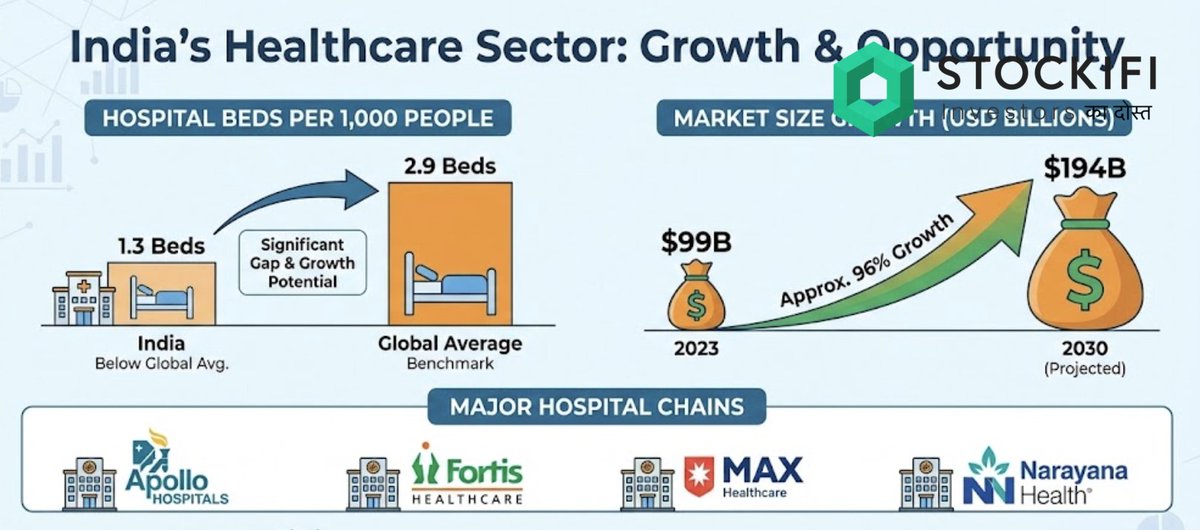

1. Hospitals are not beds. They’re monopolies in disguise.

1. Hospitals are not beds. They’re monopolies in disguise.

A CDMO is like a pharma factory-for-hire.

A CDMO is like a pharma factory-for-hire.

Imagine thousands of trucks lined up on a highway, loaded with gold.

Imagine thousands of trucks lined up on a highway, loaded with gold.

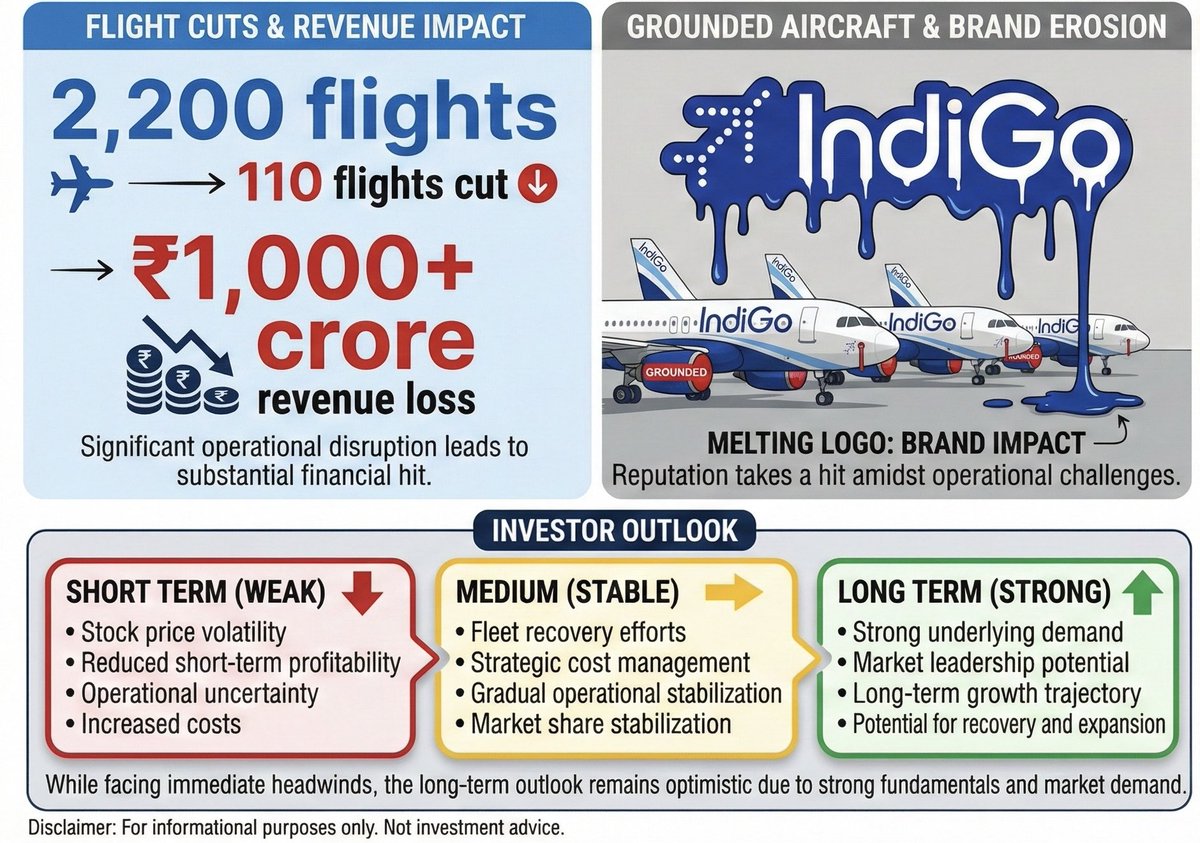

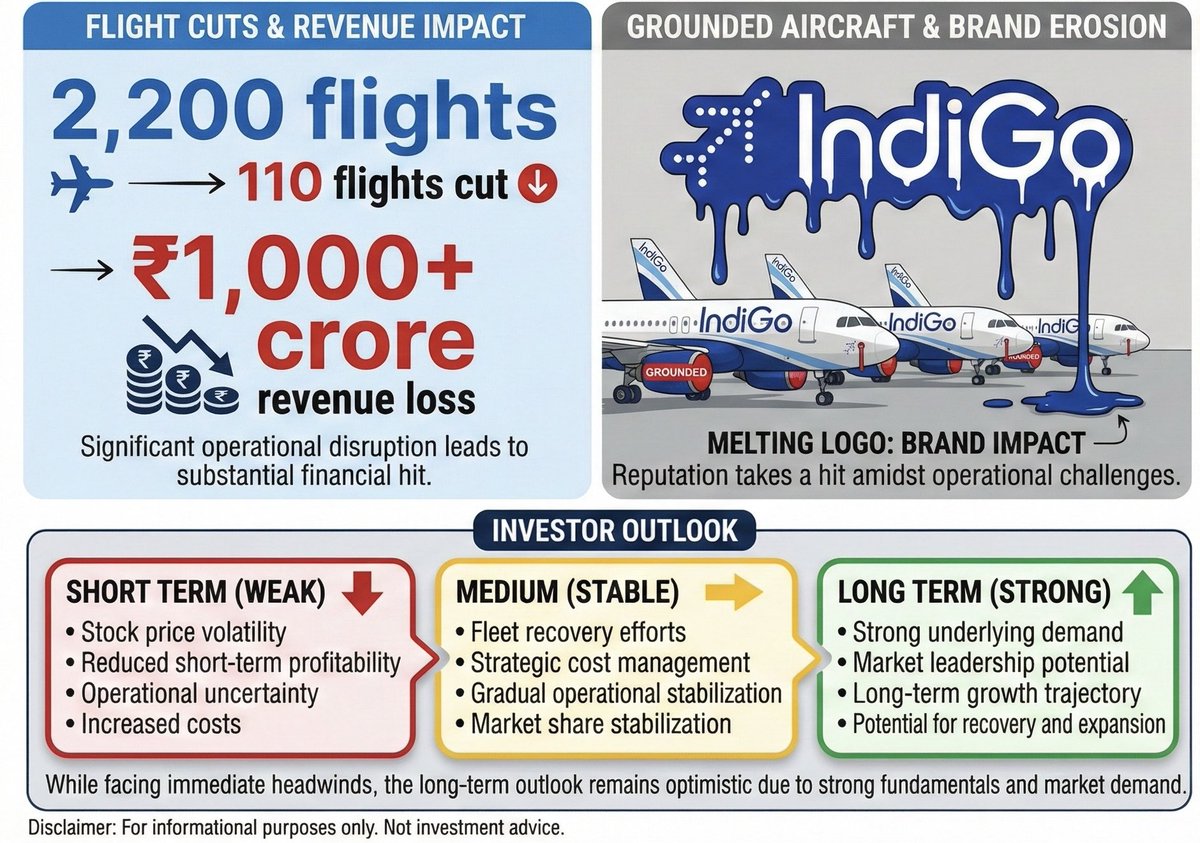

Each domestic flight brings in ₹30–40 lakh.

Each domestic flight brings in ₹30–40 lakh.

Step 1: Enter With a Controlled Explosion

Step 1: Enter With a Controlled Explosion

In 2015, India made a decision that barely made headlines.

In 2015, India made a decision that barely made headlines.

Here’s what just happened:

Here’s what just happened:

Think of Tank Terminals as India's underground oil & gas backbone.

Think of Tank Terminals as India's underground oil & gas backbone.

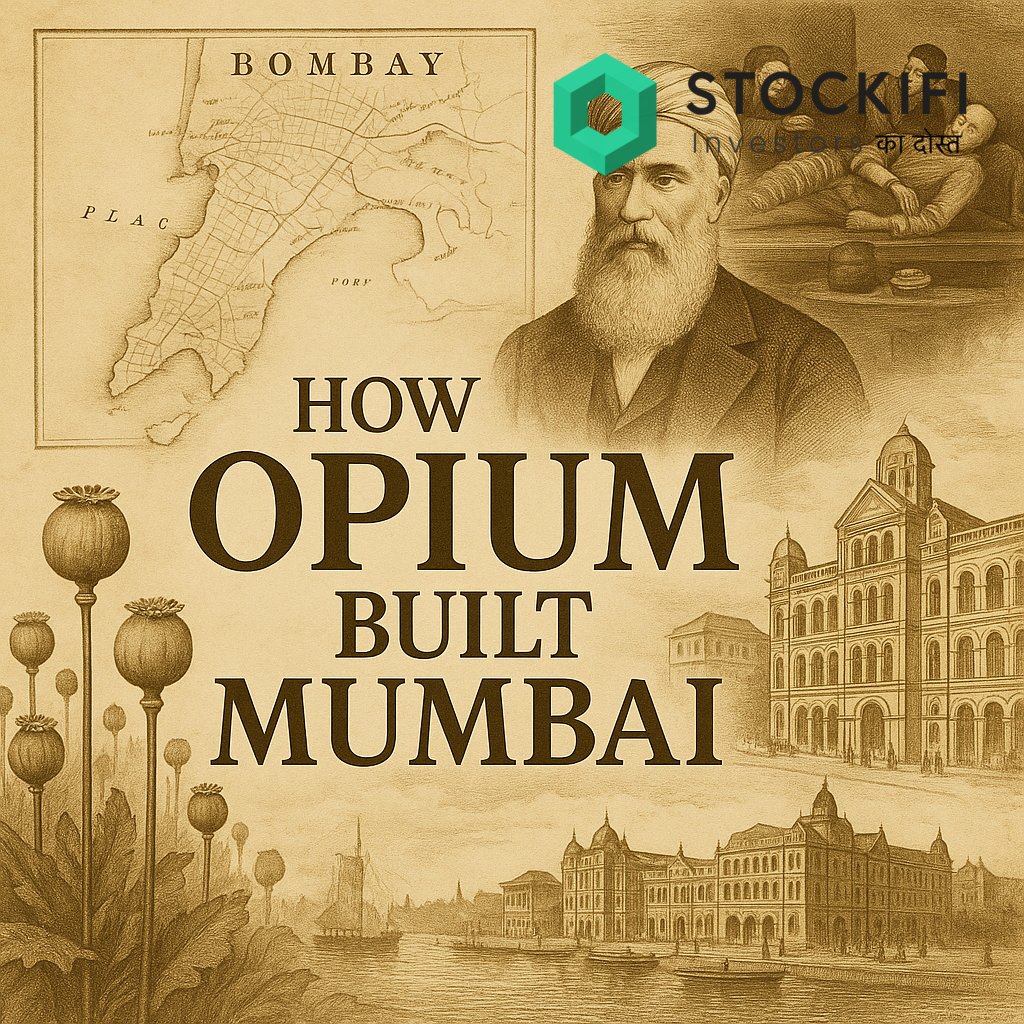

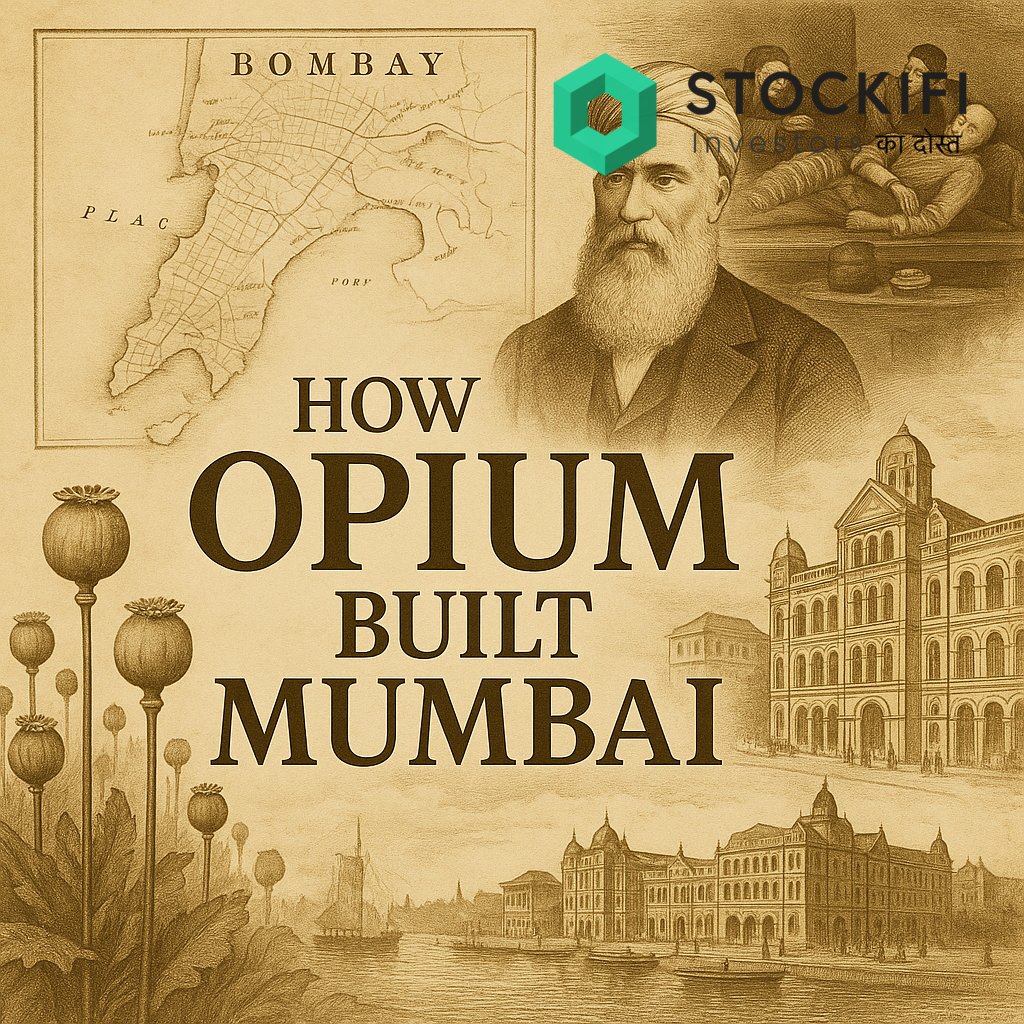

By the 1820s, Britain had a problem:

By the 1820s, Britain had a problem:

Why this matters

Why this matters

1930s

1930s

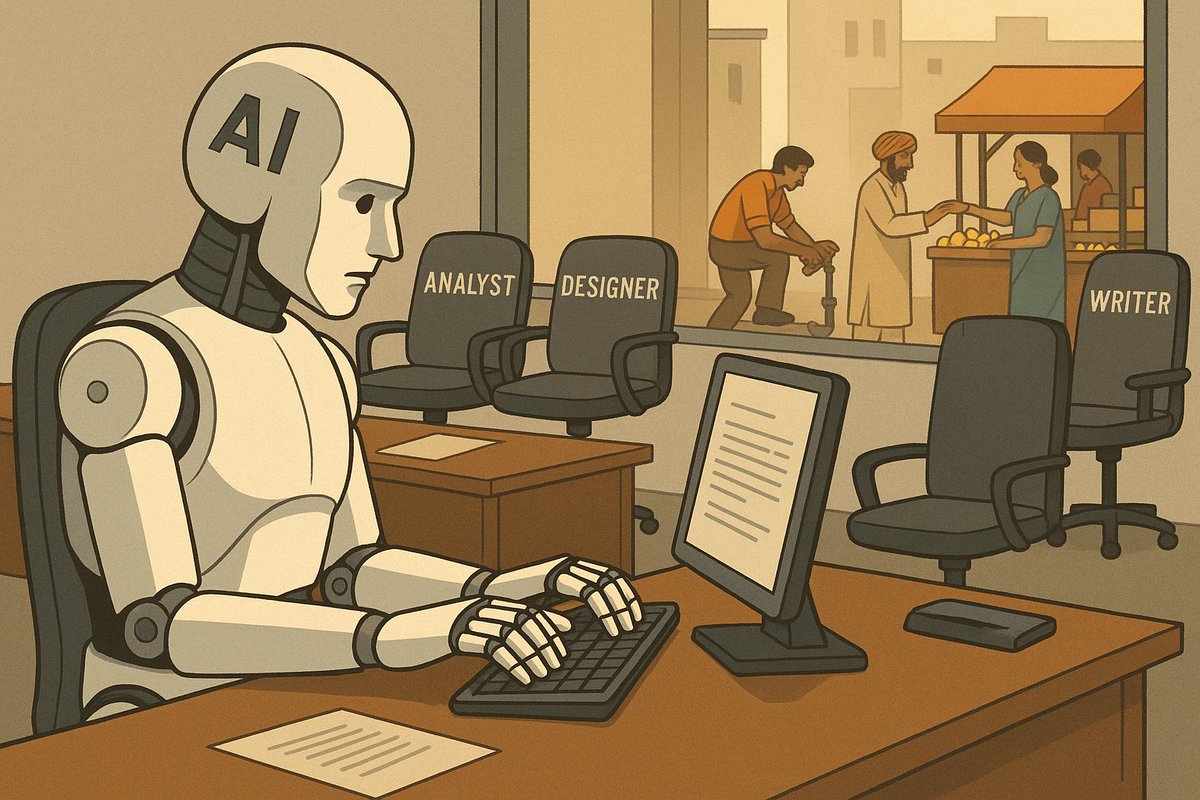

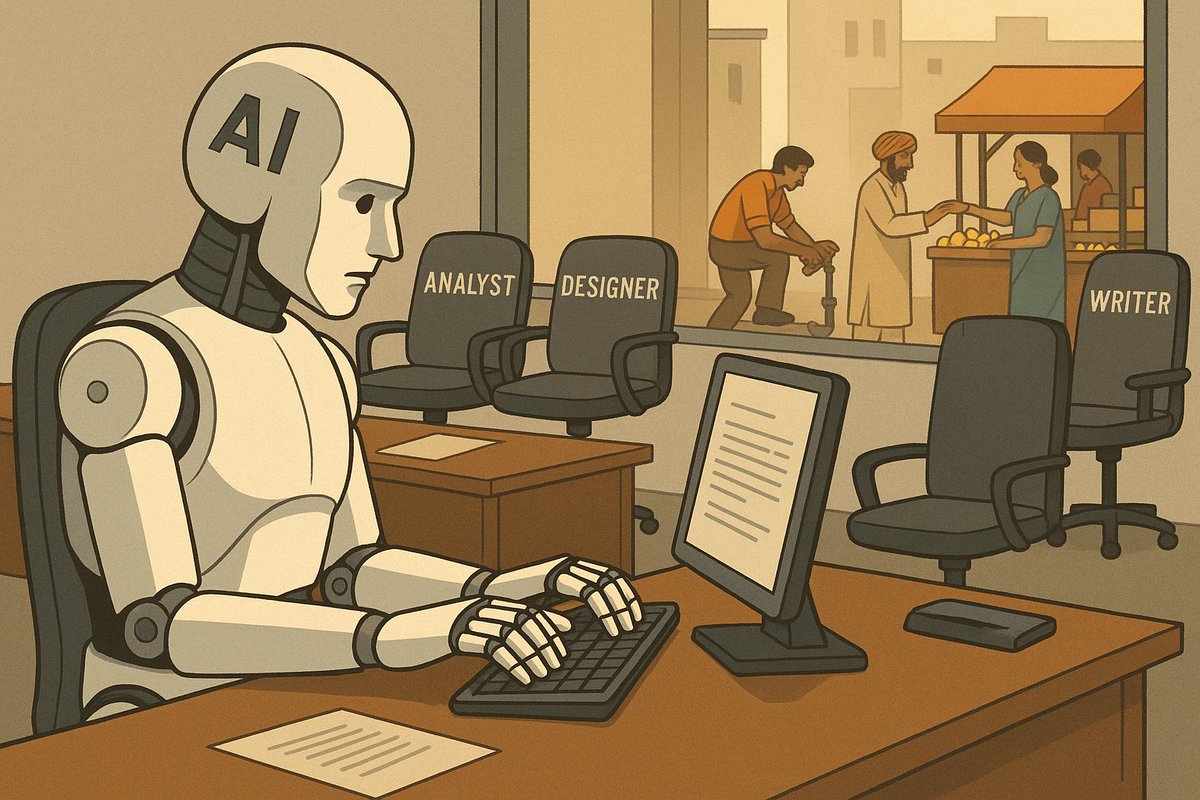

India’s $250 billion IT-BPO industry is built on solving foreign digital problems with Indian digital talent.

India’s $250 billion IT-BPO industry is built on solving foreign digital problems with Indian digital talent.

Enter: Zepto Super Mall

Enter: Zepto Super Mall

Early 1980s.

Early 1980s.

IPO = Initial Public Offering

IPO = Initial Public Offering